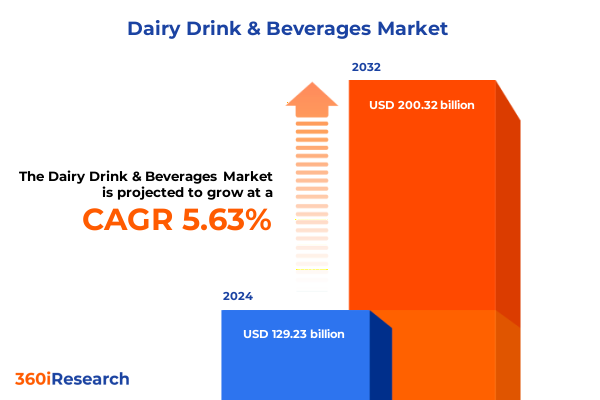

The Dairy Drink & Beverages Market size was estimated at USD 136.18 billion in 2025 and expected to reach USD 143.57 billion in 2026, at a CAGR of 5.66% to reach USD 200.32 billion by 2032.

Comprehensive introduction to emerging consumer preferences and innovation influences shaping the competitive United States dairy drink and beverages landscape

The United States dairy drink and beverages market is undergoing a pivotal evolution driven by shifting consumer lifestyles, heightened health awareness, and rapid innovation across product categories. In recent years, health-conscious consumers have gravitated toward functional offerings that deliver probiotics, high-protein content, and low-sugar formulations without sacrificing taste. As wellness culture becomes ingrained in everyday routines, fortified dairy drinks are positioned at the intersection of nutrition and convenience, capturing interest from busy professionals, fitness enthusiasts, and families alike. Concurrently, premiumization has emerged as a defining trend, with discerning buyers willing to invest in artisanal flavors, organic certifications, and distinctive packaging that reflects brand purpose.

Innovation in the market is not limited to formulation enhancements. Brands are experimenting with cross-category collaborations-incorporating superfruit infusions, botanical extracts, and adaptogens-to cultivate new consumption occasions beyond breakfast or post-workout. Manufacturers are also leveraging digital platforms to engage consumers through personalized recommendations, social media campaigns, and direct-to-consumer subscription models. Sustainability initiatives are equally front and center, as environmental considerations influence purchasing decisions and drive investment in recycled materials, carbon-neutral production, and supply chain transparency. Together, these factors underscore a dynamic landscape where agility and consumer focus are imperative for market participants to thrive.

Examining the significant transformative shifts driving innovation, sustainability adoption, and reconfigured value chains across the dairy beverages landscape

The dairy drink and beverage industry is experiencing profound transformation as sustainability commitments, digital disruption, and health-driven innovation converge to reshape value chains. Leading companies are accelerating investments in eco-friendly packaging, such as lightweight glass alternatives and fully recyclable cartons, to meet consumer expectations and regulatory requirements. Simultaneously, digital commerce and data analytics are redefining distribution strategies: brands are cultivating direct relationships with customers through proprietary e-commerce platforms, while leveraging retailer partnerships for omnichannel fulfillment. This hybrid approach improves responsiveness to demand fluctuations and enhances consumer engagement.

On the product front, the rise of personalized nutrition is triggering a shift toward modular offerings that enable consumers to tailor nutrient profiles according to individual health goals. Advancements in biotechnology and dairy processing are facilitating the creation of novel formulations-ranging from lab-fermented proteins to precision-fortified beverages-that cater to specific dietary preferences, including lactose intolerance and calorie management. Moreover, transparency has become a core competitive advantage, driving brands to adopt blockchain-enabled traceability tools that authenticate ingredient origins and reinforce quality assurances. Together, these transformative shifts underscore a market in flux, where agility, innovation, and sustainability are catalysts for future growth.

In-depth assessment of cumulative tariff implications for trade costs, supply chain resilience, and market competitiveness in United States dairy drinks in 2025

The United States government’s implementation of cumulative tariff adjustments in 2025 has had a discernible impact on dairy drink and beverage trade flows, compelling both importers and domestic producers to recalibrate supply chain strategies. Tariffs on selected fermented products and milk-based formulations rose to an average of 12 percent, up from the prior 6 percent level, increasing landed costs for imported yogurt drinks, kefir, and specialty lassis. Consequently, U.S. manufacturers gained a measure of competitive advantage, as domestically produced offerings became more price-competitive. However, higher input costs for many multinational brands have translated into modest retail price inflation, nudging some value-conscious consumers toward private-label alternatives or substitute beverages.

These tariff-induced cost pressures have also spurred supply chain resilience measures. Some producers are nearshoring production by expanding facility footprints within North America, while others are renegotiating contracts with raw milk suppliers to offset higher import duties. Simultaneously, trade associations and policymakers have engaged in bilateral discussions to explore quota expansions and tariff-rate reductions, aiming to stabilize cross-border flows and mitigate volatility. Overall, the 2025 tariff landscape has realigned competitive dynamics, encouraging industry stakeholders to adopt agile sourcing and pricing strategies that safeguard margins without compromising product quality or consumer trust.

Comprehensive exploration of segmentation dimensions revealing consumer behavior shifts, packaging evolution, dietary preferences, and distribution approaches

Segmentation in the dairy drink and beverages market reveals nuanced consumer preferences and evolving opportunities across multiple dimensions. Product type analysis shows that fermented offerings, including buttermilk, kefir, lassi, and yogurt drinks, are capturing attention due to growing awareness of gut health and probiotic benefits. Concurrently, milk-based products-encompassing condensed milk, flavored milk, milk shakes, skim milk, and whole milk-continue to attract traditionalists and younger demographics seeking indulgent flavor profiles or nutritional fundamentals.

Packaging formats further influence purchasing decisions, as brands balance heritage and innovation by utilizing glass bottles for premium positioning and plastic bottles for on-the-go convenience. Meanwhile, can and carton formats appeal to consumers valuing portability, while Tetra Packs extend shelf life for wider distribution. Processing techniques delineate another critical axis, with pasteurized products dominating mass-market channels and non-pasteurized variants catering to niche segments seeking artisanal authenticity. Dietary preferences intersect with these categories, as high-protein formulations resonate with fitness-focused audiences, lactose-free alternatives serve the intolerant population, and low-calorie options address weight management concerns.

Distribution channels complete the segmentation picture. Offline environments such as convenience stores, specialty shops, and supermarkets & hypermarkets facilitate impulse purchases and bulk shopping, respectively, whereas online channels-comprising brand websites and e-commerce marketplaces-enable subscription-based models, targeted promotions, and enhanced personalization. Together, these layered segmentation insights form a roadmap for product development and tailored marketing strategies.

This comprehensive research report categorizes the Dairy Drink & Beverages market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Packaging Type

- Processing Technique

- Dietary Preference

- Distribution Channel

Regional analysis of consumption patterns, growth drivers, and regulatory impacts across Americas, EMEA, and Asia-Pacific dairy drink markets

Geographic dynamics vary significantly across the Americas, Europe, Middle East & Africa (EMEA), and Asia-Pacific regions, each presenting unique drivers and challenges for dairy drink and beverage players. In the Americas, robust consumer demand in the United States is underpinned by premiumization trends and health-oriented formulations, while Canada’s market favors fortified products and lactose-free lines. Latin American markets, particularly Mexico and Brazil, are experiencing a surge in dairy drink consumption driven by rising incomes and urbanization.

Within EMEA, Western Europe remains the frontier for innovative fermented beverages and specialty flavored milks, supported by stringent food safety regulations and high consumer awareness. The Middle East is witnessing accelerating interest in traditional yogurt-based drinks like lassi, while North Africa is benefiting from government-led dairy consolidation programs. Regulatory landscapes across these markets differ, with EU labeling standards, Gulf Cooperation Council import protocols, and African Union trade harmonization efforts influencing market entry and compliance costs.

Asia-Pacific is the fastest-growing region, propelled by population growth and shifting dietary habits in India, China, and Southeast Asia. Local manufacturers are tailoring portfolios to regional tastes-such as sweetened milk teas and probiotic-infused ayran equivalents-while multinational corporations are investing in joint ventures and greenfield facilities to capitalize on expanding consumer bases. These regional insights emphasize the need for localized strategies and regulatory agility to navigate diverse market conditions.

This comprehensive research report examines key regions that drive the evolution of the Dairy Drink & Beverages market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

In-depth insights into leading dairy drink and beverage companies focusing on strategic moves, innovation, competitive strengths, and collaborative initiatives

Market leadership in the dairy drink and beverage sector is shaped by a cadre of dynamic companies pursuing innovation, strategic collaborations, and robust distribution networks. Major global players have prioritized expanding functional portfolios, launching products fortified with plant proteins, vitamins, and live cultures to meet rising consumer expectations. These leaders are also investing heavily in research and development, forging partnerships with biotechnology firms to pioneer next-generation fermentation techniques and alternative dairy proteins.

In North America, homegrown brands have leveraged agility to introduce on-trend flavors such as matcha-infused lassis and cold-brew coffee-milk hybrids, capturing niche segments ahead of larger competitors. Strategic alliances with leading retailers and e-commerce platforms have enabled these companies to scale quickly, optimizing shelf-space presence and digital visibility. Collaboration across the value chain-ranging from co-manufacturing agreements to sustainability consortia-has further enhanced operational efficiencies and bolstered brand reputations.

Competitive positioning also hinges on geographic footprint, as enterprises with integrated supply chains spanning raw milk collection to retail distribution maintain greater resilience to price fluctuations and logistical disruptions. Meanwhile, joint ventures in emerging markets facilitate entry into high-potential regions, combining local expertise with brand equity. Together, these corporate strategies underscore the importance of innovation, collaboration, and end-to-end control in sustaining market advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Dairy Drink & Beverages market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arla Foods

- Associated Milk Producers, Inc.

- Borden, Inc.

- Britannia Industries Limited

- Chr. Hansen

- Dairy Farmers of America, Inc.

- DANA Dairy Group Ltd

- Danone S.A.

- Eagle Family Foods Group LLC

- FrieslandCampina NV

- Goya Foods, Inc.

- Gujarat Cooperative Milk Marketing Federation Ltd.

- Hiland Dairy

- Hochwald Foods GmbH

- ITC Limited

- Lactalis Group

- Morinaga Milk Industry Co.,Ltd.

- Nestle S.A.

- Rasna Private Limited

- Royal FrieslandCampina N.V.

- Ruby Food Products Private Limited

- Santini Foods, Inc.

- The Farmer's Cow

- The Hershey Company

- United Dairy Ltd.

Actionable recommendations to empower industry leaders with strategic foresight, operational excellence, sustainability integration, and consumer-centric innovation

Industry leaders should prioritize targeted innovation pipelines that align with evolving health and wellness imperatives, embedding functional ingredients such as probiotics, plant-based proteins, and fiber-rich formulations into new offerings. To enhance sustainability credentials, companies must adopt circular packaging models, invest in highrecovery recycling technologies, and partner with suppliers committed to regenerative agriculture. Operational excellence can be achieved by leveraging advanced analytics for demand forecasting, enabling just-in-time production and minimizing waste across the value chain.

Further, cultivating direct-to-consumer channels will empower brands to capture first-party data, drive personalized engagement strategies, and build long-term loyalty through subscription programs and exclusive digital content. Strategic alliances with retailers, logistics providers, and technology partners can facilitate omnichannel fulfillment and enrich consumer touchpoints. To navigate regulatory complexity, organizations should establish dedicated compliance units that monitor evolving standards across key regions, ensuring rapid adaptation and continued market access.

By fostering cross-functional collaboration-uniting R&D, marketing, supply chain, and sustainability teams-companies can expedite innovation cycles and enhance responsiveness to market signals. Embracing a consumer-centric mindset, underpinned by real-time insights and agile decision-making processes, will position industry participants to anticipate trends, mitigate risks, and secure a competitive edge in the dynamic dairy drink and beverages landscape.

Detailed research methodology outlining data sources, primary and secondary research techniques, expert validation processes, and analytical frameworks employed

This research adopts a mixed-methodology framework combining qualitative and quantitative analysis to ensure robust, multidimensional insights. Secondary research involved a comprehensive review of industry reports, regulatory filings, trade publications, and company disclosures to map historic trends and benchmark best practices. Primary research comprised in-depth interviews with senior executives, R&D specialists, supply chain directors, and retail buyers in the dairy drink and beverage ecosystem, providing firsthand perspectives on emerging opportunities and operational challenges.

Quantitative validation was conducted through structured surveys across manufacturers, distributors, and end-consumers to gauge shifting preferences, purchase drivers, and segment-specific behaviors. Data triangulation techniques were employed to reconcile secondary findings with primary inputs, ensuring consistency and reliability. Key metrics pertaining to product type performance, packaging adoption, dietary demand, and distribution dynamics were analyzed using statistical modeling and scenario planning tools. Global advisory panels and peer reviews were leveraged throughout the process to validate assumptions, refine segmentation frameworks, and stress-test conclusions against real-world market conditions.

This methodological rigor underpins the report’s actionable insights, equipping decision-makers with a clear line of sight into market dynamics, competitive positioning, and strategic priorities required to excel in the evolving dairy drink and beverages sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Dairy Drink & Beverages market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Dairy Drink & Beverages Market, by Product Type

- Dairy Drink & Beverages Market, by Packaging Type

- Dairy Drink & Beverages Market, by Processing Technique

- Dairy Drink & Beverages Market, by Dietary Preference

- Dairy Drink & Beverages Market, by Distribution Channel

- Dairy Drink & Beverages Market, by Region

- Dairy Drink & Beverages Market, by Group

- Dairy Drink & Beverages Market, by Country

- United States Dairy Drink & Beverages Market

- China Dairy Drink & Beverages Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Conclusion synthesizing key insights on market dynamics, disruptive trends, regulatory impacts, and strategic pathways for dairy beverage sector

The United States dairy drink and beverages market is defined by rapid innovation, multifaceted segmentation, and evolving trade dynamics that together shape competitive landscapes. Consumers are seeking products that balance nutrition, taste, and sustainability, driving brands to innovate across functional formulations, packaging solutions, and distribution models. Tariff adjustments in 2025 have realigned cost structures and supply chain strategies, underscoring the need for sourcing flexibility and resilient partnerships.

Segmentation insights reveal that fermented drinks are capitalizing on the gut health trend, while milk-based offerings continue to enjoy broad appeal across diverse demographics. Packaging and processing distinctions further differentiate value propositions, and distribution channels-offline and online-offer complementary pathways to market. Regional disparities, from the mature Americas and EMEA markets to the high-growth Asia-Pacific arena, necessitate localized approaches and regulatory agility.

Leading companies distinguish themselves through strategic collaborations, sustained R&D investment, and integrated supply chain capabilities. Actionable recommendations emphasize the importance of functional innovation, sustainability integration, omnichannel engagement, and adaptive compliance frameworks. By leveraging rigorous research methodologies and data-driven insights, industry stakeholders can navigate complex market forces and capture emerging opportunities in the evolving dairy drink and beverages landscape.

Take the next step toward market leadership by accessing the full report and engaging with Ketan Rohom for tailored insights and sales support

For tailored insights, strategic guidance, and direct access to the comprehensive market research report, reach out to Ketan Rohom, Associate Director, Sales & Marketing. His expertise in dairy drink and beverage market dynamics can help you align your growth ambitions with data-driven opportunities. Connect with him to explore customized solutions, request a detailed sample, and secure your copy of the full report to inform executive decisions and seize competitive advantages.

- How big is the Dairy Drink & Beverages Market?

- What is the Dairy Drink & Beverages Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?