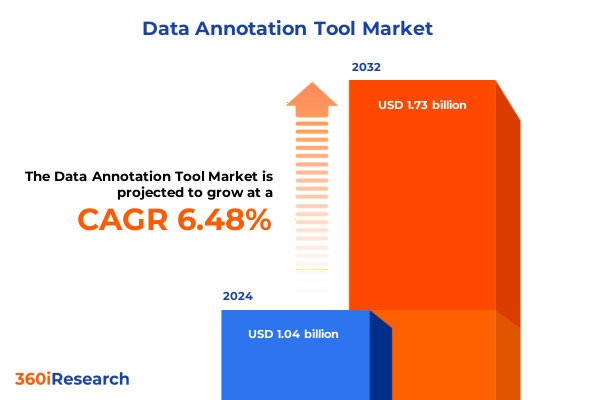

The Data Annotation Tool Market size was estimated at USD 1.10 billion in 2025 and expected to reach USD 1.17 billion in 2026, at a CAGR of 6.56% to reach USD 1.73 billion by 2032.

Setting the Stage for Unprecedented Growth in Data Annotation Tools Amidst Rapid AI Adoption and Evolving Data Complexity and Scaling Requirements

Global enterprises are experiencing an unprecedented surge in demand for accurate, scalable, and efficient data labeling capabilities as artificial intelligence initiatives become central to innovation strategies. This executive summary opens by framing how an exponential increase in unstructured data, fueled by social media, edge computing, and the Internet of Things, has elevated the importance of high-quality annotation. Organizations are now prioritizing the integrity and granularity of labeled data to underpin critical use cases ranging from computer vision to natural language processing.

In response to this dynamic environment, solution providers are rapidly evolving their offerings, integrating automation and human expertise to meet diverse annotation requirements. The interplay between advanced annotation platforms and specialized workflows is redefining traditional service delivery models, driving not only improved throughput but also enhanced data reliability. As we embark on this comprehensive analysis, the following sections will dissect transformative market shifts, the downstream impact of trade policies, and actionable guidance for stakeholders seeking to harness annotation tools as a competitive differentiator.

Unveiling the Transformative Forces Redefining Data Annotation With Emerging Technologies and Evolving Enterprise Data Strategies

The data annotation landscape is undergoing a profound transformation, with emerging technologies such as synthetic data generation, zero-shot learning, and active learning reshaping workflows and elevating accuracy benchmarks. Recent advancements in machine learning model architectures have spurred adoption of semi-supervised techniques that blend automated labeling with targeted human intervention, reducing annotation cycles while preserving quality. This hybrid approach has proven particularly effective in handling complex scenarios such as anomaly detection and fine-grained entity recognition.

Concurrent shifts in enterprise data strategies have reoriented investments toward scalable annotation pipelines capable of ingesting and processing multimodal data streams. Organizations are increasingly deploying cloud-native platforms, facilitating dynamic resource allocation and global workforce collaboration. Meanwhile, stricter data privacy regulations and heightened scrutiny around algorithmic biases are driving providers to implement more robust validation frameworks. Consequently, annotation offerings now emphasize transparency and auditability, ensuring that labeled datasets are both compliant and ethically sound. These developments collectively underscore the market’s pivot toward more intelligent, compliant, and adaptive annotation solutions.

Analyzing the Comprehensive Ripple Effects of 2025 United States Tariff Adjustments on the Data Annotation Tools Ecosystem

In 2025, newly instituted tariff measures introduced by United States policymakers have produced significant reverberations across the data annotation tools ecosystem. Increased import duties on specialized labeling hardware and ancillary software components have elevated input costs for annotation platform vendors, prompting strategic realignments of supply chains and vendor partnerships. As a result, several service providers have localized critical operations, investing in domestic infrastructure to mitigate the financial impact of cross-border levies.

These tariffs also indirectly influenced pricing structures, compelling solution providers to reevaluate contract terms and subscription models. Some vendors passed a portion of the incremental costs to end users, while others absorbed these expenses to maintain competitive positioning. At the same time, demand shifted toward annotation-as-a-service models, where scalable cloud deployments offered a buffer against hardware surcharges. In the longer term, trade tensions have accelerated innovation in software-centric approaches, with an emphasis on algorithmic efficiency to reduce dependence on specialized tooling. Ultimately, the ripple effects of these tariffs have catalyzed a rebalancing of global annotation operations and reinforced the strategic importance of resilient delivery frameworks.

Illuminating Critical Segmentation Dimensions That Shape Market Dynamics From Annotation Modalities to Deployment and Industry Nuances

A nuanced understanding of market segmentation reveals how distinct annotation requirements and deployment preferences shape adoption trajectories. When examining annotation modalities, it becomes evident that text-based services, including named entity recognition, semantic labeling, and sentiment analysis, remain foundational for many language-driven applications, while image annotation and video capabilities serve critical roles in autonomous systems and security monitoring. Audio labeling, too, is gaining traction, particularly in voice-enabled interfaces and speech analytics.

Labeling methodologies vary widely, with fully automated approaches offering speed and cost efficiency for routine tasks, and fully manual workflows delivering the precision needed for edge-case scenarios. Hybrid strategies merge these paradigms, enabling dynamic allocation of human oversight where algorithmic confidence falls below acceptable thresholds. Equally important is the type of data under annotation. Structured datasets, such as tabular records, often require less iterative intervention, whereas unstructured data from text, image, and sensor streams demands more sophisticated orchestration.

Industry-specific demands further diversify the landscape, as automotive, healthcare, media and entertainment, and retail each impose distinct quality and compliance standards. Deployment preferences reinforce these divergences; some enterprises gravitate toward cloud-native solutions to leverage elastic scalability, whereas sectors with strict data sovereignty requirements continue to rely on on-premises installations. By examining these segmentation dimensions, organizations can better align tools and workflows to their unique operational imperatives.

This comprehensive research report categorizes the Data Annotation Tool market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Annotation Type

- Labeling Method

- Data Type

- Industry Vertical

- Deployment Mode

Exploring Regional Differentiators Driving Adoption Patterns Across the Americas Europe Middle East Africa and Asia Pacific Markets

Regional dynamics exert profound influence on adoption patterns and solution architectures within the data annotation tool market. In the Americas, mature AI ecosystems and robust innovation hubs have driven rapid uptake of advanced annotation platforms, particularly in North America, where technology giants and startups alike invest heavily in localized data processing capabilities. Conversely, Latin American enterprises are increasingly leveraging third-party annotation services to bridge talent and infrastructure gaps, often favoring cloud-first deployments to accelerate time to value.

Across Europe, the Middle East, and Africa, regulatory landscapes and digital transformation agendas vary significantly, necessitating tailored annotation strategies. While Western European firms emphasize stringent data privacy compliance and ethical AI principles, emerging markets in Eastern Europe and the Gulf Cooperation Council are prioritizing cost-effective, scalable solutions to support smart city initiatives and telecommunications expansions. Africa’s nascent AI projects, often supported by international development programs, tend to adopt hybrid labeling models to optimize resource allocation.

Meanwhile, Asia-Pacific remains a hotbed of innovation, with countries such as China, Japan, South Korea, and India leading investments in autonomous vehicles, robotics, and natural language applications. Regional preferences range from fully automated, high-throughput pipelines in advanced markets to manual and hybrid configurations in nations where regulatory frameworks and talent pools continue to evolve. Collectively, these regional insights underscore the importance of agility and local compliance in designing annotation strategies that resonate across diverse geographies.

This comprehensive research report examines key regions that drive the evolution of the Data Annotation Tool market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Leading Innovators and Strategic Collaborators Shaping the Future of Data Annotation Tool Capabilities and Solutions

Prominent solution providers are continually raising the bar for annotation accuracy, scalability, and workflow orchestration. Leading cloud platform vendors have augmented their native labeling services with prebuilt AI models and marketplace integrations, enabling customers to streamline procurement and accelerate project kickoffs. At the same time, specialist annotation firms have deepened their domain expertise, bundling consulting services and custom tooling to address vertical-specific requirements in sectors like healthcare diagnostics and retail inventory management.

Strategic partnerships and ecosystem expansions are hallmark trends, as core platform operators collaborate with boutique service providers to deliver end-to-end annotation solutions. These alliances bridge gaps in specialized skill sets, ensuring that clients benefit from both cutting-edge automation algorithms and rigorous human validation processes. Meanwhile, several emerging players are carving out niches by focusing on cognitive annotation techniques, such as contextual labeling and bias mitigation, to meet the growing demand for ethically vetted datasets.

Through proactive investments in research and development, these companies are not only enhancing their annotation engines but also introducing sophisticated governance frameworks. This includes tooling for lineage tracking, annotation audit trails, and real-time quality dashboards that empower stakeholders to maintain oversight at scale. In this intensely competitive environment, the ability to offer differentiated value through innovation and strategic collaboration remains the defining factor for market leaders.

This comprehensive research report delivers an in-depth overview of the principal market players in the Data Annotation Tool market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Anolytics Inc.

- Appen Limited

- Clickworker GmbH

- CloudFactory Inc.

- Cogito Tech, Inc.

- CrowdAI, Inc.

- Cvat.ai

- Dataloop AI Ltd.

- Datature Pte. Ltd.

- Encord, Inc.

- iMerit Technology Services Pvt. Ltd.

- Keymakr, Inc.

- Kili Technology, Inc.

- Labelbox, Inc.

- Labellerr Inc.

- Ossisto Technologies Pvt. Ltd.

- Sama, Inc.

- Scale AI, Inc.

- SuperAnnotate AI, Inc.

- TELUS International (Cda) Inc.

- V7 Labs, Inc.

Empowering Industry Leaders With Strategic Action Plans to Maximize Value Capture and Enhance Data Annotation Efficiencies

Industry leaders seeking to harness the full potential of data annotation tools must adopt a multi-pronged strategy that balances technological innovation with operational rigor. First, organizations should integrate active learning workflows that dynamically allocate human review only to cases with low model confidence, thereby optimizing annotation throughput while safeguarding quality. By embedding such feedback loops, teams can iteratively refine model performance and reduce redundant manual interventions.

Second, to mitigate rising cost pressures from equipment tariffs and talent shortages, enterprises should explore partnerships with multi-regional annotation networks. These collaborations can leverage localized expertise and cost arbitrage, maintaining consistent service levels across fluctuating regulatory landscapes. Concurrently, deploying annotation pipelines in cloud-based environments enables elastic scaling, enabling teams to ramp capacity up or down in alignment with project cycles.

Finally, decision-makers must establish robust governance protocols that enforce transparency and compliance. Implementing standardized annotation guidelines, regular audit checkpoints, and bias detection mechanisms will ensure ethical and regulatory adherence. Investing in training programs for annotators and quality monitors further institutionalizes best practices. By executing these recommendations, industry leaders can not only drive operational efficiencies but also future-proof their annotation initiatives against evolving market and policy dynamics.

Detailing Robust Methodological Approaches Underpinning Data Collection Annotation Validation and Quality Assurance Processes

This research leverages a combination of primary and secondary data collection methods to ensure the highest standards of rigor and reliability. Primary research involved structured interviews with enterprise AI architects, annotation operations managers, and technology vendors to uncover firsthand insights into workflow preferences, pain points, and emerging requirements. Survey instruments were distributed across multiple regions to validate adoption trends and gather quantitative measures of technology uptake.

Secondary research comprised a thorough analysis of industry white papers, government trade publications, and publicly available patent filings to contextualize tariff impacts and regional regulatory shifts. Technical documentation and product release notes were reviewed to map feature roadmaps and competitive differentiators. To maintain data integrity, all findings were cross-verified against multiple sources, with any discrepancies reconciled through follow-up inquiries.

Quality assurance processes included iterative validation of annotation accuracy metrics and consistency audits of interview transcripts. A dedicated team applied statistical sampling techniques to verify the representativeness of survey responses and ensure that quantitative insights were both robust and actionable. This multi-tiered methodology underpins the credibility of our analysis, offering stakeholders confidence in the strategic recommendations that follow.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Data Annotation Tool market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Data Annotation Tool Market, by Annotation Type

- Data Annotation Tool Market, by Labeling Method

- Data Annotation Tool Market, by Data Type

- Data Annotation Tool Market, by Industry Vertical

- Data Annotation Tool Market, by Deployment Mode

- Data Annotation Tool Market, by Region

- Data Annotation Tool Market, by Group

- Data Annotation Tool Market, by Country

- United States Data Annotation Tool Market

- China Data Annotation Tool Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesis of Key Insights and Forward-Looking Perspectives to Guide Strategic Decision-Making in the Data Annotation Arena

As organizations navigate the complexities of data annotation in an era defined by rapid AI innovation, several cross-cutting themes emerge. The confluence of advanced hybrid labeling techniques, evolving regulatory pressures, and the strategic imperative for localized operations underscores the multifaceted nature of today’s annotation landscape. Stakeholders must remain vigilant, continuously recalibrating their approaches in response to geopolitical developments and technology breakthroughs.

Looking ahead, the integration of synthetic data generation, self-supervised learning, and enhanced explainability tools is poised to further reshape annotation workflows. Enterprises that invest in modular, API-driven architectures will be best positioned to incorporate these capabilities without disrupting existing pipelines. Moreover, the rise of collaborative annotation marketplaces offers new avenues for scaling expertise while maintaining stringent quality controls.

Ultimately, success in this domain will hinge on an organization’s ability to harmonize automation and human judgment, align annotation strategies with broader AI objectives, and foster a culture of continuous improvement. By synthesizing the insights presented in this report, decision-makers can chart a strategic course that leverages the full power of data annotation as a catalyst for innovation and competitive differentiation.

Connect With Ketan Rohom to Unlock Comprehensive Data Annotation Tool Insights and Secure Your Personalized Market Intelligence Report

To initiate a transformative collaboration and secure unparalleled market intelligence on data annotation tools, reach out to Ketan Rohom, Associate Director of Sales & Marketing. His expertise will guide you through tailored insights that address your organization’s unique requirements. Engaging with this comprehensive research will empower you to navigate emerging opportunities, anticipate competitive pressures, and capitalize on strategic trends shaping the data annotation ecosystem.

Don’t miss the opportunity to leverage these in-depth findings. By connecting with Ketan Rohom, you will gain exclusive access to the detailed report, including nuanced perspectives on segmentation, geopolitical influences, technological advancements, and best practices for scaling annotation operations. Contact him today to schedule a personalized briefing, discuss customized research extensions, and secure your team’s competitive advantage in an increasingly data-driven world

- How big is the Data Annotation Tool Market?

- What is the Data Annotation Tool Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?