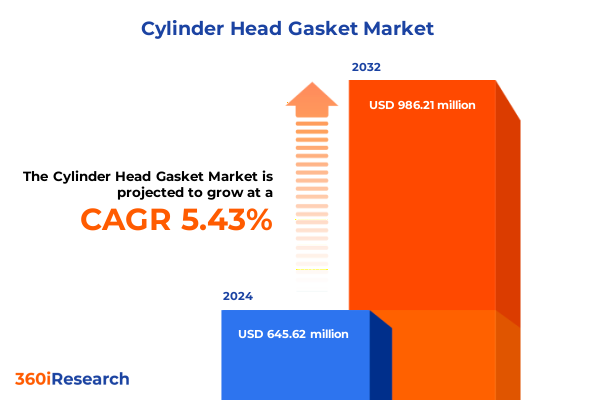

The Cylinder Head Gasket Market size was estimated at USD 681.50 million in 2025 and expected to reach USD 713.42 million in 2026, at a CAGR of 5.42% to reach USD 986.21 million by 2032.

Unlocking the Critical Function and Strategic Importance of the Cylinder Head Gasket in Modern Internal Combustion Engine Performance and Reliability

The cylinder head gasket serves as the linchpin of the internal combustion engine, performing the vital task of sealing the combustion chamber while isolating oil and coolant passages. Without a properly functioning head gasket, engines risk losing compression, experiencing fluid cross-contamination, and suffering catastrophic failure under extreme thermal and mechanical stresses. Its critical role demands materials and designs capable of withstanding pressures exceeding 2,500 psi and temperatures surpassing 600°F within a compact, dynamic environment.

This market research analysis delves into the multifaceted aspects of the cylinder head gasket landscape, examining the underlying technology, regulatory influences, and evolving customer expectations that drive innovation. By exploring material advancements such as multi-layer steel and composite solutions, we uncover how engineering refinements enhance durability and thermal resistance. Furthermore, the interplay between automotive electrification trends and the continued evolution of internal combustion engines creates both opportunities and challenges for gasket suppliers.

Through a structured examination of tariff impacts, segmentation dynamics, and regional patterns, this executive summary equips decision-makers with a holistic understanding of market forces. As industries navigate the dual imperatives of performance optimization and sustainability, comprehending the strategic importance of cylinder head gaskets becomes paramount for OEMs, Tier 1 suppliers, and aftermarket stakeholders alike.

Charting the Paradigm Shift Driven by Advanced Materials, Digital Manufacturing, and Sustainability Redefining the Cylinder Head Gasket Value Chain

The cylinder head gasket market is undergoing a paradigm shift driven by breakthroughs in material science, manufacturing automation, and sustainability mandates. Advanced multi-layer steel formulations incorporating nano-engineered coatings have raised the bar for corrosion resistance and thermal stability, enabling gaskets to operate reliably under increasingly aggressive combustion pressures. At the same time, hybrid composite gaskets fortified with graphene and bio-derived polymers are emerging as viable alternatives, balancing high-performance sealing with reduced environmental footprints.

Simultaneously, manufacturers are integrating Industry 4.0 principles into production lines, leveraging AI-driven quality control and robotic assembly to tighten tolerances and accelerate throughput. This shift not only mitigates human error but also minimizes material waste, aligning with broader circular economy goals. The rise of additive manufacturing techniques, particularly laser welding and precision machining, further underscores the focus on customization and rapid prototyping.

Transitioning to electric and hybrid powertrains has introduced new requirements for thermal management and lightweight design. While pure battery-electric vehicles eliminate the need for traditional head gaskets, the proliferation of hybrid and high-efficiency internal combustion engines sustains demand for advanced sealing solutions. As a result, suppliers are realigning R&D priorities to develop thinner, lighter gaskets capable of maintaining integrity across a broader temperature range. These transformative shifts collectively redefine the value chain, demanding agility from both OEMs and aftermarket specialists.

Assessing the Comprehensive Cumulative Impact of Escalating United States Tariffs Implemented in 2025 on the Cylinder Head Gasket Supply Chain

In 2025, the United States rolled out a sweeping 25 percent tariff on imported passenger vehicles and light trucks under Section 232 of the Trade Expansion Act, effective April 2, followed by a parallel levy on key engine components-including cylinder head gaskets-beginning May 3. The proclamation mandates that non-US content be assessed at the full ad valorem rate, while USMCA-compliant parts enjoy a temporary exemption pending a process to isolate non-US value.

Collectively, these measures have imposed direct cost burdens on OEMs and aftermarket distributors. Major automakers have reported significant financial impacts: Stellantis faced approximately €300 million in direct tariff costs during the first half of 2025, while General Motors and Ford disclosed Q2 losses of $1.1 billion and up to $1.5 billion, respectively, attributable primarily to import duties. These elevated tariffs have compressed margins, prompted production pauses in Mexico and Canada, and spurred reassessments of cross-border supply chains.

Independent repairers and aftermarket channels confront parallel challenges, with tariff-induced price increases anticipated to be passed on to end users. Many distributors are exploring alternative sourcing strategies to mitigate exposure, yet availability constraints threaten inventory levels and could accelerate consolidation within the channel. As the tariff landscape evolves, stakeholders must balance short-term cost management against long-term supply chain resilience, particularly in light of potential retaliatory measures and ongoing trade negotiations.

Revealing Critical Segmentation Insights Across Materials, Applications, Vehicle Classes, Sales Channels, and Engine Types Shaping Cylinder Head Gasket Demand

A nuanced understanding of segmentation dynamics reveals how material selection, application requirements, and distribution channels interact to shape demand. Gaskets composed of multi-layer steel dominate scenarios demanding extreme pressure containment, while composite and copper variants address niche performance and thermal conductivity needs. Elastomeric designs remain essential for engines where cost-effectiveness and simpler installation protocols prevail. Transitioning to application categories, commercial vehicle platforms-especially heavy and light commercial tiers-prioritize durability and longevity under continuous duty cycles, whereas passenger car segments balance sealing performance with weight and packaging constraints.

From the vantage point of vehicle classification, heavy commercial vehicles, light commercial vehicles, and passenger cars each present distinct duty profiles and maintenance intervals that influence gasket material and design choices. Distribution pathways further diversify the landscape: original equipment manufacturers adhere to stringent OEM specifications, while aftermarket segments-spanning offline channels and growing online platforms-cater to repair shops and end users seeking replacement components. Engine type remains a critical axis, with diesel powertrains favoring gaskets engineered for high torque and combustion pressures, and gasoline engines relying on solutions optimized for lighter duty cycles and tighter emission controls.

This layered segmentation approach underscores the imperative for suppliers to tailor product suites and service offerings. By aligning material portfolios with application demands, distribution preferences, and engine specifications, stakeholders can capture value across diverse end-markets and strengthen their competitive positioning.

This comprehensive research report categorizes the Cylinder Head Gasket market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Engine Type

- Application

- Sales Channel

Highlighting Key Regional Dynamics and Growth Drivers Across the Americas, EMEA, and Asia-Pacific Markets Influencing Cylinder Head Gasket Industry Performance

Regional factors play a pivotal role in defining market trajectories and competitive strategies. In the Americas, robust passenger vehicle ownership rates and a mature aftermarket ecosystem drive consistent demand for replacement gaskets, particularly in North America where performance-oriented multi-layer steel solutions are prized by both enthusiasts and fleet operators. Latin American markets are gradually expanding, with light commercial vehicles emerging as a growth lever for cost-effective composite gasket applications.

Across Europe, Middle East, and Africa, stringent emission regulations and an accelerating shift toward sustainable materials underscore the prevalence of bio-derived composite gaskets and advanced coatings. European OEMs are at the forefront of R&D into low-carbon manufacturing processes, leveraging recyclable polymers to meet the tightest environmental mandates. Meanwhile, emerging markets within EMEA present opportunities for aftermarket expansion, particularly in regions with older vehicle fleets that demand reliable replacement solutions.

The Asia-Pacific region remains the largest manufacturing hub for engine components, with significant capacity expansions by key regional players to serve both domestic and export markets. Countries such as China, India, and South Korea are investing in automated production lines to support rising output of heavy commercial and passenger vehicles, leading to increased production of gaskets designed for high-throughput assembly environments. As these economies invest in infrastructure and logistics, the aftermarket channel is also evolving, with digital platforms enabling more efficient parts distribution across vast geographies.

This comprehensive research report examines key regions that drive the evolution of the Cylinder Head Gasket market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Movements, Technological Innovations, and Competitive Differentiators of Leading Cylinder Head Gasket Manufacturers

Leading suppliers are deploying targeted strategies to differentiate their offerings and secure competitive advantage. ElringKlinger has expanded capacity for high-performance multi-layer steel gaskets and introduced a heat-resistant coating that boosts durability by nearly ten percent in turbocharged engines, addressing the needs of both OEM and aftermarket customers. Federal-Mogul, under the Tenneco umbrella, has ventured into smart gasket technology, integrating sensors capable of detecting leaks and pressure anomalies, thereby enabling proactive maintenance and reducing total cost of ownership for fleet operators.

Dana Incorporated’s Victor Reinz brand has responded to tightening emission standards by launching asbestos-free and low-friction gasket materials, enhancing fuel economy by an estimated five percent while increasing recyclable content to align with circular economy principles. Nippon Gasket has focused on composite reinforcement fibers to elevate heat resistance and extend service life in high-performance applications, scaling up production by over seven percent to meet Asia-Pacific demand. Freudenberg has seized aftermarket opportunities by introducing gasket kits optimized for aging vehicle fleets, collaborating with major distributors to broaden its reach in Europe and North America.

These competitive movements highlight the importance of continuous innovation, quality assurance, and channel partnerships. Companies investing in advanced materials, sensor integration, and sustainable manufacturing are well-positioned to navigate the evolving landscape and capture value across both OEM and aftermarket segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cylinder Head Gasket market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Briggs & Stratton Corporation

- CRP Industries Inc.

- Dana Incorporated

- E. DOBSON & CO. (GASKETS) LTD

- ElringKlinger AG

- Freudenberg FST GmbH

- Fuji Racing Ltd.

- Jayem Auto Industries Pvt. Ltd.

- Kokusan Parts Industry Co., Ltd.

- Kumar Auto Industries

- NICHIAS Corporation

- Nippon Gasket Co., Ltd.

- Nippon Leakless Corporation

- Phelps Industrial Products LLC

- Sanwa Packing Industry Co.,Ltd.

- Stephens Gaskets Ltd.

- Tenneco Incorporated

- The Cary Company

- Uchiyama Manufacturing Corp

- Yantai Ishikawa Sealing Technology

Formulating Actionable Recommendations for Industry Leaders to Capitalize on Material Innovations, Supply Chain Resilience, and Regional Opportunities

To thrive amidst intensifying tariffs, supply chain disruptions, and material shifts, industry leaders should adopt a multifaceted strategy. Prioritizing investment in advanced material R&D-including bio-composites and nano-enhanced coatings-will position suppliers to meet both performance and sustainability criteria. At the same time, leveraging digital manufacturing tools and AI-driven quality control can reduce cycle times and enhance yield, mitigating cost pressures resulting from import duties.

Stakeholders must also fortify supply chain resilience by diversifying sourcing networks and deepening partnerships with USMCA-compliant producers to minimize tariff exposure. Establishing agile inventory management practices and near-shoring key production steps can further insulate operations from geopolitical volatility. Engaging proactively with regulatory bodies and trade associations will ensure timely adaptation to evolving tariff frameworks and free-trade agreements.

Finally, aligning go-to-market strategies with regional demand nuances-such as performance-oriented offerings in North America and sustainable composites in EMEA-will amplify growth opportunities. Cultivating digital channels alongside traditional distribution networks will enhance market penetration, particularly within emerging Asia-Pacific markets where e-commerce adoption is accelerating. By integrating these recommendations into strategic roadmaps, industry leaders can secure a competitive edge and drive long-term value creation.

Outlining Our Rigorous Market Research Methodology Integrating Primary Stakeholder Interviews, Comprehensive Data Triangulation, and Segmentation Analysis

Our research methodology blends rigorous qualitative and quantitative techniques to ensure robust insights. We conducted in-depth interviews with a spectrum of stakeholders, including OEM engineering leads, aftermarket distributors, and material science experts, to capture firsthand perspectives on product performance and market trends. This primary research was complemented by exhaustive secondary data collection, drawing on company disclosures, regulatory filings, and trade association reports to validate emerging patterns.

Data triangulation played a central role in reinforcing the credibility of our findings. By cross-referencing thematic insights from interviews with industry publications and tariff schedules, we achieved a balanced view of supply chain impacts and technological trajectories. Segmentation analysis was then employed to assess distinct market segments-spanning materials, applications, vehicle classes, distribution channels, and engine types-uncovering nuanced demand drivers and competitive dynamics.

Finally, expert review panels comprised of former OEM executives and regulatory specialists provided critical validation, ensuring our conclusions and recommendations are grounded in practical experience. This integrated methodology delivers a comprehensive, reliable foundation for strategic decision-making across the cylinder head gasket value chain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cylinder Head Gasket market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cylinder Head Gasket Market, by Material Type

- Cylinder Head Gasket Market, by Engine Type

- Cylinder Head Gasket Market, by Application

- Cylinder Head Gasket Market, by Sales Channel

- Cylinder Head Gasket Market, by Region

- Cylinder Head Gasket Market, by Group

- Cylinder Head Gasket Market, by Country

- United States Cylinder Head Gasket Market

- China Cylinder Head Gasket Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Synthesizing Key Findings and Strategic Imperatives from Tariff Impacts to Technological Trends Underpinning the Future of the Cylinder Head Gasket Market

This executive summary has illuminated the pivotal role of cylinder head gaskets in engine performance and reliability, while mapping the evolving forces reshaping the market. Advanced materials and manufacturing technologies are driving a shift toward thinner, more heat-resistant designs, even as electrification trends introduce new imperatives for hybrid platforms. Concurrently, the implementation of 25 percent US tariffs on vehicles and key components has created both cost challenges and strategic imperatives for supply chain realignment.

Segmentation insights reveal diverse demand profiles across material types, application segments, vehicle classes, distribution channels, and engine variants, underscoring the need for tailored product strategies. Regional dynamics in the Americas, EMEA, and Asia-Pacific further reinforce the importance of localized approaches, from performance-oriented offerings in North America to sustainable composites in Europe and automated production in Asia.

Competitive analysis highlights leading suppliers’ innovations in smart gaskets, eco-friendly materials, and performance coatings, demonstrating the value of continuous R&D and strategic partnerships. The actionable recommendations provided offer a roadmap for industry leaders to capitalize on material advancements, mitigate tariff impacts, and leverage regional opportunities. Together, these insights chart a clear path for stakeholders to navigate market complexities and secure sustainable growth.

Engage with Ketan Rohom to Secure Your Customized Cylinder Head Gasket Market Research Report and Drive Strategic Advantage

Ready to transform your strategic decision-making and harness the full potential of the cylinder head gasket market? Reach out to Ketan Rohom today to secure a tailored research report designed expressly for your organizational priorities. Ketan Rohom, Associate Director, Sales & Marketing, is available to guide you through exclusive insights, custom data sets, and in-depth analysis that will equip your team with the clarity needed to outperform competitors.

By engaging directly with Ketan, you gain access to a consultative experience where your unique challenges and objectives become the focal point of our deliverables. Whether you require deep dives into specific material segments, regional demand assessments, or a granular view of tariff impacts, Ketan will ensure your report is customized to your exact specifications. Don’t miss the opportunity to leverage our comprehensive expertise and accelerate your strategic initiatives in the cylinder head gasket domain.

Contact Ketan Rohom now to discuss your requirements and initiate your personalized research journey. Secure the competitive intelligence that will keep you ahead of market shifts and empower you to make evidence-based decisions with confidence.

- How big is the Cylinder Head Gasket Market?

- What is the Cylinder Head Gasket Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?