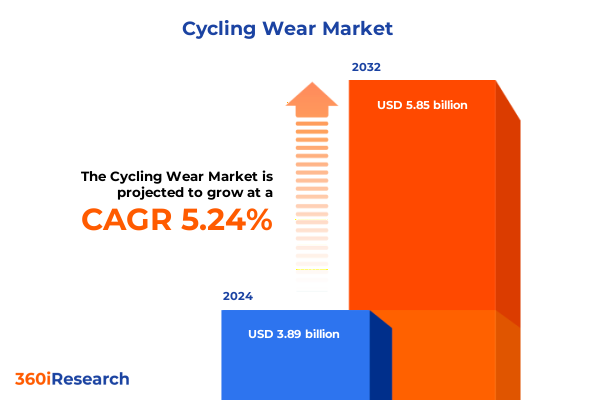

The Cycling Wear Market size was estimated at USD 4.05 billion in 2025 and expected to reach USD 4.22 billion in 2026, at a CAGR of 5.40% to reach USD 5.85 billion by 2032.

Building a Holistic Foundation for Understanding Current Market Dynamics and Innovation Trajectories in Cycling Wear to Guide Strategic Leadership

The cycling apparel sector has undergone a remarkable metamorphosis, emerging as a confluence of high-performance engineering, lifestyle-driven aesthetics, and sustainability imperatives. This report lays the groundwork for understanding how technical fabric innovations, consumer expectations for comfort and style, and heightened environmental awareness have collectively elevated cycling wear beyond its traditional functional role. By charting this evolution, we aim to empower decision makers with a robust perspective on current market forces and future directions.

As cycling transforms from a niche pursuit into a mainstream fitness and leisure activity, the demand for apparel that seamlessly integrates performance, breathability, durability, and design has escalated. Athletes and casual riders alike now seek gear that offers advanced moisture management, aerodynamic benefits, and ergonomic construction, all while reflecting personal style and brand identity. This fusion of utility and expression underscores the market’s potential for growth and differentiation.

Concurrently, the rise of eco-conscious consumption has driven brands to adopt circular design principles and transparent sourcing methods. Sustainable fibers, low-impact dyes, and recyclable packaging are no longer fringe considerations; they represent strategic imperatives that shape brand loyalty and regulatory compliance. As digital channels proliferate, omnichannel experiences and direct-to-consumer outreach are amplifying brand narratives, fostering deeper connections with end users and accelerating innovation cycles.

This introduction sets the stage for a detailed exploration of transformative market shifts, policy impacts, segmentation nuances, regional performance drivers, competitive landscapes, actionable strategies, and the rigorous methodology underpinning our findings. Through this holistic lens, stakeholders will gain clarity on the pathways to sustained success in the evolving world of cycling wear.

Unveiling the Profound Transformational Forces Reshaping Consumer Behavior and Technological Innovation in Cycling Apparel Landscape

The cycling apparel landscape is currently defined by a series of transformative shifts that are reshaping value propositions and competitive dynamics. First, technological advancements in textile engineering have unlocked an unprecedented array of performance attributes, from thermoregulation and compression mapping to ultra-lightweight seamless construction. These developments not only enhance athletic output but also drive differentiation in a crowded marketplace.

Parallel to these material innovations, the rise of personalization and customization is empowering consumers to curate gear that aligns with individual physiological and aesthetic preferences. Digitally enabled design platforms facilitate tailored fit solutions and unique graphic adaptations, fostering deeper consumer engagement and brand loyalty. Moreover, the integration of wearable sensors and smart textiles is paving the way for real-time biometric feedback, transforming apparel into a data-rich interface between rider and coach.

In tandem with technological and personalization trends, sustainability has emerged as a transformative force. Leading manufacturers are investing in recycled polymers, bio-based fibers, and closed-loop production systems, responding to both regulatory pressures and evolving consumer ethics. The shift toward circularity is no longer an aspirational objective but a mandate that redefines supply chains, cost structures, and marketing narratives.

Together, these dynamics-technical innovation, personalization, and eco-centric practices-are accelerating the transition to a more agile, consumer-centric marketplace. Brands that harness these trends effectively will be best positioned to capture emerging opportunities and cultivate lasting competitive advantage.

Assessing Compounded Effects of 2025 United States Tariff Measures on Cost Structures and Supply Chain Resilience within Cycling Wear Sector

In 2025, the United States implemented a suite of tariff adjustments on select textile and apparel imports, triggering a cascade of cost pressures and strategic realignments across the cycling wear industry. While the primary objective of these measures was to bolster domestic manufacturing and address trade imbalances, downstream effects have reverberated through sourcing, pricing, and supply chain resilience.

Consequently, many brands have reevaluated their production footprints, shifting from traditional low-cost regions to diversified manufacturing hubs that offer favorable duty regimes and logistical proximity to key markets. This redistribution of production has introduced additional complexities related to vendor qualification, quality assurance, and lead time variability. As a result, supply chain managers are investing in digital traceability platforms and risk modeling tools to safeguard continuity and performance.

The tariff-driven cost escalations have also influenced pricing strategies, compelling retailers and direct-to-consumer channels to absorb margins or adjust price points, with mixed impacts on consumer demand elasticity. Simultaneously, mid-tier and premium segments have leveraged design-to-cost methodologies to preserve product integrity while mitigating input cost fluctuations. Collaboration with suppliers to negotiate long-term agreements and volume-based incentives has further softened the tariff impact.

Looking ahead, industry participants are exploring nearshoring initiatives and strategic stockpiling to hedge against future policy shifts. By incorporating advanced analytics to forecast duty implications and optimize inventory positioning, brands and distributors can navigate the tariff landscape with greater agility, ensuring that cost volatility does not undermine innovation or market penetration.

Revealing Critical Segmentation Perspectives Illuminating Diverse Consumer Needs and Product Preferences Across Fabric, Distribution, and Usage Profiles

A nuanced understanding of consumer demand and product performance necessitates a granular segmentation framework. When examining the cycling wear market by product type, one observes a continuum from accessory categories-such as arm and leg warmers, caps, and headbands-to core performance pieces like cycling shorts, bib shorts, and jackets. Eyewear, gloves, jerseys, and socks further illustrate the breadth of consumer touchpoints, each requiring distinct design and material considerations.

Turning to fabric type, the dichotomy between natural and synthetic materials remains salient. Natural fibers offer breathability and biodegradability, yet synthetic blends of nylon, polyester, and spandex deliver the stretch, moisture-wicking, and durability essential for high-intensity activities. In particular, advanced polyamide and polyester formulations combined with elastane are driving performance gains and fit precision, setting the stage for continued innovation in composite textile engineering.

When differentiating by end user, market dynamics diverge across kids, men, and women segments. Pediatric cycling wear prioritizes reinforced safety features and ergonomic fits for growth and movement patterns, whereas adult offerings emphasize aerodynamic efficiency, muscle support, and gender-specific anatomical design. Women’s apparel has garnered particular attention, with brands expanding size inclusivity and tailoring silhouettes to enhance comfort and style.

Finally, distribution channel segmentation underlines the interplay between offline retail environments and online commerce platforms. Brick-and-mortar stores provide experiential fitting services and community engagement, while e-commerce channels facilitate rapid launch cycles, direct consumer feedback loops, and digital brand storytelling. Strategic integration of these channels underpins omnichannel approaches and shapes the competitive calculus for leading market players.

This comprehensive research report categorizes the Cycling Wear market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Fabric Type

- Application

- End User

- Distribution Channel

Mapping Distinct Regional Performance Drivers and Emerging Opportunities Across the Americas, EMEA, and Asia-Pacific Cycling Wear Markets

Regional dynamics in cycling wear are shaped by distinct consumer behaviors, regulatory landscapes, and distribution infrastructures. In the Americas, strong participation in endurance events, gran fondos, and urban commuting has fueled demand for a range of performance-oriented and lifestyle-driven apparel. Brands operating in North America, in particular, are capitalizing on robust e-commerce ecosystems and strategic partnerships with fitness platforms to cultivate brand communities and loyalty.

In Europe, the Middle East, and Africa, cultural and climatic diversity drives variation in apparel preferences and performance requirements. Mediterranean enthusiasts gravitate toward lightweight, breathable designs, while Northern European riders seek thermal layering solutions and waterproof capabilities. Across the Middle East and Africa, rising interest in recreational cycling and emerging urbanization trends have prompted local distributors to emphasize UV protection, moisture management, and adaptive fit technologies for hot and humid environments.

Asia-Pacific’s landscape encompasses mature markets such as Japan and South Korea, where premium branding and technological integration dominate, alongside rapidly growing segments in China, India, and Southeast Asia. These regions exhibit keen interest in value-driven innovations, including hybrid multifunctional gear that transitions seamlessly between cycling and casual wear. Additionally, the proliferation of digital retail channels and social commerce platforms is accelerating market entry for both established brands and agile local designers.

Collectively, these regional insights underscore the necessity of tailoring product development, pricing, and channel strategies to localized consumer expectations and environmental conditions, enabling brands to optimize market penetration and cultivate sustainable growth trajectories.

This comprehensive research report examines key regions that drive the evolution of the Cycling Wear market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Strategic Partnerships Driving Innovation, Sustainability, and Competitive Differentiation in Cycling Apparel

A review of leading industry participants reveals strategic priorities centered on innovation, sustainability, and consumer engagement. High-performance brands have invested heavily in proprietary fabric technologies and aerodynamic research, collaborating with professional teams and research institutions to validate product efficacy under real-world conditions. These partnerships bolster credibility and accelerate technology transfer to mass-market lines.

In parallel, a wave of new entrants and niche labels are differentiating through authentic storytelling, limited-edition capsule collections, and direct-to-consumer business models. By curating exclusive collaborations with athletes and artists, these brands foster community-driven marketing momentum while maintaining agile product development cycles. Their ability to rapidly iterate based on social feedback loops challenges established players to adapt more fluidly to evolving trends.

Sustainability leadership is emerging as a critical axis of competition, with frontrunners adopting comprehensive circular economy initiatives. Through take-back programs, recycled yarn integration, and transparent supply chain disclosures, these companies are reshaping consumer perceptions and setting new benchmarks for industry accountability. Investors and stakeholders increasingly view such commitments as hallmarks of forward-looking enterprise risk management.

Meanwhile, distribution partnerships with specialty retailers, omni-experience flagship stores, and online marketplaces reinforce brand accessibility and service excellence. Strategic alliances with fitness tech providers, event organizers, and lifestyle platforms further extend brand narratives, creating ecosystem-driven touchpoints that resonate with discerning cyclists across performance and leisure segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cycling Wear market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- adidas AG

- ASSOS of Switzerland GmbH

- Bellwether Cyclewear, Inc.

- Bohang Ltd

- Castelli by Manifattura Valcismon S.p.A.

- DE MARCHI SPORT Srl

- Decathlon S.A.

- Endura Limited by Pentland Chaussures Limited

- Giessegi S.r.l.

- GORE Wear GmbH

- JRD Cycling Ltd

- Löffler GmbH & Co KG

- Monton Sports

- Nalini S.p.A.

- NIKE, Inc.

- Orbea, S. Coop.

- Pearl Izumi USA, Inc.

- PUMA SE

- Rapha Racing Limited

- Runtowell Ltd

- Santini Maglificio Sportivo S.p.A.

- Sportful S.r.l.

- Under Armour, Inc.

- Vaude GmbH & Co. KG

- Vermarc Sport NV

Empowering Industry Leaders with Targeted Strategies to Optimize Product Innovation, Tariff Mitigation, and Omnichannel Engagement in Cycling Wear

To thrive in an environment marked by rapid innovation and policy uncertainty, industry leaders must adopt a multifaceted strategy that balances agility with resilience. Prioritizing investment in sustainable material research will not only address regulatory and consumer pressures but also unlock cost efficiencies through closed-loop manufacturing and waste reduction. Concurrently, fostering collaborative R&D ventures with textile science institutes can expedite the commercialization of next-generation performance fabrics.

On the operational front, diversifying production footprints and embracing nearshoring opportunities will mitigate exposure to tariff volatility and logistical disruptions. Leveraging predictive analytics to model duty scenarios and optimize inventory positioning can further enhance supply chain responsiveness. Leadership teams should also explore long-term supplier partnerships with volume-based incentives to stabilize input costs and guarantee quality standards.

Digital transformation remains a cornerstone of competitive differentiation. Companies should refine omnichannel strategies by integrating immersive in-store experiences with virtual fit technologies and post-purchase engagement tools. Utilizing advanced CRM systems and data-driven personalization algorithms will deepen consumer relationships and drive repeat purchases. Moreover, strategic alliances with sports event organizers and community platforms can amplify brand visibility and authenticity.

By executing these targeted initiatives, cycling wear brands can simultaneously fortify operational resilience, accelerate product innovation, and elevate consumer experiences, securing a leadership position in an increasingly discerning marketplace.

Detailing Rigorous Research Methodology Incorporating Primary Insights, Multimodal Data Analysis, and Expert Validation Processes for Robust Findings

This study’s conclusions are founded upon a rigorous research framework designed to ensure both depth and validity. Primary research components included in-depth interviews with senior executives, product development specialists, and supply chain managers across key global markets, complemented by structured surveys capturing practitioner insights and consumer preferences. These engagements provided qualitative perspectives on industry pain points, innovation drivers, and strategic priorities.

Secondary research encompassed a comprehensive review of trade journals, regulatory filings, technical white papers, and reputable news outlets. This phase enabled contextualization of primary findings within broader macroeconomic and policy environments. Special attention was given to trade commission documents and tariff schedules to elucidate the implications of 2025 duty amendments.

Quantitative data analytics involved triangulation of company disclosures, publicly available shipment statistics, and digital retail performance metrics to detect trends in product adoption, channel shifts, and regional demand. Advanced data modeling techniques were applied to identify correlations between tariff structures and cost migration patterns, ensuring that reported impacts reflect real-world supply chain behaviors.

To guarantee the integrity of insights, all data underwent a multi-tier quality validation process, including expert panel reviews and cross-referencing against independent databases. This methodological rigor underpins the reliability of our strategic recommendations and ensures that stakeholders can act with confidence on the findings presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cycling Wear market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cycling Wear Market, by Product Type

- Cycling Wear Market, by Fabric Type

- Cycling Wear Market, by Application

- Cycling Wear Market, by End User

- Cycling Wear Market, by Distribution Channel

- Cycling Wear Market, by Region

- Cycling Wear Market, by Group

- Cycling Wear Market, by Country

- United States Cycling Wear Market

- China Cycling Wear Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Concluding Synthesis Highlighting Key Takeaways, Strategic Imperatives, and the Future Trajectory of the Cycling Wear Ecosystem

The cycling wear market is navigating a pivotal moment characterized by technological breakthroughs, shifting policy landscapes, and evolving consumer expectations. From the integration of smart textiles to the imperatives of sustainability, the sector’s innovation trajectory demands that brands remain both visionary and pragmatic. Strategic adaptability will differentiate those who capitalize on emerging material technologies and those who are hindered by supply chain disruptions.

Segmentation insights reveal that tailoring product portfolios to distinct performance needs, fabric preferences, and end user demographics is essential for competing across accessory, core apparel, and protective categories. Meanwhile, regional nuances underscore the importance of customizing go-to-market strategies to cultural and climatic conditions, ensuring relevance in the Americas, EMEA, and Asia-Pacific domains.

The ripple effects of 2025 tariff adjustments affirm the need for agile sourcing strategies and proactive duty management, while competitive profiling highlights the momentum behind sustainability leadership and consumer-centric brand narratives. By synthesizing these insights, industry stakeholders can refine their innovation roadmaps, optimize operational resilience, and cultivate brand loyalty through authentic, data-driven experiences.

In sum, the evolving cycling wear ecosystem presents both significant challenges and unparalleled opportunities. Stakeholders who integrate these findings into strategic planning will be best positioned to harness growth, drive meaningful impact, and set new standards in performance, sustainability, and consumer engagement.

Engage Directly to Access Comprehensive Cycling Wear Market Insights and Connect with Ketan Rohom for Customized Guidance and Report Acquisition

To explore the full breadth of evidence-based insights into cycling wear market evolution and to secure tailored strategic intelligence, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, who is poised to guide you through the report’s findings and address any bespoke requirements, ensuring you leverage these insights to strengthen your competitive positioning and meet emerging consumer demands in this dynamic industry.

- How big is the Cycling Wear Market?

- What is the Cycling Wear Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?