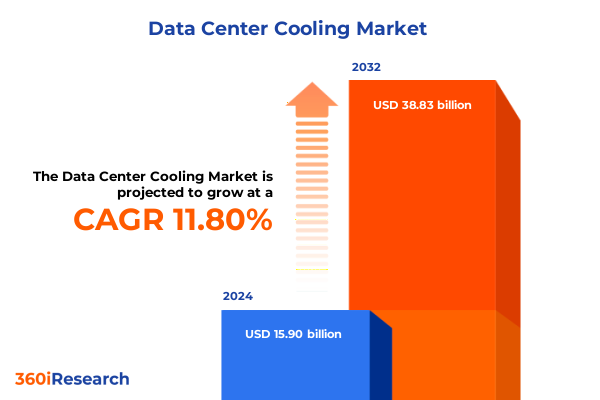

The Data Center Cooling Market size was estimated at USD 17.72 billion in 2025 and expected to reach USD 19.78 billion in 2026, at a CAGR of 11.85% to reach USD 38.83 billion by 2032.

Evolving data center cooling as a strategic enabler for AI workloads, sustainability commitments, and resilient digital infrastructure worldwide

Data centers are entering an era in which cooling is inseparable from performance, risk management, and sustainability. As AI training clusters, GPU-rich inference farms, and real-time analytics reshape data center workloads, thermal management has become a board-level concern rather than a purely operational one. Cooling already accounts for a significant share of total facility energy use, and high-density racks for AI and high-performance computing are pushing traditional air-based systems to their physical and economic limits.

At the same time, regulators, investors, and customers are demanding measurable progress on energy efficiency and climate impact. Power availability constraints in mature hubs, water scarcity in several hyperscale regions, and community scrutiny of data center footprints are converging to make cooling strategy a critical lever for achieving environmental and social goals. Operators can no longer rely on incremental efficiency tweaks; they must consider new architectures that address both thermal and sustainability requirements holistically.

The result is a global pivot from conventional computer room air conditioning towards a spectrum of advanced solutions, including high-efficiency chillers, free-air and economizer designs, and multiple forms of liquid cooling. These technologies are not standalone interventions; they interact with IT design, site selection, and power infrastructure. This report positions data center cooling within that broader context, highlighting how technology, policy, and supply-chain forces are reshaping choices across different facility types and geographies.

Against this backdrop, executives need a clear narrative: which technologies are moving from experimental to mainstream, how tariffs and trade policy are altering cost structures, where demand is most intense across segments and regions, and how vendors are repositioning their portfolios. The following sections answer these questions with an emphasis on practical insight that can inform near-term projects and long-term build-out strategies alike.

From air-based legacies to liquid, hybrid, and intelligent systems reshaping the global data center cooling technology landscape

The most profound transformation in data center cooling today is the shift from air-centric systems to architectures that incorporate liquid in multiple forms. Direct-to-chip liquid cooling and immersion cooling are increasingly deployed wherever rack power densities exceed what traditional air handling can support efficiently. Industry analyses highlight that many facilities now routinely plan for racks well above historic norms, especially in AI and high-performance computing deployments, driving operators to evaluate liquid-based options not as niche solutions but as standard design elements for new builds and major retrofits.

Within liquid cooling, two-phase direct-to-chip designs are gaining particular momentum. These systems exploit phase change in a closed loop to remove large amounts of heat with comparatively little energy input. Sector commentary characterizes 2025 as a year of implementation rather than experimentation, with more sophisticated data centers beginning to standardize on such systems for their highest-density workloads. This is complemented by continuing investment in single-phase solutions and emerging hybrid architectures that combine liquid at the rack with optimized air handling at room level, recognizing that not every workload justifies full liquid deployment.

Innovation is not limited to facility-level systems. On the component side, chipmakers and hyperscale operators are developing increasingly granular cooling technologies. Recent demonstrations of microfluidic channels etched directly into silicon packages illustrate how tightly integrated thermal management is becoming, allowing heat to be removed closer to the source and enabling higher sustained performance without prohibitive energy overhead. These advances signal a future in which thermal design is co-optimized with compute architecture from the outset rather than treated as an afterthought.

Importantly, these technology shifts are intertwined with sustainability imperatives. Liquid systems that enable higher rack densities can reduce the physical footprint of new construction, and designs that minimize or eliminate evaporative cooling respond directly to water scarcity concerns in constrained regions. Operators are increasingly framing cooling investments in terms of power usage effectiveness improvements, water usage reductions, and support for corporate decarbonization objectives. In this way, transformative shifts in the cooling landscape are not just enabling more powerful data centers; they are redefining what responsible digital infrastructure looks like.

Navigating the cumulative impact of evolving United States tariffs on data center cooling supply chains, costs, and investment decisions

United States tariff policy has become a significant external force shaping the economics of data center cooling in 2025. A series of measures targeting steel, aluminum, and a wide range of manufactured goods have raised input costs for heat exchangers, coils, structural frames, and other metal-intensive components. Industry reporting describes sharp increases in tariffs on Chinese imports, combined with a baseline tariff on products from other major trading partners, which capture many commercial HVAC and cooling products. For manufacturers of chillers, cooling towers, and air-handling units, these moves translate into higher material costs, pricing pressure, and an urgent need to diversify sourcing.

At the same time, tariff treatment has become more nuanced across geographies and product categories. For HVAC parts and assemblies manufactured in Mexico and Canada, exemptions tied to regional trade agreements have significantly mitigated cost escalation, provided that rules-of-origin requirements are met. This has encouraged several global cooling vendors to leverage or expand production in these countries as a hedge against tariffs on components sourced from Asia. Yet imports of key items such as compressors, motors, and specialized heat exchangers from China still face layered tariffs that can push effective rates far above headline levels, exerting upward pressure on equipment prices and, ultimately, on total installed cost for data center projects in the United States.

Electronics-rich categories tell a more complex story. Policymakers have carved out important exemptions or reductions for certain technology products, including servers and related computing equipment, to avoid severe disruption of digital infrastructure and consumer electronics markets. Decisions earlier in 2025 to exclude smartphones, computers, and various semiconductor devices from some of the steepest reciprocal tariffs have provided relief for server imports and associated IT hardware, even as other sectors continue to bear high rates. For data center operators, this creates an asymmetry: the IT stack may experience some tariff relief, while the mechanical and electrical infrastructure that supports it, including cooling plant, remains exposed to elevated costs.

The cumulative impact of these policies extends beyond upfront equipment pricing. Longer and more complex supply chains, with partial shifts toward nearshoring and friend-shoring, introduce new lead-time and logistics risks. Cooling vendors must balance commitments to domestic manufacturing with the realities of global component ecosystems, while operators face greater variability in procurement timelines and project budgets. Tariff volatility and time-limited exemptions add further complexity, making it difficult to plan multi-year build programs based on stable assumptions.

For data center stakeholders, 2025 is therefore a year in which tariff-aware strategy becomes essential. Procurement teams are scrutinizing bills of materials to understand where tariff exposure is concentrated, comparing offers from vendors with different manufacturing footprints, and evaluating whether modular or prefabricated cooling solutions assembled in low-tariff jurisdictions can mitigate costs. Investors and developers, meanwhile, are incorporating trade-policy scenarios into sensitivity analyses for new campuses. In combination, these responses highlight that United States tariffs are no longer a background policy issue; they are a structural factor in the design and deployment of cooling systems for digital infrastructure.

Unpacking demand patterns and technology preferences across data center cooling offerings, architectures, workloads, and deployment scenarios

Demand patterns across data center cooling are best understood through the lens of the underlying market segments, beginning with the distinction between services and solutions. On the solutions side, operators continue to deploy a mix of air conditioning units, chiller plants, cooling towers, economizer systems, and liquid cooling platforms. The balance among these depends on climate, rack density, and facility type. Liquid cooling systems, whether direct-to-chip or immersion-based, gain traction in high-density zones and specialized clusters, while high-efficiency air conditioning and chiller combinations remain prevalent in mixed-density environments and legacy sites where retrofits must be staged over time.

Services form a parallel layer of value. Consulting support is increasingly sought in the early design phase to align thermal architectures with power constraints, sustainability goals, and risk tolerance. Installation and deployment services are becoming more complex, particularly when integrating in-rack liquid systems with existing air-cooled halls or when phasing upgrades in live facilities. Maintenance and support are also evolving; service providers now monitor not only mechanical performance but also fluid quality, leak detection, and control-system tuning, recognizing that advanced cooling technologies demand specialized operational expertise.

Another powerful lens is system integration. Integrated systems that combine cooling, power distribution, and monitoring within a unified architecture are gaining favor in hyperscale, cloud, and high-performance computing environments, where the ability to optimize across subsystems translates directly into efficiency and capacity gains. Standalone systems still play a critical role, especially in incremental expansions, retrofits, and smaller enterprise sites that prefer modular add-ons. The coexistence of integrated and standalone approaches reflects a pragmatic response to heterogeneous portfolios: operators with dozens of facilities often deploy deeply integrated solutions in new campuses while relying on discrete additions in older buildings.

Differences in cooling type map closely to workload characteristics. Room-based cooling remains important for general-purpose enterprise and colocation spaces that host a variety of moderate-density workloads. Row-based and rack-based cooling, by contrast, align with AI clusters, dense virtualization, and storage or network zones where heat loads are highly concentrated. As operators carve out high-density corridors inside otherwise conventional halls, rack-level cooling allows them to support new workloads without wholesale redesign of entire facilities, effectively creating micro-environments tailored to specific thermal profiles.

Power rating bands add another dimension. Facilities below 1 MW are typically associated with edge deployments or smaller enterprise sites, where simplicity and reliability of cooling matter as much as raw efficiency. Installations in the 1 MW to 5 MW range include many regional colocation and enterprise data centers, which increasingly adopt economizers, containment strategies, and targeted liquid deployments to manage rising densities. Above 5 MW, large colocation, hyperscale, and high-performance computing sites face the full brunt of AI-driven loads and are at the forefront of adopting liquid systems, advanced controls, and waste-heat recovery schemes, reflecting the scale at which small percentage gains in efficiency translate into meaningful absolute savings.

Segmenting by data center type, hyperscale and cloud facilities are leading adopters of liquid and hybrid cooling, driven by AI services and massive multi-tenant workloads. Colocation providers are rapidly upgrading to remain attractive to customers with GPU-intensive applications, while enterprise data centers exhibit more gradual transitions constrained by capital cycles and on-premises application portfolios. Edge data centers prioritize compact, highly reliable cooling tuned to local conditions, telecom sites must balance cooling with space and power constraints at network nodes, and high-performance computing facilities often push the most aggressive thermal designs in pursuit of scientific and engineering performance.

End-user verticals bring their own nuances. Banking, financial services, and insurance emphasize resilience, low latency, and compliance, often leading to conservative change management but growing interest in efficient cooling for analytics and risk engines. Energy and utilities sectors support simulation and grid-optimization workloads that can be thermally intensive. Government and defense facilities must align with security and classification constraints, sometimes limiting deployment options. Healthcare and life sciences increasingly rely on genomics and imaging workloads, which favor higher density clusters, while IT and telecommunication firms are at the cutting edge of cloud and network builds. Manufacturing and industrial users pursue cooling strategies that support digital twins and industrial IoT platforms, and retail and e-commerce players focus on scaling capacity for seasonal peaks without disproportionate energy penalties.

Finally, deployment mode shapes how these segmentation patterns translate into projects. New construction offers the greatest freedom to adopt state-of-the-art liquid or hybrid designs, integrate waste-heat reuse, and optimize building envelopes for free cooling and containment. Retrofit deployments, however, represent a substantial share of activity as operators seek to extend the life and capability of existing sites. Here, phased introduction of row-based or rack-based cooling, upgrades to chiller plants, and enhancements to monitoring and control systems allow organizations to gradually align legacy facilities with modern performance and sustainability expectations.

This comprehensive research report categorizes the Data Center Cooling market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- System Integration

- Cooling Type

- Power Rating

- Data Center Type

- End-User

- Deployment Mode

Regional perspectives on data center cooling as Americas, EMEA, and Asia-Pacific respond to power, climate, and policy pressures

Regional dynamics exert a powerful influence on how data center cooling strategies evolve, beginning with the Americas. In the United States, rapid growth in AI infrastructure and cloud footprints is colliding with power availability constraints in several established hubs. Analyses show that occupancy rates in major European and North American markets are high and power delivery lags contracted demand, a pattern that intensifies the focus on energy-efficient cooling to maximize usable capacity within fixed electrical envelopes. In North America, this is driving adoption of advanced economizer-based air systems and targeted liquid cooling deployments that can safely support higher rack densities without proportionally increasing total facility energy use.

Elsewhere in the Americas, emerging data center clusters in Latin America are balancing the need for robust cooling under warm and humid conditions with infrastructure and cost constraints. Operators in markets such as Brazil, Chile, and Mexico are exploring combinations of high-efficiency chillers, indirect evaporative solutions, and modular cooling blocks that can be scaled as local demand and power infrastructure mature. For many of these sites, climatic conditions make free-air cooling less viable for large portions of the year, so reliability and water usage become central considerations in system selection.

Europe, the Middle East, and Africa present a contrasting mix of challenges and opportunities. In Western and Northern Europe, strict energy-efficiency regulations, decarbonization commitments, and community concerns about water use are driving aggressive targets for power usage effectiveness and, increasingly, water usage metrics. Limited new grid capacity in cities such as London, Dublin, and Frankfurt has already slowed some data center projects, elevating the importance of cooling systems that deliver more compute per megawatt. At the same time, operators are experimenting with district energy integration and heat reuse, feeding waste heat from data centers into municipal heating networks to improve overall system efficiency.

In the Middle East, large-scale cloud and hyperscale developments are emerging in climates characterized by high ambient temperatures and, in some cases, constrained freshwater resources. Here, the emphasis is on cooling solutions that maintain reliability under extreme conditions while minimizing water consumption. Indirect evaporative systems, high-efficiency chillers tailored to hot climates, and designs that reduce reliance on traditional cooling towers are gaining interest. In parts of Africa, where grid stability and infrastructure investment remain uneven, modular data centers with integrated, resilient cooling solutions are increasingly used to bring capacity closer to end users.

Asia-Pacific is the most dynamic region in terms of new capacity additions, with major hubs in markets such as China, India, Singapore, Japan, and Australia. Intensifying AI and cloud demand, combined with dense urban environments, puts a premium on space-efficient and energy-efficient cooling. Policy-driven constraints on new data center permits in some cities have created incentives for highly efficient designs that can justify scarce land and power allocations. At the same time, regional diversity is significant: tropical climates in Southeast Asia pose different cooling challenges from temperate zones in parts of East Asia, encouraging a mix of free-cooling, liquid-based solutions, and advanced air systems.

Across all three regional groupings, a common theme is emerging: cooling choices are increasingly intertwined with power strategy, regulatory compliance, and public perception. Whether in a North American AI campus, a European colocation hub navigating strict efficiency rules, or an Asia-Pacific cloud region balancing density with climate considerations, regional context dictates not only which technologies are viable but also which are socially and politically acceptable over the long term.

This comprehensive research report examines key regions that drive the evolution of the Data Center Cooling market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic moves by leading cooling technology vendors and innovators shaping solutions for high-density, sustainable data centers

The vendor landscape in data center cooling is characterized by a blend of long-established infrastructure providers and specialized innovators targeting high-density and liquid-based applications. Multinational firms with deep roots in HVAC and building systems engineering continue to offer comprehensive portfolios of air conditioning units, chillers, cooling towers, and controls, often delivered alongside building management systems and broader mechanical, electrical, and plumbing services. These companies are refining their products to accommodate higher return temperatures, support free-cooling hours, and integrate seamlessly with advanced monitoring platforms used in modern data centers.

Alongside these incumbents, a cohort of liquid cooling specialists has gained prominence, particularly in response to AI and high-performance computing loads. Solution providers focused on direct-to-chip and immersion cooling have moved from proof-of-concept deployments to production-scale rollouts in hyperscale and colocation environments. They are developing cold plates capable of handling several kilowatts per device and immersion systems optimized for GPU-dense racks, helping operators support elevated power densities without proportionally increasing energy dedicated to cooling. These firms increasingly partner with server manufacturers and chip vendors to ensure mechanical compatibility and simplify deployment.

Traditional IT hardware vendors are also reshaping their offerings around cooling. Server and storage manufacturers now design platforms that are liquid-ready, offering factory-fitted cold plates and manifolds or configurations explicitly qualified for immersion. This alignment between IT and facility vendors shortens deployment timelines and reduces integration risk, which is particularly important when retrofitting liquid cooling into existing halls with continuous uptime requirements. Some providers are introducing modular data center blocks that bundle compute, power, and cooling into prefabricated units, simplifying deployment in markets with tight construction schedules or limited on-site skilled labor.

Innovation extends to adjacent services and software. Many vendors now offer digital twins and advanced simulation services that allow operators to model airflow, temperature profiles, and fluid dynamics before committing to specific designs. Integrated control platforms that coordinate chiller operation, pump speeds, valve positions, and IT load management are becoming central to achieving consistent efficiency. Vendors differentiate themselves through analytics capabilities, remote monitoring, and the ability to support mixed environments where legacy air systems and new liquid deployments must be orchestrated without compromising resilience.

Strategically, leading companies are repositioning around sustainability narratives. They highlight reductions in energy consumption, elimination or reduction of water use, and support for heat-reuse schemes as key value propositions. Many are investing in research to validate the long-term reliability of liquid systems, refine leak-detection mechanisms, and develop eco-friendlier fluids. As customers adopt more stringent environmental, social, and governance criteria in supplier selection, vendors that can demonstrate credible performance gains and robust lifecycle practices are likely to gain share in high-value segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Data Center Cooling market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Aecorsis BV

- Alfa Laval AB

- Asetek A/S

- Black Box Limited

- Chilldyne Inc.

- Coolcentric

- Daikin Industries, Ltd.

- Danfoss A/S

- Dell Technologies Inc.

- Delta Electronics, Inc.

- Eaton Corporation PLC

- Emerson Electric Co.

- Exxon Mobil Corporation

- Fujitsu Limited

- Green Revolution Cooling, Inc.

- Grundfos Holding A/S

- Heatex AB

- Hewlett Packard Enterprise Development LP

- Hitachi, Ltd.

- Huawei Technologies Co., Ltd.

- Hypertec Group Inc.

- Iceotope

- International Business Machines Corporation

- Johnson Controls International PLC

- Legrand S.A.

- LG Corporation

- LiquidStack Holding B.V.

- LITE-ON Technology Corporation

- Mitsubishi Electric Corporation

- Modine Manufacturing Company

- Munters

- Nortek Air Solutions, LLC

- NTT Limited

- Rittal GmbH & Co. KG

- Schneider Electric SE

- Schunk Group

- Siemens AG

- SPX Cooling Tech, LLC

- STULZ GmbH

- SWEP International AB by Dover Corporation

- The Dow Chemical Company

- Vertiv Holdings Co.

- Vigilent Corporation

Actionable strategic priorities for operators, investors, and partners to future‑proof data center cooling decisions in a volatile landscape

For industry leaders, the current environment calls for deliberate, multi-year strategies that align cooling investments with evolving workloads, policy trends, and supply-chain realities. A first priority is to build a clear understanding of how AI and other high-density applications will change thermal profiles across the portfolio. This involves not only modeling peak demands in flagship facilities but also anticipating secondary effects as workloads shift between on-premises sites, colocation partners, and cloud regions. With that visibility, decision-makers can determine where incremental enhancements to air systems will suffice and where a step-change to rack-level or liquid cooling is warranted.

A second priority is to adopt a hybrid architectural mindset. Rather than committing prematurely to exclusively air- or liquid-based designs, many operators will benefit from flexible configurations that can evolve as densities and tariffs change. Designing new halls with liquid-ready infrastructure, while continuing to deploy efficient air-based systems for less demanding zones, allows organizations to unlock efficiency gains where they matter most without incurring unnecessary complexity elsewhere. In parallel, retrofits should be planned as phased programs that coordinate cooling upgrades with IT refresh cycles, minimizing disruption and avoiding stranded assets.

Supply-chain resilience is equally critical. Leaders should map tariff exposure across critical cooling components, from steel-intensive structures to imported heat exchangers and controls, and then consider alternative sourcing strategies, including regional manufacturing and qualifying multiple vendors for key product categories. Where feasible, pre-negotiated framework agreements with suppliers operating in lower-tariff jurisdictions can help stabilize costs over time. At the same time, partnerships with vendors that offer strong service and support capabilities can mitigate operational risks associated with more advanced systems.

From a governance perspective, executives should integrate cooling considerations into broader sustainability and risk management frameworks. Establishing clear targets for energy and water performance, ensuring that new projects undergo rigorous thermal and environmental review, and linking cooling efficiency to corporate decarbonization initiatives can help align technical decisions with stakeholder expectations. Transparent reporting on cooling performance and improvements also strengthens relationships with regulators and communities, particularly in regions where data center expansion is under scrutiny.

Finally, leaders should invest in capabilities and culture. Advanced cooling technologies require new skill sets in design, operations, and maintenance. Training programs, updated procedures, and collaboration between IT and facilities teams are essential to realizing the full benefits of new systems. By pairing technology investments with organizational readiness, industry leaders can turn cooling from a reactive cost center into a proactive source of resilience and competitive differentiation.

Robust research methodology combining multi-source intelligence, expert validation, and granular segmentation to inform cooling market decisions

The insights presented in this report are grounded in a structured research methodology that combines multiple sources of evidence and emphasizes validation at each step. The foundation is extensive secondary research drawing on public filings from data center operators and technology vendors, technical publications from industry associations, regulatory and policy documents, and news coverage of key developments in cooling technologies, tariffs, and large-scale deployments. Particular attention is paid to sources that provide concrete details on rack densities, cooling architectures, and policy measures, ensuring that the analysis reflects the state of the industry through 2025.

Building on this base, the research incorporates insights from interviews and discussions with stakeholders across the ecosystem, including data center operators, engineering firms, equipment manufacturers, and technology partners. These qualitative inputs help contextualize quantitative and technical findings, highlighting practical constraints, adoption barriers, and emerging best practices that are not always evident in public documentation. Where possible, differing perspectives from colocation providers, hyperscalers, and enterprise operators are contrasted to illuminate how the same technology or policy change can have different implications across segments.

A detailed segmentation framework structures the analysis. The market is examined by offering, system integration, cooling type, power rating, data center type, end-user vertical, and deployment mode, allowing patterns to be identified within and across these dimensions. For each segment, the research assesses the roles of various technologies, the interplay with workload characteristics, and the influence of regional factors such as climate and regulation. Cross-segmentation helps reveal, for example, how certain cooling types align with specific power bands or how end-user requirements shape design choices in different facility categories.

Throughout, the methodology emphasizes triangulation. Findings from different sources and stakeholder groups are compared to test consistency and identify outliers that may warrant closer examination. Where accounts diverge, the analysis seeks to understand the underlying reasons, such as differences in workload mix, regulatory environment, or technology maturity. This approach reduces the risk of over-reliance on any single perspective and supports robust, nuanced conclusions.

The result is a body of insight that is both comprehensive and grounded in real-world experience. By blending documentary research, expert input, and structured segmentation, the methodology aims to deliver guidance that is actionable for decision-makers responsible for planning, procuring, and operating data center cooling systems in a rapidly evolving environment.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Data Center Cooling market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Data Center Cooling Market, by Offering

- Data Center Cooling Market, by System Integration

- Data Center Cooling Market, by Cooling Type

- Data Center Cooling Market, by Power Rating

- Data Center Cooling Market, by Data Center Type

- Data Center Cooling Market, by End-User

- Data Center Cooling Market, by Deployment Mode

- Data Center Cooling Market, by Region

- Data Center Cooling Market, by Group

- Data Center Cooling Market, by Country

- United States Data Center Cooling Market

- China Data Center Cooling Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1590 ]

Converging technology, regulatory, and cost dynamics elevate data center cooling from operational necessity to core strategic advantage

Data center cooling has moved decisively from the margins to the center of digital infrastructure strategy. Rising rack densities driven by AI and other demanding workloads, combined with growing constraints on power and water, mean that thermal management is now a primary determinant of how much useful compute a facility can deliver. At the same time, heightened regulatory scrutiny and stakeholder expectations around sustainability are elevating cooling performance and transparency to essential components of corporate responsibility.

Technology responses are reshaping the landscape. Liquid cooling in its various forms, advanced air systems, and intelligent controls are no longer experimental options reserved for a handful of cutting-edge sites. They are becoming integral to mainstream designs, especially in hyperscale, cloud, and high-performance computing environments where the gap between legacy capabilities and new requirements is most pronounced. Vendors across the spectrum are adapting, blending traditional HVAC expertise with specialized liquid and digital capabilities to meet more complex and diverse customer needs.

Policy and trade developments add another layer of complexity. Tariffs on metals and HVAC-related imports, alongside selective relief for certain IT products, are altering cost structures, supply chains, and sourcing strategies. Operators and investors can no longer assume stable global trade conditions when planning multi-year build and retrofit programs; they must incorporate policy uncertainty into their evaluations of cooling options and vendor choices.

Across segments and regions, one conclusion stands out: organizations that treat cooling as a strategic asset rather than a background utility are better positioned to navigate this environment. By aligning technology choices with workload trajectories, regulatory expectations, and financial constraints, they can unlock higher densities, improve efficiency, and enhance resilience. Those that delay or approach cooling decisions tactically risk facing constraints that limit growth, increase operating costs, and complicate sustainability commitments.

As the digital economy continues to expand, the ability to manage heat efficiently, reliably, and responsibly will remain a defining capability for data center operators and their partners. The insights in this report are intended to support that journey, providing a structured view of the forces at work and the options available to those prepared to lead rather than follow.

Take the next step with tailored insight: connect with Ketan Rohom to unlock full data center cooling intelligence and opportunities

Data center cooling decisions are no longer routine engineering choices; they define how effectively your organization can support AI workloads, deliver digital services, and meet increasingly rigorous sustainability expectations. The full report provides a structured, decision-ready view of technologies, deployment models, vendor strategies, and regulatory influences so that senior leaders can move from incremental upgrades to confident, long-horizon cooling roadmaps.

By engaging with this research, you gain access to deep segmentation by offering, system integration, cooling type, power band, data center type, end-user vertical, and deployment mode, as well as nuanced regional perspectives across the Americas, Europe, the Middle East and Africa, and Asia-Pacific. The report translates complex shifts in rack density, liquid cooling adoption, and tariff policy into implications that are immediately relevant for capital allocation, site selection, and vendor negotiations.

To turn these insights into tangible competitive advantage, connect with Ketan Rohom, Associate Director, Sales & Marketing. Ketan can guide you through the scope of the study, available licensing options, and how customized analyst support can be aligned with your specific footprint and investment horizon. Reach out to the team through the corporate website to initiate a conversation, review sample content, and explore how this report can support your next wave of data center cooling decisions.

- How big is the Data Center Cooling Market?

- What is the Data Center Cooling Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?