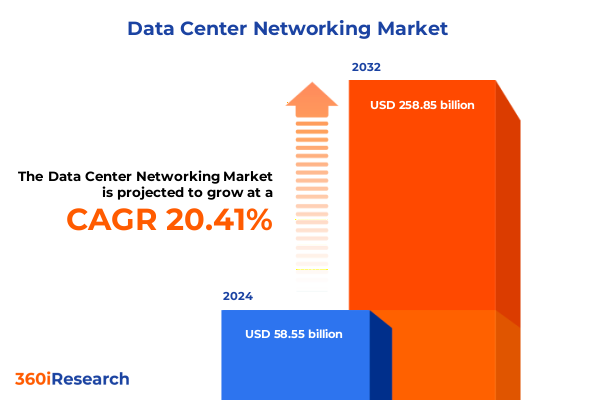

The Data Center Networking Market size was estimated at USD 70.18 billion in 2025 and expected to reach USD 84.13 billion in 2026, at a CAGR of 20.49% to reach USD 258.85 billion by 2032.

Robust data center networking solutions are essential for sustaining the surge in cloud-native applications, artificial intelligence workloads

Over the past decade, the explosion of data-driven applications has redefined the demands placed on networking infrastructures within data centers. Organizations are increasingly reliant on high-throughput, low-latency connectivity to support workloads such as real-time analytics, distributed databases, and containerized services. This shift has elevated the role of networking components from mere delivery mechanisms to strategic enablers of enterprise agility and performance.

As cloud-native architectures and artificial intelligence workloads proliferate, network architects face the dual challenge of scaling capacity and optimizing operational efficiency. Traditional hierarchical designs are giving way to more flexible leaf-spine topologies, while emerging technologies promise to further streamline data flows. This executive summary synthesizes the most critical developments shaping the data center networking landscape, offering an informed perspective for decision makers seeking to navigate the evolving ecosystem.

Innovations in silicon photonics, software-defined networking, and AI-driven automation are reshaping the architecture of next-generation data center networks

Recent advancements in silicon photonics have enabled direct integration of optical components within switch ASICs, reducing energy consumption and enhancing signal integrity at port speeds beyond 1 Tbps per link. This is exemplified by leading technology vendors unveiling photonic-enabled switches that eliminate traditional transceiver modules, promising up to 50% reductions in data center power usage and paving the way for hyper-scale GPU networking architectures.

Simultaneously, software-defined networking solutions are gaining traction, offering programmable control planes that decouple management from hardware and enable granular policy enforcement. AI-driven automation platforms now leverage telemetry and machine learning to proactively adjust network configurations, anticipate congestion points, and streamline maintenance tasks. These combined shifts are fundamentally reshaping network topologies and operational models, driving a new era of performance and agility in data center environments.

Mounting U.S. reciprocal tariffs and elevated import duties are exerting significant cost pressures on critical data center networking equipment across global operations

In early 2025, the U.S. government implemented a blanket 10% tariff on all data center networking imports, with additional reciprocal duties reaching up to 54% on specific trade partners including China and Vietnam. These measures have directly impacted the cost of critical components such as fiber optic transceivers, routers, and high-speed cables, prompting suppliers to reassess pricing strategies and margin forecasts.

Moreover, recent market intelligence indicates that tariffs will drive year-over-year price increases of approximately 5.6% for fiber optic cables and 3.6% for networking chips by early 2026, while networking equipment import volumes jumped by nearly 39.4% in the first quarter of 2025 as organizations accelerated procurement to hedge against rising costs. Such dynamics are placing strain on procurement budgets and motivating a shift toward diversified supply chains and alternative sourcing strategies.

Comprehensive segmentation across product types, deployment models, port speeds, applications, and end users reveals diverse growth trajectories and investment priorities

A nuanced approach to market segmentation reveals distinct drivers and priorities. Product portfolios span from foundational cabling and network interface cards to optical transceivers and advanced routing platforms, with switches dissected into leaf and spine architectures to address data plane and control plane requirements. Deployment patterns bifurcate into cloud-centric models, emphasizing multi-tenant scalability and pay-as-you-go economics, and on-premises infrastructures that prioritize data sovereignty, specialized security, and predictable performance. Port speeds now range from established 10 gigabit links to emerging 400 gigabit channels, reflecting the dual demand for incremental upgrades and quantum leaps in bandwidth. Use cases drive further differentiation, from the compute-intensive demands of high performance computing clusters to the stringent isolation and throughput needs of network security, and from optimized server connectivity frameworks to high-throughput storage interconnects. Finally, end users-from edge data centers supporting low-latency applications to hyperscale colocation providers, enterprise IT departments, and telecom operators-are tailoring network investments to their unique risk profiles, capacity requirements, and long-term digital transformation roadmaps.

This comprehensive research report categorizes the Data Center Networking market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Deployment Model

- Port Speed

- Application

- End User

Regional market dynamics illustrate distinct adoption patterns, regulatory influences, and investment drivers across Americas, EMEA, and Asia-Pacific data center networks

Across the Americas, expansive hyperscale developments and rapid cloud adoption continue to drive demand for high-capacity switching and routing platforms, with North American operators prioritizing interoperability and automation to support elastic workloads. In Europe, the Middle East, and Africa, regulatory frameworks around data privacy and energy efficiency are shaping procurement decisions, while regional telcos invest in resilient network fabrics to enhance coverage and service quality. Within Asia-Pacific, surging investment in edge computing infrastructure-fueled by 5G rollouts and smart manufacturing initiatives-is catalyzing demand for compact, high-speed switching solutions and robust optical interconnects. These varying regional dynamics reflect local policy, infrastructure maturity, and end-user requirements, underscoring the need for tailored strategies in each market.

This comprehensive research report examines key regions that drive the evolution of the Data Center Networking market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading industry players are leveraging strategic partnerships, technological differentiation, and global manufacturing footprints to consolidate positions in data center networking

Leading vendors are differentiating through strategic alliances, innovation roadmaps, and agile manufacturing footprints. One global networking giant has strengthened partnerships with hyperscale cloud providers to co-develop custom switch silicon that accelerates AI workloads while maintaining cost targets. Another market challenger has integrated silicon photonics directly into its switch ASICs, offering system-level power and latency benefits that align with next-generation data plane requirements. Meanwhile, diversified suppliers are leveraging flexible global production hubs and a broad supplier network to mitigate tariff impacts and secure critical component availability, demonstrating the value of resilient supply chain architectures. Collectively, these strategic moves highlight a competitive landscape where technological differentiation, co-innovation, and operational agility are key to maintaining leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Data Center Networking market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A10 Networks, Inc.

- Arista Networks, Inc.

- Broadcom Inc.

- Ciena Corporation

- Cisco Systems, Inc.

- Dell Technologies Inc.

- Edgecore Networks Corporation

- Extreme Networks, Inc.

- Fortinet, Inc.

- Fujitsu Limited

- H3C Holding Limited

- Hewlett Packard Enterprise Company LP

- Huawei Technologies Co., Ltd.

- IBM Corporation

- Intel Corporation

- Juniper Networks, Inc.

- Lenovo Group Ltd.

- NEC Corporation

- Nokia Corporation

- NVIDIA Corporation

- Pluribus Networks, Inc.

- Radware Ltd.

- Super Micro Computer, Inc.

- VMware, Inc.

Strategic initiatives and investment roadmaps for industry leaders to optimize network agility, cost efficiency, and sustainability in evolving data center environments

Industry leaders should prioritize investments in photonics-enabled hardware and software-defined architectures to achieve performance gains and operational simplicity. By adopting open network standards and leveraging AI-driven orchestration tools, organizations can create self-optimizing networks that respond to dynamic traffic patterns with minimal manual intervention. Diversifying procurement across multiple geographies and vendor ecosystems will mitigate geopolitical risks and tariff volatility, ensuring continuity of supply.

Furthermore, establishing modular upgrade paths and embracing disaggregated networking components will enable incremental capacity growth without wholesale infrastructure overhauls. Leaders should also develop a clear sustainability agenda, incorporating energy-efficient hardware and renewable power sources to meet environmental targets and reduce total cost of ownership. Collaborating with ecosystem partners to pilot next-generation technologies will provide early insights into potential disruptions and competitive differentiators.

Rigorous research methodology integrating primary expert interviews, extensive secondary data analysis, and quantitative validation underpins this market intelligence

The research methodology employed a blend of qualitative and quantitative techniques, starting with in-depth interviews with network architects, procurement executives, and technology vendors to capture firsthand insights into evolving requirements and investment criteria. Secondary data sources included publicly available financial disclosures, industry white papers, and technical standards documentation, which were rigorously cross-verified to ensure accuracy and completeness.

Quantitative analysis incorporated shipment and pricing data aggregated from customs records, industry associations, and open-source intelligence. Data consistency checks and triangulation techniques were used to validate trends across multiple sources. Finally, each segmentation and regional insight was subject to peer review by subject matter experts to confirm relevance, clarity, and alignment with the latest market developments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Data Center Networking market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Data Center Networking Market, by Product Type

- Data Center Networking Market, by Deployment Model

- Data Center Networking Market, by Port Speed

- Data Center Networking Market, by Application

- Data Center Networking Market, by End User

- Data Center Networking Market, by Region

- Data Center Networking Market, by Group

- Data Center Networking Market, by Country

- United States Data Center Networking Market

- China Data Center Networking Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesis of market dynamics underscores critical trends, opportunities, and challenges shaping the future of data center networking infrastructure and services

In summary, the data center networking landscape is undergoing profound transformation driven by surging AI workloads, architectural innovations, and evolving procurement pressures. The confluence of silicon photonics, software-defined approaches, and AI-powered automation promises to redefine performance benchmarks and operational models. At the same time, geopolitical factors such as reciprocal tariffs are reshaping cost structures and compelling supply chain diversification.

Organizations that proactively embrace open architectures, diversify their sourcing strategies, and invest in energy-efficient technologies will be best positioned to navigate uncertainty and capitalize on emerging opportunities. By aligning network evolution with broader digital transformation objectives, decision makers can ensure that their infrastructures remain resilient, agile, and capable of supporting the next wave of innovation.

Speak with Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of the data center networking report and gain actionable market intelligence today

To explore detailed analyses, competitive landscapes, and forward-looking perspectives in the data center networking domain, please reach out to Ketan Rohom, Associate Director of Sales & Marketing. Engaging directly with Ketan will allow you to secure immediate access to the comprehensive market research report, customize scope to your organization’s priorities, and leverage actionable insights that drive strategic network investments.

- How big is the Data Center Networking Market?

- What is the Data Center Networking Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?