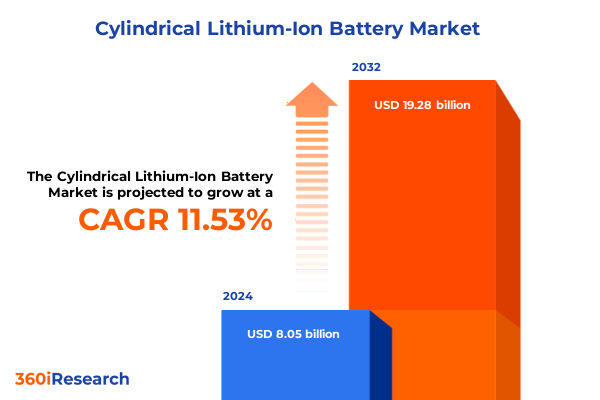

The Cylindrical Lithium-Ion Battery Market size was estimated at USD 8.91 billion in 2025 and expected to reach USD 9.89 billion in 2026, at a CAGR of 11.65% to reach USD 19.28 billion by 2032.

Unveiling the Indispensable Role of Cylindrical Lithium-Ion Batteries in Driving Technological Evolution and Energy Transformation

Cylindrical lithium-ion batteries have become a critical enabler in the global transition toward electrified mobility and renewable energy integration. Their standardized geometry, high energy density, and proven reliability underpin applications ranging from electric vehicle powertrains to grid-scale storage systems. As market demands evolve, these batteries are rapidly gaining traction across consumer electronics, medical equipment, and portable lighting devices, showcasing their versatility and fundamental importance in modern technology landscapes.

Over the last decade, advancements in electrode materials and manufacturing processes have propelled cylindrical cells beyond their traditional confines. Enhanced thermal management techniques and the incorporation of next-generation anode and cathode chemistries have led to improved cycle life and safety profiles. Against this backdrop of continuous innovation, stakeholders across the battery value chain are realigning their strategies to address escalating performance requirements and intensifying competition.

As industry participants navigate shifting regulatory frameworks and burgeoning sustainability mandates, they must also contend with dynamic supply chain complexities and raw material price volatility. Within this context, understanding the nuanced interplay of technological drivers and market forces is essential for crafting resilient business models. Consequently, this report provides a detailed foundation for decision-makers seeking to capitalize on emergent growth trajectories in the cylindrical lithium-ion battery sector.

Charting the Pivotal Shifts Reshaping the Cylindrical Lithium-Ion Battery Industry Across Manufacturing and Application Frontiers

In recent years, the cylindrical battery landscape has undergone significant transformation as manufacturers adopt high-throughput production techniques and advanced cell architectures. The shift toward larger cell formats has been accompanied by the emergence of new winding patterns and tab designs, optimizing energy density and enhancing safety margins. Concurrently, lean manufacturing principles and automation have streamlined assembly processes, resulting in lower cost structures and shortened lead times.

Moreover, the integration of digitalization across the value chain has introduced predictive maintenance and real-time quality control, reinforcing product reliability. As suppliers leverage machine learning algorithms to monitor electrode uniformity and detect defects early in production, they are able to achieve tighter tolerances and reduce end-of-line failures. These technological shifts have fostered a more agile manufacturing ecosystem that responds swiftly to fluctuating demand signals.

In parallel, collaborative partnerships between material innovators and original equipment manufacturers have accelerated the commercialization of novel cathode blends, driving incremental improvements in specific energy and voltage stability. Furthermore, increased cross-industry cooperation, spanning automotive, consumer electronics, and energy storage sectors, has catalyzed broader application development, underlining the battery’s pivotal role in enabling electrification and facilitating carbon reduction goals.

Assessing the Far-Reaching Implications of 2025 United States Tariff Measures on the Cylindrical Lithium-Ion Battery Supply Chain and Market Dynamics

The imposition of new tariff measures by the United States in early 2025 has introduced considerable headwinds for battery importers and domestic manufacturers reliant on global supply chains. These duties, applied to key precursor chemicals and finished cells, have elevated procurement costs and intensified price competition among market entrants. Consequently, several end-users are reassessing their vendor portfolios and sourcing strategies to mitigate tariff exposure and maintain cost competitiveness.

However, the cumulative effect of these tariffs also presents opportunities for reshoring production and fostering supply chain resilience. In response, some stakeholders are investing in localized electrode fabrication and module assembly capabilities, thereby reducing dependence on cross-border shipments and dampening currency fluctuations’ impacts. Moreover, government incentives and subsidies aimed at boosting domestic manufacturing have begun to offset added tariff burdens, encouraging capital investments in expanded production capacity.

Furthermore, the tariff landscape has prompted heightened collaboration between raw material suppliers and downstream assemblers to establish integrated value chains within the United States. These alliances are designed to streamline logistics, improve traceability of critical minerals, and uphold regulatory compliance. By strategically aligning operations under a single geographic footprint, companies are building a more robust framework capable of absorbing policy shifts and minimizing supply interruptions.

Decoding the Market Through Battery Type, Chemistry, Capacity, Sales Channel, and Application to Reveal Strategic Growth Drivers

Segmenting the cylindrical lithium-ion battery market reveals nuanced insights into performance drivers and strategic priorities across multiple dimensions. When analyzing product portfolios by battery type, legacy formats such as 18650 cells coexist alongside larger formats including 21700, 26650, and the emerging 32560 variant, each offering distinct trade-offs in energy density, thermal management, and integration ease. Industry players are prioritizing format optimization to align cell dimensions with application-specific power and packaging requirements.

Insights into battery chemistry highlight the continued dominance of Lithium Cobalt Oxide formulations in high-energy applications, while Lithium Iron Phosphate chemistries gain traction where safety and lifecycle longevity are paramount. Lithium Manganese Oxide blends, with their robust thermal stability, are carving out a niche in scenarios demanding high discharge rates and stringent thermal oversight. Manufacturers are dynamically adjusting their cathode material mix to balance cost, performance, and regulatory compliance in various markets.

Capacity segmentation further underscores evolving consumer and industrial preferences. Mid-range cells rated between 1000 and 3000 mAh remain prevalent in portable electronics, while higher capacities from 3000 to 5000 mAh are becoming standard in power tools and mid-tier electric vehicles. Cells exceeding 5000 mAh are now under evaluation for grid-scale storage modules, whereas sub-1000 mAh designs persist in lightweight medical devices and compact wearable technologies. These capacity-driven distinctions inform product positioning and R&D investment decisions within each stakeholder group.

Channel dynamics delineate distinct commercialization approaches, with traditional brick-and-mortar outlets accounting for substantial volumes in established regional markets, and online platforms increasingly facilitating direct-to-consumer transactions in newer geographies. Meanwhile, application segmentation highlights the breadth of end-use scenarios, as cylindrical cells empower automotive propulsion systems, drive consumer electronics innovations, stabilize renewable energy storage installations, underpin critical medical device functionality, and extend the runtime of portable lighting solutions. This holistic segmentation framework illuminates tailored strategies for capturing growth across the diverse cylindrical battery ecosystem.

This comprehensive research report categorizes the Cylindrical Lithium-Ion Battery market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Battery Chemistry

- Battery Capacity

- Sales Channel

- Application

Exploring Regional Variations and Strategic Opportunities Across Americas, Europe Middle East Africa, and Asia-Pacific Markets

Regional nuances exert a profound influence on the evolution of the cylindrical lithium-ion battery market, driven by disparate regulatory priorities, infrastructure maturity, and industrial policies. In the Americas, robust incentives for electric vehicle adoption and extensive investments in domestic cell manufacturing have fostered a competitive landscape characterized by rapid technology deployment and strategic capacity expansions. These dynamics are shaping local supply chains and encouraging vertical integration of upstream material processing.

Across the Europe, Middle East, and Africa region, stringent emissions regulations and ambitious renewable energy targets are catalyzing demand for reliable grid-scale storage solutions, while automotive electrification mandates are driving innovation in high-performance cells. Governmental frameworks promoting circular economy principles are further incentivizing second-life reuse and advanced recycling practices, reinforcing sustainable material loops and fostering collaboration between cell producers and end-of-life service providers.

In the Asia-Pacific region, long-standing leadership in battery manufacturing, particularly in key economies, continues to influence global capacity balances. Supply chain ecosystems that integrate upstream mining, cathode precursor production, and cell assembly within close geographic proximity have enabled cost efficiencies and rapid product iterations. At the same time, emerging markets within the region are experiencing surging demand for consumer electronics and two-wheeler electrification, underpinning substantial growth opportunities for cylindrical formats optimized for compact energy storage.

This comprehensive research report examines key regions that drive the evolution of the Cylindrical Lithium-Ion Battery market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Players and Their Strategic Initiatives Driving Innovation and Competitive Positioning in the Industry

Leading corporations within the cylindrical lithium-ion battery space are distinguished by their commitment to innovation, strategic partnerships, and scaled manufacturing footprints. Several key players have embarked on ambitious capacity expansion initiatives, leveraging advanced manufacturing techniques and proprietary cell designs to achieve economies of scale. Collaborative ventures with material science firms have unlocked breakthrough electrode formulations that enhance energy density while reducing reliance on critical minerals.

In addition, some firms are pioneering closed-loop supply chains, integrating recycling operations to reclaim valuable battery materials and minimize environmental impacts. These forward-looking strategies not only reinforce brand reputation but also offer cost containment benefits in the face of volatile commodity prices. Concurrently, the emphasis on digital twin technologies and factory-level data analytics is optimizing production yields and expediting new product development cycles.

Furthermore, partnerships between battery manufacturers and end-market OEMs are catalyzing co-development initiatives, ensuring that cell architectures meet precise performance benchmarks for electric vehicles, energy storage systems, and high-drain consumer devices. This alignment between cell suppliers and application integrators streamlines validation processes, accelerates time to market, and fortifies competitive positioning in rapidly evolving segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cylindrical Lithium-Ion Battery market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Altertek Ltd.

- BorgWarner Inc.

- BYD Company Limited

- Dongguan CHAM Battery Technology Co., Ltd

- Duracell Inc.

- E-One Moli Energy Corporation

- EAS Batteries GmbH

- Enpower Greentech Inc.

- EVE Energy Co., Ltd.

- Hitachi Ltd.

- Jiangsu OptimumNano Energy Co., Ltd

- Jiangsu Tenpower Lithium Co., Ltd.

- LG Chem, Ltd.

- Murata Manufacturing Co., Ltd.

- Nanograf Corp.

- Padre Electronics Co.,Limited

- Panasonic Holding Corporation

- Samsung SDI Co., Ltd.

- Shenzhen BAK Battery Co., Ltd.

- Shenzhen XTAR Electronic Co., Ltd.

- Sony Corporation

- TADIRAN BATTERIES Ltd.

- TianJin Lishen Battery Joint-Stock CO.,LTD.

- Tianneng Battery Group Co., Ltd.

- Ultralife Corporation

Formulating Strategic Recommendations to Empower Industry Leaders to Navigate Market Complexities and Seize Emerging Opportunities

To capitalize on prevailing market dynamics, industry leaders should prioritize expanding localized manufacturing capabilities to mitigate geopolitical risks and tariff-related cost pressures. Investing in agile production lines capable of accommodating multiple cylinder formats and chemistries will enable rapid response to shifting application requirements and technological advancements. Moreover, forging alliances with upstream material providers can secure consistent access to high-purity precursors and foster joint innovation efforts.

In addition, companies are advised to adopt advanced analytics and predictive maintenance protocols to enhance operational efficiency and reduce cycle downtime. These digital tools can unlock insights into process bottlenecks, facilitate proactive quality interventions, and optimize resource utilization. Simultaneously, committing to circular economy principles through strategic recycling partnerships will not only advance sustainability objectives but also create secondary revenue streams from reclaimed materials.

Finally, forging co-innovation agreements with end-market OEMs can align product roadmaps with evolving performance benchmarks, ensuring that next-generation cylindrical cells deliver tailored value propositions across automotive, grid storage, and portable electronics applications. By implementing these multifaceted recommendations, stakeholders can strengthen their market positions and drive long-term growth in a highly competitive environment.

Detailing the Integrated Research Methodology Employed to Ensure Comprehensive Analysis and Robust Market Intelligence

This analysis is underpinned by a rigorous research methodology that synthesizes both primary and secondary data sources. Expert interviews were conducted with senior executives, technical directors, and procurement specialists across the value chain to capture firsthand perspectives on technology trends, supply chain dynamics, and end-user requirements. Supplementing these insights, a comprehensive review of industry publications, patent filings, and regulatory dossiers provided contextual depth and validated market narratives.

Quantitative data was collected from proprietary databases, trade associations, and government agencies to map production capacities, material flows, and policy impacts. This quantitative foundation was further enriched by case studies detailing recent capacity expansions and strategic collaborations. Triangulation techniques were applied to reconcile discrepancies across data points and ensure analytical robustness.

Finally, our approach incorporated scenario analysis to assess the potential impact of policy shifts, technological breakthroughs, and macroeconomic factors on market trajectories. These scenarios facilitated stress testing of key assumptions and offered stakeholders a range of plausible future states, enabling more resilient strategic planning and risk mitigation.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cylindrical Lithium-Ion Battery market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cylindrical Lithium-Ion Battery Market, by Battery Chemistry

- Cylindrical Lithium-Ion Battery Market, by Battery Capacity

- Cylindrical Lithium-Ion Battery Market, by Sales Channel

- Cylindrical Lithium-Ion Battery Market, by Application

- Cylindrical Lithium-Ion Battery Market, by Region

- Cylindrical Lithium-Ion Battery Market, by Group

- Cylindrical Lithium-Ion Battery Market, by Country

- United States Cylindrical Lithium-Ion Battery Market

- China Cylindrical Lithium-Ion Battery Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Synthesis of Critical Findings and Strategic Takeaways to Guide Stakeholders in the Evolving Cylindrical Lithium-Ion Battery Market

In conclusion, the cylindrical lithium-ion battery landscape is characterized by a confluence of technological innovation, policy-driven market shifts, and evolving end-use applications. The ongoing migration toward high-energy-density formats and advanced chemistries underscores the sector’s commitment to performance enhancement. At the same time, tariff measures and regional policy frameworks are reshaping supply chain architectures and compelling stakeholders to adopt localized manufacturing and integrated value chain strategies.

Key insights derived from segmentation analyses reveal distinct growth vectors across cell formats, chemistries, capacities, channels, and end markets. Regional perspectives further highlight how incentives and regulatory mandates are steering strategic investments and technology adoption in the Americas, EMEA, and Asia-Pacific. Meanwhile, leading companies are leveraging collaborative R&D, digitalization, and recycling initiatives to strengthen competitive moats and advance sustainability objectives.

Collectively, these findings underscore a market in transition-one where agility, innovation, and strategic partnerships will determine which participants can effectively navigate emerging opportunities and challenges. As the industry accelerates toward electrification and renewable integration, stakeholders armed with nuanced insights and actionable recommendations will be best positioned to thrive.

Engage with Associate Director Ketan Rohom to Unlock In-Depth Insights and Propel Your Strategic Decisions with Customized Market Intelligence

To explore how these comprehensive insights can be tailored to your organization’s strategic roadmap and to discuss how customized data sets can empower your decision-making process, please reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure access to the full report and unlock the competitive advantage offered by our thorough analysis.

- How big is the Cylindrical Lithium-Ion Battery Market?

- What is the Cylindrical Lithium-Ion Battery Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?