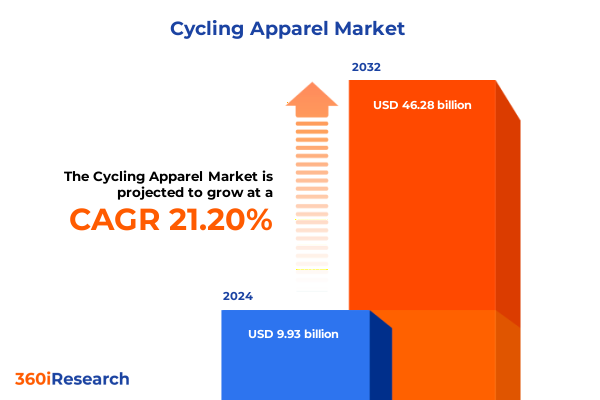

The Cycling Apparel Market size was estimated at USD 12.02 billion in 2025 and expected to reach USD 14.31 billion in 2026, at a CAGR of 21.22% to reach USD 46.28 billion by 2032.

Discover how performance innovation transformation and evolving consumer preferences are shaping cycling apparel industry for competitive advantage

The cycling apparel sector is undergoing a remarkable evolution driven by heightened consumer expectations, advanced fabric technologies and an intensified focus on sustainability. As riders seek gear that enhances comfort, performance and style, manufacturers are innovating across multiple dimensions-from aerodynamic fits and moisture-wicking constructions to eco-friendly materials that minimize environmental impact. Moreover, the rise of connected devices and wearable sensors has spurred designs that integrate seamlessly with data-driven performance analytics, enabling athletes to push their limits with confidence.

Concurrently, shifting consumer lifestyles and digital purchasing behaviors are reshaping traditional retail models. Online platforms now play a central role in product discovery, personalization and direct-to-consumer engagement, challenging brands to deliver immersive experiences and rapid fulfillment. Meanwhile, social media influencers and community-driven events continue to boost demand for limited-edition collections and collaborations that tap into lifestyle narratives. As global participation in road, mountain and triathlon disciplines expands, the industry faces both the opportunity to cater to diverse rider segments and the imperative to maintain agility in an increasingly competitive landscape. Furthermore, tariff fluctuations, supply chain disruptions and rising raw material costs underscore the necessity for strategic resilience.

In this dynamic context, industry stakeholders must align R&D, sourcing, marketing and distribution strategies to capture emerging demand. By harnessing cutting-edge materials, embracing omni-channel frameworks and prioritizing transparent sustainability commitments, cycling apparel brands can reinforce their market positions and deliver value that resonates with modern athletes and enthusiasts alike.

Uncover the transformative shifts driving the cycling apparel landscape including technological breakthroughs sustainability initiatives and market dynamics

The contemporary cycling apparel landscape is defined by a series of transformative shifts that span technological innovation, consumer engagement and operational models. Advanced textile engineering has brought forth fabrics with engineered porosity, temperature regulation and ultraviolet protection, which together elevate rider comfort across diverse climates and intensities. Simultaneously, progress in 3D knitting and seamless manufacturing techniques has unlocked new possibilities for ergonomic design, reduced wastage and scalable production.

Sustainability initiatives have also reshaped the sector, with brands increasingly turning to recycled polymers, plant-based fibers and closed-loop production systems. These eco-conscious strategies not only mitigate the industry’s carbon footprint but also resonate deeply with a growing segment of environmentally minded consumers. Moreover, regulatory pressures and corporate commitments to circularity are driving investments in materials recovery and repair services, fostering long-term brand loyalty.

Digital transformation further amplifies these developments through virtual fit tools, AI-driven trend forecasting and online customization platforms that engage cyclists at every stage of their purchasing journeys. As omni-channel retail merges physical showrooms with virtual experiences, brands that adopt agile fulfillment infrastructures and data-centric marketing are gaining ground. Finally, collaborative ecosystems linking brands, professional teams, tech startups and research institutions have accelerated product development cycles, enabling swift iteration and early market trials. Together, these paradigm shifts underscore a redefined value proposition in which innovation, integrity and interactivity converge to shape the future of cycling apparel.

Analyze the cumulative impact of 2025 United States tariff measures on cycling apparel supply chains manufacturing strategies and consumer pricing dynamics

The 2025 tariff measures imposed by the United States have exerted a pronounced influence on the cycling apparel supply chain, prompting brands and suppliers to reassess sourcing frameworks and cost structures. With increased duties on imported textiles and finished garments from key manufacturing hubs, companies have encountered higher landed costs and margin compression. This has, in turn, accelerated conversations around nearshoring and diversified procurement strategies, as stakeholders seek to balance price pressures with delivery reliability.

In response to these cumulative impacts, some leading apparel manufacturers have forged strategic partnerships with domestic textile mills and contract facilities, thereby reducing exposure to international trade policies. Others have adopted dual-tier pricing models, allocating premium collections to existing channels while targeting price-sensitive segments with co-branded or private-label lines produced in cost-efficient regions. Supply chain analytics have become pivotal in identifying optimal inventory buffers and alternative logistics routes to mitigate the risk of port congestions and rate volatility.

Furthermore, consumer pricing dynamics have adjusted to reflect elevated input expenses, leading to a nuanced push-pull between perceived value and affordability. Brands emphasizing performance differentiation-whether through proprietary materials, tailored ergonomic features or track-tested durability-are better positioned to justify incremental price points in the face of tariff-driven headwinds. Overall, the cumulative effect of 2025 trade policies highlights the necessity for integrated supply chain agility, robust cost modeling and proactive stakeholder collaboration to sustain competitive performance.

Reveal segmentation insights on how product types activity categories materials distribution channels and end user segments shape market opportunities

Segmentation of the cycling apparel market uncovers crucial insights into how each category drives innovation, consumer engagement and growth potential. Within the realm of headwear, both headbands and visor caps have gained traction for their blend of sun protection and sweat management, appealing to recreational riders and seasoned athletes alike. Handwear segmentation between full finger and half finger gloves underscores a balance between protection and ventilation, influencing design priorities based on seasonal conditions and riding intensity. The outerwear segments reveal divergent preferences for waterproof versus windproof jackets, each tailored to address the unpredictable nature of weather, while jersey variations spanning long sleeve, short sleeve and sleeveless configurations cater to nuanced comfort and style considerations across riding environments. In lower-body apparel, bib shorts remain highly regarded among endurance cyclists for ergonomic support, whereas mountain bike shorts and waist shorts have carved distinct niches by emphasizing rugged flexibility or lightweight convenience. In the sock category, both short and long lengths continue to evolve with compression and thermoregulation features. The rise of full-length tights alongside knee-length variants in the tights & pants segment responds to a broader demand for year-round versatility.

Activity type classification-comprising mountain, road and triathlon disciplines-further differentiates consumer expectations, as off-road enthusiasts prioritize durability and load-bearing capacity, road cyclists seek aerodynamic precision and weight reduction, and triathletes favor rapid-dry, multi-sport crossover designs. Material segmentation sheds light on performance drivers, with breathable mesh fabrics leading in moisture management, cotton maintaining a comfort niche, and Lycra/Spandex enabling form-fitting stretch. Meanwhile, Merino wool offers temperature regulation and odor resistance, and Nylon and Polyester remain ubiquitous for their resilience and cost-efficiency.

Distribution channel insights emphasize a dynamic interplay between established offline outlets-including department stores, specialty bike shops and sporting goods retailers-and digital ecosystems driven by brand-owned websites and broad-reaching e-commerce platforms. Finally, end user segmentation among men, unisex and women profiles reveals targeted design and marketing approaches that recognize anthropometric, aesthetic and lifestyle distinctions shaping purchase decisions across global cycling communities.

This comprehensive research report categorizes the Cycling Apparel market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Activity Type

- Material

- Distribution Channel

- End User

Illuminate critical regional insights demonstrating diverse growth trajectories consumer behaviors and strategic priorities across Americas EMEA and Asia Pacific markets

Regional dynamics within the cycling apparel ecosystem present unique growth narratives shaped by local infrastructure, economic factors and cultural adoption. In the Americas, robust road and mountain biking traditions drive sustained demand for performance-oriented apparel, with the United States market particularly notable for its appetite for premium and technologically advanced offerings. Consumers in North America increasingly leverage digital platforms not only for purchases but also for product research and community engagement, prompting brands to integrate seamless online-to-offline experiences. Latin America, while representing a smaller share, signals potential through growing recreational participation and expanding retail networks, especially in Brazil and Mexico.

Across Europe, Middle East and Africa, varying adoption curves underscore the importance of regional adaptation. Western European countries continue to lead in premium segment penetration, supported by well-established cycling infrastructures and high per capita spending on specialized gear. Meanwhile, emerging markets in Eastern Europe and the Middle East demonstrate an appetite for aspirational brands, albeit tempered by price sensitivity and evolving retail landscapes. In Africa, nascent cycling communities are fostering grassroots demand, presenting an opportunity for affordable yet durable apparel solutions.

The Asia-Pacific region encapsulates a broad spectrum of maturity levels, from the mature, innovation-driven markets of Japan and South Korea-where consumers seek pioneering materials and bespoke fit-to the rapidly expanding economies of China, India and Southeast Asia. E-commerce growth and urbanization fuel widespread access to cycling apparel, while local manufacturers capitalize on cost advantages and shorter lead times. Across all Asia-Pacific markets, the convergence of lifestyle wellness trends and emerging sports tourism creates fertile ground for both global brands and regional challengers to cultivate loyalty through tailored product assortments.

This comprehensive research report examines key regions that drive the evolution of the Cycling Apparel market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examine leading company strategies product innovations collaborations and competitive positioning shaping the forefront of the global cycling apparel industry

Leading companies in the cycling apparel arena are leveraging strategic innovation, partnerships and brand differentiation to cement their market positions. Global players renowned for their proprietary fabric technologies continue to expand R&D capabilities, investing in novel polymer formulations and smart textiles that integrate wearable sensors. These advancements not only reinforce premium brand equity but also create entry barriers for new entrants.

Meanwhile, heritage cycling brands are pursuing collaboration strategies with professional teams, triathlon series and outdoor apparel labels to broaden their audience reach and validate product performance under demanding conditions. Through co-branded collections and limited-edition drops, companies tap into enthusiast communities, driving both direct sales and secondary market buzz. Simultaneously, digital-native challengers have harnessed direct-to-consumer distribution models to accelerate feedback loops and reduce channel margins, offering customizable kits that appeal to boutique segment shoppers.

Strategic acquisitions and equity partnerships are also shaping the competitive terrain, as established apparel groups look to diversify into adjacent categories such as footwear, protective gear and wearable electronics. These moves enable cross-selling opportunities and integrated marketing campaigns that elevate customer lifetime value. In addition, sustainability leadership has emerged as a differentiator, with select firms pioneering recycled fiber programs and transparent supply chain reporting to address environmental concerns while strengthening stakeholder trust. Collectively, these strategies illustrate how top-tier companies are orchestrating multifaceted initiatives to drive brand affinity, operational efficiency and long-term resilience.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cycling Apparel market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ASSOS of Switzerland GmbH

- Bioracer BV

- Café du Cycliste SARL

- Castelli Milano 1938 Limited

- DashAmerica, Inc.

- Endura Ltd

- Giordana Sports Ltd

- Le Col Ltd

- MAAP Australia Pty Ltd

- Manifattura Valcismon S.p.A.

- POC Sweden AB

- Rapha Racing Ltd

- Rapha Racing Pty Ltd

- Santini Maglificio Sportivo S.r.l.

- Specialized Bicycle Components, Inc.

- Sportful S.r.l.

- Sugoi Performance Apparel, Inc.

- Trek Bicycle Corporation

- Velocio Performance LLC

- W. L. Gore & Associates, Inc.

Present actionable recommendations enabling industry leaders to optimize operations strengthen innovation and capitalize on opportunities in cycling apparel

To thrive in this evolving environment, industry leaders must enact a series of strategic initiatives that align innovation, supply chain agility and customer-centric engagement. First, prioritizing investment in advanced material research will create performance differentiation while reinforcing premium brand positioning. By establishing cross-industry partnerships with textile innovators and academic institutions, companies can accelerate development timelines for next-generation fabrics that optimize comfort, weight and environmental impact.

Second, adopting a resilient sourcing framework supported by scenario modeling and diversified vendor networks will mitigate exposure to trade policy shifts and logistics disruptions. Incorporating nearshore production capabilities, strategic inventory buffers and real-time analytics will enable faster response to market fluctuations and seasonal demand cycles. Third, refining omni-channel strategies to blend immersive in-store experiences with seamless digital touchpoints can deepen consumer engagement. Leveraging virtual try-on technologies, AI-driven product recommendations and subscription-based loyalty programs will foster repeat purchases and community advocacy.

Moreover, embedding sustainability into the core product lifecycle-from raw material selection through end-of-life recovery-will resonate with an increasingly eco-conscious customer base. Transparent reporting on recycled content, carbon footprints and circularity initiatives will enhance brand credibility. Finally, deploying data-driven marketing campaigns that harness social listening, athlete endorsements and localized content can capture emerging micro-segment opportunities. These integrated actions will empower industry leaders to optimize operations, amplify innovation and capitalize on evolving consumer preferences.

Detail the comprehensive research methodology featuring stakeholder interviews rigorous analysis and data validation ensuring reliable cycling apparel insights

This report’s insights derive from a rigorous research methodology that integrates primary stakeholder interviews, comprehensive analysis and systematic data validation to ensure accuracy and reliability. Primary research involved in-depth discussions with senior executives, product managers, material suppliers and specialty retailers, uncovering firsthand perspectives on emerging trends, operational challenges and strategic priorities. Expert interviews spanned cross-functional teams, from R&D leaders exploring next-generation fabrics to brand marketers driving omnichannel campaigns.

Secondary analysis incorporated an extensive review of industry publications, peer-reviewed journals and trade association reports, supplemented by web-based resources and regulatory filings. This layered approach enabled triangulation of qualitative insights and quantitative data, ensuring that conclusions reflect both macro-level patterns and granular segment dynamics. Key analytical frameworks-including SWOT, Porter’s Five Forces and trend impact matrices-were applied to synthesize competitive landscapes, identify growth enablers and pinpoint potential disruptors.

Data validation procedures included cross-referencing multiple independent sources, conducting consistency checks on historical trends and employing expert panel reviews to refine assumptions. This iterative feedback loop fostered methodological transparency and minimized bias. Additionally, the research leveraged proprietary databases and custom surveys to capture real-time shifts in pricing, channel mix and material innovation. Collectively, these rigorous methods underpin the report’s strategic recommendations and ensure that stakeholders receive actionable, trustworthy insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cycling Apparel market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cycling Apparel Market, by Product Type

- Cycling Apparel Market, by Activity Type

- Cycling Apparel Market, by Material

- Cycling Apparel Market, by Distribution Channel

- Cycling Apparel Market, by End User

- Cycling Apparel Market, by Region

- Cycling Apparel Market, by Group

- Cycling Apparel Market, by Country

- United States Cycling Apparel Market

- China Cycling Apparel Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

Conclude with synthesized insights outlining strategic imperatives evolutionary trends and future outlook to guide decision makers in the cycling apparel sector

Through a synthesis of technological, commercial and regulatory developments, this executive summary consolidates key insights essential for navigating the cycling apparel market’s complex terrain. The analysis highlights how performance-driven fabric innovations and sustainability imperatives are redefining product value propositions. Simultaneously, a nuanced segmentation framework reveals the diverse preferences across product categories, activity types, channel strategies and end-user profiles that dictate tailored go-to-market approaches.

The examination of 2025 tariff impacts underscores the imperative for supply chain resilience and dynamic cost modeling, while regional insights illustrate that success hinges on market-specific strategies-from premium positioning in Western Europe to e-commerce-driven expansion in Asia-Pacific. Leading companies have demonstrated the power of collaborative partnerships, digital-first engagement and sustainability leadership in fostering brand differentiation and consumer loyalty.

Looking ahead, decision-makers must consolidate these learnings into integrated action plans, leveraging agility in sourcing, innovation in materials and precision in channel activation. By aligning strategic priorities with evolving consumer sentiments and regulatory landscapes, organizations can capitalize on emerging opportunities, mitigate risks and chart a path toward sustained market leadership in the cycling apparel sector.

Engage with Ketan Rohom Associate Director Sales and Marketing to purchase the full cycling apparel market research report and unlock strategic intelligence

To secure unparalleled insights into consumer behaviors competitive dynamics and evolving trends within the cycling apparel sector, we invite you to engage directly with Ketan Rohom, Associate Director of Sales & Marketing. Partnering with Ketan offers access to bespoke guidance on how this comprehensive research can support strategic decision-making and accelerate your market positioning. Through a collaborative consultation, you’ll explore specific methodologies, data points and customized deliverables tailored to your organization’s objectives.

During your conversation, Ketan will outline the extensive scope of the published report, highlight key chapters and demonstrate how granular segmentation and regional analyses can inform product development, channel strategies and go-to-market planning. You will also learn how the report’s actionable recommendations align with your growth aspirations, whether entering new territories, optimizing supply chains or enhancing sustainability credentials.

By initiating a dialogue with Ketan, you gain a direct liaison who understands your priorities and can coordinate access to ancillary services such as data extracts, custom modeling and executive briefings. Don’t miss this opportunity to leverage deep market intelligence endorsed by rigorous research practices. Reach out to Ketan Rohom today to purchase the full cycling apparel market research report and unlock the strategic intelligence you need to thrive.

- How big is the Cycling Apparel Market?

- What is the Cycling Apparel Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?