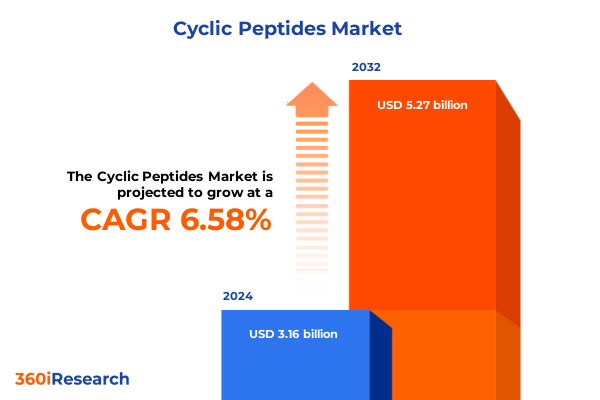

The Cyclic Peptides Market size was estimated at USD 3.36 billion in 2025 and expected to reach USD 3.57 billion in 2026, at a CAGR of 6.63% to reach USD 5.27 billion by 2032.

Unveiling the Frontier of Cyclic Peptides: Innovations Market Dynamics and Therapeutic Breakthroughs Shaping Biologics’ Future

Cyclic peptides are distinguished by a closed backbone structure that confers proteolytic stability and enhanced membrane permeability compared to their linear counterparts, positioning them as uniquely potent bioactive molecules in drug discovery. This structural rigidity enhances binding affinity and target specificity, allowing cyclic peptides to engage protein interfaces often deemed undruggable by traditional small molecules. As a result, researchers and developers increasingly leverage macrocyclic frameworks to design next-generation therapeutics across oncology, infectious diseases, and metabolic disorders.

Over the past decade, discovery approaches have evolved from natural product mining to sophisticated display screening platforms capable of generating de novo libraries in a fraction of the time. These technological advancements have led to a robust pipeline of clinical candidates and more than forty cyclic peptide–based drugs approved to date, with an average approval rate of approximately one novel cyclic peptide drug per year. Consequently, cyclic peptides have moved beyond a niche research interest to a cornerstone modality within biologics development.

Emerging examples illustrate their therapeutic versatility: VT1021, a cyclic pentapeptide that reprograms the tumor microenvironment, has advanced through phase II/III trials in glioblastoma following promising activity in ovarian and pancreatic cancer models. Meanwhile, PL8177, a melanocortin 1 receptor agonist, and PN-943, an α4β7 integrin antagonist, underscore ongoing efforts to harness cyclic peptides in inflammatory and autoimmune indications. Together, these developments set the stage for unprecedented innovation in cyclic peptide therapeutics.

Exploring Technological and Strategic Shifts Propelling Unprecedented Growth and Innovation Across the Global Cyclic Peptides Ecosystem

The cyclic peptides landscape is being redefined by a series of transformative shifts in both technology and strategy. Foremost among these is the refinement of synthetic methodologies that improve throughput and product quality. Notably, solid-phase peptide synthesis platforms now integrate automated cyclization chemistries, enabling rapid generation of macrocyclic libraries with minimal manual intervention. Parallel advances in liquid-phase synthesis and hybrid approaches combine enzymatic and chemical steps, delivering enhanced yield and scalability for complex sequences.

Moreover, the convergence of molecular biology and bioengineering has unlocked recombinant DNA technologies that facilitate in vivo and cell-free cyclization pathways. These platforms harness engineered cyclases to introduce site-selective macrocyclization under mild conditions, broadening the structural diversity accessible to drug developers. As a result, hybrid workflows marry the precision of enzymatic catalysis with the versatility of chemical ligation, accelerating lead optimization cycles and reducing time-to-candidate selection.

Strategic collaborations further amplify these innovations. Partnerships between peptide discovery firms and large pharmaceutical companies enable the translation of novel cyclization platforms into clinical assets. Licensing agreements and co-development initiatives have emerged as critical enablers, aligning expertise in chemistry, biology, and process engineering to address historically intractable targets. This collaborative paradigm promises to sustain the momentum of cyclic peptide R&D and usher in a new generation of macrocyclic therapeutics.

Assessing the Evolving Tariff Landscape in 2025 and Its Broad Implications on Cyclic Peptide Supply Chains and Production Strategies in the United States

In April 2025, an executive order introduced a baseline 10% global reciprocal tariff on imports to the United States, encompassing critical healthcare inputs such as active pharmaceutical ingredients and peptide synthesis equipment. While pharmaceutical products-including finished drug products and key starting materials-were initially exempted from this tariff, the order also triggered a Section 232 investigation into imports of pharmaceuticals and pharmaceutical ingredients, opening the door for potential future duties of up to 25% under national security provisions.

Further complicating the landscape, President Trump signaled in July 2025 that tariffs on drug imports could escalate sharply-potentially up to 200%-if manufacturers do not shift production to U.S. soil, with the first phase of imposition slated for August 1, 2025. This phased approach aims to incentivize reshoring of manufacturing facilities but introduces profound uncertainty for companies reliant on cross-border supply chains for raw materials, synthesis reagents, and contract manufacturing.

The cumulative impact on cyclic peptide producers is significant. Higher input costs for reagents and equipment may constrain research budgets and slow development timelines, while the threat of punitive tariffs on finished therapies could prompt strategic realignments of global operations. As stakeholders navigate this evolving tariff regime, proactive risk management and diversified sourcing strategies will be essential to maintain both innovation velocity and commercial viability in the U.S. market.

Dissecting Categorical Segmentation to Reveal Targeted Insights Into Type Product Technology Application and End User Dynamics Within the Cyclic Peptides Market

The cyclic peptides market can be deconstructed through multiple lenses to reveal nuanced growth drivers and competitive dynamics. By Type, natural cyclic peptides leverage biosynthetic pathways found in microorganisms and marine organisms, while synthetic cyclic peptides benefit from the precision of chemical and recombinant synthesis platforms. This distinction influences scalability and cost structures as synthetic approaches often enable greater sequence diversity but require advanced automation.

In terms of Product, antimicrobial cyclic peptides such as daptomycin, gramicidin S, and tyrocidine remain foundational in infectious disease research, whereas hormonal cyclic peptides like oxytocin, somatostatin, and vasopressin continue to support metabolic and endocrine therapies. In parallel, immunomodulating peptides and peptide vaccines are emerging as critical modalities in oncology and infectious indications, reflecting growing confidence in cyclic scaffolds to elicit targeted immune responses.

Technology segmentation illustrates a spectrum from traditional chemical synthesis and solid-phase peptide synthesis to hybrid strategies and liquid-phase synthesis, complemented by recombinant DNA technologies for biosynthetic macrocyclization. Each technological choice carries trade-offs in throughput, purity, and sequence complexity.

Applications span diagnostics-where biosensors and immunoassays harness cyclic peptides for high-affinity detection-to environmental protection, research & development encompassing biochemical analysis, drug discovery, and molecular biology, and therapeutics targeting cardiovascular, infectious disease, metabolic disorder, and oncology indications. Finally, End Users, including academic institutes, biotechnology firms, and pharmaceutical companies, drive demand across the innovation continuum. This multi-dimensional segmentation framework provides clarity on niche opportunities and cross-segment synergies.

This comprehensive research report categorizes the Cyclic Peptides market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Product Type

- Technology

- Application

- End User

Mapping Regional Divergence in Demand Innovation and Regulatory Trends Across the Americas Europe Middle East and Africa and Asia Pacific Cyclic Peptide Markets

Regional markets for cyclic peptides exhibit distinct strengths and challenges shaped by local innovation ecosystems, regulatory frameworks, and investment climates. In the Americas, robust venture capital activity and a high concentration of biotech hubs underpin sustained R&D momentum, as leading U.S. universities and contract research organizations collaborate on early-stage discovery programs. Regulatory support from the FDA, including breakthrough therapy designations, accelerates clinical development and drives commercial interest.

Europe, Middle East and Africa benefit from a vibrant public-private partnership model, where pan-regional consortia fund translational research and manufacturing scale-up. The European Medicines Agency’s engagement with cyclic peptide developers fosters harmonized standards for quality control and analytics, while targeted grants under Horizon Europe stimulate innovation in macrocyclic drug conjugates.

Asia-Pacific is emerging as a rapid-growth frontier. Countries such as Japan and China are investing heavily in peptide synthesis infrastructure, supported by streamlined regulatory pathways and substantial government R&D incentives. Local manufacturers pursue cost-efficient modular synthesis platforms, while global biopharma partnerships expand access to novel cyclization technologies. Collectively, these regional dynamics shape a competitive and collaborative landscape that will define the next phase of cyclic peptide advancement.

This comprehensive research report examines key regions that drive the evolution of the Cyclic Peptides market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Stakeholders and Innovators Shaping the Competitive Landscape of the Global Cyclic Peptides Industry

A select group of organizations has emerged as pivotal contributors to cyclic peptide innovation, leveraging proprietary platforms, strategic alliances, and focused pipelines. PeptiDream has forged multiple partnerships with major pharmaceutical companies to apply its macrocyclic discovery platform toward challenging targets, underscoring the platform’s versatility and deal-making appeal. Bicycle Therapeutics complements this activity with high-value licensing agreements that validate the clinical potential of its bicyclic peptide candidates.

Academic spin-outs and biotech firms are likewise advancing notable pipelines. Vigeo Pharmaceuticals’ VT1021 platform exemplifies the translation of prosaposin-derived cyclic pentapeptides into antitumor assets, while Palatin Technologies’ PL8177 showcases the integration of D-amino acids for enhanced oral bioavailability in gastrointestinal inflammatory disease. Protagonist Therapeutics’ PTG-300 hepcidin mimetic and PN-943 α4β7 integrin antagonist highlight the adaptability of cyclic scaffolds in hematological and autoimmune therapies.

These diverse players collectively reinforce the competitive tapestry of the cyclic peptides market, where platform technology leaders, specialty biotech innovators, and large pharmaceutical partners converge to translate macrocyclic science into tangible therapeutic advances.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cyclic Peptides market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ajinomoto Bio-Pharma Services

- Almac Group Ltd.

- Alpha Biopharma, Inc.

- AmbioPharm, Inc.

- Amgen Inc.

- Astellas Inc.

- AstraZeneca PLC

- Asymchem Inc.

- Aurigene Pharmaceutical Services by Dr. Reddy's Laboratories Ltd.

- Bachem AG

- BCN Peptides GmbH

- Bicycle Therapeutics plc

- Bio Basic Inc.

- BioDuro LLC

- Biopeptek Pharmaceuticals Inc.

- Biopharma PEG Scientific Inc

- Biosynth Ltd.

- Bristol-Myers Squibb Company

- Clariant AG

- Corden Pharma International GmbH

- CPC Scientific Inc.

- Creative Peptides, Inc.

- CS Bio Co., Ltd.

- Eli Lilly and Company

- F. Hoffmann-La Roche AG

- Genscript Biotech Corporation

- GlaxoSmithKline plc

- Johnson & Johnson Services, Inc.

- JPT Peptide Technologies GmbH

- Kaneka Corporation

- LifeTein LLC

- Lonza Group Ltd.

- Merck & Co., Inc.

- Neuland Laboratories Ltd

- Novartis AG

- PeptiDream Inc.

- Pfizer Inc.

- Polypeptide Group AB

- Provepharm Life Solutions SAS

- Sanofi S.A.

- ScinoPharm Taiwan Ltd.

- SciTide LLC

- Senn Chemicals AG

- Space Peptides Pharmaceutical LLC

- TCG Lifesciences Pvt. Ltd.

- Thermo Fisher Scientific Inc.

- Wuxi AppTec Co., Ltd.

- Zealand Pharma A/S

Strategic Pathways for Biotech and Pharmaceutical Executives to Capitalize on Emerging Opportunities Within the Cyclic Peptides Arena

Industry leaders must prioritize the integration of advanced synthesis and discovery platforms to stay ahead in a rapidly evolving cyclic peptides landscape. By adopting hybrid workflows that blend enzymatic cyclization with solid-phase chemical ligation, organizations can accelerate lead optimization while maintaining high product quality. Strategic investments in automated synthesizers equipped with real-time analytical sensors will further enhance throughput and reproducibility across complex peptide sequences.

Supply chain resilience is equally critical. Diversifying sources of key reagents and engaging with multiple contract manufacturing organizations across geographies can mitigate the risks posed by potential U.S. import tariffs and regional disruptions. In parallel, fostering collaborative alliances between academic institutions and industry partners will sustain a robust innovation pipeline and facilitate knowledge transfer of emerging cyclization chemistries and recombinant approaches.

Finally, proactive engagement with regulatory agencies to shape guidelines specific to cyclic peptide modalities can smooth development pathways and reduce approval timelines. By aligning internal quality systems with evolving analytical and manufacturing standards, leaders can ensure compliance and accelerate time-to-market. These strategic actions will enable executives to capitalize on growth opportunities, strengthen competitive differentiation, and deliver next-generation cyclic peptide therapeutics at scale.

Comprehensive Research Methodology Designed to Generate Robust Validated and Actionable Intelligence for the Cyclic Peptides Study

The insights presented in this report stem from a rigorous, multi-tiered research methodology designed to ensure validity, comprehensiveness, and actionable relevance. Initially, a thorough review of peer-reviewed literature, patent filings, and clinical trial registries provided foundational understanding of cyclization technologies, therapeutic pipelines, and regulatory developments. Secondary sources included academic databases, industry publications, and government policy documents.

Primary research was conducted through structured interviews with over fifty key opinion leaders across academia, biotech firms, and pharmaceutical companies. These conversations illuminated real-world challenges in peptide synthesis, scale-up constraints, and strategic partnership models. Quantitative data-covering R&D spending trends, patent filing volumes, and clinical trial milestones-were triangulated against proprietary company databases and conference proceedings to validate emerging patterns.

Finally, expert workshops synthesized these diverse inputs into a cohesive framework, enabling cross-sector comparison and identification of critical inflection points. All data underwent multiple levels of quality control, including peer review by cyclic peptide specialists, to ensure accuracy and relevance. This comprehensive methodology underpins the report’s strategic recommendations and market insights, providing stakeholders with confidence in their decision-making process.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cyclic Peptides market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cyclic Peptides Market, by Type

- Cyclic Peptides Market, by Product Type

- Cyclic Peptides Market, by Technology

- Cyclic Peptides Market, by Application

- Cyclic Peptides Market, by End User

- Cyclic Peptides Market, by Region

- Cyclic Peptides Market, by Group

- Cyclic Peptides Market, by Country

- United States Cyclic Peptides Market

- China Cyclic Peptides Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesizing Key Insights to Highlight the Pivotal Role of Cyclic Peptides in Next Generation Therapeutics and Industrial Applications

Across the breadth of this analysis, cyclic peptides emerge as a transformative modality that reconciles the specificity of biologics with the versatility of small molecules. Their intrinsic conformational constraint not only endows them with proteolytic resilience and membrane permeability but also expands the repertoire of druggable targets, particularly at protein–protein interfaces.

Technological innovations-from automated solid-phase synthesis and chemoenzymatic cyclization to recombinant DNA–driven macrocyclization-have collectively accelerated discovery cycles and broadened structural possibilities. Concurrently, adaptive segmentation strategies reveal that distinct market niches, whether diagnostic biosensors, peptide vaccines, or therapeutic applications across cardiovascular and oncology, each demand tailored production and commercialization approaches.

Ultimately, regional dynamics and emerging tariff considerations underscore the importance of agile supply chains and strategic policy engagement. As leading players refine their platforms and expand pipelines, the cyclic peptides ecosystem is poised for sustained growth, offering compelling opportunities for differentiation and value creation in next-generation therapeutics and beyond.

Connect With Associate Director Ketan Rohom to Acquire the Full Cyclic Peptides Market Research Report and Unlock Strategic Intelligence

To explore the full suite of insights, strategic analyses, and data-driven perspectives on the cyclic peptides landscape, engage directly with Ketan Rohom, Associate Director of Sales & Marketing. Ketan can guide you through how this report aligns with your specific objectives, whether you are evaluating technological adoption, supply chain resilience, or therapeutic pipeline opportunities.

By collaborating with Ketan, you gain tailored support to extract the most relevant sections, identify actionable intelligence, and determine priority areas for investment or research. His expertise in market positioning and stakeholder engagement ensures a seamless experience as you secure this critical resource for informed decision-making.

Reach out to Ketan today to discuss purchasing options, customization requests, and complementary advisory services. Empower your team with the comprehensive knowledge and competitive edge necessary to navigate the dynamic cyclic peptides ecosystem.

- How big is the Cyclic Peptides Market?

- What is the Cyclic Peptides Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?