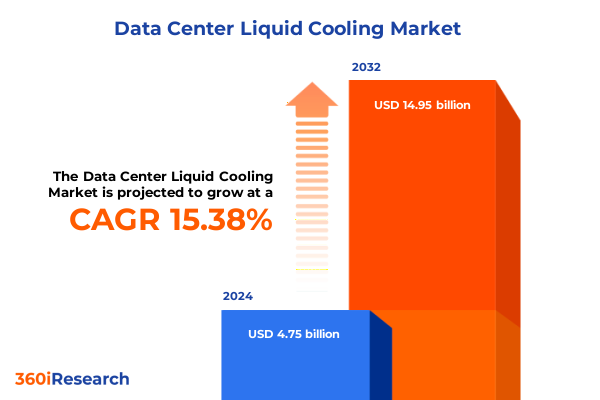

The Data Center Liquid Cooling Market size was estimated at USD 4.75 billion in 2024 and expected to reach USD 5.47 billion in 2025, at a CAGR of 15.38% to reach USD 14.95 billion by 2032.

Unveiling the Critical Role of Liquid Cooling in Next-Generation Data Centers Amid Intensifying Performance and Sustainability Demands

The exponential growth of data-intensive applications, from artificial intelligence training clusters to real-time analytics workloads, has propelled liquid cooling from a niche innovation to an indispensable component of modern data center architecture. Cooling strategies that rely solely on forced air have reached their physical limits in managing ever-increasing heat densities. Consequently, liquid cooling has emerged as a high-performance, energy-efficient solution that directly addresses the dual imperatives of thermal management and carbon footprint reduction.

By circulating specialized coolants in close proximity to critical components, liquid cooling systems enable higher rack densities and unlock new levels of processing power without proportionally increasing energy consumption. Moreover, as corporate sustainability mandates and regulatory pressures intensify, organizations are under mounting obligation to demonstrate carbon reduction targets and optimize energy usage. Liquid cooling resonates across both operational and environmental dimensions, positioning it as a strategic investment rather than a supplementary upgrade.

As data center operators and equipment manufacturers reimagine facility designs, the evolution of liquid cooling signals a paradigm shift in how thermal infrastructure is conceptualized. Advanced configurations-from direct chip-level immersion to rear door heat exchangers-are not only alleviating cooling bottlenecks but also redefining supply chain partnerships and lifecycle support models. This report delves into those emerging dynamics, setting the stage for a comprehensive exploration of the transformative forces reshaping data center cooling landscapes.

Examining Paradigm-Altering Technological Advances and Architectural Shifts Reshaping Data Center Liquid Cooling Infrastructure Ecosystems Worldwide

In recent years, the data center landscape has witnessed transformative advances that have fundamentally altered the role of cooling infrastructure. Traditional reliance on ambient air movement is giving way to innovative liquid-based thermal management solutions that offer superior heat extraction capabilities. As organizations pursue ever greater computational throughput, novel architectures such as direct-to-chip cooling and full-immersion cooling have migrated from experimental testbeds to mainstream deployments.

These technological breakthroughs are complemented by broader architectural shifts. Increasingly, facility designs integrate modular cooling pods and customizable coolant distribution units that can be rapidly scaled to accommodate fluctuating workloads. Digital twins and real-time monitoring platforms now work in tandem with adaptive controls, enabling predictive adjustments to flow rates and coolant temperatures. Consequently, end users are achieving precise thermal control while reducing energy expenditures.

Moreover, the convergence of edge computing, hyperscale cloud, and 5G-enabled infrastructures has diversified demand profiles, driving the adoption of both centralized and distributed liquid cooling ecosystems. From hyperscale farms prioritizing maximum energy reuse to edge nodes demanding compact, self-contained units, the industry is embracing a multifaceted approach. Through this prism of dynamic requirements and technological maturation, liquid cooling has emerged as a cornerstone of next-generation data center design.

Assessing the Far-Reaching Effects of United States 2025 Tariffs on the Data Center Liquid Cooling Supply Chain Dynamics

The implementation of new tariffs on critical liquid cooling components in the United States in 2025 has introduced a significant inflection point for supply chain strategies and procurement frameworks. Key elements such as advanced heat exchangers, specialized pumps, and high-grade coolants now face elevated import duties, prompting equipment vendors and facility operators to reassess sourcing geographies and cost structures. The immediate effect has been an uptick in landed costs and extended lead times, which in turn has underlined the importance of diversified supplier networks.

In response, many original equipment manufacturers and integrators have accelerated initiatives to localize production capabilities. Regional fabrication partnerships, joint ventures with domestic pump and coolant producers, and qualification of alternate component designs are rapidly gaining traction. These efforts not only mitigate tariff exposure but also deliver the added benefit of reduced transit times and greater control over quality standards. Consequently, while short-term capital expenditures have risen, the move toward near-shore supply has fortified resilience and improved lifecycle support consistency.

Looking ahead, the 2025 tariff landscape is catalyzing innovation in procurement models. Consortium purchasing among enterprise and colocation operators, along with framework agreements that include built-in tariff adjustment clauses, are becoming industry best practices. Ultimately, this evolving terrain underscores a strategic imperative: building supply chain agility to navigate shifting trade policies without compromising deployment timelines or performance objectives.

Decoding Comprehensive Segmentation Perspectives Based on Cooling Techniques Components Technologies Tiers Applications Sizes and End Users

A nuanced understanding of market segmentation reveals how different cooling strategies and deployment models influence adoption patterns across the industry. Based on cooling technique, solutions range from direct liquid cooling architectures that affix cold plates directly to processor modules to indirect methods where coolant is circulated through rear door heat exchangers. These distinct approaches inform infrastructure design choices, balancing factors like thermal efficiency, serviceability, and integration complexity.

Turning to the component perspective, the market divides into services-encompassing design and consulting, installation and deployment, and support and maintenance-and solution categories, which include coolants, cooling units, heat exchangers, and pumps. Design and consulting services are vital in tailoring system specifications, while robust support frameworks ensure long-term operational reliability. On the solution side, innovations in low-viscosity dielectric fluids and compact heat exchanger geometries have expanded the technical envelope of liquid cooling.

Technology segmentation further differentiates the landscape into cold plate cooling, direct-to-chip cooling, liquid immersion cooling, and rear door heat exchanger cooling. Each technique offers a unique performance profile, with immersion systems excelling at uniform heat dispersion and cold plates enabling targeted thermal management at high power densities. Tier type classification spans from Tier 1 facilities with basic cooling redundancy requirements to Tier 4 installations demanding fully fault-tolerant architectures. Application contexts vary from colocation facilities designed for modular scalability to hyperscale deployments optimized for maximal compute density. Data center size segmentation distinguishes large, purpose-built campuses from small and mid-sized sites with more constrained footprints. Finally, end-user verticals such as education, financial services, government and defense, healthcare, IT and telecommunications, manufacturing, and retail drive differentiated demand for cooling performance, service levels, and compliance adherence.

This comprehensive research report categorizes the Data Center Liquid Cooling market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Cooling Technique

- Component

- Liquid Type

- Infrastructure Level

- Data Center Type

- End User Industry

- Data Center Size

Illuminating Regional Variations in Adoption and Growth Trajectories Across the Americas EMEA and Asia-Pacific Data Center Cooling Markets

Regional analysis highlights distinct adoption drivers and market maturation curves across the Americas, Europe, Middle East and Africa, and Asia-Pacific. In the Americas, the presence of hyperscale cloud giants and stringent energy efficiency mandates has accelerated investments in advanced liquid cooling architectures. Early adopters in this region are pioneering large-scale immersion deployments that demonstrate compelling gains in power usage effectiveness and water conservation.

In Europe, the Middle East and Africa, regulatory frameworks around carbon emissions and circular economy principles are driving a growing emphasis on sustainable coolant formulations and energy reuse strategies. Colocation providers and government-sponsored research centers are collaborating on pilot projects to repurpose waste heat for district heating systems. These initiatives underscore the region’s commitment to holistic environmental stewardship.

The Asia-Pacific landscape is characterized by rapid data center expansion to meet burgeoning consumer and enterprise demand, particularly in markets like China, India, and Southeast Asia. Local manufacturers are partnering with global technology firms to develop cost-optimized liquid cooling solutions that can thrive in diverse climatic conditions. As a result, the region is emerging as a vibrant center of innovation and volume deployment for both modular edge cooling platforms and hyperscale immersion farms.

This comprehensive research report examines key regions that drive the evolution of the Data Center Liquid Cooling market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Pioneering Industry Players Driving Innovation and Strategic Partnerships within the Data Center Liquid Cooling Sector

A survey of the competitive landscape reveals a diverse ecosystem of vendors offering specialized liquid cooling technologies, end-to-end integration services, and value-added support. Leading equipment suppliers have differentiated through targeted acquisitions, joint development agreements, and expanded service portfolios that cover consulting, commissioning, and lifecycle maintenance.

Several established engineering firms have deepened their presence by integrating direct-to-chip cooling modules into broader IT hardware offerings, while novel entrants specializing in immersion solutions have gained traction through partnerships with hyperscale operators. Component manufacturers, from coolant formulators to precision pump designers, are forging alliances to deliver turnkey systems that meet stringent performance and compliance standards.

Strategic collaborations between data center operators and technology providers are fueling customized pilot programs. These trials enable end users to validate new coolant chemistries, assess modular skid-based deployment models, and optimize monitoring frameworks before committing to full-scale rollouts. The resulting landscape is one of both consolidation among tier-one suppliers and agile innovation by specialist firms, driving a healthy competitive environment and continuous technological evolution.

This comprehensive research report delivers an in-depth overview of the principal market players in the Data Center Liquid Cooling market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AIREDALE INTERNATIONAL AIR CONDITIONING LTD.

- Alfa Laval AB

- aquatherm GmbH

- Asetek Inc.

- Asperitas

- CoolIT Systems Inc.

- Dell Inc.

- EVAPCO, Inc.

- Exxon Mobil Corporation

- Fujitsu Limited

- Green Revolution Cooling, Inc.

- Hewlett Packard Enterprise Development LP

- Hitachi, Ltd.

- Iceotope Technologies Limited

- Intel Corporation

- International Business Machines Corporation

- JETCOOL Technologies Inc. by Flex Ltd

- Johnson Electric Holdings Limited

- Lenovo Group Limited

- Liquidcool Solutions, Inc.

- LiquidStack Holding B.V.

- Midas Immersion Cooling

- Mikros Technologies by Jabil Inc.

- Mitsubishi Heavy Industries, Ltd.

- Munters Group AB

- NVIDIA Corporation

- Rittal GmbH & Co. KG

- Schneider Electric SE

- Stulz GmbH

- Submer Technologies SL

- The Dow Chemical Company

- USystems Limited

- Vertiv Group Corp.

- ZutaCore, Inc.

Strategic Imperatives and Actionable Roadmap for Industry Leaders to Capitalize on Liquid Cooling Opportunities and Mitigate Emerging Risks

Industry leaders must adopt a multifaceted strategy to capitalize on the dynamic liquid cooling opportunity while mitigating emerging risks. First, organizations should prioritize modular system architectures that can adapt to evolving workload profiles, enabling incremental capacity expansion without disruptive facility overhauls. Equally important is diversifying the supply chain through strategic partnerships and dual-source agreements, which can buffer the impact of tariff shifts and logistical bottlenecks.

In parallel, investing in next-generation coolant research-focused on biodegradable, low-toxicity formulations-will address tightening regulatory requirements and corporate sustainability mandates. Operational teams should also deploy advanced analytics and digital twin models to monitor thermal performance in real time, facilitating predictive maintenance and continuous optimization. Training programs for facility engineers and IT staff must be updated to encompass liquid-specific safety protocols and service procedures.

Finally, forging collaborative innovation ecosystems with academic institutions, standards bodies, and cross-industry consortia will accelerate best practice development and ensure interoperability between diverse cooling technologies. By executing this integrated roadmap, leaders can deliver high-density compute capacity, reduce lifecycle costs, and uphold the highest environmental standards.

Detailing Rigorous Research Frameworks Data Collection Techniques and Analytical Approaches Employed in Liquid Cooling Market Examination

This research draws upon a structured methodology that integrates both primary and secondary data streams to achieve comprehensive market insights. Primary research included in-depth interviews with senior executives from data center operators, engineering service providers, solution vendors, and component manufacturers. These conversations provided qualitative context around adoption drivers, procurement challenges, and technology roadmaps.

Secondary research encompassed an extensive review of industry journals, technical white papers, regulatory filings, and patent databases to track evolving coolant chemistries, system architectures, and performance benchmarks. Publicly available technical standards and certification requirements were also analyzed to gauge compliance trends across key markets.

Data triangulation techniques ensured the validity of findings by cross-referencing inputs from multiple sources. Quantitative data points-such as equipment shipment volumes and infrastructure performance metrics-were normalized across regions and deployment segments. Finally, a rigorous quality assurance process including peer review and expert validation underpins the reliability of the conclusions and recommendations presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Data Center Liquid Cooling market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Data Center Liquid Cooling Market, by Cooling Technique

- Data Center Liquid Cooling Market, by Component

- Data Center Liquid Cooling Market, by Liquid Type

- Data Center Liquid Cooling Market, by Infrastructure Level

- Data Center Liquid Cooling Market, by Data Center Type

- Data Center Liquid Cooling Market, by End User Industry

- Data Center Liquid Cooling Market, by Data Center Size

- Data Center Liquid Cooling Market, by Region

- Data Center Liquid Cooling Market, by Group

- Data Center Liquid Cooling Market, by Country

- United States Data Center Liquid Cooling Market

- China Data Center Liquid Cooling Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2385 ]

Synthesizing Core Findings and Strategic Insights to Navigate the Future Trajectory of Data Center Liquid Cooling Technology

As data center density and sustainability imperatives converge, liquid cooling emerges not merely as an engineering upgrade but as a foundational enabler of future digital infrastructures. The evolution from ambient air cooling to advanced liquid architectures reflects both the technical demands of high-performance computing and the environmental responsibilities shouldered by modern IT operations.

The 2025 tariff environment has underscored the criticality of supply chain resilience and strategic sourcing, prompting vendors and operators alike to pivot toward regional partnerships and innovative procurement models. Simultaneously, the rich tapestry of segmentation-from cooling techniques and technology types to end-user verticals and data center tiers-illuminates the nuanced needs that drive adoption and shape service offerings.

Regional dynamics further reinforce the importance of tailored approaches, as North America, EMEA, and Asia-Pacific markets each follow distinct developmental trajectories. Ultimately, the companies that succeed will be those that marry modular flexibility with sustainable practices, leverage data-driven operational controls, and cultivate collaborative ecosystems. This synthesis of insights lays the groundwork for informed decision-making and strategic investment in the next era of data center cooling.

Engage with Ketan Rohom to Secure In-Depth Analysis and Empower Decision-Making with a Customized Data Center Liquid Cooling Report

I invite you to partner with Ketan Rohom, Associate Director of Sales & Marketing, to gain exclusive access to an in-depth data center liquid cooling research report tailored to your strategic objectives. Whether you seek comparative analysis of emerging technologies, detailed supply chain impact assessments, or customized regional forecasts, this report unlocks the critical insights needed to inform board-level decisions, optimize cooling architectures, and secure competitive advantage.

Engaging directly with Ketan ensures that your organization receives a comprehensive consultation, enabling you to align our proprietary research with your specific roadmap. From arranging a personalized briefing to discussing bespoke add-on modules focused on advanced immersion cooling or tariff-driven supply chain resilience, you can shape the final deliverables to match your most pressing challenges.

To elevate your decision-making with data-driven findings and expert recommendations, reach out to Ketan Rohom. Take the next step in mastering the liquid cooling landscape, future-proofing your infrastructure investments, and accelerating your journey toward sustainable, high-density computing environments.

- How big is the Data Center Liquid Cooling Market?

- What is the Data Center Liquid Cooling Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?