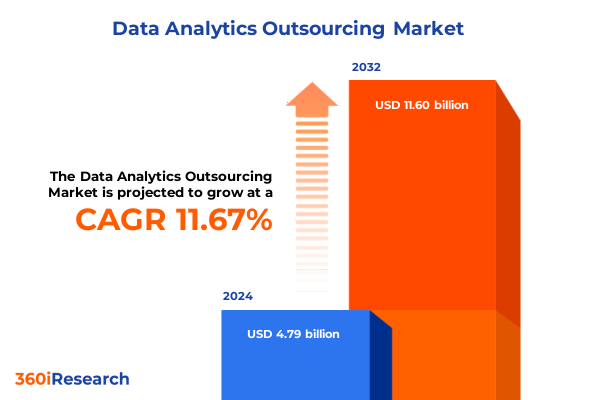

The Data Analytics Outsourcing Market size was estimated at USD 5.34 billion in 2025 and expected to reach USD 5.94 billion in 2026, at a CAGR of 11.70% to reach USD 11.60 billion by 2032.

Setting the Stage for Strategic Data Analytics Outsourcing in a Rapidly Evolving Digital Economy and Intensifying Competitive Environment

As enterprises strive to unlock value from vast and complex data ecosystems, outsourcing analytics functions has emerged as a pivotal strategy to drive innovation and operational efficiency. The introduction of cloud-native platforms, the proliferation of advanced machine learning algorithms, and the rise of distributed workforces have collectively reshaped the way organizations approach data analytics. Against this backdrop, a strategic examination of outsourcing partners, service models, and governance frameworks is essential to align external expertise with internal objectives.

This executive summary presents a holistic overview of the current data analytics outsourcing landscape, emphasizing the convergence of technological advancements and shifting business imperatives. By synthesizing recent trends, regulatory influences, and vendor capabilities, it offers decision-makers a clear understanding of how to leverage external resources to accelerate insights delivery, reduce costs, and foster agility. Through this lens, leaders can make informed investments in analytics capabilities that support long-term growth and resilience in the face of rapid market changes.

Embracing Next-Generation Data Analytics Outsourcing through AI-Driven Techniques and Cloud-Native Service Models

The data analytics outsourcing sphere has undergone profound transformation, driven by the emergence of scalable cloud infrastructures and the mainstream adoption of artificial intelligence. Organizations are no longer constrained by on-premises hardware investments, enabling service providers to offer flexible, consumption-based models that align costs with usage patterns. This shift has expedited project timelines and broadened access to advanced analytics tools for enterprises of all sizes.

Simultaneously, the integration of machine learning and natural language processing has elevated the scope of analytics services, moving beyond static reporting to predictive and prescriptive insights. Vendors that combine domain expertise with cutting-edge algorithmic capabilities are now able to deliver real-time decision support, fostering a proactive culture within client organizations. Coupled with the growing acceptance of multi-vendor ecosystems and collaborative governance structures, these shifts signal a new era of co-innovation in which external partners play a central role in strategic data initiatives.

Navigating the Repercussions of 2025 United States Tariffs on Overseas Analytics Services and Supply Chain Structures

In 2025, newly imposed tariffs on foreign technology services and components have introduced a layer of complexity to data analytics outsourcing strategies. The cumulative impact of these measures has been felt across pricing models, as service providers adjust their cost structures to reflect increased import duties, compliance overheads, and supply chain realignments. As a result, enterprises are reevaluating long-standing vendor relationships and exploring nearshore or domestic alternatives to mitigate tariff exposure.

The ripple effects extend beyond direct cost implications, influencing the broader outsourcing ecosystem. Providers have accelerated investments in localized delivery centers and strategic partnerships with domestic technology firms to circumvent tariff constraints. This realignment has also prompted clients to revisit contract terms, emphasizing greater flexibility and risk-sharing provisions. Consequently, the post-tariff landscape demands a nuanced approach to vendor management, balancing cost optimization with the agility to respond to future trade policy changes.

Dissecting Outsourcing Strategy through Process, Function, Enterprise Scale, and Industry-Specific Analytics Requirements

A nuanced perspective on data analytics outsourcing becomes clear when examining distinct process types, business functions, organization sizes, and industry verticals. When viewed through the lens of process categories-ranging from advanced analytics and data modeling and visualization to data management, reporting, and dashboarding-enterprises must evaluate vendor capabilities across specialization, tool interoperability, and data governance rigor. Service providers with deep expertise in predictive modeling and machine learning frameworks excel in advanced analytics engagements, while those emphasizing ETL pipelines and master data management protocols offer robust data management solutions that ensure consistency and reliability.

Classification by business function reveals divergent priorities. Outsourcing initiatives supporting customer service focus on sentiment analysis and automated query resolution, whereas finance functions prioritize compliance-driven reporting and risk analytics. Human resources engagements center on people analytics to enhance talent acquisition and retention, while marketing and sales leverage customer segmentation and campaign effectiveness metrics. Supply chain and operations functions, on the other hand, benefit from real-time visibility dashboards and predictive maintenance algorithms that drive cost efficiencies.

Organizational scale further informs outsourcing strategies. Large enterprises often pursue integrated, end-to-end partnerships encompassing multiple process types and geographies, leveraging established vendors with global delivery networks. In contrast, small and medium-sized enterprises favor modular, pay-as-you-go offerings that enable targeted deployments without extensive capital commitments, empowering them to incrementally expand analytics capabilities in alignment with growth trajectories.

Finally, vertical-specific requirements underscore the importance of industry-tailored solutions. The banking and financial services sector demands robust security frameworks and compliance with stringent regulations, including granular reporting across banking, financial services, and insurance segments. In the energy and utilities domain, oil and gas firms seek predictive resource extraction models, power generation entities focus on load forecasting, and water utilities emphasize asset monitoring. Healthcare organizations, spanning diagnostics, hospitals, and pharmaceuticals, require analytics platforms that support patient outcomes and regulatory adherence. Information technology and telecommunications companies prioritize network performance analytics, while manufacturers in automotive and electronics adopt digital twins and yield optimization models. Retail and e-commerce operators leverage real-time inventory analytics, personalized recommendation engines, and point-of-sale insights to drive customer engagement and revenue growth.

This comprehensive research report categorizes the Data Analytics Outsourcing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Process Type

- Business Function

- Organization Size

- Industry Vertical

Uncovering Diverse Regional Dynamics in Analytics Outsourcing Spanning Americas, EMEA, and Asia-Pacific Markets

Regional dynamics play a pivotal role in shaping data analytics outsourcing partnerships, as economic conditions, regulatory environments, and talent availability vary significantly across geographies. In the Americas region, mature markets in North America lead in cloud adoption and advanced analytics maturity, with enterprises frequently leveraging nearshore centers in Latin America to balance cost and quality. North American clients benefit from aligned time zones and cultural affinity, facilitating seamless collaboration with service providers across borders.

In Europe, Middle East, and Africa (EMEA), a mosaic of regulatory frameworks and language diversity drives a fragmentation of outsourcing strategies. Organizations within the European Union emphasize data privacy compliance and geopolitical risk mitigation, often engaging local vendors to navigate the complexities of cross-border data flows. Meanwhile, Gulf Cooperation Council markets in the Middle East invest heavily in digital transformation hubs, fostering partnerships with global service providers for large-scale analytics deployments. African economies are gradually emerging as cost-effective delivery locations, supported by growing investments in technology education and infrastructure.

Asia-Pacific continues to be a rapidly expanding frontier for analytics outsourcing, driven by a robust talent pool in nations such as India, the Philippines, and Malaysia. These markets excel in delivering high-volume, transactional analytics services, while emerging markets in Southeast Asia pursue higher-value use cases, including predictive maintenance and localized customer insights. Enterprise buyers in the region must weigh the advantages of scale and cost against evolving data sovereignty policies and infrastructure readiness.

This comprehensive research report examines key regions that drive the evolution of the Data Analytics Outsourcing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Leading and Niche Providers through Intellectual Property Investments and Collaborative Innovation Models

Leading global and specialized service providers have differentiated themselves through targeted investments in intellectual property, domain expertise, and digital platforms. Established players with expansive delivery networks have focused on bundling advanced analytics frameworks with managed services, offering end-to-end analytics lifecycle support from data ingestion through insight delivery. These incumbents often emphasize partnerships with leading cloud hyperscalers to ensure tight integration and performance optimization.

Conversely, niche vendors are carving out strongholds in vertical-specific solutions and emerging technologies. Select providers have developed proprietary AI accelerators and industry benchmarks that resonate with sectors such as healthcare and manufacturing, where compliance, traceability, and precision modeling are paramount. The proliferation of analytics marketplaces and SaaS-based analytics modules has also enabled mid-sized players to compete by offering out-of-the-box solutions for specific business functions, such as HR people analytics and marketing attribution modeling.

Strategic alliances between consulting firms, technology vendors, and outsourcing specialists have further reshaped competitive dynamics. By co-creating innovative solutions, these consortiums can address complex, multi-domain challenges, such as integrating IoT telemetry with enterprise resource planning systems or deploying federated learning across distributed enterprise networks. Forward-looking clients are evaluating providers based not only on scale and cost, but also on their ability to drive transformational outcomes through collaborative innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Data Analytics Outsourcing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture plc

- Capgemini SE

- Cognizant Technology Solutions Corporation

- Deloitte Touche Tohmatsu Limited

- Ernst & Young Global Limited

- EXL Service Holdings Inc

- Fractal Analytics Inc

- Genpact Limited

- Happiest Minds Technologies Limited

- HCL Technologies Limited

- Infosys Limited

- International Business Machines Corporation

- KPMG International Limited

- LatentView Analytics Corporation

- LTI Mindtree Limited

- Mu Sigma Inc

- NTT DATA Corporation

- Opera Solutions LLC

- PricewaterhouseCoopers International Limited

- Tata Consultancy Services Limited

- Tech Mahindra Limited

- Tiger Analytics LLC

- Wipro Limited

- WNS Holdings Limited

- ZS Associates Inc

Driving Sustainable Value through Governance, Modular Architectures, and Collaborative Talent Development

Industry leaders should adopt a multifaceted approach to data analytics outsourcing that prioritizes strategic alignment, architectural flexibility, and continuous improvement. First, organizations must establish clear governance frameworks that define roles, responsibilities, and performance metrics, ensuring accountability across both internal and external stakeholders. By embedding service-level agreements with outcome-based incentives, clients can foster a culture of shared ownership and drive higher levels of service excellence.

Second, a modular technology architecture that separates analytics engines from core systems of record allows for rapid experimentation and seamless integration of new capabilities. Enterprises should leverage APIs and containerized deployments to incorporate third-party analytics tools and accelerate time to market. This agility is particularly critical when responding to shifts in regulatory requirements or evolving data sources, such as IoT streams and third-party data aggregators.

Third, investing in a robust talent strategy that balances outsourced expertise with internal capacity building is essential for sustaining long-term value. Cross-functional centers of excellence can serve as incubators for analytics innovation, providing a platform for knowledge transfer and upskilling internal teams. Simultaneously, strategic vendor partnerships should include skill development initiatives to ensure that outsourced teams remain aligned with the organization’s methodology and culture.

Finally, continuous monitoring and iterative optimization of outsourcing arrangements will help organizations capture emerging opportunities and mitigate risks. Implementing governance dashboards that track key performance indicators, cost variances, and compliance metrics enables proactive course corrections. Through regular joint steering committee reviews and co-innovation workshops, clients and providers can collaboratively refine analytics roadmaps and capitalize on new technological advances.

Applying Rigorous Primary and Secondary Research Protocols with Quantitative Validation and Analytical Frameworks

This analysis is grounded in a rigorous research methodology designed to capture the evolving contours of the data analytics outsourcing market. Primary research involved in-depth interviews with senior executives across various geographies, service providers, and end-user organizations to garner qualitative insights into strategic priorities, decision criteria, and operational challenges. Secondary research encompassed a comprehensive review of industry publications, regulatory filings, vendor white papers, and technology trend reports to contextualize primary findings and validate emerging patterns.

Quantitative data was triangulated through an extensive survey of analytics and IT decision-makers, yielding statistically significant perspectives on outsourcing preferences, cost considerations, and service maturity levels. Analytical frameworks such as SWOT analysis, competitive positioning matrices, and technology adoption curves were employed to systematically evaluate vendor capabilities and market dynamics. Additionally, scenario modeling was utilized to assess the potential impact of regulatory changes, including tariff adjustments and data sovereignty policies, on outsourcing strategies.

A layered validation process ensured the robustness of findings, incorporating peer reviews with subject matter experts and cross-referencing with historical market data. The result is a nuanced portrayal of the outsourcing ecosystem that balances empirical rigor with forward-looking insights, enabling stakeholders to make well-informed strategic decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Data Analytics Outsourcing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Data Analytics Outsourcing Market, by Process Type

- Data Analytics Outsourcing Market, by Business Function

- Data Analytics Outsourcing Market, by Organization Size

- Data Analytics Outsourcing Market, by Industry Vertical

- Data Analytics Outsourcing Market, by Region

- Data Analytics Outsourcing Market, by Group

- Data Analytics Outsourcing Market, by Country

- United States Data Analytics Outsourcing Market

- China Data Analytics Outsourcing Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Summarizing the Strategic Imperatives and Future-Proof Considerations for Data Analytics Outsourcing Success

The convergence of technological innovation, regulatory complexity, and dynamic market forces underscores the critical role of data analytics outsourcing in driving enterprise transformation. Organizations that master the art of selecting the right partners, structuring flexible engagements, and fostering collaborative ecosystems will be best positioned to convert raw data into actionable insights at scale. While external pressures such as tariffs and evolving compliance mandates introduce new layers of risk, proactive governance and continuous optimization can turn these challenges into competitive advantages.

As the data landscape continues to evolve, a strategic approach to outsourcing will enable enterprises to remain agile, harness emerging technologies, and cultivate a culture of data-driven decision-making. By aligning outsourcing initiatives with overarching business objectives and investing in the right mix of internal and external talent, organizations can accelerate innovation and secure long-term value in an increasingly complex environment.

Empower Your Data-Driven Future by Partnering with Our Specialist to Secure Comprehensive Analytics Outsourcing Insights

For organizations seeking to harness the full potential of data analytics outsourcing, partnering with a seasoned research provider can streamline decision-making and accelerate strategic initiatives. Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore how our in-depth report addresses your unique challenges and objectives. Gain exclusive access to comprehensive market insights, tailored guidance on navigating regulatory shifts, and tactical recommendations designed to drive operational excellence. Secure your copy today to stay ahead of emerging trends, optimize vendor selection, and unlock competitive advantage in an increasingly data-driven world.

- How big is the Data Analytics Outsourcing Market?

- What is the Data Analytics Outsourcing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?