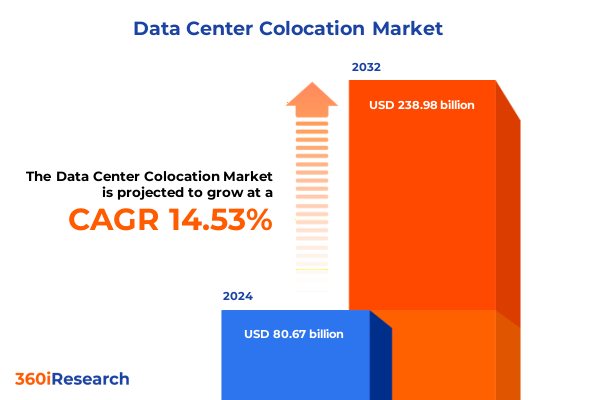

The Data Center Colocation Market size was estimated at USD 91.37 billion in 2025 and expected to reach USD 103.49 billion in 2026, at a CAGR of 14.72% to reach USD 238.98 billion by 2032.

Unveiling the Critical Role and Growing Imperative of Data Center Colocation in Today's Digital Infrastructure Ecosystem Amid Rapid Digital Transformation

The rapid pace of digital transformation has elevated the strategic importance of data center colocation as organizations seek to manage soaring volumes of data and complex workloads with agility and cost efficiency. As enterprises pivot to hybrid and multi-cloud architectures, colocation providers have emerged as critical partners, offering access to high-performance facilities, robust connectivity, and scalable infrastructure without the capital burden of building and maintaining owned data centers. This foundational shift aligns with the broader drive toward decentralized computing, where agility and interoperability are paramount.

Driven by the proliferation of artificial intelligence and machine learning applications, demand for colocation capacity has intensified in markets across North America, Europe, and Asia-Pacific. Providers are racing to expand their footprints and integrate advanced features such as GPU racks, dedicated AI clusters, and high-bandwidth interconnection services to support latency-sensitive workloads. Moreover, growing concerns around data sovereignty, regulatory compliance, and industry-specific requirements have spurred enterprise customers to explore colocation as a means to ensure localized data control and uninterrupted service continuity in an increasingly complex regulatory environment.

In parallel, the surge of edge computing and Internet of Things deployments has reshaped how colocation services are architected, with a growing emphasis on micro data center formats and distributed node strategies that bring processing power closer to end users. These edge nodes complement the massive hyperscale facilities that dominate core infrastructure, enabling real-time analytics, reduced latency, and improved operational efficiency for use cases ranging from autonomous vehicles and telemedicine to industrial automation. As a result, colocation providers are innovating across both core and edge tiers to deliver comprehensive solutions that address the evolving demands of the digital economy.

Examining The Transformative Shifts Redefining Data Center Colocation With AI-Powered Services, Edge Architecture, And Sustainable Practices

Over the past year, colocation providers have embraced artificial intelligence not only as an end-user workload but also as a core element of facility operations and service offerings. AI-driven infrastructure management systems now monitor energy consumption, predict equipment failures, and orchestrate cooling operations in real time, yielding significant gains in efficiency and uptime. These capabilities empower providers to deliver differentiated service levels and meet the stringent requirements of mission-critical applications in finance, healthcare, and government.

Meanwhile, the ascendancy of edge computing has catalyzed a new wave of micro and modular data center deployments. By decentralizing compute resources across regional nodes and often leveraging prefabricated, quickly deployable units, organizations can process data at the point of origin and streamline latency-sensitive workloads. This shift toward distributed architectures reflects a broader trend of disaggregating monolithic data center designs into agile, purpose-built edge clusters that complement large-scale hyperscale facilities.

Sustainability has also taken center stage as carbon reduction targets and energy efficiency regulations intensify worldwide. Providers are investing in on-site renewable energy installations, including solar arrays, wind turbines, and battery storage, to hedge against grid volatility and demonstrate environmental stewardship. Advanced cooling solutions such as liquid immersion, direct liquid cooling, and free-air economization are increasingly integrated to curb water usage and drive down power usage effectiveness (PUE). These initiatives not only align with corporate sustainability goals but also address the operational cost pressures associated with rising energy prices.

Finally, hyperscale cloud operators and colocation platforms are forging partnerships and joint ventures to bolster capacity in strategic regions. By pooling resources and aligning on sustainability, interconnection, and AI readiness, these alliances accelerate expansion and deliver economies of scale that benefit both hyperscalers and enterprise tenants. Collectively, these transformative shifts underline the colocation market’s evolution into a dynamic ecosystem characterized by intelligence, resilience, and environmental responsibility.

Assessing The Cumulative Consequences Of United States Tariff Policies On Data Center Colocation Dynamics And Infrastructure Costs In 2025

In early 2025, the United States government implemented a suite of reciprocal tariffs that have materially affected data center colocation economics and project timelines. Tariffs of 34% on equipment from China, 32% from Taiwan, 25% from South Korea, and a baseline 10% duty on all imports have driven up the costs of critical infrastructure components ranging from switches and racks to cooling systems and power distribution units. Semiconductors remain temporarily exempt, yet any future expansion of chip duties could trigger further cost pressures.

Construction materials such as steel, aluminum, and copper-integral to data center shells, power grids, and cabling infrastructure-are also subject to increased duties. Supply chain disruptions and elevated raw material costs have compelled many colocation operators to revisit build-out schedules, with some projects postponed or reconfigured to rely on locally sourced alternatives where feasible. The uncertainty around long-term tariff policy has introduced risk premiums into capital expenditure models, complicating financial planning and vendor negotiations.

Furthermore, operators have responded by diversifying their supplier bases, exploring manufacturing hubs in Mexico, Vietnam, and India to mitigate tariff exposure and logistical constraints. These supply-chain realignments, while effective in the medium term, may introduce quality assurance and lead-time challenges, given the required certification and compliance testing for critical data center components. In the interim, colocation providers are passing a portion of these increased costs to customers through amended service agreements, while also exploring longer-term contracts to lock in pricing as a hedge against continuing duty escalation.

Collectively, the 2025 tariff policies have injected a layer of complexity into the colocation market, forcing stakeholders to balance cost management, supply chain resilience, and strategic expansion objectives. As the trade environment remains fluid, colocation providers and their enterprise customers must maintain agile sourcing strategies and robust scenario planning to navigate the evolving regulatory landscape.

Deriving Key Segmentation Insights By Integrating Market Perspectives Across Types, Services, Tiers, Capacities, Enterprise Sizes, Deployments, And End-User Industries

The data center colocation market can be understood through multiple lenses, beginning with the fundamental distinction between retail and wholesale offerings. Retail colocation caters to enterprises seeking modest-scale deployments with flexible contract terms, while wholesale colocation addresses the needs of hyperscale operators requiring custom data halls and power densities. Within these broad categories, service portfolios span a continuum-from cloud on-ramp connectivity that provides direct access to leading public clouds, to interconnection services enabling seamless private peering between networks and ecosystems of partners.

At the infrastructure level, tier classifications delineate reliability and redundancy attributes, with Tier 1 facilities offering basic power and cooling redundancy, and Tier 3 centers delivering concurrently maintainable systems for higher availability. Power capacity further refines this segmentation, as high-power sites exceeding 5 MW support densely packed GPU clusters, whereas low-power sites under 1 MW serve edge or remote applications, with medium-power campuses bridging the gap for mixed workloads.

Enterprise size emerges as a key filter, as large global corporations seek long-term, scalable footprints to support AI and big data initiatives, while small and medium enterprises prioritize modular footprints and rapid provisioning. Deployment types also vary, with core data centers undergirding centralized compute platforms, disaster recovery sites ensuring business continuity, and edge data centers distributed close to end users for minimal latency. Finally, end-user industries such as banking, healthcare, media, and energy impose unique demands around security, compliance, and connectivity, shaping colocation requirements from the ground up.

This comprehensive research report categorizes the Data Center Colocation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Service Type

- Tier Level

- Power Capacity

- Deployment Type

- Enterprise Size

- End User Industry

Synthesizing Regional Dynamics And Future Opportunities Within The Americas, Europe Middle East & Africa, And Asia-Pacific Data Center Colocation Markets

Regional markets exhibit distinct drivers and challenges, shaping demand for colocation capacity in the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, the United States remains the epicenter of hyperscale and enterprise colocation, fueled by extensive fiber networks, mature interconnection hubs, and abundant connectivity to cloud on-ramps. Strategic investment in states such as Pennsylvania has been spotlighted by government initiatives and private sector funding to transform legacy infrastructure into AI-ready campuses, leveraging both natural gas and emerging nuclear power solutions.

Across Europe Middle East & Africa, markets have bifurcated between established hubs in Western Europe and emerging nodes in the Nordics. Ireland, once a darling of hyperscale expansion, has grappled with grid capacity constraints and rising energy consumption that surpasses residential demand, prompting moratoriums on new connections around Dublin and a strategic pivot toward renewable-rich regions such as County Offaly. These developments underscore the interplay between infrastructure growth and sustainable power availability.

In the Asia-Pacific region, China’s recent initiative to aggregate and redistribute underutilized compute capacity across more than 7,000 data centers illustrates both the scale of investment and the potential for optimization in oversupplied markets. Meanwhile, Southeast Asian countries such as Malaysia and Singapore are gaining traction as alternative hubs, offering more stable regulatory environments and strong incentives for local manufacturing of data center components. These dynamics highlight an ongoing shift toward diversified regional supply chains and capacity expansion outside traditional power centers.

This comprehensive research report examines key regions that drive the evolution of the Data Center Colocation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Data Center Colocation Companies And Their Strategic Initiatives Driving Competitive Advantage And Market Leadership

Equinix stands at the forefront of global colocation, operating over 260 interconnected data centers and offering a software-defined interconnection fabric that links enterprises to more than 3,000 cloud and network providers. Its xScale joint ventures and targeted acquisitions have expanded hyperscale capacity, while AI-powered monitoring and advanced liquid cooling solutions reinforce its leadership in performance and sustainability. Equity analysts at J.P. Morgan maintain an Outperform rating on Equinix, citing its pivotal role in the AI ecosystem and ability to capture rising interconnection demand.

Digital Realty has emerged as a close competitor, with more than 300 facilities globally and a strategic focus on AI-ready modular data halls under its PlatformDIGITAL offering. High-density power configurations and partnerships with renewable energy providers underscore its commitment to sustainability, while ServiceFabric Connect enables hybrid connectivity that blends colocation with multi-cloud environments. UBS analysts recently upgraded Digital Realty to a Buy rating, pointing to sustained rent growth and record lease signings against an exceptionally low vacancy backdrop.

NTT Corporation and QTS Data Centers also command significant presence, with NTT leveraging its global network to deliver secure colocation and managed services across North America, Europe, and Asia. QTS differentiates through “Software Defined Data Centers” and a strong focus on security and compliance, tailored for regulated industries. Other notable players include CoreSite and Cyxtera, each capitalizing on strategic metropolitan footprints and specialized service bundles to attract enterprise workloads.

This comprehensive research report delivers an in-depth overview of the principal market players in the Data Center Colocation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 365 Data Centers

- AtlasEdge Data Centres

- China Telecom Global Limited

- Colt Group Holdings Limited

- CoreSite

- Cyfuture India Pvt. Ltd.

- DartPoints

- Deft by ServerCentral, LLC

- Digital Realty Trust Inc.

- Eaton Corporation

- Equinix, Inc.

- Fujitsu Limited

- Global Switch Limited

- Internap Holding LLC

- Iron Mountain Incorporated

- KDDI Corporation

- Mantra Data Centers

- Netrality Properties, LP

- NTT Communications Corporation

- Panduit Corp.

- PointOne Corp.

- QTS Realty Trust, Inc.

- Rittal GmbH & Co. KG

- ScaleMatrix Holdings, Inc.

- Singtel Group

- Telehouse International Corporation

- Vapor IO, Inc.

- Verizon Communications Inc.

- Zenlayer Inc.

Formulating Actionable Recommendations To Empower Industry Leaders In Navigating The Evolving Data Center Colocation Ecosystem Effectively

Industry leaders should prioritize diversification of supply chains by engaging multiple equipment vendors and exploring near-shoring options to mitigate the impact of future tariff disruptions. Establishing collaborative partnerships with local manufacturers can secure preferential pricing and reduce lead times for critical infrastructure components. By maintaining dynamic sourcing frameworks, providers can ensure uninterrupted expansion and service delivery.

Furthermore, integrating advanced AI and analytics platforms into facility operations will yield substantial efficiency gains. Predictive maintenance algorithms, real-time energy optimization, and automated workload orchestration not only enhance reliability but also drive sustainable cost structures. Investment in AI-powered management tools should be coupled with staff training and change-management initiatives to fully realize operational benefits.

Sustainability must remain a cornerstone of strategic planning, with on-site renewable energy installations, battery storage systems, and low-carbon cooling solutions embedded into new and retrofit projects. Targets for carbon neutrality can be reinforced through transparent reporting and third-party certifications, strengthening market reputation and compliance with tightening environmental regulations.

Finally, providers should cultivate flexible contract models that offer scalable power and space options, enabling customers to adapt rapidly to shifting workload patterns. Tailored interconnection and hybrid cloud integration services will differentiate offerings and deepen customer relationships across diverse verticals.

Outlining A Robust Research Methodology That Underpins The Quality And Credibility Of The Data Center Colocation Market Analysis

This analysis is grounded in a multi-stage research approach that began with a comprehensive review of public policy documents, tariff announcements, and government trade publications. Primary data sources included official tariff schedules, regulatory filings, and industry association white papers, ensuring accuracy in the evaluation of trade impacts. Secondary research encompassed peer-reviewed journals, reputable news outlets, and expert commentary to identify emerging trends and technology shifts.

Expert interviews with senior executives, facilities managers, and service architects provided qualitative insights into operational challenges and strategic imperatives. These conversations were complemented by vendor briefings and technology demonstrations to assess the maturity and adoption of AI, edge computing, and sustainable infrastructure solutions. Quantitative data was synthesized from equipment shipment reports, energy consumption forecasts, and capital expenditure indicators to triangulate market dynamics.

Rigorous validation procedures included cross-referencing information across multiple credible sources and conducting iterative reviews with subject-matter experts. Data triangulation and sensitivity analyses were performed on key variables such as tariff rates, power capacities, and interconnection demand to ensure robustness. The resulting framework yields a holistic perspective on the colocation landscape, combining empirical data with practitioner experiences to support strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Data Center Colocation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Data Center Colocation Market, by Type

- Data Center Colocation Market, by Service Type

- Data Center Colocation Market, by Tier Level

- Data Center Colocation Market, by Power Capacity

- Data Center Colocation Market, by Deployment Type

- Data Center Colocation Market, by Enterprise Size

- Data Center Colocation Market, by End User Industry

- Data Center Colocation Market, by Region

- Data Center Colocation Market, by Group

- Data Center Colocation Market, by Country

- United States Data Center Colocation Market

- China Data Center Colocation Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1272 ]

Concluding Reflections On The Strategic Imperatives And Future Trajectory Of The Data Center Colocation Market In A Digital-First Era

As digital transformation accelerates across industries, data center colocation has emerged as an indispensable component of enterprise infrastructure strategies. The convergence of AI workloads, edge computing demands, and sustainability imperatives is reshaping the market, prompting both established players and new entrants to innovate at an unprecedented pace. Colocation providers that embrace intelligence, flexibility, and environmental stewardship will be best positioned to capitalize on the next wave of growth.

Meanwhile, the cumulative effect of U.S. tariff policies underscores the necessity for agile supply chains and diversified sourcing strategies. Operators must balance cost management with strategic expansion objectives, adapting to an evolving trade environment with careful scenario planning. Regional dynamics in the Americas, Europe Middle East & Africa, and Asia-Pacific further highlight the importance of localized approaches that align with infrastructure availability, regulatory landscapes, and power grid maturity.

Looking ahead, the market trajectory will be defined by those who can seamlessly integrate advanced technologies, sustainable practices, and customer-centric service models. By synthesizing segmentation insights and leveraging regional strengths, colocation providers can architect resilient platforms that address the complex requirements of today’s digital ecosystem while anticipating the opportunities of tomorrow.

Engage With Ketan Rohom Today To Secure Comprehensive Data Center Colocation Market Intelligence And Propel Your Strategic Decisions Forward

Ketan Rohom, Associate Director of Sales & Marketing, invites you to leverage the depth and rigor of this comprehensive data center colocation market report to inform your strategic decisions and stay ahead of the competition. With exclusive insights into the latest transformative shifts, tariff impacts, segmentation nuances, and regional dynamics, this report offers unparalleled clarity on the evolving landscape. Reach out today to secure your copy and unlock the information that will empower your organization’s next phase of growth and resilience.

- How big is the Data Center Colocation Market?

- What is the Data Center Colocation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?