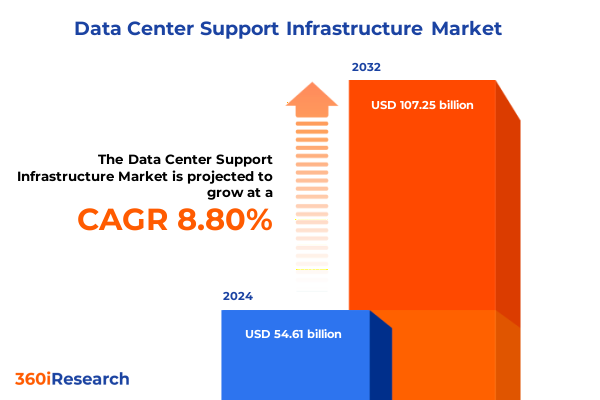

The Data Center Support Infrastructure Market size was estimated at USD 59.22 billion in 2025 and expected to reach USD 64.31 billion in 2026, at a CAGR of 8.85% to reach USD 107.25 billion by 2032.

Accelerating AI, Rising Energy Demands, and Geopolitical Shifts Reshape the Strategic Role of Data Center Support Infrastructure

Data center support infrastructure has moved from a background operational concern to a central strategic issue for boardrooms and policymakers alike. The confluence of AI acceleration, pervasive digitization, and intensifying regulatory scrutiny is reshaping how organizations design, power, cool, protect, and manage the facilities that underpin critical digital services. What was once an exercise in incremental engineering optimization has become a multidimensional challenge involving energy markets, supply chains, sovereignty rules, and trade policy.

At the same time, the physical and electrical footprint of data centers is changing at unprecedented speed. Power usage by U.S. data centers has already more than doubled since the late 2010s, and a Department of Energy–backed study indicates that they may account for as much as 12% of U.S. electricity consumption by 2028, up from roughly 4.4% in 2023. Growing demand is being driven not only by hyperscale cloud providers but also by enterprises modernizing legacy systems, public-sector digital transformation, and the rapid emergence of AI training and inference clusters that operate at rack densities once considered infeasible.

This environment imposes new performance and resilience expectations on support infrastructure spanning power distribution, cooling systems, cable management, racks and enclosures, monitoring and management software, and physical security. Traditional design assumptions around redundancy, efficiency, and capacity headroom are being challenged by power-dense AI servers, increasingly stringent uptime requirements, and the need to deliver lower latency at the edge. In parallel, stakeholders ranging from local communities to national regulators are demanding greater transparency around energy use, emissions, and land and water impact.

Consequently, decision-makers can no longer evaluate support infrastructure technologies in isolation. They must view them as tightly coupled elements within larger systems that include utility grids, renewable generation portfolios, network backbones, and global supply networks. This executive summary explores how transformative technology shifts, evolving tariff regimes, granular segmentation dynamics, regional patterns, and competitive strategies are redefining the data center support infrastructure landscape, and it outlines practical considerations for leaders seeking to align infrastructure investments with long-term strategic goals.

AI Workloads, Liquid Cooling, Edge Expansion, and Software-Defined Operations Transform Data Center Support Infrastructure Strategies Worldwide in Profound Ways

The most consequential change in recent years has been the rapid rise of AI and other high-performance workloads, which are pushing rack power densities far beyond the thresholds that legacy facilities were designed to accommodate. Analyst data indicates that average rack densities grew by more than a third between 2022 and 2024, with AI-specific clusters already reaching in excess of 80 to 100 kW per rack in advanced deployments. This escalation is driving a fundamental shift from air-centric cooling architectures toward liquid-assisted and full liquid cooling solutions, accompanied by more sophisticated power distribution and monitoring schemes.

Liquid cooling is moving from experimental pilots to large-scale production in AI-focused sites. Independent research points to liquid cooling penetration in AI data centers climbing from the mid-teens in 2024 to roughly one-third of such facilities in 2025, with further growth expected thereafter. Operators are deploying combinations of direct-to-chip cold plates, rear-door heat exchangers, and immersion-based systems to manage thermal loads that would otherwise exceed the practical limits of air alone. This transition has material implications for the design of cooling infrastructure, cable management pathways, and racks and enclosures, which must now support higher weight, different airflow patterns, and the integration of coolant distribution units and manifolds.

In parallel, software-driven monitoring and management is becoming indispensable as operators grapple with greater complexity and tighter operating margins. Next-generation monitoring and management software platforms aggregate telemetry from power infrastructure, cooling systems, environmental sensors, and IT equipment into unified dashboards augmented by analytics. These tools increasingly apply machine learning to predict failures, optimize energy usage, and orchestrate workload placement based on real-time capacity and thermal constraints. As AI models become both the workloads and the optimization engines, a feedback loop is emerging in which smarter software actively shapes how support infrastructure is operated.

Edge and modular deployments represent another transformative shift. To reduce latency and support distributed applications-from industrial automation to content delivery and 5G networks-operators are rolling out more compact facilities in secondary metros, remote industrial sites, and network aggregation points. Many of these locations rely on modular and containerized data centers that integrate power, cooling, racks, and security in prefabricated blocks. This model reduces deployment time and mitigates some construction risk, but it also places a premium on highly integrated, remotely manageable support infrastructure that can operate in less forgiving environments.

Overlaying these trends is a powerful sustainability imperative. Global studies point to data center energy use potentially doubling by 2030, with AI emerging as a major driver of incremental consumption. In response, operators are embracing higher-efficiency uninterruptible power supplies, advanced power distribution architectures, and cooling systems designed for elevated inlet temperatures and free-cooling opportunities. Waste-heat recovery, closed-loop water systems, and integration with on-site or contracted renewables are moving from optional enhancements to core design requirements. Collectively, these shifts are redefining what constitutes state-of-the-art support infrastructure and are elevating the strategic importance of vendors and integrators capable of delivering solutions that balance performance, efficiency, and environmental stewardship.

Cumulative 2025 United States Tariffs Reshape Data Center Support Infrastructure Costs, Supply Chains, and Capital Allocation Decisions Fundamentally

United States trade policy has entered a new phase in 2025, with tariffs now a central tool shaping the economics of technology supply chains. A baseline tariff of 10% on most imports took effect in early April, followed by enhanced reciprocal tariffs on key trading partners, including elevated rates on imports from China, the European Union, Taiwan, South Korea, Japan, India, and several Southeast Asian manufacturing hubs. These measures build on earlier actions that increased duties on strategically sensitive categories such as semiconductors and industrial inputs, including steel and aluminum products.

The cumulative effect on data center support infrastructure is significant because many critical components-server platforms, power distribution units, switchgear, chillers, in-row coolers, racks and cabinets, security cameras, and structured cabling-are deeply dependent on cross-border supply chains centered in East Asia and Europe. Even where some electronics categories, such as completed computers and certain semiconductor devices, have received temporary exemptions from the steepest tariff tiers, the broader landscape remains volatile, with frequent adjustments and partial suspensions that complicate long-term planning. Operators and integrators are already reporting cost increases for imported electrical equipment and extended delivery times as suppliers reconfigure sourcing and logistics.

Analysts warn that the new tariff regime could materially raise the cost of building and expanding data centers in the United States over the next several years. Independent assessments suggest that higher duties on technology equipment suppliers in China, Taiwan, and South Korea-combined with the 10% baseline on most other imports-risk chilling some of the ambitious AI infrastructure buildout plans announced by major cloud and technology firms. While ongoing exemptions for certain semiconductor flows mitigate the near-term impact on server pricing, infrastructure categories more difficult to re-shore, such as transformers and other power infrastructure components, face compounding pressures from both tariffs and pre-existing supply shortages.

For data center owners, the result is a new calculus that places greater emphasis on total landed cost, supplier diversification, and regional manufacturing presence. Power infrastructure and cooling infrastructure providers with production capacity in tariff-favored jurisdictions, or with the ability to assemble finished systems domestically from globally sourced subcomponents, are gaining relative advantage. In cable management, racks and enclosures, and security and surveillance systems, some operators are accelerating qualification of alternative vendors to reduce concentration risk in highly taxed geographies.

Service providers are also adapting. Consulting and design services now routinely incorporate tariff scenarios into site selection and technology evaluation, modeling how different sourcing and deployment strategies affect lifecycle costs under varying duty structures. Installation and integration services are expanding their role in value engineering, redesigning solutions to make greater use of tariff-exempt components or domestically produced substitutes without compromising performance. Maintenance and support services, together with training and education services, are helping operators adjust spare-parts strategies and workforce skills to address a more heterogeneous mix of equipment and to navigate evolving customs and compliance requirements.

Over time, this cumulative tariff environment is likely to accelerate broader trends toward regionalization of supply chains and increased domestic or nearshore production of critical infrastructure elements. However, in the short to medium term it introduces cost inflation, planning uncertainty, and execution risk into nearly every category of data center support infrastructure, underscoring the importance of scenario-based investment strategies and close coordination with vendors on their own mitigation plans.

Granular Product, Service, Deployment, and Vertical Segmentation Reveals Diverging Investment Priorities Across Modern Data Center Environments Worldwide Today

A segmentation lens reveals how unevenly these macro forces play out across different slices of the data center support infrastructure landscape. Within product types, power infrastructure and cooling infrastructure sit at the center of strategic urgency as operators wrestle with soaring rack densities, grid constraints, and increasingly demanding service-level expectations. Investment in advanced uninterruptible power systems, distributed power architectures, high-efficiency transformers, and liquid-ready cooling systems is accelerating, while cable management and racks and enclosures are being redesigned to accommodate heavier equipment, denser cabling bundles, and integrated liquid cooling manifolds. At the same time, monitoring and management software is emerging as the connective tissue tying these elements together, enabling predictive maintenance, capacity optimization, and energy-efficiency tuning, while security and surveillance solutions evolve to address both physical threats and integration with logical access control.

Service type segmentation underscores the growing importance of knowledge-intensive offerings. Consulting and design services now extend far beyond traditional mechanical and electrical engineering, incorporating tariff scenario analysis, sustainability modeling, and IT workload profiling into early-stage planning. Installation and integration services are responding to the complexity of hybrid deployments that blend air and liquid cooling, conventional and modular power systems, and on-premises with cloud-connected infrastructure. Maintenance and support services are expanding into proactive reliability engineering and firmware lifecycle management for increasingly software-defined environments, while training and education services help operators upskill staff on safety procedures, liquid handling, advanced automation tools, and cybersecurity practices tied to infrastructure management platforms.

Different data center archetypes exhibit distinct support infrastructure priorities. Enterprise data centers and managed service data centers tend to modernize incrementally, focusing on retrofits that improve efficiency and extend the life of existing facilities. Colocation data centers and cloud provider data centers, particularly hyperscale data centers, are pushing the frontier on high-density designs, advanced cooling, and sophisticated monitoring and management software to serve AI and cloud-native workloads. Edge data centers and telecom data centers emphasize compact, ruggedized solutions with strong remote management capabilities, often relying on modular and containerized data centers that bundle power, cooling, racks, and security into standardized blocks optimized for rapid deployment.

Deployment mode adds another dimension. On-premises environments remain essential for latency-sensitive, regulated, or legacy workloads, but they increasingly interact with cloud and hybrid architectures. In hybrid deployments, support infrastructure must accommodate dynamic workload placement, variable power profiles, and shared operational responsibilities across organizational boundaries. Cloud-centric strategies, meanwhile, influence requirements indirectly, as enterprises scrutinize the resilience and sustainability credentials of the facilities operated by their cloud providers and expect alignment with their own environmental and governance commitments.

Organization size and end-user industry further shape demand patterns. Large enterprises, particularly in sectors such as banking, financial services and insurance, information technology and telecommunication, and manufacturing, often operate a mix of dedicated and outsourced facilities and therefore seek scalable, standardized support infrastructure platforms that can span different sites and architectures. Small and medium enterprises, by contrast, more frequently consume infrastructure as a service through colocation or cloud providers, placing indirect but still meaningful pressure on support infrastructure standards. Government and healthcare settings introduce additional regulatory and security considerations, driving stringent requirements for physical security and surveillance, monitoring and management software with strong audit capabilities, and resilient power and cooling configurations that ensure continuity of critical public services and clinical operations.

Viewed holistically, this segmentation shows that while the most visible innovation is occurring in hyperscale and cloud provider data centers, the ripple effects extend across enterprise, telecom, and edge environments. Product and service providers that can tailor offerings to the nuanced needs of each segment-without fragmenting their portfolios beyond manageability-are best positioned to capture demand as organizations at every scale adapt to a more demanding infrastructure era.

This comprehensive research report categorizes the Data Center Support Infrastructure market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Service Type

- Data Center Type

- Deployment Mode

- Organization Size

- End-User Industry

Contrasting Regional Dynamics in the Americas, Europe–Middle East–Africa, and Asia-Pacific Redefine Data Center Support Infrastructure Strategies Through 2025 and Beyond

Regional dynamics add another layer of complexity, with the Americas, Europe–Middle East–Africa, and Asia-Pacific facing distinct constraints and opportunities. In the Americas, and particularly in the United States, unprecedented AI-driven data center expansion is colliding with finite grid capacity and community concerns over energy costs. A Department of Energy–backed analysis and subsequent reporting indicate that data centers already consume over 4% of U.S. electricity and could reach the low double digits as a share of national demand by the late 2020s. This growth has contributed to rising electricity bills for residents in some states and has prompted federal and state initiatives to streamline grid connections, encourage clean energy pairing, and require developers to shoulder a greater share of infrastructure upgrades. These conditions are elevating the strategic importance of highly efficient power and cooling infrastructure, sophisticated monitoring and management software for energy optimization, and solutions that integrate on-site generation, storage, and demand-response capabilities.

Across Europe, the Middle East, and Africa, a different mix of pressures is at work. Many European countries are enforcing or considering tight regulations on data center energy efficiency, water usage, and waste heat recovery, in some cases introducing effective moratoria on new builds in grid-constrained metropolitan areas unless stringent sustainability criteria are met. At the same time, the region faces volatile electricity pricing and an accelerating shift toward renewable generation, both of which increase the value of flexible, grid-interactive power infrastructure and advanced cooling solutions capable of operating effectively at higher ambient temperatures. In the Middle East, large-scale investments in cloud regions and smart-city projects are driving demand for robust cooling infrastructure and security and surveillance systems designed for harsh climates and elevated physical-security expectations. In parts of Africa, growing digitization and mobile penetration are creating opportunities for smaller, modular facilities that can operate reliably on less mature grids, often in combination with solar and storage systems.

Asia-Pacific, meanwhile, is both a major manufacturing base for data center hardware and one of the fastest-growing regions for new capacity deployment. Countries such as China, India, Indonesia, and Vietnam have seen rapid growth in cloud, e-commerce, and fintech ecosystems, which in turn fuel demand for power infrastructure, cooling infrastructure, racks and enclosures, and cable management tailored to dense urban sites and humid climates. At the same time, several Asia-Pacific economies have become focal points in global trade frictions, exposing operators to heightened tariff risk when sourcing from or serving the United States and other markets with newly aggressive trade policies. This interplay of opportunity and risk is encouraging some regional providers to invest more heavily in domestic supply chains, liquid cooling capabilities, and modular and containerized data centers that can be replicated quickly across multiple jurisdictions.

Taken together, these regional patterns suggest that there is no single blueprint for data center support infrastructure. In the Americas, grid constraints and community scrutiny are pushing operators toward deep integration with energy systems and more transparent sustainability reporting. In Europe, the Middle East, and Africa, regulatory frameworks and resource constraints are driving highly efficient, environmentally sensitive designs and increasing the importance of heat reuse and water stewardship. In Asia-Pacific, rapid demand growth is intersecting with supply chain centrality and trade-policy exposure, making flexibility in sourcing, design, and deployment a critical differentiator for both operators and vendors.

This comprehensive research report examines key regions that drive the evolution of the Data Center Support Infrastructure market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evolving Competitive Landscape Shows Infrastructure OEMs, Colocation Providers, and Integrators Racing to Enable Next-Generation Data Center Resilience Worldwide

The competitive landscape for data center support infrastructure is characterized by an intricate ecosystem of global original equipment manufacturers, regional specialists, colocation and cloud providers, and systems integrators. Large electrical and industrial players supply much of the core power infrastructure, including switchgear, uninterruptible power supplies, and power distribution units, alongside advanced monitoring and management software that can orchestrate increasingly complex electrical topologies. In cooling infrastructure, a combination of incumbent HVAC manufacturers and specialized data center cooling vendors are racing to deliver solutions that support both air and liquid modalities, high rack densities, and stringent efficiency requirements.

Racks and enclosures, together with cable management solutions, form another arena of innovation as vendors redesign cabinets to accommodate heavier AI servers, integrate liquid cooling distribution, and support higher cable densities without compromising airflow or serviceability. Providers of security and surveillance technologies are aligning their offerings with evolving threat models by integrating physical access control, video analytics, and linkage to broader cybersecurity platforms. Across these product categories, vendors that can demonstrate credible roadmaps for liquid cooling readiness, grid integration, and sustainability metrics are finding their solutions shortlisted more frequently in competitive procurements.

Colocation providers and cloud operators, while traditionally viewed as customers rather than infrastructure vendors, exert substantial influence on the market’s direction. Their multi-billion-dollar buildout programs effectively set de facto standards for power and cooling architectures, monitoring interfaces, and sustainability benchmarks. Public announcements of AI-focused campuses and region expansions frequently reference the adoption of liquid cooling, elevated rack densities, and collaboration with utilities to secure dedicated renewable power capacity, reinforcing expectations that these features will become standard options across the industry.

Systems integrators and specialist engineering firms occupy a pivotal position between technology suppliers and end users. They are increasingly responsible for stitching together heterogeneous portfolios of power, cooling, racks, cabling, security, and monitoring solutions into coherent architectures that reflect local regulatory regimes, tariff exposures, and organizational risk appetites. Their ability to navigate supply chain disruptions, redesign solutions in response to tariff changes, and manage complex installation and commissioning programs is becoming a core selection criterion for operators undertaking multi-site or multi-country expansion plans.

As AI adoption, tariff regimes, and energy constraints continue to evolve, competitive differentiation is shifting from isolated product features toward holistic solution capabilities. Companies that can combine robust hardware, intelligent software, consultative design and integration expertise, and credible sustainability credentials are best placed to shape the next generation of data center support infrastructure and to build durable partnerships with both hyperscale and enterprise customers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Data Center Support Infrastructure market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 365 Operating Company, LLC

- ABB Ltd.

- Amazon Web Services, Inc.

- Asetek Inc. A/S

- Capgemini Services SAS

- Carrier Global Corporation

- Caterpillar Inc.

- Cisco Systems, Inc.

- Comarch S.A.

- CommScope, Inc.

- Cummins Inc.

- Daikin Industries, Ltd.

- Dell Inc.

- Delta Electronics, Inc.

- Device42 Inc.

- Digital Realty Trust Inc.

- Eaton Corporation plc

- Equinix Inc.

- FNT Software GmbH

- GE Vernova Group

- Generac Power Systems, Inc.

- HCL Technologies Limited

- Hewlett Packard Enterprise Company

- Hitachi Ltd.

- Huawei Technologies Co., Ltd.

- International Business Machines Corporation

- Johnson Controls International plc.

- KDDI CORPORATION

- Legrand S.A.

- Lenovo Group Limited

- Microsoft Corporation

- NTT DATA, Inc. Group

- NVIDIA Corporation

- Panduit Corp.

- Reliance Industries Limited

- Rittal GmbH & Co. KG

- Rolls-Royce plc

- Schneider Electric SE

- Siemens AG

- STULZ GmbH

- SUBMER TECHNOLOGIES, S.L.

- Trane Technologies plc

- Vertiv Group Corp.

Strategic Actions for Industry Leaders to Mitigate Risk, Capture Emerging Demand, and Future-Proof Data Center Support Infrastructure Globally

In this environment of technological acceleration and policy uncertainty, industry leaders must adopt a more deliberate and scenario-based approach to data center support infrastructure. The first strategic imperative is to treat power infrastructure and cooling infrastructure as co-equal, long-lead assets that require integrated planning. Executives should mandate cross-functional teams that bring together facilities, IT, procurement, and sustainability specialists to evaluate high-density, liquid-ready designs, assess grid interconnection risks, and explore options for on-site or contracted renewable generation and energy storage. Structured sensitivity analyses that vary tariff levels, energy prices, and utilization assumptions can illuminate which design choices remain robust under a wide range of futures.

A second priority is to deepen supply chain resilience across key product categories, including racks and enclosures, cable management, and security and surveillance equipment, in addition to the more obvious power and cooling systems. Leaders should map their existing supplier base against the evolving U.S. tariff schedule and other trade measures, identify concentrations in high-tariff or geopolitically exposed jurisdictions, and qualify alternative vendors where necessary. In parallel, organizations can strengthen relationships with integration and installation partners that have demonstrated an ability to source functionally equivalent components from multiple regions and to adapt designs without sacrificing performance or compliance.

Third, executives should elevate monitoring and management software from a tactical tool to a strategic asset. By investing in platforms capable of integrating real-time telemetry from diverse infrastructure elements and applying analytics or AI to optimize operations, organizations can unlock meaningful reductions in energy consumption and unplanned downtime. These tools also provide the granular data needed to satisfy increasingly rigorous environmental, social, and governance reporting requirements and to validate the business case for efficiency-focused retrofits.

Finally, leaders should not neglect the human and organizational dimensions of this transition. Training and education services that build expertise in liquid cooling technologies, electrical safety in high-density environments, and advanced automation can significantly reduce operational risk. Clear governance mechanisms that define decision rights between central teams and site-level operators are essential for consistent execution across portfolios that may include enterprise data centers, colocation deployments, cloud-based workloads, and edge locations. By aligning investment decisions with a coherent long-term narrative about resilience, efficiency, and regulatory readiness, industry leaders can turn today’s volatility in tariffs, energy markets, and technology standards into a source of competitive advantage rather than disruption.

Robust Mixed-Method Research Approach Integrates Primary Insights and Secondary Intelligence to Illuminate Data Center Support Infrastructure Trends Comprehensively

The analysis underlying this executive summary is grounded in a mixed-method research design that combines primary insights from industry stakeholders with a rigorous synthesis of secondary intelligence. Extensive interviews and structured discussions were conducted with data center operators, colocation providers, cloud architects, utility representatives, systems integrators, and infrastructure vendors across major regions. These conversations provided real-world perspectives on the practical challenges of deploying high-density AI clusters, integrating liquid cooling, securing grid connections, and adapting to shifting tariff and regulatory landscapes.

In parallel, a comprehensive review of public filings, policy announcements, technical whitepapers, and independent research was undertaken to characterize trends in energy consumption, tariff structures, and technology adoption. Recent government-backed studies on data center electricity usage and projections to the late 2020s informed the assessment of power infrastructure and cooling infrastructure requirements. Trade and legal analyses of the 2025 United States tariff regime, including the introduction of a 10% baseline duty and higher reciprocal tariffs for selected trading partners, were incorporated to understand implications for imported equipment categories relevant to data center support infrastructure.

Technology-focused sources were used to track the evolution of cooling architectures, particularly the transition from air-based to liquid-assisted and fully liquid solutions in AI-centric facilities. Evidence from industry research and vendor announcements regarding liquid cooling penetration, rack power densities, and new product introductions was cross-checked to avoid over-reliance on any single viewpoint. Similarly, analysis of regional dynamics drew on energy-market outlooks, regulatory consultations, and documented data center expansion plans to build a nuanced picture of conditions in the Americas, Europe–Middle East–Africa, and Asia-Pacific.

Throughout, the research adopted a triangulation approach, comparing multiple independent sources and reconciling discrepancies through additional inquiry or conservative interpretation. Where future-oriented projections were considered-for example, regarding energy consumption, liquid cooling adoption, or tariff policy trajectories-the emphasis was placed on directional insight rather than precise numeric outcomes. No single dataset was treated as definitive; instead, patterns were inferred from the convergence of evidence across qualitative and quantitative inputs. This methodology supports a balanced, empirically grounded view of how data center support infrastructure is evolving under the combined influence of technology innovation, energy and sustainability imperatives, and geopolitical and macroeconomic forces.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Data Center Support Infrastructure market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Data Center Support Infrastructure Market, by Product Type

- Data Center Support Infrastructure Market, by Service Type

- Data Center Support Infrastructure Market, by Data Center Type

- Data Center Support Infrastructure Market, by Deployment Mode

- Data Center Support Infrastructure Market, by Organization Size

- Data Center Support Infrastructure Market, by End-User Industry

- Data Center Support Infrastructure Market, by Region

- Data Center Support Infrastructure Market, by Group

- Data Center Support Infrastructure Market, by Country

- United States Data Center Support Infrastructure Market

- China Data Center Support Infrastructure Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Executive Synthesis Underscores the Strategic Centrality of Support Infrastructure in Sustaining High-Performance, Sustainable, and Secure Data Centers Worldwide

Taken together, the trends examined in this executive summary underscore the extent to which data center support infrastructure has become a strategic lever rather than a purely operational concern. Power infrastructure and cooling infrastructure now sit at the intersection of AI adoption, energy policy, and community expectations, with decisions about architectures and locations reverberating through electricity markets and local economies. Racks and enclosures, cable management solutions, and security and surveillance technologies are evolving in lockstep, reshaped by higher densities, more distributed footprints, and heightened threat awareness.

The accelerating transition toward liquid cooling, the proliferation of edge and modular deployments, and the rise of software-driven monitoring and management collectively point to a future in which infrastructure must be more intelligent, adaptive, and tightly integrated. At the same time, the 2025 United States tariff environment has injected a new source of uncertainty and cost pressure into global supply chains, prompting operators and vendors to rethink sourcing strategies, diversify manufacturing footprints, and embed tariff resilience into design and deployment planning.

Segmentation by product type, service type, data center archetype, deployment mode, organization size, and end-user industry reveals that while the most visible innovation is clustered in hyperscale and cloud provider data centers, the implications are pervasive. Enterprise data centers, colocation facilities, managed service environments, edge sites, telecom hubs, and modular and containerized data centers are all being compelled to evolve their support infrastructure to keep pace with rising performance, resilience, and sustainability expectations. Likewise, the Americas, Europe–Middle East–Africa, and Asia-Pacific regions are navigating distinct combinations of energy constraints, regulatory frameworks, and trade exposures that shape both risks and opportunities.

In this context, organizations that approach support infrastructure strategically-integrating technical, financial, regulatory, and supply chain considerations-will be better equipped to sustain competitive advantage. Those that delay investment in modern, liquid-ready cooling systems, advanced power architectures, and intelligent monitoring and management tools risk finding their facilities unable to host next-generation workloads or to comply with emerging policy and community standards. Conversely, early movers who align infrastructure roadmaps with larger trends in AI, sustainability, and trade policy can not only reduce operational risk but also position themselves as preferred partners for customers seeking resilient, efficient, and transparent digital infrastructure.

The path forward will not be uniform or risk-free, but the contours are clear: support infrastructure is now a core determinant of data center viability and strategic relevance. Executives who recognize this shift and act accordingly will shape how and where digital capabilities grow in the coming decade.

Act Now with Ketan Rohom’s Guidance to Unlock Deep Insights and Confident Decisions from the Data Center Support Infrastructure Report

The decision to invest in a comprehensive data center support infrastructure report is ultimately a decision to reduce uncertainty and accelerate execution. In an environment defined by rapidly rising power densities, mounting energy constraints, and shifting tariff regimes, relying on intuition or dated benchmarks exposes even sophisticated organizations to avoidable risk. A structured, evidence-based view of how power, cooling, racks, cabling, software, and security are evolving across different data center archetypes gives leaders the foundation they need to move decisively rather than reactively.

By engaging directly with Ketan Rohom, Associate Director of Sales and Marketing, decision-makers gain a guided path into the full depth of insights contained in the report. Instead of navigating hundreds of pages alone, executives can quickly map the research to their specific footprint, whether they are operating hyperscale cloud campuses, regional colocation facilities, enterprise server rooms, or distributed edge sites. This guided approach helps surface the most relevant implications for procurement strategies, vendor partnerships, deployment models, and capital planning.

Moreover, Ketan’s close involvement with infrastructure buyers, integrators, and technology vendors worldwide enables a pragmatic translation of the report’s findings into concrete next steps. Leaders can explore optional custom briefings or workshops that align the research with their internal investment cases, sustainability roadmaps, and tariff mitigation strategies. Rather than treating the report as a static document, the engagement becomes an ongoing strategic resource that can be revisited as assumptions shift.

Now is an opportune time to secure access, while the industry is still in the early innings of the AI-driven buildout and before tariff and regulatory regimes harden into a new baseline. Working with Ketan to obtain the report allows organizations to move faster than competitors in refining their infrastructure roadmaps, strengthening supplier negotiations, and prioritizing the initiatives that most directly enhance resilience, performance, and total cost of ownership.

- How big is the Data Center Support Infrastructure Market?

- What is the Data Center Support Infrastructure Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?