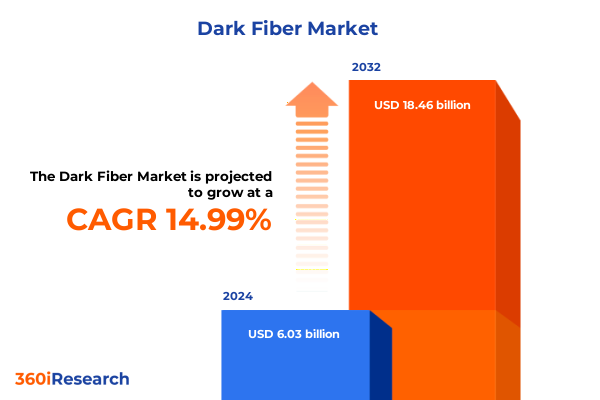

The Dark Fiber Market size was estimated at USD 6.88 billion in 2025 and expected to reach USD 7.85 billion in 2026, at a CAGR of 15.12% to reach USD 18.46 billion by 2032.

Exploring the strategic importance of unlit optical fiber infrastructure as the backbone of networks while framing the scope of this dark fiber market analysis

The landscape of telecommunications is rapidly evolving in response to surging data traffic, cloud computing adoption, and the proliferation of bandwidth‐intensive applications. Unlit fiber, commonly referred to as dark fiber, refers to pre‐installed optical fiber infrastructure that remains inactive until it is “lit” by the end user deploying transceivers and networking equipment. Because it enables end users to control their own signal transmission, dark fiber offers unparalleled flexibility in scaling capacity, optimizing latency, and ensuring network resiliency. As organizations pursue digital transformation and expand their geographic footprints, dark fiber will increasingly serve as the foundational medium for high‐capacity, mission‐critical connectivity.

This executive summary defines dark fiber’s strategic role and presents a structured analysis of market dynamics, transformative trends, and regulatory influences that are shaping deployment decisions. We examine the cumulative impact of 2025 US tariffs on supply cost structures and highlight key segmentation insights across fiber type, material, network topology, deployment methodologies, enterprise adoption patterns, and end‐use verticals. In addition, regional differentiators, competitive positioning of major providers, actionable recommendations for industry leaders, and an overview of our rigorous research methodology provide decision makers with a comprehensive view. This summary culminates in conclusive observations and a tailored call to action, laying the groundwork for informed strategy development in the dark fiber domain.

Analyzing how digital transformation trends from cloud migration to 5G rollout are reshaping dark fiber demand and redefining infrastructure strategies

Digital transformation has accelerated the demand for high‐capacity infrastructure as enterprises migrate critical workloads to the cloud and adopt hybrid IT architectures. Data center interconnectivity, edge computing deployments, and the Internet of Things are placing unprecedented stress on existing networks. In response, carriers and corporate network teams are turning to dark fiber solutions to secure dedicated bandwidth, minimize latency, and retain control over scaling. As a result, the dark fiber landscape is witnessing a shift from traditional long‐haul link construction toward metro and regional network densification, driven by the need to deliver high‐throughput connectivity directly to enterprise campuses, carrier hotels, and fiber‐rich hubs.

Moreover, the rollout of 5G mobile networks and the rise of private wireless initiatives have intensified requirements for ultra‐low latency and predictable performance. Industry participants are forging new supply models, including consortium fiber builds and public‐private partnerships, to pool resources and expand reach. At the same time, advances in optical technologies-such as coherent transmission and pluggable transceivers-enable carriers and large enterprises to light dark fiber with greater spectral efficiency, supporting multi‐terabit capacity over a single strand. These transformative shifts underscore a growing recognition that dark fiber is no longer a niche asset but a strategic enabler for next‐generation connectivity.

Examining the cascading consequences of 2025 US tariffs on fiber optic components and their effects on procurement costs resiliency and deployment timelines

In 2025, the United States imposed additional tariffs on fiber optic cable components under trade policy adjustments aimed at bolstering domestic manufacturing. Key inputs-including glass preforms, cable assemblies, connectors, and transceiver modules-faced new levy rates that increased landed costs for imported goods. Suppliers and network operators experienced immediate cost pressures, with incremental increases estimated in the low double digits on per‐unit expenditures. These cost variances prompted many buyers to reassess their procurement strategies, leading to a shift toward sourcing from US‐based manufacturers, renegotiating long‐term contracts, or partially absorbing costs to maintain competitive service pricing.

As the tariff regime persisted through mid‐2025, deployment schedules in both greenfield and brownfield projects experienced delays while operators evaluated alternative vendors and adjusted project budgets. Some suppliers responded by expanding domestic production capacity or by relocating critical assembly operations to tariff‐free jurisdictions. Meanwhile, service providers accelerated collaboration with contract manufacturers to mitigate supply chain risks and pursued inventory optimization measures. The cumulative effect of these measures has been a temporary slowdown in network rollouts balanced by a longer‐term strengthening of North American supply chain resilience, ensuring greater predictability for future dark fiber deployments.

Unpacking segmentation dimensions to reveal how fiber type material choices and deployment preferences shape usage patterns across end user industries

Dark fiber demand is influenced by multiple segmentation dimensions that reflect distinct user requirements. Based on fiber type, networks leverage either single mode for long‐distance, high‐bandwidth links or multimode for shorter campus and data center interconnect applications that benefit from lower equipment costs. Material composition further differentiates offerings, with glass fibers providing minimal signal attenuation over extended runs, while plastic fibers serve niche use‐cases where cost and ease of handling take precedence. From the perspective of network type, dark fiber can be designed for long haul connectivity spanning hundreds of kilometers between metropolitan areas or for metro deployments that focus on dense urban grids and access networks.

Deployment mode represents another critical axis, contrasting aerial installations that offer rapid, cost‐effective rollout with underground or underwater trenching solutions that provide enhanced protection and longevity. Enterprise adoption patterns diverge across large enterprises, which prioritize dedicated capacity and service level control, versus small and medium enterprises that often seek managed or shared dark fiber arrangements to balance performance and cost. End user industries span banking, financial services and insurance, education and research institutions, energy and utilities operators, government and defense agencies, healthcare networks, media and entertainment content providers, retail and e-commerce platforms, and telecom and IT service operators-each with unique performance, security, and geographic requirements that drive dark fiber design and uptake.

This comprehensive research report categorizes the Dark Fiber market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Fiber Type

- Material

- Network Type

- Deployment Mode

- Enterprise Size

- End User Industry

Highlighting regional dynamics that influence dark fiber adoption across the Americas through EMEA and into the evolving Asia-Pacific technology markets

Regional landscapes for dark fiber exhibit unique characteristics shaped by regulatory frameworks, infrastructure maturity, and investment climates. In the Americas, incumbent carriers and competitive builders are focused on expanding metro and intercity fiber corridors to support cloud on-ramps, hyperscale data centers, and carrier neutral facilities. Municipal initiatives in major US cities have also opened opportunities for localized dark fiber networks, enabling smart city deployments and broadband equity projects. The open access model has gained traction among select metro areas, fostering competition and accelerating deployment timelines.

Across Europe, the Middle East, and Africa, regulatory diversity influences fiber strategies. Western European countries with open access mandates see a proliferation of neutral host fiber networks that serve multiple service providers, while Central and Eastern European markets remain investment-driven by incumbent operators extending reach into underserved regions. In the Middle East, sovereign wealth funds are underwriting large-scale dark fiber builds to support digital cities and national broadband plans. Meanwhile in Africa, international development programs are pairing with private sector capital to deploy submarine and terrestrial fiber links that bridge connectivity gaps. Turning to the Asia-Pacific region, governments in major economies are prioritizing 5G densification and edge computing frameworks, fueling demand for both aerial and underground dark fiber routes. Data center clusters in Southeast Asia and Oceania continue to attract global hyperscalers, prompting regional carriers to invest in new fiber rings and cross-border links to meet growing bandwidth requirements.

This comprehensive research report examines key regions that drive the evolution of the Dark Fiber market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing leading dark fiber providers market positioning innovation initiatives and partnership strategies that define competition within the global network sector

The competitive landscape of dark fiber is defined by a blend of global infrastructure investors and regional specialized operators. Global carriers and tower companies have leveraged their balance sheets and right-of-way portfolios to build expansive fiber routes that span multiple metros and states. These providers pursue a range of strategies-from acquiring existing fiber assets to constructing new routes in collaboration with public agencies-to secure a competitive advantage. In parallel, dedicated fiber infrastructure firms focus on key markets where demand density and rental yields justify aggressive network densification.

Technology partners and equipment vendors also play an influential role by advancing optical transmission solutions that maximize strand capacity. Formal alliances between dark fiber owners and transceiver manufacturers allow both parties to co-develop proof-of-concept demonstrations for ultra-long reach and high-capacity wavelength services. At the same time, regional integrators and system architects tailor dark fiber offerings to specific use cases in government, healthcare, financial services, and media industries, underscoring the market’s ecosystem nature. Innovators continue to explore multi-city consortium builds and fiber-sharing models as a means to reduce capital intensity, while forward-looking players pilot automated provisioning platforms to simplify customer onboarding and accelerate time to revenue.

This comprehensive research report delivers an in-depth overview of the principal market players in the Dark Fiber market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- American Dark Fiber, LLC

- Arelion

- Astound Business Solutions, LLC

- Bandwidth Infrastructure Group CA, LLC

- Charter Communications, Inc.

- Cloudscene Pty Ltd.

- Colt Technology Services Group Limited

- Consolidated Communications Holdings, Inc.

- Dark Fibre Africa (Pty) Ltd.

- Deutsche Bahn AG

- Dobson Fiber

- Etihad Etisalat Company (Mobily)

- euNetworks Group Limited

- Eurofiber Group

- EXA Infrastructure

- FiberLight LLC

- FirstLight

- Frontier Communications Parent, Inc.

- GasLINE GmbH & Co. KG

- GlobalConnect Group

- iQ Networks

- KDDI CORPORATION

- Lumen Technologies Inc.

- LuxConnect S.A.

- Lyntia Networks S.A.U.

- Metro Fiber Networks, Inc.

- MOX Networks, LLC

- Neos Networks Limited

- NGN Fiber Network GmbH & Co KG

- Orange Group

- Saudi Telecom Company

- SICOM Ltd.

- Southern Company

- Stealth Communications Services, LLC

- Sterlite Power Transmission Limited

- SummitIG

- Superloop Limited

- Swoop Holdings Limited

- Tampnet AS

- Telstra Group Limited

- Ufinet Latam S.L.U.

- Uniti Group Inc.

- Verizon Communications Inc.

- Windstream Intellectual Property Services, LLC

- Zayo Group, LLC

Providing strategic actions for industry leaders to enhance network resilience optimize deployment and capitalize on emerging dark fiber opportunities

Industry leaders must adopt a multi-pronged approach to capitalize on dark fiber opportunities and mitigate evolving risks. First, organizations should revisit supply agreements, diversifying equipment vendors to limit exposure to tariff-driven price volatility and ensure continuity of component availability. Proactive collaboration with domestic manufacturers and contract assemblers can further strengthen supply chain resilience. Simultaneously, investment in network automation platforms will streamline provisioning workflows, reduce operational complexities, and enable rapid service activation across both aerial and underground segments.

Beyond operational improvements, providers should cultivate strategic partnerships with hyperscalers, financial institutions, and large enterprises to co-develop bespoke dark fiber offerings tailored to emerging use cases such as distributed edge computing and private 5G networks. Engaging with regulatory bodies and municipal authorities to support open access frameworks can also enhance network utilization and create new revenue streams. Ultimately, a balanced emphasis on cost optimization, technological innovation, and ecosystem collaboration will be essential for leaders aiming to solidify their market position and drive sustainable growth in the dark fiber sector.

Detailing rigorous research methodology combining primary interviews secondary data analysis and expert validation to deliver dark fiber market perspectives

This report’s findings rest on a rigorous research framework that integrates qualitative and quantitative methodologies. Secondary data analysis drew upon public company disclosures, regulatory filings, industry white papers, and technical specifications from standards bodies to establish a foundational understanding of market drivers, competitive dynamics, and technology trends. Primary research consisted of in-depth interviews with senior executives, network architects, and procurement specialists across service providers, equipment vendors, and enterprise end users to validate assumptions and gather real-world perspectives on deployment challenges and investment priorities.

An iterative data triangulation process reconciled insights from secondary sources and primary interviews, while expert validation workshops ensured the accuracy and relevance of key observations. Proprietary datasets on network builds, tariff schedules, and supply chain footprints were employed to contextualize the cumulative impact of regulatory changes. Finally, all findings underwent an internal peer review to guarantee methodological consistency and organizational rigor. This comprehensive approach underpins the strategic insights and recommendations presented throughout the report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Dark Fiber market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Dark Fiber Market, by Fiber Type

- Dark Fiber Market, by Material

- Dark Fiber Market, by Network Type

- Dark Fiber Market, by Deployment Mode

- Dark Fiber Market, by Enterprise Size

- Dark Fiber Market, by End User Industry

- Dark Fiber Market, by Region

- Dark Fiber Market, by Group

- Dark Fiber Market, by Country

- United States Dark Fiber Market

- China Dark Fiber Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Synthesizing the key findings and implications to underscore the strategic importance and future potential of dark fiber infrastructure

The analysis reveals that dark fiber has emerged as an indispensable asset class for organizations striving to meet escalating connectivity demands with greater control and flexibility. Transformative shifts-including the acceleration of digital transformation initiatives, the densification required by 5G networks, and shifting procurement landscapes driven by US tariffs-underscore the need for adaptive strategies. Strategic segmentation by fiber type, material composition, network topology, deployment mode, enterprise scale, and vertical industry requirements highlights the market’s complexity and the necessity for tailored solutions.

Regional nuances further emphasize that no single model fits all markets: while the Americas prioritize open access metro builds and data center interconnects, EMEA markets balance regulatory mandates with private network initiatives, and Asia-Pacific regions pursue expansive fiber densification tied to national digital strategies. Leading providers are responding with differentiated positioning, partnership ecosystems, and technological innovation, setting the stage for continued evolution. Taken together, these insights illustrate that organizations who proactively align their network architectures, procurement strategies, and partnership models with emerging trends will secure a sustainable competitive advantage in the dynamic dark fiber landscape.

Inviting industry decision makers to engage with Ketan Rohom for insights and to secure access to the comprehensive dark fiber market research report

Engaging with Ketan Rohom offers a direct pathway to unlock comprehensive dark fiber market intelligence tailored to your organization’s strategic objectives. As Associate Director of Sales & Marketing, Ketan brings deep expertise in connectivity solutions and can guide you through the report’s findings to align deployment strategies with emerging opportunities. Discussions with Ketan can illuminate nuanced implications for your network architecture, capital planning, and partnership models. To secure full access to the market research report and benefit from personalized insights, reach out to Ketan Rohom and empower your decision-making with confidence.

- How big is the Dark Fiber Market?

- What is the Dark Fiber Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?