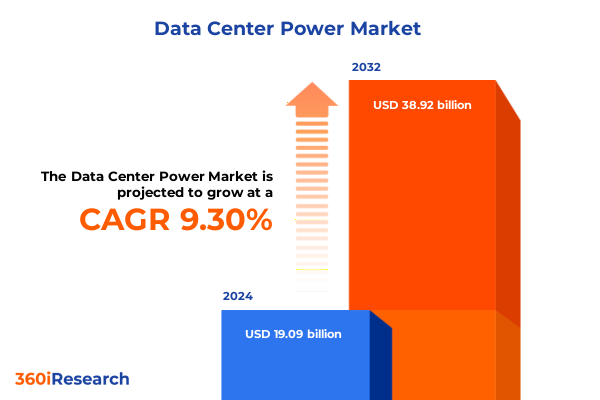

The Data Center Power Market size was estimated at USD 20.53 billion in 2025 and expected to reach USD 22.08 billion in 2026, at a CAGR of 9.56% to reach USD 38.92 billion by 2032.

Establishing the Crucial Nexus Between Reliability, Sustainability, and Scalability in Modern Data Center Power Infrastructure

The rapid evolution of digital services and the relentless surge in data consumption have pushed the resilience and efficiency of data center power systems into the spotlight. As enterprises migrate critical workloads to cloud environments and hyperscale providers expand their footprints, the reliability of underlying electrical infrastructure has never been more critical. Simultaneously, stringent sustainability goals and regulatory pressures are compelling operators to reimagine energy supply architectures and adopt greener power sources.

Against this backdrop, power management is transforming from a traditional utility cost center into a strategic differentiator. Market participants are focusing on next-generation uninterruptible power supply solutions, intelligent power distribution units, and modular busway systems that support rapid capacity scaling. Meanwhile, service providers are enhancing their offerings with advanced monitoring, predictive maintenance, and integration capabilities to deliver holistic lifecycle support. This introduction sets the stage for exploring the key drivers, structural shifts, and strategic considerations that will define data center power infrastructure in the years ahead.

Unveiling the Convergence of AI-Driven Demand, Renewable Integration, and Edge Proliferation Revolutionizing Power Architectures

The data center power landscape is undergoing a fundamental transformation driven by several converging forces. First, the unprecedented rise of artificial intelligence workloads is imposing volatile and high-density power demands that legacy power systems struggle to accommodate. This volatility is compelling infrastructure teams to adopt dynamic load-balancing technologies and scalable power modules that can respond rapidly to fluctuating consumption patterns.

Concurrently, corporate and governmental commitments to net-zero emissions have accelerated the integration of renewable energy sources into data center designs. Solar arrays, on-site wind turbines, and battery-based energy storage are evolving from niche experiments into core elements of power resilience strategies. Grid modernization initiatives and carbon pricing schemes further amplify the economic appeal of clean energy, making hybrid power architectures the new norm.

Meanwhile, distributed edge computing is decentralizing traditional data center footprints, giving rise to a proliferation of smaller, regional facilities that require modular, plug-and-play power systems. This shift has sparked innovation in prefabricated, containerized power solutions and remote monitoring technologies that streamline deployment in challenging environments. Taken together, these forces are redefining best practices, compelling operators to rethink their power supply strategies and invest in flexible, future-proof infrastructure.

Assessing the Compounded Financial and Timeline Consequences of Multifaceted U.S. Tariffs on Data Center Power Assets

Since the imposition of reciprocal tariffs and targeted trade measures, the cumulative cost of critical power infrastructure components has escalated significantly. Tariffs under Section 232 have levied a 25% duty on imported steel and a 10% duty on aluminum, directly influencing the expenditure profiles of new data center projects. At the same time, an ongoing Section 232 review of copper products threatens additional duties on cabling and power distribution transformers, injecting further uncertainty into procurement planning and financial forecasts. Despite a semiconductor import exemption, essential power systems such as uninterruptible power supplies and switchgear remain subject to heightened prices, and analysts warn that these increases could suppress near-term investment activity.

Beyond raw material levies, data reveal that many operators have accelerated component stockpiling to hedge against future tariff escalations, driving a pronounced uptick in early imports. This strategy, while mitigating immediate expense risks, has exacerbated supply chain congestion and elongated delivery lead times for transformers-where utilities report waits approaching four years without pre-reserved capacity-and other specialized equipment. Meanwhile, price projections for electrical transformers and environmental control systems built domestically suggest year-on-year increases of 3.2% and 4.5% respectively, amplifying total construction costs and compelling stakeholders to explore alternative design approaches or domestic sourcing partnerships.

Deconstructing Component, Tier, Facility, and Industry Diversities to Illuminate Power Infrastructure Investment Drivers

Insight into component segmentation reveals a bifurcated market defined by services and solutions, where firms extend comprehensive support through design, integration, deployment, and maintenance while delivering core power hardware such as busway systems, power distribution units, generators, monitoring equipment, and uninterruptible power supplies. The layered complexity of tier architectures, spanning from Tier 1 to Tier 4, underscores variability in availability targets, redundancy requirements, and certification thresholds, shaping procurement and operational strategies. Data center typology further distinguishes market dynamics: colocation facilities balance cost efficiency and service flexibility, edge deployments prioritize modularity and rapid deployment, enterprise campuses focus on customized security and control, and hyperscale sites emphasize massive capacity and automation. Across industry verticals-from banking, financial services, and insurance to government and defense, healthcare, information technology and telecommunications, manufacturing, media and entertainment, and retail -their unique regulatory frameworks, uptime expectations, and sustainability mandates drive differentiated demand for power capacity, resiliency, and lifecycle services.

This comprehensive research report categorizes the Data Center Power market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component Type

- Tier Type

- Data Center Type

- Industry Vertical

Exploring Distinct Regional Drivers from Hyperscale Growth in the Americas to Renewable-Driven Microgrids in EMEA and APEC

Regional analysis illuminates distinct growth drivers and deployment models across the Americas, Europe, Middle East and Africa, and Asia-Pacific. In the Americas, robust cloud provider expansion and large-scale hyperscale builds in Northern Virginia, Texas, and Silicon Valley continue to dominate capacity additions, with operators prioritizing combustible generator backups and energy storage to offset grid constraints. Meanwhile, Latin American markets are embracing modular, edge-optimized solutions to extend digital services into underserved areas and bridge connectivity gaps.

In Europe, Middle East and Africa, stringent carbon reduction targets and renewable integration mandates have elevated microgrid architectures, paired with advanced battery energy storage, in Western Europe. Gulf Cooperation Council states are investing heavily in utility-scale solar and on-site generation to power hyperscale and colocation projects, while African markets are pursuing hybrid mini-grid models to address inconsistent grid capacity.

The Asia-Pacific region exhibits a dual dynamic: hyperscale growth in China and Southeast Asia is fueling demand for high-density power delivery and reliable cooling systems, whereas markets such as Australia and Japan are implementing advanced power monitoring and predictive maintenance solutions to enhance energy efficiency and achieve net-zero commitments.

This comprehensive research report examines key regions that drive the evolution of the Data Center Power market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Market Leaders Shaping Innovation and Global Service Excellence in Data Center Power Systems

Leading power infrastructure providers are differentiating themselves through technology innovation, strategic partnerships, and global service networks. Schneider Electric emphasizes digital twin and predictive analytics capabilities within its EcoStruxure platform, enabling real-time load optimization and preventive maintenance. ABB has expanded its portfolio via acquisitions of smart grid software firms, enhancing its ability to integrate renewable power and microgrid controls. Eaton leverages its modular UPS systems and cloud-based monitoring tools to deliver scalable resilience for enterprise and hyperscale sites alike.

Vertiv focuses on edge-optimized solutions and remote management suites, targeting the rapid rollout of distributed IT assets. Huawei and Delta Electronics continue to enhance their power inverter and energy storage offerings, positioning themselves as end-to-end renewable integration specialists. Legrand’s targeted investments in busbar technology and scalable PDU platforms address the evolving needs of modern data halls. Generac has reentered the large-scale generator market through joint ventures to capture demand for high-availability backup power, while Siemens integrates grid-connectivity modules to future-proof critical facility operations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Data Center Power market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Active Power Solutions Ltd.

- AEG Power Solutions BV

- Black Box Corporation

- Caterpillar Inc.

- Control Technology Co.

- Cummins Inc.

- Cyber Power Systems Inc.

- Danfoss AS

- Delta Electronics, Inc.

- Eaton Corporation

- Exide Technologies

- Generac Power Systems, Inc.

- General Electric Company

- Hewlett Packard Enterprise Development LP

- Huawei Technologies Co., Ltd.

- Legrand S.A.

- Panduit Corp. by Vigilent Corporation

- Rittal GmbH & Co. KG

- Rolls Royce Holdings Plc

- Schneider Electric SE

- Siemens AG

- Toshiba Corp.

- Vertiv Holdings Co.

Actionable Strategic Imperatives for Diversifying Supply Chains, Deploying Digital Solutions, and Advancing Hybrid Energy Infrastructures

Industry leaders should prioritize supply chain diversification by establishing strategic sourcing agreements across multiple geographies to mitigate tariff and logistics risks. Embracing digital transformation within power operations-through the deployment of AI-driven monitoring, predictive maintenance, and digital twin simulations-will optimize capacity utilization and reduce downtime. Investing in modular, prefabricated power systems accelerates deployment timelines while minimizing capital outlays, offering a flexible alternative to traditional hardwired installations.

To align with decarbonization goals, stakeholders must evaluate hybrid energy architectures that combine utility feeds, on-site renewables, and energy storage, securing long-term cost advantages and regulatory incentives. Forming joint ventures with local renewable providers and leveraging government grants can accelerate sustainable power adoption. Finally, scenario planning that incorporates potential tariff changes, material shortages, and regulatory shifts will empower decision-makers to adapt swiftly, maintaining project agility and financial resilience.

Outlining a Robust Research Framework Combining Multisource Data, Stakeholder Interviews, and Rigorous Validation Processes

This report integrates a structured research methodology encompassing both secondary and primary data collection. Industry publications, regulatory filings, public company disclosures, and specialized databases provided the foundation for identifying market drivers, technological innovations, and competitive landscapes. To validate findings, we conducted in-depth interviews with key stakeholders, including data center operators, power equipment manufacturers, infrastructure service providers, and regulatory experts across major regions.

Quantitative analyses, such as segment penetration rates and growth trend evaluations, were triangulated against multiple data sources to ensure consistency and accuracy. Vendor share analyses were performed using a mix of shipment data and financial performance metrics. Regional assessments were mapped against macroeconomic indicators and energy policy frameworks. Throughout the research process, findings underwent rigorous peer review and quality control checks to maintain reliability and address potential biases.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Data Center Power market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Data Center Power Market, by Component Type

- Data Center Power Market, by Tier Type

- Data Center Power Market, by Data Center Type

- Data Center Power Market, by Industry Vertical

- Data Center Power Market, by Region

- Data Center Power Market, by Group

- Data Center Power Market, by Country

- United States Data Center Power Market

- China Data Center Power Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Summarizing the Imperative for Integrated, Sustainable, and Digitally-Enabled Power Strategies in Data Center Infrastructure

The data center power ecosystem is navigating a period of rapid transformation propelled by AI-induced load volatility, sustainability targets, and emerging tariff complexities. Modular and digital power solutions are at the forefront of this evolution, offering operators the agility and insights needed to optimize reliability and control costs. While U.S. tariff measures have introduced new cost pressures and supply chain uncertainties, they have also catalyzed innovation in domestic manufacturing and strategic procurement approaches.

Understanding detailed segmentation dynamics across component types, tier categories, facility models, and vertical markets is critical for aligning product development and service offerings with evolving customer requirements. Regional strategy must balance global best practices with local policy landscapes and infrastructure realities. The competitive landscape is defined by providers who can deliver integrated, data-driven, and sustainable power solutions. By proactively adopting the recommendations outlined, industry participants can position themselves to thrive amid ongoing disruption and capitalize on the energy infrastructure opportunities of tomorrow.

Secure Priority Access to Specialized Data Center Power Market Intelligence by Engaging with Ketan Rohom for Purchase Details

Elevate your strategic planning and secure a competitive edge in the data center power market by acquiring the comprehensive research report today. Connect with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, to discuss tailored insights, customization options, and priority delivery schedules. His expertise ensures you receive the precise data and analysis needed to drive informed decisions, mitigate emerging risks, and capitalize on growth opportunities. Reach out now to subscribe and transform your energy infrastructure strategy with actionable, research-backed guidance.

- How big is the Data Center Power Market?

- What is the Data Center Power Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?