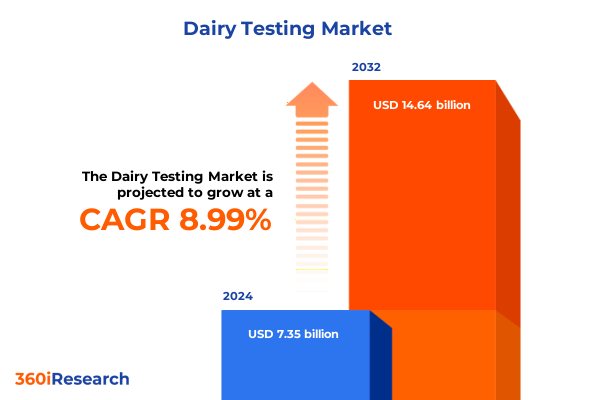

The Dairy Testing Market size was estimated at USD 7.96 billion in 2025 and expected to reach USD 8.62 billion in 2026, at a CAGR of 9.09% to reach USD 14.64 billion by 2032.

Understanding the Critical Role and Emerging Paradigms in Dairy Product Testing Across Global Supply Chains and Regulatory Frameworks for Consumer Protection

The dairy testing sector sits at the nexus of food safety, regulatory compliance, and consumer trust, serving as a fundamental safeguard for public health. With dairy products representing one of the most perishable and widely consumed food categories, the importance of robust testing frameworks cannot be overstated. Across global supply chains, dairy testing encompasses a range of analyses-from detecting microbial pathogens to identifying chemical adulterants-each playing a critical role in preventing foodborne outbreaks and ensuring product integrity.

Over the past decade, regulatory landscapes have evolved significantly, with landmark rules such as the FDA’s Food Safety Modernization Act (FSMA) final rule for preventive controls mandating risk-based product testing and environmental monitoring for ready-to-eat dairy products in processing facilities. Complementing federal mandates, the Pasteurized Milk Ordinance (PMO) sets forth grade "A" milk requirements, ensuring that both raw and finished products meet rigorous quality standards, a framework administered through cooperative federal-state programs under the National Conference on Interstate Milk Shipments. Additionally, international bodies such as Codex Alimentarius and bilateral agreements impose diverse testing prerequisites that exporters must navigate to access critical markets. Consequently, dairy testing has transitioned from a largely reactive practice to an integrated component of proactive food safety management, underscoring its strategic importance for dairy producers, processors, and regulators alike.

Revolutionary Technological Disruptions and Regulatory Convergence Reshaping the Dairy Testing Landscape with Speed and Precision

The dairy testing arena is undergoing transformative shifts driven by advancements in digital technologies and an evolving regulatory convergence that prioritize speed, precision, and transparency. Blockchain-enabled traceability platforms now allow stakeholders to record immutable transaction data, enabling rapid pinpointing of contamination sources and reducing recall scopes from broad batch withdrawals to targeted lot isolations. This level of digital oversight integrates seamlessly with Internet of Things (IoT) sensors, which monitor critical parameters such as temperature and humidity throughout transportation and storage, feeding real-time data into secure ledgers and fostering compliance assurance.

Concurrently, artificial intelligence (AI) and machine learning approaches are redefining microbial and quality testing paradigms. Recent studies demonstrate that shotgun metagenomics data, when interpreted through AI algorithms, can accurately flag anomalies such as antibiotic residues or unauthorized additives in bulk tank milk, outperforming traditional diversity metrics and clustering methods. Critical applications also include AI-driven imaging tools for rapid chromogenic culture interpretation, streamlining mastitis pathogen detection on-farm and reducing the reliance on specialist intervention. These innovations, aligned with tightening regulatory expectations around rapid and high-throughput testing, underscore the sector’s pivot toward integrated, data-driven safety assurance protocols.

Analyzing the Cascading Effects of 2025 Tariff Measures on United States Dairy Testing Practices and Global Trade Dynamics

In early 2025, the United States implemented a series of tariff measures that have reverberated through the dairy sector, affecting both export dynamics and testing demands. The imposition of a 10% retaliatory levy by China on 26 U.S. dairy products-from fluid milk to cheese varieties-imposed immediate revenue pressures on exporters and heightened the need for rigorous compliance testing to meet certification requirements under new trade conditions. Concurrently, under emergency trade powers, the U.S. announced 25% tariffs on Canadian dairy imports, prompting Canada to respond with elevated duties on U.S. exports within the USMCA framework and fueling further trade negotiation complexities.

These tariff escalations have compelled dairy laboratories to expand their analytical capabilities, ensuring that product specifications align with diverse tariff quotas and non-tariff measures across multiple markets. In particular, the need to validate origin claims, compositional parameters, and adherence to maximum residue limits has intensified, driving laboratories to adopt multiplex and high-throughput testing methodologies. Industry stakeholders are now advocating for targeted negotiations to alleviate tariff burdens, recognizing that prolonged trade disputes could erode testing volumes, disrupt supply chain stability, and undermine global consumer confidence in U.S. dairy products.

Decoding Advanced Segmentation Patterns Revealing Diverse Testing Modalities Methods and Application Niches in Dairy Analysis and Market Dynamics

Insights drawn from sophisticated market segmentation reveal that dairy testing is inherently multifaceted, with a rich tapestry of testing types catering to different analytical objectives. Adulteration testing spans chemical, microbial, and miscellaneous analyses, each addressing potential economic and safety concerns in raw and processed dairy. Bioinformatics tools segment into hardware support and software solutions, enabling genomic and pathogen surveillance to support high-resolution trace-back investigations. Quality testing further diversifies into microbial assays, nutritional profiling, and organoleptic evaluations, ensuring that sensory and compositional attributes meet stringent consumer and regulatory standards. Parallel safety testing, encompassing allergens, pathogens, and pesticide residues, underscores the industry’s commitment to mitigating public health risks and maintaining the highest thresholds of consumer protection.

Methodologically, the market bifurcates into rapid and traditional testing approaches. Rapid methods-chromatography, immunoassays, PCR, and spectroscopy-offer expedited, on-site decision support, with chromatography branching into gas and liquid modalities and spectroscopy leveraging mass and NIR analyses for swift residue screening. Traditional techniques, such as colorimetric assays and microbial culturing, remain indispensable for confirmatory testing and regulatory compliance, particularly when quantifying viability or certifying pathogen inactivation. Application-driven segmentation highlights consumer testing services, production and processing oversight, R&D initiatives, and retail distribution control, illustrating the pervasive role of testing across the dairy value chain. Finally, end-user segmentation spans dairy processors-from large-scale operations to artisanal producers-regulatory bodies including government agencies and NGOs, and research laboratories housed within academic and commercial settings, each demanding tailored analytical solutions to address unique operational and compliance requirements.

This comprehensive research report categorizes the Dairy Testing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Testing Type

- Product Type

- Technology

- Application Areas

- End-User

Evaluating Regional Dynamics Unveiling the Distinct Drivers Shaping Dairy Testing Strategies in the Americas EMEA and Asia Pacific and Strategic Implications

Regional landscapes for dairy testing are distinguished by varied regulatory architectures, consumer expectations, and infrastructure maturity. In the Americas, the United States and Canada lead with well-established frameworks such as the PMO and USMCA provisions, supported by comprehensive APHIS IRegs that outline country-specific export requirements and certification pathways. Latin American markets, while expanding rapidly, often contend with resource constraints and heterogeneous regulatory regimes, prompting stakeholders to deploy mobile and rapid testing units to bridge gaps in cold chain monitoring and border inspections.

Within Europe, Middle East, and Africa, the European Union’s harmonized standards drive robust testing protocols, underpinned by TRQs and strict maximum residue limits that laboratories must verify through accredited methods. Conversely, in parts of the Middle East and Africa, evolving frameworks-often informed by Codex and bilateral agreements-demand agile testing solutions adaptable to local contexts. Asia-Pacific exhibits pronounced regulatory diversity: Japan and South Korea maintain stringent import lists and health certificates, while emerging economies such as India and China enforce complex facility registration and quarantine requirements, compelling U.S. exporters to secure specialized testing endorsements and navigate dynamic policy shifts outlined by USDA Foreign Agricultural Service advisory reports. Across these regions, digital traceability and risk-based testing programs are increasingly adopted to harmonize compliance and operational efficiencies.

This comprehensive research report examines key regions that drive the evolution of the Dairy Testing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Entities Driving Innovation Collaboration and Competitive Differentiation in the Global Dairy Testing Market and Ecosystem Evolution

Key market participants are intensifying their focus on innovation-driven differentiation and strategic collaborations. Thermo Fisher Scientific, a stalwart in laboratory instrumentation and consumables, reported revenue growth driven by new rapid test kits for antibiotic residues, underpinning its leadership in high-throughput dairy analysis. Eurofins Scientific and SGS have expanded their dairy testing portfolios through targeted acquisitions and the integration of multiplex molecular assays, strengthening their global laboratory networks. Neogen Corporation’s acquisition of rapid microbial testing specialist BioLumix exemplifies how vertical integration enhances service breadth and accelerates time-to-result capabilities, particularly in pathogen screening scenarios.

Meanwhile, specialized niche players such as Charm Sciences and Biomerieux are advancing biosensor and immunoassay platforms tailored to on-site testing, enabling producers to conduct allergen and mycotoxin analyses with minimal sample preparation. Collaborative ventures between technology firms and dairy cooperatives are also emerging, focusing on blockchain traceability pilots and AI-driven anomaly detection frameworks. Collectively, these efforts underscore a competitive ecosystem where scale and innovation coalesce, driving continuous improvements in testing accuracy, turnaround time, and regulatory compliance.

This comprehensive research report delivers an in-depth overview of the principal market players in the Dairy Testing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agrolab Group

- ALS Limited

- AsureQuality Limited

- Bureau Veritas

- Certified Laboratories, Inc.

- Charm Sciences, Inc.

- CVR Labs Private Limited

- Dairy One Cooperative, Inc.

- DSM-Firmenich AG

- Eurofins DQCI, LLC

- FARE Labs Pvt. Ltd.

- FOSS India Private Limited

- IDEXX Laboratories, Inc.

- Intertek Group PLC

- LGC Group

- Microbac Laboratories, Inc.

- Mérieux NutriSciences Corporation

- NDDB CALF Limited

- Neogen Corporation

- Nova Biologicals

- R-Biopharm AG

- Symbio Laboratories

- TUV SUD

Strategic Imperatives for Industry Leaders to Capitalize on Innovation Frameworks Strengthen Compliance Expand Testing Capabilities to Drive Sustainable Growth

Industry leaders must prioritize a strategic agenda that embraces technological adoption while reinforcing compliance foundations. First, integrating blockchain and IoT systems with laboratory information management systems will create unified digital ecosystems, facilitating real-time data sharing and traceability that mitigate recall risks and enhance consumer transparency. Second, investment in AI-driven platforms for microbial and genomic analysis can substantially reduce detection times and increase anomaly detection sensitivity, positioning laboratories at the forefront of proactive food safety intervention.

Furthermore, stakeholders should cultivate partnerships with third-party testing providers to offset regulatory gaps such as the FDA’s temporary suspension of proficiency testing, ensuring laboratory accreditation continuity and service resilience. Strengthening workforce capabilities through targeted training on advanced analytical techniques and data science applications will empower teams to manage complex datasets and deliver actionable insights. Finally, proactive engagement with policymakers and standard-setting bodies will shape favorable testing regulations and facilitate mutual recognition agreements that streamline cross-border compliance. By pursuing these imperatives, industry leaders can transform challenges into competitive advantages and drive sustainable growth.

Comprehensive Research Methodology Integrating Multisource Data Triangulation Expert Consultations and Rigorous Analytical Protocols

This research employs a rigorous methodology combining extensive secondary data review with primary interviews and quantitative analyses. Secondary sources include regulatory documents from agencies such as the FDA, USDA APHIS IRegs publications, and international standards from Codex Alimentarius, supplemented by academic literature on AI and blockchain applications in food safety. Primary insights were gathered through structured interviews with laboratory directors, dairy company executives, and regulatory experts across key regions.

Quantitative data were triangulated through laboratory survey responses to validate adoption rates of testing technologies and to assess the operational impacts of tariff measures. The segmentation framework was refined using market share analysis and trend extrapolation techniques, ensuring that each category accurately reflects current industry dynamics. Data integrity was maintained through cross-validation against published financial reports and government trade statistics, providing a comprehensive foundation for analysis and recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Dairy Testing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Dairy Testing Market, by Testing Type

- Dairy Testing Market, by Product Type

- Dairy Testing Market, by Technology

- Dairy Testing Market, by Application Areas

- Dairy Testing Market, by End-User

- Dairy Testing Market, by Region

- Dairy Testing Market, by Group

- Dairy Testing Market, by Country

- United States Dairy Testing Market

- China Dairy Testing Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Concluding Insights Synthesizing Market Evolution and Strategic Pathways in Dairy Testing for Enhanced Safety Quality Trust and Future Outlook

The dairy testing landscape is poised at a critical juncture where technological innovation, regulatory evolution, and trade policy intersections define market trajectories. The convergence of digital traceability, AI-driven diagnostics, and rapid testing methods offers unprecedented opportunities to elevate food safety, quality assurance, and consumer confidence. However, the sector must navigate tariff-induced disruptions and regulatory vacuums, such as proficiency testing suspensions, to maintain testing integrity and service continuity.

Looking ahead, the successful integration of advanced analytics and collaborative frameworks will determine the industry’s ability to respond to emerging challenges and capitalize on growth drivers. Stakeholders who invest strategically in technology adoption, workforce development, and policy engagement will secure leadership positions in the global dairy testing ecosystem. Ultimately, a unified approach that balances innovation with robust compliance will ensure that dairy testing remains a cornerstone of public health protection and market competitiveness.

Engage with Ketan Rohom for Exclusive Access and Tailored Insights into the Comprehensive Dairy Testing Market Report Today

To explore detailed findings and gain a competitive edge in the evolving dairy testing landscape, connect with Ketan Rohom, Associate Director, Sales & Marketing, to secure your copy of the comprehensive market research report. This tailored synthesis provides industry-leading insights into technology adoption, regulatory shifts, tariff impacts, and strategic opportunities crafted to inform critical decisions for enhancing your testing programs and market positioning. Reach out today to discuss how this report can support your growth objectives and operational excellence.

- How big is the Dairy Testing Market?

- What is the Dairy Testing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?