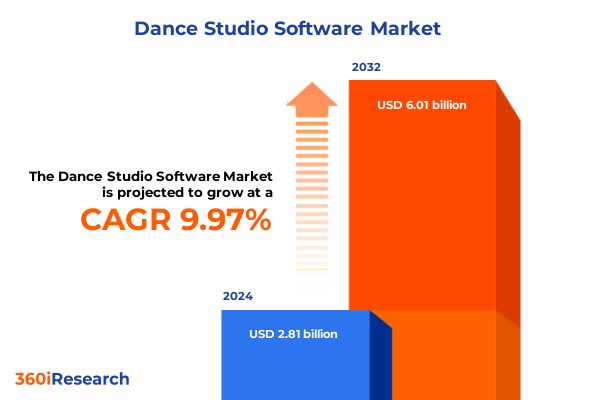

The Dance Studio Software Market size was estimated at USD 3.09 billion in 2025 and expected to reach USD 3.41 billion in 2026, at a CAGR of 14.54% to reach USD 8.01 billion by 2032.

Introducing a New Paradigm in Dance Studio Software that Seamlessly Integrates Management, Engagement, and Insight for Studio Success

The contemporary dance studio environment demands a unified and intuitive management platform that aligns administrative tasks with artistic vision. Introducing a software solution that transcends conventional scheduling and billing, this platform offers integrated communication channels, real-time performance analytics, and seamless client interactions. More than simply a tool, it becomes a collaborator that frees instructors and administrators to focus on creative growth and student engagement.

By adopting this integrated approach, studios experience streamlined operations that reduce administrative overhead and eliminate fragmented workflows. Class attendance, curriculum updates, and payment tracking occur within a single ecosystem, minimizing the risk of human error and ensuring transparency at every stage. Through embedded feedback mechanisms and interactive portals, students and parents gain immediate access to updates and resources, fostering stronger studio communities.

As the industry pivots toward digital-first experiences and virtual learning, studios equipped with comprehensive software stand poised to lead. The next generation of dance management platforms offers not only stability and reliability but also the adaptability necessary to respond to evolving client preferences and instructional models. Consequently, studios can confidently expand their offerings, knowing that their operational backbone supports both current needs and future ambitions.

Exploring the Critical Technological and Behavioral Shifts Reshaping Dance Studio Management from Cloud Migration to Personalized Mobile Engagement

Over the past several years, dance studios have witnessed a remarkable evolution driven by advancements in cloud infrastructure and mobile application development. Studios are increasingly migrating from legacy on-premise systems to cloud-hosted environments, unlocking nearly instantaneous software updates and remote access to critical data. Additionally, intuitive mobile interfaces have empowered instructors to manage classes and communicate with clients on the go, wherever inspiration strikes.

Meanwhile, data-driven personalization has surged to the forefront of client expectations. Through integrated marketing tools, studios now deliver tailored email campaigns and social media outreach that resonate with individual interests. Automated scheduling algorithms allocate classes based on historical attendance patterns and instructor availability, significantly reducing no-shows and waitlists. Consequently, studios cultivate deeper connections with students and foster a more consistent revenue stream.

Moreover, contactless experiences have become indispensable. From touchless check-ins using mobile apps to digital invoicing and payment processing, safety and convenience are no longer optional. As studios embrace hybrid teaching models combining in-person and virtual sessions, the demand for platforms that flawlessly bridge these modalities continues to accelerate. As a result, technology-driven studios are setting new standards for engagement, retention, and operational efficiency.

Evaluating the Far-reaching Consequences of 2025 U.S. Tariff Policies on Dance Studio Technology Procurement and Operational Cost Structures

Since the introduction of elevated U.S. tariff measures in early 2025, dance studios have navigated an increasingly complex procurement environment for hardware and peripherals. Devices such as tablets for student check-in, barcode scanners for class access, and specialized audio equipment have seen cost escalations as import duties apply across a broader range of electronic components. Consequently, studios are reallocating budgets to offset these increases, often delaying planned upgrades or seeking alternative suppliers.

Furthermore, the ripple effect of tariffs on middleware and integrated software–hardware bundles has prompted leading platform providers to reevaluate vendor partnerships. Some vendors have opted to absorb part of the additional duty burden, while others have implemented tiered pricing strategies to mitigate upfront cost spikes. This dynamic has influenced procurement cycles, with studios adopting multi-year licensing agreements to lock in favorable rates and hedge against future tariff adjustments.

Despite these challenges, studios are leveraging these shifts to renegotiate terms and explore more flexible hardware-as-a-service models. By embracing modular, interoperable devices that conform to universal standards, administrators are reducing dependence on region-specific imports. As the landscape continues to evolve, adaptable studios that prioritize strategic vendor alliances and total cost of ownership analysis will maintain a competitive edge.

Unlocking Comprehensive Segmentation Perspectives to Drive Tailored Deployment, Functionality, User Experience, and Pricing Strategies in Dance Studio Software

Understanding the nuances of deployment options is essential for tailoring a platform to studio needs. While cloud-based solutions deliver real-time scalability and remote administration, on-premise installations offer studios direct control over data sovereignty and local network performance. Consequently, some studios prefer private server setups to comply with internal security policies, whereas others embrace the agility of hosted services to reduce IT overhead.

Functionality segmentation reveals that comprehensive billing modules extend beyond simple invoicing to encompass automated payment processing, support for multiple currencies, and transparent transaction histories. Class management features now integrate attendance tracking with dynamic curriculum planning, allowing instructors to adjust lesson content based on real-time performance metrics. Marketing tools facilitate targeted email marketing campaigns and seamless social media integration to drive class enrollment, while advanced scheduling capabilities utilize automated class allocation and calendar synchronization to optimize resource utilization.

End users drive platform design through feedback loops that reflect the unique demands of ballet studios, dance academies, and fitness-oriented studios. Similarly, studio size determines feature prioritization, as large facilities require multi-location management dashboards, medium studios seek cost-effective core modules, and small independent studios value straightforward, user-friendly interfaces. Finally, pricing flexibility ranges from perpetual licensing to subscription models, including annual commitments or month-to-month plans, while platform delivery spans web-based portals and native mobile applications on Android and iOS. These overlapping lenses ensure that software providers can precisely align product offerings with studio requirements.

This comprehensive research report categorizes the Dance Studio Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Functionality

- Studio Size

- Pricing Model

- Platform

- Deployment

- End User

Unveiling Key Regional Variations Revealing Unique Market Dynamics and Growth Drivers across the Americas, EMEA, and Asia-Pacific Dance Studio Software Markets

Regional market dynamics vary significantly across the Americas, where North American studios embrace rapid cloud adoption alongside stringent data privacy regulations. In Latin America, studios contend with intermittent connectivity, leading many to seek hybrid solutions that support offline operations with periodic synchronization. Within this region, a growing middle class fuels demand for mid-tier subscriptions and mobile-first enrollment experiences.

Transitioning to Europe, Middle East, and Africa, studios face a tapestry of regulatory environments and linguistic diversity. European facilities often require multilingual interfaces and adherence to GDPR, influencing platform localization and data handling practices. Middle Eastern studios emphasize premium service models that integrate value-added offerings such as virtual masterclasses, while studios in African markets prioritize cost-effective licensing with minimal bandwidth requirements to accommodate variable infrastructure.

Across Asia-Pacific, rapid technological innovation drives early adoption of AI-based analytics and contactless attendance solutions. Studios in Australia and New Zealand favor comprehensive all-in-one suites that support multi-studio networks, whereas Southeast Asian studios gravitate toward flexible, pay-as-you-go subscription plans. This region’s appetite for mobile engagement has propelled the popularity of native apps, fostering community features and in-app social interactions that resonate with digitally native clientele.

This comprehensive research report examines key regions that drive the evolution of the Dance Studio Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Key Industry Players and Their Strategic Innovations Shaping the Competitive Landscape of Dance Studio Management Platforms

Market leaders differentiate through strategic investments in user experience and platform extensibility. Certain providers focus on developing advanced API frameworks that enable seamless integration with third-party tools, from customer relationship management systems to live streaming services. Consequently, studios gain the flexibility to assemble a best-in-class technology stack, reinforcing their competitive positioning.

Another cohort of companies prioritizes vertical specialization by tailoring modules specifically for ballet studios or fitness-oriented academies, embedding domain-specific features such as barre workout tracking or cross-training session templates. In contrast, some innovators concentrate on fostering collaborative communities via integrated social features, encouraging student referrals and peer-to-peer engagement through in-app messaging and shared media galleries.

Additionally, emerging players are leveraging artificial intelligence to automate administrative tasks, from predictive enrollment analytics to dynamic pricing adjustments based on seasonal demand. By adopting machine learning algorithms, these platforms offer studios prescriptive guidance for class scheduling and resource allocation. As competitive pressures intensify, leading companies will continue to expand their ecosystems through partnerships, acquisitions, and modular product suites that deliver both depth and breadth of functionality.

This comprehensive research report delivers an in-depth overview of the principal market players in the Dance Studio Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Class Manager Limited

- Dance Studio Management

- DanceStudio-Pro, LLC

- Fitli, LLC

- Kicksite, LLC

- MINDBODY, Inc.

- Pike13, LLC

- Punchpass, LLC

- Vagaro, LLC

- WellnessLiving Inc.

- Wellsoft, Inc.

- Zen Planner, LLC

Guiding Industry Leaders toward Technological Excellence and Enhanced Client Engagement with Strategic Recommendations for Sustainable Growth

Leaders in the dance studio software sector should prioritize the development of modular architecture that facilitates rapid feature deployment and third-party integrations. By embracing microservices, product teams can roll out specialized enhancements without disrupting core functionality, enabling studios to adopt new capabilities incrementally and maintain operational continuity.

Furthermore, studios must cultivate data-driven decision-making processes by integrating analytics dashboards that consolidate enrollment trends, revenue streams, and student satisfaction metrics. By leveraging these insights, administrators can identify underperforming classes, optimize pricing tiers, and tailor marketing initiatives for maximum impact. Strategic emphasis on transparent reporting fosters accountability and drives continuous improvement.

Finally, investing in client education and support ensures successful user adoption and long-term satisfaction. Interactive knowledge bases, live training sessions, and responsive customer success teams empower instructors and administrators to harness the full potential of their software. As competition intensifies, studios that combine technological excellence with proactive stakeholder engagement will emerge as market leaders.

Employing a Rigorous Blend of Primary Interviews and Secondary Intelligence to Deliver a Robust Framework for Dance Studio Software Market Analysis

This research employs a comprehensive methodology that combines in-depth primary interviews with leading studio operators, software developers, and industry consultants. These conversations provide qualitative insights into adoption drivers, pain points, and feature priorities. Supplementing these perspectives, a thorough secondary intelligence review incorporates white papers, regulatory filings, and vendor documentation to establish broader market context and corroborate firsthand accounts.

Quantitative data collection encompasses surveys targeting studio owners across diverse geographies and end-user segments. This approach ensures balanced representation of deployment preferences, functionality utilization, and pricing model inclinations. Data validation protocols include cross-referencing survey outputs with public financial disclosures and technology usage reports from independent analytics firms.

By integrating primary and secondary findings through structured triangulation, our framework delivers robust, multidimensional insights. This approach not only identifies current market realities but also uncovers emerging trends and potential disruptions. Consequently, stakeholders gain a reliable basis for strategic planning, vendor selection, and investment prioritization.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Dance Studio Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Dance Studio Software Market, by Functionality

- Dance Studio Software Market, by Studio Size

- Dance Studio Software Market, by Pricing Model

- Dance Studio Software Market, by Platform

- Dance Studio Software Market, by Deployment

- Dance Studio Software Market, by End User

- Dance Studio Software Market, by Region

- Dance Studio Software Market, by Group

- Dance Studio Software Market, by Country

- United States Dance Studio Software Market

- China Dance Studio Software Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Summarizing Insights and Strategic Imperatives to Empower Stakeholders with Clear Pathways for Adapting to Evolving Dance Studio Technology Requirements

The convergence of cloud computing, mobile engagement, and data-driven personalization defines the current landscape of dance studio management software. Studios that embrace these principles unlock efficiencies in scheduling, billing, and client communication, positioning themselves to thrive amid evolving consumer expectations. At the same time, shifting tariff structures have underscored the importance of flexible procurement strategies and strategic vendor partnerships.

Segmentation analysis highlights the necessity of aligning deployment options, feature sets, and pricing models with studio size, genre specialization, and geographic constraints. Simultaneously, regional insights emphasize the influence of regulatory frameworks, infrastructure maturity, and cultural nuances on platform adoption. A clear understanding of competitive dynamics reveals the value of extensible architectures, AI-driven automation, and verticalized solutions in differentiating provider offerings.

Looking ahead, studios that leverage comprehensive analytics and invest in client support will gain a sustainable competitive advantage. By adopting a holistic view of technology requirements, operational processes, and market trends, stakeholders can chart a clear path toward growth and innovation. The journey to digital excellence is ongoing, but with the right insights and strategies, studios can confidently lead the way.

Secure Your Competitive Advantage and Drive Studio Performance by Engaging with Our Associate Director for Immediate Access to the Comprehensive Report

To explore how your studio can harness the full scope of this research, reach out to Ketan Rohom, Associate Director, Sales & Marketing. Ketan will guide you through the report’s detailed analysis and customize the insights to your studio’s unique requirements. By partnering directly with him, you secure privileged access to actionable intelligence that can transform your operations and client experience.

Initiate a conversation today and empower your decision-making with the industry’s most authoritative market research on dance studio software.

- How big is the Dance Studio Software Market?

- What is the Dance Studio Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?