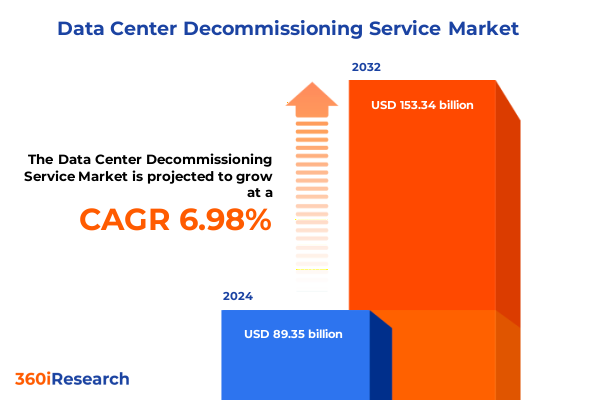

The Data Center Decommissioning Service Market size was estimated at USD 12.12 billion in 2025 and expected to reach USD 12.95 billion in 2026, at a CAGR of 7.37% to reach USD 19.94 billion by 2032.

Unveiling the Critical Imperative of Secure and Eco-Conscious Data Center Decommissioning Amid Unprecedented Digital Growth and Technological Innovation

The rapid expansion of digital infrastructure across enterprises, hyperscale operators, and edge deployments has created a growing imperative for systematic data center decommissioning practices that safeguard information, recover value, and minimize environmental impact. As organizations refresh hardware to accommodate advanced AI and cloud workloads, legacy equipment volumes have surged, necessitating process-driven approaches to ensure secure data destruction and regulatory compliance. At the same time, heightened stakeholder scrutiny around e-waste and sustainability underscores the need for eco-conscious asset disposition strategies that align with corporate social responsibility goals.

In parallel, evolving regulations-from global data privacy frameworks like GDPR and CCPA to extended producer responsibility in the European Union-are imposing stringent requirements on how decommissioned hardware is handled, tracked, and recycled. Adopting industry best practices is no longer optional but a critical business enabler to mitigate risk and uphold corporate reputation in an era of intensifying regulatory oversight.

Moreover, the integration of automation and AI-driven systems is revolutionizing traditional workflows by accelerating inventory management, data sanitization, and equipment dismantling activities while reducing manual errors. By leveraging these technologies, service providers and enterprises alike are realizing greater operational efficiency and cost-effectiveness, positioning decommissioning as a strategic opportunity to unlock secondary revenue streams through IT asset disposition. These dynamics collectively set the stage for an in-depth exploration of transformative shifts, tariff impacts, segmentation nuances, and regional differentiators that define the contemporary data center decommissioning market.

Charting the Major Technological, Regulatory, and Sustainability-Driven Transformations Shaping Data Center Decommissioning Practices Globally

The data center decommissioning industry is undergoing profound transformation driven by technological innovation, regulatory evolution, and sustainability imperatives. Advanced robotics and AI-enabled systems now automate physical dismantling, asset tracking, and data wiping processes, dramatically reducing project timelines and human error. Decision-makers are deploying intelligent platforms to plan and execute decommissioning with precision, improving visibility across complex supply chains and ensuring every serialized asset is accounted for from rack to recycling facility.

Concurrently, regulatory landscapes are shifting to reinforce environmental accountability and data security. In the European Union, upcoming battery due diligence requirements mandate that data center operators verify the provenance and recyclability of UPS batteries, enforce supplier transparency, and report annual risk assessments by August 2025. These measures extend the lifecycle responsibility of manufacturers and end users, compelling the sector to embed sustainability metrics and third-party certification into core decommissioning protocols.

At a strategic level, the circular economy paradigm is gaining traction as service providers and enterprises forge partnerships to refurbish, remarket, and recycle IT hardware. By integrating closed-loop processes, companies are recovering precious metals, reducing landfill contributions, and unlocking new revenue streams. Together, these transformative shifts are redefining decommissioning as a value-creation endeavor that balances operational efficiency, compliance, and environmental stewardship.

Assessing the Far-Reaching Consequences of 2025 U.S. Tariffs on Equipment Costs, Supply Chains, and Strategic Data Center Decommissioning Initiatives

The enactment of targeted U.S. tariffs in 2025 has introduced a complex layer of cost and supply chain considerations for data center decommissioning services. Tariffs ranging from 10% to 50% on imported metals and electronic components have elevated capital expenditures for key decommissioning infrastructure-from material handling equipment to secure shredding systems. Hyperscale operators are reassessing decommissioning budgets amid rising copper and steel prices, potentially delaying project timelines or shifting to alternative jurisdictions with more favorable trade conditions.

These import duties are also prompting strategic supply chain diversification as providers seek tariff-exempt sourcing in regions such as Mexico, Vietnam, and India. While localization efforts offer relief from U.S. levies, establishing new vendor partnerships and validating quality standards requires substantial lead time and capital investment. In the interim, service providers are stockpiling critical decommissioning tools and components, creating temporary warehousing costs and tying up working capital.

Furthermore, the unpredictability of reciprocal tariffs on technology equipment has introduced a new dimension of uncertainty. Providers now incorporate tariff risk assessments into long-term planning, balancing the potential cost pass-through to end clients against the need to maintain competitive service pricing. As a result, industry stakeholders are closely monitoring policy developments to adapt their decommissioning frameworks and sustain operational continuity under evolving trade regimes.

Unraveling Key Market Dynamics Across Service Types, End-Use Industries, Organization Sizes, and Asset Categories in Data Center Decommissioning

Market segmentation in the data center decommissioning space can be understood through the prism of service type, end-use industry, organization size, and asset classification. Within service type, providers offer comprehensive asset disposition programs that encompass donation facilitation, refurbishment, and remarketing, complementing these with specialized data destruction methods such as degaussing, overwriting, and physical shredding. Parallel offerings in deinstallation and dismantling range from precise cabling removal to full rack teardown, followed by recycling and disposal solutions for electronic waste, hazardous materials, and metal recovery.

From an end-use perspective, financial services firms, government agencies, healthcare institutions, IT and telecom operators, and retail enterprises each exhibit unique decommissioning requirements driven by data sensitivity, compliance demands, and renewal cycles. Large enterprises typically engage turnkey decommissioning partners with global footprint and high-volume capabilities, whereas small and medium businesses-including medium and small enterprises-often prioritize modular, cost-efficient packages that can scale with their evolving asset lifecycle needs.

Asset type further refines market focus, with services tailored to the secure disposition of hard disk drives, solid state drives, and tape archives, alongside decommissioning of servers, desktops, laptops, networking hardware such as routers, switches, and firewalls, and non-IT infrastructure components like cabling, cooling systems, and power distribution units. By aligning service offerings to these distinct segmentation vectors, providers craft integrated solutions that address every phase of the decommissioning journey, ensuring optimal risk mitigation and value recovery.

This comprehensive research report categorizes the Data Center Decommissioning Service market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Organization Size

- Asset Type

- End Use Industry

Illuminating Regional Variations in Decommissioning Strategies and Market Drivers Across the Americas, EMEA, and Asia-Pacific Data Center Landscapes

Regional insights reveal divergent approaches to decommissioning shaped by local regulations, market maturity, and sustainability agendas. In the Americas, heightened enforcement of data privacy legislation and revitalized e-waste rules have elevated demand for certified data destruction and third-party chain-of-custody services. Providers are expanding domestic processing centers and forging partnerships with local recyclers to streamline operations and comply with stringent national requirements.

Across Europe, the Middle East, and Africa, the push for circular economy adoption is driving robust investment in refurbishment and recycling infrastructure. High-efficiency directives mandate annual reporting on energy consumption and waste metrics, compelling both local operators and multinational firms to integrate comprehensive environmental documentation into their decommissioning workflows. Public sector initiatives in the region are also championing extended producer responsibility models to ensure end-of-life asset management aligns with sustainability targets.

In Asia-Pacific, rapid data center proliferation has ushered in a parallel uptick in decommissioning activity. Governments in leading markets are formalizing e-waste regulations and incentivizing domestic recycling capabilities, prompting providers to develop modular, portable decommissioning solutions that cater to edge deployments and hyperscale facilities alike. The region’s emphasis on resource security and strategic autonomy further fuels collaboration between service vendors and local authorities to enhance processing capacity and circular resource streams.

This comprehensive research report examines key regions that drive the evolution of the Data Center Decommissioning Service market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting Leading Industry Players and Their Strategic Initiatives Driving Innovation and Compliance in the Data Center Decommissioning Sector

Leading companies in the decommissioning sector are differentiating through specialization, scale, and innovation. Iron Mountain leverages its global footprint and secure chain-of-custody protocols to deliver rapid, compliant asset disposition, remarketing retired hardware and providing certified data erasure at scale. Schneider Electric, through its EcoStruxure IT platform, integrates DCIM monitoring and battery due diligence capabilities, enabling data center operators to streamline decommissioning workflows while meeting emerging EU sustainability regulations.

Atos extends its consulting-led approach to modernization consulting, offering tailored roadmaps for IT equipment inventory, physical security assessments, and energy efficiency optimization that dovetail into decommissioning planning and execution. Specialized providers such as SK Tes bring hyperscale-grade processing facilities across multiple continents, ensuring end-to-end management of deinstallation, logistics, data destruction, and recycling within a unified platform. Regional experts like DataIT differentiate with flexible, compliance-focused service models, emphasizing ISO and R2v3 certifications for small and mid-market clients seeking cost-effective decommissioning solutions.

Collectively, these firms exemplify the sector’s commitment to security, sustainability, and operational excellence, continuously refining service portfolios to meet the exacting standards of diverse industries and regulatory environments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Data Center Decommissioning Service market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- B2B Exports LLC

- Cisco Systems, Inc.

- Dell Technologies Inc.

- Hewlett Packard Enterprise Company

- International Business Machines Corporation

- Iron Mountain Incorporated

- Schneider Electric SE

- Sims Limited

- Stericycle, Inc.

- Veolia Environnement S.A.

- Vertiv Holdings Co.

Actionable Strategic Pathways for Industry Leaders to Optimize Decommissioning Operations, Mitigate Risks, and Capitalize on Emerging Opportunities

Industry leaders should prioritize integration of automated asset tracking and AI-driven logistics to enhance project visibility and reduce human error. By deploying robotics for repetitive dismantling tasks and advanced analytics for capacity planning, organizations can compress decommissioning timelines and lower labor costs, thereby improving overall project economics. Announcing pilot programs in targeted facilities can accelerate technology adoption while building in-house expertise.

To mitigate tariff-induced supply chain risks, service providers must cultivate diversified sourcing networks across tariff-exempt regions and consider strategic stockpiling of critical equipment. Engaging in collaborative trade agreement reviews and leveraging free trade channels can unlock duty relief for essential decommissioning tools and hardware. Periodic risk assessments should inform contractual terms with clients to balance capex fluctuations and maintain service-level commitments.

Embedding circular economy principles into service delivery will drive sustainability performance and unlock new revenue streams. Establishing refurbishment and remarketing partnerships enables companies to recapture value from retired assets while supporting clients’ net-zero objectives. Simultaneously, aligning decommissioning processes with evolving regulations-such as EU battery due diligence and e-waste directives-ensures compliance and enhances brand reputation. By adopting transparent reporting frameworks, providers can demonstrate environmental impact reductions and reinforce stakeholder trust.

Delineating the Rigorous Multi-Source Research Methodology Underpinning the In-Depth Analysis of Data Center Decommissioning Services

This analysis synthesizes findings from a comprehensive research framework combining primary and secondary sources. Primary insights were gathered through expert interviews with service providers, decommissioning engineers, and regulatory officials, offering qualitative perspectives on emerging trends. Secondary data was consolidated from industry publications, regulatory communiqués, and recent trade policy announcements, including U.S. tariff provisions and EU environmental directives.

Case studies of leading vendors provided real-world validation of best practices, while a review of public sustainability reports and financial disclosures shed light on evolving corporate commitments to circularity. Regulatory analysis encompassed scrutiny of the EU battery due diligence regulation, the WEEE Directive, and U.S. import tariff schedules. Data triangulation across these sources ensured robust, fact-based conclusions, with attention to global regional nuances and evolving market dynamics.

To maintain analytical rigor, all information was cross-verified with official government publications, industry whitepapers, and reputable news outlets. This methodological approach underpins the credibility of the insights presented and provides a reproducible framework for future market assessments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Data Center Decommissioning Service market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Data Center Decommissioning Service Market, by Service Type

- Data Center Decommissioning Service Market, by Organization Size

- Data Center Decommissioning Service Market, by Asset Type

- Data Center Decommissioning Service Market, by End Use Industry

- Data Center Decommissioning Service Market, by Region

- Data Center Decommissioning Service Market, by Group

- Data Center Decommissioning Service Market, by Country

- United States Data Center Decommissioning Service Market

- China Data Center Decommissioning Service Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2226 ]

Consolidating Insights and Charting the Future Trajectory of Data Center Decommissioning in an Era of Digital Transformation and Sustainability

The convergence of advanced automation, circular economy imperatives, and regulatory complexities has elevated data center decommissioning from a tactical necessity to a strategic differentiator. Stakeholders who integrate secure data destruction, streamlined asset disposition, and sustainable recycling frameworks will not only mitigate risk but also drive operational efficiency and unlock new revenue channels through hardware remarketing.

Given the volatility introduced by U.S. tariffs and shifting global trade policies, supply chain resilience and strategic sourcing have emerged as critical components of decommissioning planning. Regional regulatory variations further underscore the importance of adaptable service models that align with local environmental, security, and reporting requirements.

Looking ahead, the intertwining of AI-powered execution, enhanced compliance architectures, and circular economy collaborations will define the next generation of decommissioning excellence. Organizations that proactively embrace these dynamics, invest in emerging technologies, and foster cross-sector partnerships will secure competitive advantage and position themselves as leaders in the evolving landscape of digital infrastructure retirement.

Empower Your Organization with Expert Decommissioning Insights by Consulting Ketan Rohom to Secure a Competitive Advantage

If you’re ready to deepen your understanding of the evolving data center decommissioning landscape and translate insights into strategic advantage, connect directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan brings extensive expertise in guiding enterprises through complex decommissioning projects and aligning them to regulatory, sustainability, and technological trends. Engage with him to explore bespoke research offerings tailored to your organization’s unique requirements, secure early access to comprehensive market intelligence, and gain actionable guidance for optimizing asset disposition and environmental compliance. Reserve your personalized consultation today to ensure your decommissioning strategy leverages the latest data-driven insights and positions your business for future growth and resilience.

- How big is the Data Center Decommissioning Service Market?

- What is the Data Center Decommissioning Service Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?