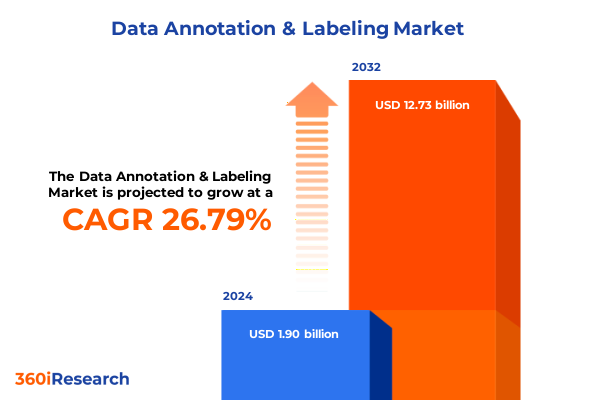

The Data Annotation & Labeling Market size was estimated at USD 2.37 billion in 2025 and expected to reach USD 2.97 billion in 2026, at a CAGR of 27.11% to reach USD 12.73 billion by 2032.

Comprehensive introduction establishing the significance of data annotation and labeling solutions for AI-driven industries and outlining the summary’s scope

In an era defined by the rapid proliferation of artificial intelligence and machine learning applications, the foundational role of accurate, high-quality data annotation and labeling cannot be overstated. As organizations strive to harness the predictive power of complex algorithms, the integrity of training datasets emerges as a critical determinant of solution efficacy and performance. This executive summary is crafted to provide decision-makers with a concise yet thorough overview of the prevailing market landscape, emergent trends, and strategic imperatives shaping the data annotation and labeling domain. Embedded within these pages are distilled insights designed to illuminate how annotation services and technological innovations converge to underpin robust AI pipelines.

Recognizing that stakeholders from diverse sectors require clarity amidst an evolving ecosystem, this introduction establishes the context for subsequent analyses. By delineating the summary’s scope-encompassing transformative industry shifts, tariff implications, segmentation and regional perspectives, competitive assessments, and actionable recommendations-it offers a roadmap for navigating complex market dynamics. The intent is to equip leaders with the strategic perspective necessary to optimize annotation processes, align investments with growth vectors, and capitalize on emerging opportunities in a landscape increasingly driven by intelligent automation.

In-depth exploration of transformative shifts reshaping data annotation and labeling practices driven by technological advancements and market demands

The data annotation and labeling landscape has undergone profound transformations as automation capabilities have matured and AI-driven workflows demand ever-greater precision and scale. Traditional manual annotation models have given way to hybrid systems that seamlessly integrate human expertise with artificial intelligence–driven automation, accelerating throughput while preserving quality. This paradigm shift is fueled by advances in machine learning algorithms capable of self-supervision, enabling iterative retraining loops where models contribute to their own labeling under human oversight. Consequently, service providers are reconfiguring their delivery models to offer more sophisticated annotation pipelines that balance efficiency with rigorous validation protocols.

Moreover, evolving customer requirements are catalyzing a reevaluation of deployment modalities. While cloud-based platforms continue to attract investment for their inherent scalability and rapid provisioning capabilities, there is a resurging interest in on-premise solutions among organizations subject to stringent data sovereignty and regulatory mandates. This duality reflects a broader market trajectory that values both agility and compliance. In parallel, the adoption of specialized annotation tools tailored to audio, image, text, and video data forms underscores a transition toward domain-specific services. Collectively, these shifts herald a new era of data annotation and labeling, where technological innovation converges with market-driven customization to redefine industry standards.

Detailed analysis of cumulative impacts from United States tariffs through 2025 on data annotation and labeling industry cost structures supply chains and pricing

United States tariff policies enacted through 2025 have exerted multifaceted pressures on the data annotation and labeling industry, influencing cost structures, supply chains, and service delivery economics. Tariffs on imported hardware components, including high-performance GPUs and specialized annotation workstations, have elevated capital expenditures for both in-house labeling initiatives and service provider network expansions. The resulting increase in hardware acquisition costs has driven some organizations to explore alternative procurement strategies, such as regional sourcing agreements or multi-supplier frameworks, to mitigate exposure to elevated duties.

Simultaneously, tariffs affecting enterprise data storage solutions and networking infrastructure have amplified operational expenses for annotation platforms, particularly for those maintaining extensive on-premise deployments. These cumulative cost pressures have prompted a reassessment of pricing models, with service providers increasingly negotiating value-based contracts or introducing tiered pricing to absorb a portion of the tariff-driven augmentation in input costs. Moreover, the landscape of global labor arbitrage has been reshaped as certain offshore hubs experience differential impacts from trade policies, compelling annotation companies to diversify geographic footprints. This strategic realignment aims to balance cost optimization with resilience against potential future trade disruptions.

Key segmentation insights illuminating market dynamics across offerings data forms deployment models technologies and application scenarios informing strategic decisions

A nuanced understanding of market segmentation provides critical insights into where strategic investments can yield the highest ROI. When segmented by offering across services and solutions, companies specializing in end-to-end managed annotation services are capitalizing on the growing demand for turnkey AI data pipelines, whereas solution-centric providers differentiate through proprietary tooling and platform-based analytics. In terms of data form segmentation, annotation requirements diverge significantly among audio, image, text, and video datasets; video annotation in particular demands sophisticated frame-by-frame review mechanisms, driving innovation in semi-automated labeling tools.

Examining deployment type reveals contrasting priorities: cloud-based deployments appeal to organizations seeking elasticity and minimal upfront investment, while on-premise offerings resonate with sectors prioritizing data governance and security. Further granularity emerges upon considering data type segmentation-semi-structured, structured, and unstructured data each present distinct labeling challenges, catalyzing the development of specialized quality control frameworks. Technological segmentation highlights the ascendancy of automated and AI-driven annotation methods, complemented by hybrid systems that integrate manual verification for edge-case scenarios, even as pure manual annotation remains relevant for high-risk or highly regulated applications. When evaluated by organization size, large enterprises leverage scale to negotiate volume discounts and implement custom solutions, whereas small and medium enterprises often prefer modular services that offer flexibility. Finally, application-based segmentation points to robust demand in catalog and content management, data quality control, dataset management, security and compliance, sentiment analysis, and workforce management, underscoring that annotation services are instrumental across diverse functional use cases. This multi-dimensional segmentation landscape enables stakeholders to align their offerings precisely with market needs.

This comprehensive research report categorizes the Data Annotation & Labeling market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Data Form

- Deployment Type

- Data Type

- Technology

- Organization Size

- Application

- End-User

Critical regional perspectives highlighting variations across Americas Europe Middle East Africa and Asia-Pacific influences on data annotation and labeling market growth

Regional dynamics play a pivotal role in shaping market opportunities and competitive strategies. In the Americas, strong demand from sectors such as autonomous driving, e-commerce, and healthcare has fueled sustained investment in annotation capabilities, supported by mature technology ecosystems and robust venture funding. The United States continues to lead in adopting advanced annotation platforms, while Latin American countries are emerging as attractive nearshore hubs due to cost advantages and growing pools of skilled labor.

Across Europe, the Middle East, and Africa, regulatory frameworks such as GDPR in Europe exert a pronounced influence on deployment preferences, driving hybrid and on-premise solutions where data sovereignty is paramount. At the same time, government initiatives in the Middle East to accelerate digital transformation have catalyzed demand for tailored annotation services, particularly in smart city and defense applications. Meanwhile, the Asia-Pacific region exhibits heterogeneous growth patterns: advanced economies like Japan and South Korea prioritize cutting-edge automation workflows, whereas emerging markets in Southeast Asia and India are rapidly expanding their service provider networks to cater to global clients, leveraging competitive cost structures. These differentiated regional profiles underscore the need for market participants to adopt tailored go-to-market strategies and optimize resource allocation in line with localized demand drivers.

This comprehensive research report examines key regions that drive the evolution of the Data Annotation & Labeling market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Insights into leading companies shaping the data annotation and labeling market with strategic moves technological innovations and competitive positioning dynamics

Leading players in the data annotation and labeling market are distinguished by their strategic alignments, technology portfolios, and global delivery footprints. Providers emphasizing AI-driven automation have accelerated investments in proprietary model training capabilities, enabling semi-supervised annotation that dramatically reduces human effort for large-scale image and video datasets. Concurrently, organizations that prioritize hybrid annotation frameworks are forging partnerships with academic and research institutions to refine quality assurance protocols, ensuring rigorous oversight for mission-critical applications in defense and healthcare.

Competitive positioning is further influenced by the agility of service customization: select firms offer modular platforms that seamlessly integrate with clients’ existing machine learning workflows, while others deliver fully managed solutions under subscription-based models. Strategic alliances with cloud hyperscalers have emerged as a common theme, granting annotation providers access to advanced compute resources and streamlined deployment pipelines. Moreover, the emergence of specialized niche players focusing on complex data types-such as LiDAR point clouds and multimodal sensory inputs-illustrates the market’s increasing fragmentation. Collectively, these competitive dynamics underscore the importance of innovation, scalability, and domain expertise as key differentiators for industry frontrunners.

This comprehensive research report delivers an in-depth overview of the principal market players in the Data Annotation & Labeling market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adobe Inc.

- AI Data Innovations

- AI Workspace Solutions

- Alegion AI, Inc. by SanctifAI Inc.

- Amazon Web Services, Inc.

- Annotation Labs

- Anolytics

- Appen Limited

- BigML, Inc.

- CapeStart Inc.

- Capgemini SE

- CloudFactory International Limited

- Cogito Tech LLC

- Content Whale

- Dataloop Ltd

- Datasaur, Inc.

- Deepen AI, Inc.

- DefinedCrowd Corporation

- Hive AI

- iMerit

- International Business Machines Corporation

- KILI TECHNOLOGY SAS

- Labelbox, Inc.

- Learning Spiral

- LXT AI Inc.

- Oracle Corporation

- Precise BPO Solution

- Samasource Impact Sourcing, Inc

- Scale AI, Inc.

- Snorkel AI, Inc.

- SuperAnnotate AI, Inc.

- TELUS Communications Inc.

- Uber Technologies Inc.

- V7 Ltd.

Actionable recommendations empowering industry leaders to leverage insights optimize operations and drive growth in the evolving data annotation and labeling landscape

To capitalize on accelerating market opportunities, industry leaders must adopt a proactive stance that harmonizes technological innovation with client-centric service design. Strategic investments in automated annotation engines should be complemented by robust human-in-the-loop processes to address edge-case complexities and maintain the highest quality benchmarks. By integrating continuous feedback loops into annotation workflows, providers can refine model accuracy over time and deliver measurable improvements in downstream AI performance.

Operational excellence will hinge on optimizing geographic delivery strategies: diversifying offshore and nearshore hubs while ensuring compliance with evolving data privacy regulations. Leaders should explore partnerships with cloud providers to co-develop scalable annotation platforms, leveraging shared infrastructure and advanced analytics to drive cost efficiencies. Additionally, service offerings can be differentiated through vertical specialization-creating bespoke annotation frameworks tailored to high-growth sectors such as autonomous systems, healthcare diagnostics, and financial analytics. Finally, fostering talent development programs that upskill annotators in advanced tooling and domain knowledge will enhance service quality, enabling organizations to deliver end-to-end annotation solutions that meet the stringent demands of modern AI deployments.

Transparent overview of the research methodology detailing data sources analytical approaches validation procedures and quality assurance protocols employed

The research methodology underpinning this executive summary is built upon a rigorous, multi-source data collection framework, ensuring robustness and reliability. Primary insights were garnered through in-depth interviews with key stakeholders across annotation service providers, end-user organizations, and industry analysts. These conversations were supplemented by extensive secondary research, including technical white papers, regulatory documents, and peer-reviewed publications to capture the latest workflow innovations and compliance trends.

Quantitative data were triangulated via proprietary data aggregation tools that analyzed technology adoption rates, deployment models, and service pricing across multiple markets. Rigorous validation procedures were implemented through cross-referencing vendor disclosures, public filings, and third-party datasets, ensuring consistency and accuracy. Quality assurance protocols included iterative expert reviews, statistical outlier analysis, and scenario-based sensitivity testing to assess the resilience of core findings. This comprehensive methodological approach guarantees that the insights presented herein reflect the current and emergent realities of the data annotation and labeling marketplace.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Data Annotation & Labeling market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Data Annotation & Labeling Market, by Offering

- Data Annotation & Labeling Market, by Data Form

- Data Annotation & Labeling Market, by Deployment Type

- Data Annotation & Labeling Market, by Data Type

- Data Annotation & Labeling Market, by Technology

- Data Annotation & Labeling Market, by Organization Size

- Data Annotation & Labeling Market, by Application

- Data Annotation & Labeling Market, by End-User

- Data Annotation & Labeling Market, by Region

- Data Annotation & Labeling Market, by Group

- Data Annotation & Labeling Market, by Country

- United States Data Annotation & Labeling Market

- China Data Annotation & Labeling Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 1431 ]

Conclusive synthesis summarizing key findings overarching themes and strategic implications for stakeholders in the data annotation and labeling market

This executive summary has distilled critical insights into the evolving dynamics of the data annotation and labeling market, highlighting how technological innovations, regulatory landscapes, and segmentation nuances converge to shape industry trajectories. The transition toward hybrid AI-driven annotation workflows underscores a broader trend of efficiency paired with precision, while tariff-induced cost pressures reinforce the imperative for strategic sourcing and adaptive pricing models.

Segment-level analysis reveals that opportunities abound across diverse data forms, deployment preferences, technological frameworks, organizational sizes, applications, and end-user verticals, necessitating tailored strategies to capture growth. Regional variations further emphasize the importance of localization and compliance, with distinct drivers at play in the Americas, EMEA, and Asia-Pacific. Forward-looking companies will leverage these insights to refine their service portfolios, forge strategic alliances, and invest in talent and automation to maintain a competitive edge. Collectively, the findings presented here equip stakeholders with a holistic understanding of market forces and actionable pathways to navigate the complexities of an increasingly data-centric world.

Compelling call-to-action encouraging engagement with Associate Director Sales Marketing to acquire the comprehensive market research report and unlock strategic advantages

For tailored insights or to discuss how the comprehensive data annotation and labeling market research report can empower your strategic initiatives and operational excellence, connect with Associate Director Sales & Marketing Ketan Rohom. With extensive expertise in guiding decision-makers across industries, Ketan Rohom can facilitate customized presentations, in-depth data walkthroughs, and address specific queries regarding the report’s findings. Engaging directly with an expert liaison ensures you gain clarity on market dynamics, segmentation nuances, regional variations, and competitive landscapes to drive informed investment, procurement, and technology adoption decisions. Reach out proactively to secure early access options, explore bespoke consultancy packages, and position your organization at the forefront of AI-driven data services innovation without delay.

- How big is the Data Annotation & Labeling Market?

- What is the Data Annotation & Labeling Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?