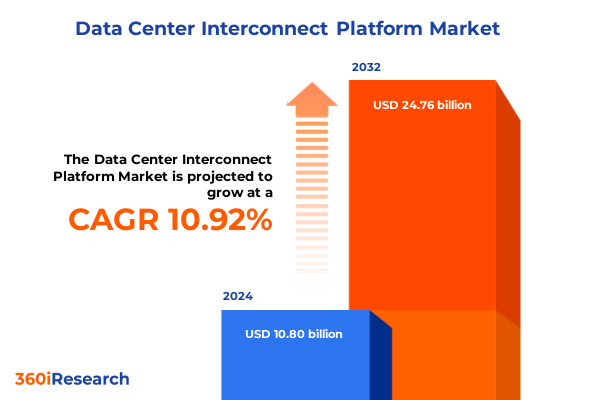

The Data Center Interconnect Platform Market size was estimated at USD 11.84 billion in 2025 and expected to reach USD 12.99 billion in 2026, at a CAGR of 11.10% to reach USD 24.76 billion by 2032.

Exploring How Next-Generation Data Center Interconnect Platforms Are Redefining Connectivity, Performance, and Enterprises’ Digital Transformation Strategies

In today’s hyper-connected environment, enterprises demand seamless, high-capacity links between data centers to support mission-critical applications, cloud migrations, and real-time data analytics. Data Center Interconnect (DCI) platforms lie at the heart of this transformation by enabling scalable, resilient, and secure connectivity across distributed facilities. As digital ecosystems evolve, next-generation DCI solutions are shifting from simple point-to-point links to programmable, intelligent networks that dynamically adapt to traffic demands and ensure optimal performance under diverse load profiles.

The imperative for low latency, high throughput, and stringent service-level agreements has driven substantial innovation in optical transport, routing, and switching technologies. Enterprises now leverage automation, software-defined networking, and advanced telemetry to orchestrate end-to-end connectivity, reduce operational complexity, and accelerate time to value. In this context, DCI platforms are no longer siloed components but integral elements of a holistic digital infrastructure strategy that underpins cloud services, colocation environments, and on-premise data hubs.

This executive summary introduces the critical shifts reshaping the DCI landscape, examines the 2025 tariff environment in the United States, and highlights segmentation and regional insights. Leading vendors, strategic imperatives, and actionable recommendations are also explored to provide a comprehensive view of the opportunities and challenges facing decision-makers in this domain.

As we move forward, the next section delves into the transformative technological, operational, and strategic shifts driving unprecedented evolution in data center connectivity globally, setting the stage for an in-depth analysis of market dynamics and competitive positioning.

Identifying the Disruptive Technological, Operational, and Strategic Shifts Propelling Unprecedented Evolution in Data Center Connectivity Worldwide

Enterprises and service providers alike are witnessing a paradigm shift in the way data center connectivity is designed, deployed, and managed. Moving beyond traditional static links, modern interconnect strategies harness software-defined networking to enable real-time traffic optimization. Moreover, automation frameworks are now embedded at the network layer, allowing dynamic provisioning of wavelengths and bandwidth tiers on demand, which in turn accelerates provisioning cycles from weeks to minutes.

In addition, the rise of high-capacity wavelength technologies-particularly the shift toward 400Gbps and terabit-class links-has redefined performance benchmarks. These advancements empower organizations to support high-performance computing workloads, big data analytics, and AI-driven applications without compromising latency or throughput. At the same time, the continued maturation of coherent optics and modular hardware designs has strengthened vendor roadmaps, driving down cost per bit and improving energy efficiency.

Security and resilience have also undergone a transformation, as zero trust principles extend into the interconnect layer. Encryption at line rates, automated threat detection, and segmentation within DCI fabrics now form the baseline for any enterprise-grade deployment. Hybrid cloud adoption further demands seamless interoperability between on-premise, colocation, and public cloud environments, prompting the emergence of open APIs and multivendor orchestration platforms.

As a result of these trends, organizations are positioned to embrace distributed architectures, edge-enabled use cases, and AI inference at scale. The following section examines how new tariff measures in the United States are influencing procurement strategies, supply chain decisions, and overall cost structures in this rapidly evolving arena.

Analyzing the Far-Reaching Consequences of 2025 United States Tariff Policies on Data Center Interconnect Infrastructure, Supply Chains, and Cost Structures

Throughout 2025, newly implemented tariffs on optical transport equipment, routers, and switches in the United States have introduced considerable pressure on hardware acquisition budgets. Providers sourcing hardware components domestically have encountered immediate cost increases, prompting procurement teams to reassess existing vendor contracts and negotiate revised pricing structures. Concurrently, import duties have added lead-time complexity, as custom clearances and compliance documentation lengthen delivery schedules by an average of two to three weeks.

Consequently, many enterprises are adapting by diversifying their vendor portfolios, exploring alternative sourcing from allied markets, and accelerating the adoption of software-centric architectures that decouple hardware costs from network scaling. In parallel, some organizations are shifting to managed services deployments to off-load tariff risk and hedge against capital expenditure spikes, all while maintaining high availability and performance standards.

Furthermore, the cumulative effects of tariff-induced cost pressures are reshaping total cost of ownership models. Operational teams are now factoring in elevated maintenance fees and support renewals tied to higher equipment valuation. In response, industry leaders are investing in predictive maintenance and capacity analytics to extend asset lifecycles and offset incremental duties. This holistic view of cost management is fostering closer collaboration between finance, operations, and network engineering teams.

Looking ahead, the convergence of evolving tariff landscapes, supply chain resilience strategies, and software-driven innovations will define the competitive battleground. The upcoming sections unpack detailed segmentation insights and regional dynamics to guide stakeholders through these multifaceted challenges and opportunities.

Unlocking Actionable Insights from Components, Deployment Models, Bandwidth Tiers, Applications, and Industry Verticals to Guide Strategic Investment Decisions

A nuanced understanding of market segmentation reveals diverse growth vectors and investment priorities across component categories. In hardware, optical transport equipment continues to lead in capital intensity, augmented by next-gen routers and high-density switches that facilitate scalable connectivity. At the same time, managed services and on-premise deployment models cater to distinct customer needs: while managed services offer predictable operational expenditure and simplified lifecycle management, on-premise installations attract organizations requiring complete control over data sovereignty and customization.

Bandwidth tiers play a pivotal role in shaping technology roadmaps, with 100Gbps links representing the mainstream workhorse for enterprise trunking, 10Gbps ports supporting legacy and mid-tier use cases, and 400Gbps channels emerging as the backbone for hyperscale and AI-optimized environments. Deployment strategies for each bandwidth level are increasingly influenced by application requirements-cloud services interconnect demand high port density and rapid provisioning, colocation environments emphasize multitenancy and secure segmentation, while content delivery networks prioritize geolocation-based traffic steering.

Moreover, end-user industries exhibit differentiated adoption patterns. The financial services sector and healthcare verticals prioritize ultra-low latency and stringent compliance protocols, whereas IT & Telecom operators invest heavily in scalable fabrics and network slicing to drive new revenue streams. Retail enterprises leverage DCI platforms to unify omnichannel architectures, and government agencies focus on hardened security measures and redundancy. High-performance computing deployments, spanning research institutions and energy firms, elevate the importance of direct, high-bandwidth interconnects to power simulation and modeling workloads.

This multi-dimensional segmentation landscape underscores the necessity for vendors and service providers to tailor solutions across components, deployment models, bandwidth tiers, application scenarios, and industry requirements. In the next section, we explore how these dynamics materialize across key regions, illuminating regional differentiators and growth catalysts.

This comprehensive research report categorizes the Data Center Interconnect Platform market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology

- Deployment Model

- Bandwidth

- Application

- End User Industry

Exploring Regional Nuances and Growth Drivers Across the Americas, Europe, Middle East & Africa, and Asia-Pacific to Inform Tailored Market Strategies

Regional dynamics in the Data Center Interconnect domain display marked contrasts driven by infrastructure maturity, regulatory frameworks, and investment climates. In the Americas, robust cloud adoption and hyperscale expansion in North America underpin demand for high-capacity DCI fabrics. Established hyperscalers continue to expand their footprints, while mid-market enterprises modernize legacy networks. Latin America, despite variable connectivity infrastructure, demonstrates rising interest in managed services as organizations seek to overcome local deployment challenges through third-party expertise.

Across Europe, Middle East, and Africa, Europe’s stringent data protection regulations and cross-border data flow requirements shape procurement preferences, with strong emphasis on encryption and auditability. The Middle East’s rapid digital transformation initiatives and large-scale smart city projects drive greenfield DCI deployments, whereas African markets, characterized by emerging cloud ecosystems, increasingly adopt modular, scalable solutions that balance cost and performance. These contrasting demands have catalyzed partnerships between global vendors and regional system integrators focused on customized service offerings.

Asia-Pacific presents a mosaic of opportunities. Japan and South Korea, with advanced fiber infrastructure, accelerate the rollout of ultra-high bandwidth interconnects to support AI research and content streaming. China’s expansive data center build-out, fueled by domestic cloud champions, emphasizes sovereign technology stacks and in-region supply chains. Meanwhile, Southeast Asian markets such as Singapore and Australia rely on multi-cloud connectivity strategies to bridge national data centers and global service meshes, often leveraging collaborative platforms to ensure interoperability.

Understanding these regional nuances is essential for stakeholders seeking to optimize market entry strategies, forge local partnerships, and align technical roadmaps with regional regulatory and operational imperatives. The subsequent section analyzes leading players and competitive strategies shaping the DCI platform landscape.

This comprehensive research report examines key regions that drive the evolution of the Data Center Interconnect Platform market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Technology Innovators, Strategic Partnerships, and Competitive Dynamics Shaping the Data Center Interconnect Platform Market’s Future Trajectory

The competitive landscape of data center interconnect platforms is defined by a combination of legacy networking giants and nimble specialists. Leading hardware vendors invest heavily in coherent optical transport systems, leveraging deep R&D pipelines to enhance capacity scaling and power efficiency. Routers and switch manufacturers continue refining merchant silicon architectures to deliver line-rate encryption and segmentation capabilities without compromising port density.

Strategic alliances between system integrators and specialist software providers are also reshaping the ecosystem. These partnerships enable comprehensive offerings that bundle orchestration layers, AI-driven analytics, and end-to-end managed services, effectively lowering the barrier to adoption for organizations with limited in-house expertise. Meanwhile, emerging pure-play software vendors focus on multi-domain automation, abstracting heterogeneous underlying infrastructures to deliver a unified control plane.

Additionally, mergers and acquisitions have accelerated consolidation, as larger incumbents seek to integrate adjacent capabilities-ranging from security toolsets to predictive maintenance platforms-directly into their DCI portfolios. This wave of consolidation enhances value propositions by simplifying procurement and support models. At the same time, innovative startups differentiate themselves through specialized features such as sub-millisecond latency tuning, blockchain-backed audit logs, and cloud-native microservices designed specifically for inter-data-center orchestration.

Overall, market leaders combine broad hardware roadmaps, software-centric services, and strategic partnerships to address the full spectrum of customer requirements. Their strategies emphasize modularity, automation, and security, reflecting the evolving demands of enterprises and hyperscalers alike. Our subsequent recommendations draw on these observations to guide industry leaders in aligning their solutions with market priorities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Data Center Interconnect Platform market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ADVA Optical Networking SE

- Amazon.com, Inc.

- Applied Optoelectronics, Inc.

- Arista Networks, Inc.

- Broadcom Inc.

- Ciena Corporation

- Cisco Systems, Inc.

- Coherent, Inc.

- Colt Technology Services Group Limited

- Corning Incorporated

- Dell Technologies Inc.

- Digital Realty Trust, Inc.

- Equinix, Inc.

- Extreme Networks, Inc.

- Fujitsu Limited

- Hewlett Packard Enterprise Company

- Huawei Technologies Co., Ltd.

- International Business Machines Corporation

- Juniper Networks, Inc.

- Lumentum Holdings Inc.

- Marvell Technology, Inc.

- Megaport

- Microsoft Corporation

- Microsoft Corporation

- Mitsubishi Heavy Industries, Ltd.

- NEC Corporation

- Nokia Corporation

- Oracle Corporation

- RANOVUS

- Schneider Electric SE

- Telefonaktiebolaget LM Ericsson

- ZTE Corporation

Delivering Proven Strategic and Operational Recommendations for Industry Leaders to Capitalize on Emerging Opportunities and Mitigate Risks in Data Center Connectivity

To capitalize on emerging opportunities in the data center interconnect arena, industry leaders should prioritize a cohesive strategy that integrates hardware innovation with software-driven orchestration. Investing in programmable optical transport platforms and open APIs will enable rapid adaptation to evolving bandwidth requirements and deployment models. Furthermore, building end-to-end automation frameworks-integrating orchestration, analytics, and policy enforcement-can substantially reduce time to service activation and improve operational agility.

Simultaneously, organizations must adopt a multi-vendor sourcing approach to mitigate risks associated with potential tariff changes and evolving trade policies. Negotiating flexible supply agreements, exploring regional manufacturing partnerships, and leveraging managed services can help smooth out cost volatility while preserving high performance and reliability standards. Strengthening vendor relationships through strategic alliances will also facilitate faster access to new technology updates and roadmap insights.

In addition, leaders should segment their go-to-market offerings to address specific vertical requirements. Tailoring solutions for financial services, healthcare, and high-performance computing workloads-each with distinct security, compliance, and performance criteria-will unlock premium value propositions. Complementing these verticalized offerings with comprehensive support bundles, enhanced SLAs, and consultative services will further differentiate market positioning.

Finally, continuous investment in talent and skill development is critical. Cultivating cross-functional teams that blend core network engineering expertise with software-development capabilities will accelerate the integration of advanced features such as AI-based capacity forecasting and zero-touch provisioning. By aligning organizational structures with technological evolution, industry leaders can maintain a competitive edge and drive sustained growth in the volatile DCI market.

Detailing a Rigorous, Multidimensional Research Methodology Combining Primary and Secondary Insights to Ensure Accuracy and Strategic Relevance in Our Analysis

This analysis is grounded in a rigorous, multi-stage research methodology designed to deliver both depth and accuracy. Primary research includes structured interviews and workshops with network architects, CIOs, and procurement specialists across key industries, providing firsthand insights into deployment challenges, performance priorities, and investment drivers. These interactions were complemented by surveys targeting data center operators to quantify trends in bandwidth adoption, security requirements, and service preferences.

Secondary research encompasses a thorough review of publicly available company filings, technical whitepapers, and industry conference proceedings. Proprietary databases tracking supply chain flows and tariff changes were cross-referenced with trade data to validate cost impact assessments. In addition, competitive intelligence captured recent product launches, strategic partnerships, and M&A activities, enabling a comprehensive mapping of vendor strategies.

To ensure impartiality, data was triangulated across multiple sources and subjected to an internal peer review process. Analytical frameworks, including SWOT and scenario planning, were employed to interpret complex market dynamics and anticipate potential disruptions. Furthermore, expert panels comprising former network operations leaders and financial analysts provided additional validation of key findings and strategic recommendations.

The combined approach delivers actionable, evidence-based insights tailored for decision-makers seeking to navigate the rapidly evolving data center interconnect landscape. The final section synthesizes these findings and outlines the critical next steps for stakeholders to maintain competitive advantage.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Data Center Interconnect Platform market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Data Center Interconnect Platform Market, by Component

- Data Center Interconnect Platform Market, by Technology

- Data Center Interconnect Platform Market, by Deployment Model

- Data Center Interconnect Platform Market, by Bandwidth

- Data Center Interconnect Platform Market, by Application

- Data Center Interconnect Platform Market, by End User Industry

- Data Center Interconnect Platform Market, by Region

- Data Center Interconnect Platform Market, by Group

- Data Center Interconnect Platform Market, by Country

- United States Data Center Interconnect Platform Market

- China Data Center Interconnect Platform Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Summarizing Critical Findings and Strategic Imperatives That Empower Stakeholders to Navigate Complexity and Achieve Competitive Advantage in the Evolving Connectivity Landscape

As the demand for seamless, high-capacity connectivity continues to accelerate, data center interconnect platforms have become foundational enablers of enterprise and hyperscale architectures. This analysis has highlighted the transformative impact of software-defined networking, advanced optics, and emerging tariff landscapes on procurement strategies and operational models. Furthermore, detailed segmentation and regional insights have illuminated the diverse needs of end-users across verticals and geographies.

The evidence underscores that strategic agility-leveraging automation, modular hardware, and flexible sourcing-remains paramount in addressing cost pressures and performance demands. Collaboration between network engineering, finance, and procurement functions is critical to developing holistic, future-proof interconnect solutions. Moreover, vendors that integrate security, analytics, and end-to-end orchestration into unified offerings are best positioned to differentiate in a competitive market.

Looking forward, embracing open standards, investing in talent with hybrid network-software expertise, and fostering partnerships that bridge global supply chains will be essential. Organizations that proactively adapt to evolving bandwidth requirements, regulatory shifts, and emerging application demands will unlock new growth horizons. Ultimately, the insights presented here equip stakeholders with a clear roadmap for decision-making in an increasingly complex connectivity ecosystem.

With this conclusion, readers are invited to leverage the recommendations and detailed findings throughout this report to shape strategic initiatives, optimize operational efficiencies, and sustain long-term competitive advantage.

Connect with Ketan Rohom to Secure Exclusive Data Center Interconnect Platform Insights and Empower Your Strategic Decisions

Connect with Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of the comprehensive Data Center Interconnect Platform market research report and unlock unparalleled insights to drive strategic decisions starting today

- How big is the Data Center Interconnect Platform Market?

- What is the Data Center Interconnect Platform Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?