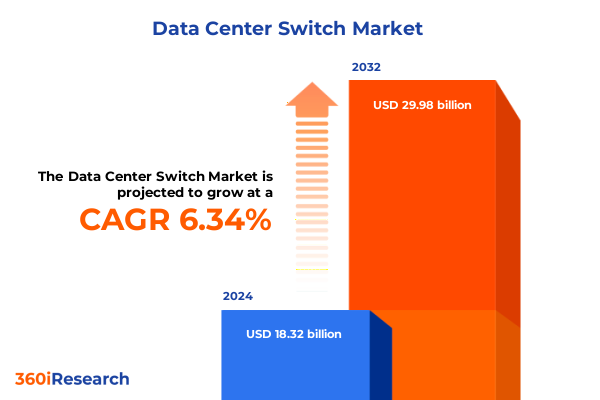

The Data Center Switch Market size was estimated at USD 19.32 billion in 2025 and expected to reach USD 20.37 billion in 2026, at a CAGR of 6.47% to reach USD 29.98 billion by 2032.

Exploring the critical role of data center switching technology as digital transformation accelerates enterprise connectivity and cloud infrastructure evolution

In today’s digital era, the data center switch has evolved from a traditional packet-forwarding device into a pivotal element that underpins enterprise connectivity, cloud computing, and artificial intelligence deployments. As organizations accelerate their digital transformation journeys, networks must adapt to support greater throughput, lower latency, and enhanced programmability. The relentless rise of AI workloads and distributed applications has placed unprecedented demands on switch fabrics, driving vendors to innovate across both hardware and software domains.

Emerging data center environments now require switches that seamlessly integrate advanced network services, from telemetry and segmentation to security enforcement, directly into the fabric. Industry leaders such as Cisco have acknowledged this shift by embedding programmable data processing units (DPUs) within their latest Smart Switches, enabling on-switch offload of compute-intensive security and monitoring tasks to simplify infrastructure and improve operational agility. Similarly, Arista Networks’ Etherlink platforms demonstrate the critical need for ultra-high capacity fabrics capable of supporting AI cluster sizes ranging from a few thousand to hundreds of thousands of XPUs, underscoring the network’s centrality to AI-driven enterprise success.

As connectivity requirements continue to evolve-with organizations embracing hybrid multicloud strategies, edge computing, and software-defined networking-the data center switch stands at the crossroads of scalability, performance, and security. This report delves into how leading solution providers are responding to these demands, the impact of trade policies on procurement, and the strategic insights derived from rigorous segmentation, regional analysis, and competitive profiling. By understanding these trends, decision-makers can position their network architectures to deliver resilient, future-proof infrastructure that supports the next wave of digital innovation.

How technological innovations and network architectures are reshaping data center switch design to meet evolving performance, scalability, and energy efficiency

The data center switching landscape is undergoing a profound transformation driven by rapid advancements in silicon processing, network operating systems, and architecture paradigms. Traditional multi-tier topologies are ceding ground to leaf-spine designs, which deliver deterministic latency and streamlined traffic patterns essential for AI and east-west data flows. Arista’s Etherlink portfolio exemplifies this shift, offering one-tier and two-tier topologies that minimize network hops, reduce optical transceiver counts, and optimize cluster scaling for AI training and inference.

On the hardware front, programmable DPUs and P4-capable ASICs are enabling switches to offload complex network services-such as microsegmentation, encryption, and enhanced telemetry-directly onto the line card. Cisco’s Smart Switches, featuring integrated AMD Pensando DPUs, illustrate how convergence of networking and security functions can simplify data center footprints while maintaining performance and compliance requirements. Moreover, the drive toward disaggregation and open networking is influencing vendor strategies, with an increasing emphasis on standardized silicon pipelines and a modular software ecosystem that decouples control-plane innovation from fixed-function ASIC constraints.

These architectural and silicon innovations are complemented by evolving management frameworks that embrace intent-based networking, predictive analytics, and closed-loop automation. Providers are integrating AI-driven operational tools within their management suites to automatically detect anomalies, forecast capacity needs, and enforce policy across hybrid environments. As a result, data center operators gain the agility to adapt to surges in traffic, dynamically adjust security postures, and optimize resource utilization, ensuring that network infrastructure remains a strategic enabler rather than an operational bottleneck.

Evaluating the layered impact of reciprocal, Section 301, IEEPA, and semiconductors tariffs on data center switch procurement and global supply chain dynamics

In 2025, the United States’ multilevel tariff regime presents a complex cost calculus for organizations procuring data center switching equipment. Reciprocal tariffs, introduced in early April at a baseline rate of 10 percent, were temporarily elevated to 125 percent on Chinese-origin materials before a mutual tariff reduction agreement on May 12, 2025, lowered reciprocal duties back to a 10 percent rate for an initial 90-day window. However, this reduction applies only to reciprocal tariffs, leaving other layers intact.

Section 301 duties remain applicable to networking hardware and related optics, varying between 7.5 percent and 25 percent depending on HTS classification. In March 2025, IEEPA-authorized fentanyl-related tariffs also imposed an additional 20 percent levy on specified goods to address national security concerns. Critically, the effective rate on certain semiconductor components, including those integral to switch silicon, was doubled to 50 percent as of January 1, 2025, amplifying cost pressures for high-performance switching platforms.

While some exclusions from Section 301 duties were extended for three months through August 31, 2025, many previously exempted items reverted to taxable status in June when the USTR declined further extension due to limited sourcing alternatives. Organizations must therefore navigate a shifting landscape where supply chain reconfiguration, sourcing diversification, and total cost modeling become essential strategies to mitigate tariff-induced margin erosion. These layered duties not only influence vendor selection and procurement timing but also accelerate initiatives to localize component production and qualify alternative suppliers.

Discover how segmentation by type, port speed, topology, end user, and application uncovers opportunities and competitive dynamics in data center switching

Understanding the nuanced dynamics of the data center switch market requires a deep dive into five core segmentation dimensions. By type, the market is split between fixed and modular solutions, with modular designs further differentiated into chassis-based systems offering high port density and flexible line card upgrades and stackable platforms that deliver cost-efficient scale for smaller deployments. Port speed segmentation reflects a spectrum from 10 GbE and 25 GbE to 40 GbE and 100 GbE interfaces, each tailored to specific performance and utilization profiles across midrange and hyperscale operations. Topology-based insights contrast leaf and spine configurations, where leaf switches handle server connectivity and spine switches orchestrate high-capacity aggregation, driving predictable latency for east-west traffic patterns. End-user segmentation highlights distinct demands from cloud service providers seeking ultra-dense fabrics, enterprise customers prioritizing security and integration, and telecommunications operators balancing carrier-grade reliability with evolving service architectures. Application-focused segmentation reveals the differing requirements of data center interconnect-both inter site and intra site-server access, and storage area network use cases, each imposing unique throughput, latency, and protocol demands on switch silicon and software architectures. These segmentation insights guide strategic deployment, informing decisions on platform selection, feature prioritization, and lifecycle management to meet diverse operational objectives.

This comprehensive research report categorizes the Data Center Switch market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Port Speed

- Topology

- End User

- Application

Regional demand variations across the Americas, EMEA, and Asia-Pacific reveal unique adoption trajectories for data center switching technologies

Regional dynamics exert a profound influence on data center switching trends, shaped by local infrastructure investments, regulatory environments, and technology adoption patterns. In the Americas, hyperscale cloud providers continue to bolster capacity, with Amazon Web Services committing at least $11 billion to expand its Georgia data center footprint in early 2025, driven by surging AI and enterprise cloud demands. This expansion underscores the region’s emphasis on high-capacity fabrics, renewable energy sourcing, and edge connectivity to meet low-latency requirements across North America.

Within Europe, Middle East & Africa, global operators are pursuing targeted buildouts to address sovereignty and sustainability mandates. AWS’s strategic investment in a $1.4 billion facility near Zaragoza, Spain-with a focus on renewable power and sovereign cloud capabilities-exemplifies the drive to localize infrastructure and comply with regional data governance frameworks. Simultaneously, South Africa’s inclusion in AWS’s expansion roadmap highlights EMEA’s diversification beyond traditional hubs, enabling service delivery across under-penetrated markets.

Asia-Pacific stands out as the fastest-growing region for data center infrastructure, fueled by government incentives and massive hyperscale investments. Thailand’s approval of $2.7 billion in data center and cloud service projects reflects Southeast Asia’s AI-driven infrastructure surge, while larger hyperscale providers have earmarked multibillion-dollar programs across Australia, Taiwan, and Malaysia to capitalize on regional digitalization trends and support AI workloads. This confluence of objectives-balancing scale, sustainability, and regulatory compliance-drives differentiated switching architectures tailored to each regional ecosystem.

This comprehensive research report examines key regions that drive the evolution of the Data Center Switch market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading solution providers driving innovation in data center switching with strategic investments, technology advancements, and ecosystem partnerships

Leading solution providers are shaping the data center switch landscape through differentiated product roadmaps, strategic partnerships, and ecosystem integrations. Cisco has redefined the integration of networking and security with its N9300 Series Smart Switches, embedding AMD Pensando DPUs to offload security and monitoring functions directly within the switch fabric. This architectural convergence simplifies data center designs and accelerates AI readiness without compromising performance or resilience.

Arista Networks has responded to AI-driven demands with its Etherlink AI platforms, which deliver single-tier and two-tier topologies capable of supporting thousands to hundreds of thousands of XPUs. Powered by Broadcom Tomahawk 5 and Jericho3-AI silicon, these leaf and spine solutions optimize cluster scaling, reduce optical transceiver usage, and pair with advanced EOS features for seamless visibility and control across AI fabrics. The collaborative deployment of Arista’s 7700R4 Distributed Etherlink Switch within Meta Platforms’ Disaggregated Scalable Fabric further underscores the vendor’s focus on hyperscale, AI-optimized network designs.

Juniper Networks and Huawei also rank among the industry leaders recognized for both execution and vision. According to recent evaluations, Juniper’s AI-driven automation and policy-driven operational framework differentiate its QFX and PTX switch portfolios, while Huawei’s CloudEngine series and Yunshan OS, coupled with the iMaster NCE management suite, demonstrate a broad, fabric-centric approach to data center switching, particularly within rapidly digitizing markets across Asia and beyond. As these companies navigate competitive pressures and evolving customer priorities, their strategic investments in silicon innovation, software ecosystems, and partner alliances continue to define the contours of the market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Data Center Switch market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accton Technology Corporation

- Arista Networks, Inc.

- Broadcom Inc.

- Celestica Inc.

- Cisco Systems, Inc.

- Dell Technologies Inc.

- Extreme Networks, Inc.

- H3C Technologies Co., Ltd.

- Hewlett Packard Enterprise Company

- Huawei Technologies Co., Ltd.

- Juniper Networks, Inc.

- Lenovo Group Limited

- Marvell Technology, Inc.

- Nokia Corporation

- NVIDIA Corporation

- Quanta Cloud Technology Inc.

- Ruijie Networks Co., Ltd.

- ZTE Corporation

Strategic imperatives for industry leaders to optimize data center switching deployment, foster innovation, and navigate regulatory and supply chain challenges

To stay ahead in an increasingly competitive and complex data center switching environment, industry leaders should consider several strategic imperatives. First, aligning network architectures with AI-centric workloads and automation frameworks is paramount; organizations must evaluate platforms that natively integrate compute offloads, advanced telemetry, and policy-driven segmentation to reduce operational overhead and accelerate time to value. Embracing open networking standards and disaggregated hardware ecosystems can mitigate vendor lock-in, foster innovation, and streamline integration with emerging edge and multicloud environments.

Second, proactive supply chain management and tariff mitigation strategies are essential in light of the layered tariff landscape. Establishing dual-sourcing agreements, qualifying alternative suppliers outside high-tariff jurisdictions, and exploring localized assembly or contract manufacturing can buffer cost volatility and ensure continuity of switch deployments. Additionally, grouping procurement cycles to coincide with periodical tariff exclusions can yield meaningful cost efficiencies over the lifecycle of network refresh programs.

Third, sustainability and energy efficiency should be elevated from compliance tasks to strategic differentiators. By selecting switch architectures optimized for low-power silicon and adopting renewable power procurement, organizations can reduce total cost of ownership and meet evolving ESG requirements. Investing in intelligent power and cooling management, coupled with predictive analytics, enables operators to right-size capacity and minimize carbon footprints.

Finally, cultivating robust partnerships across the vendor ecosystem-encompassing silicon suppliers, software developers, and systems integrators-will accelerate the adoption of converged network solutions. Collaborative pilots, open API integrations, and joint innovation labs can accelerate the maturation of next-generation architectures, positioning organizations to capitalize on the network’s critical role in driving digital transformation.

Robust research framework integrating primary interviews, secondary analysis, and quantitative modeling to deliver insights into data center switching trends

Our analysis is underpinned by a rigorous, multi-modal research approach designed to deliver actionable and reliable insights. Primary data was gathered through in-depth interviews with network architects, CTOs, and operations leaders across hyperscale, enterprise, and telecommunications organizations, providing firsthand perspectives on switching requirements and future roadmaps. Concurrently, our expert panel of industry veterans validated emerging trends and helped interpret the strategic implications of tariff policy shifts and technological advancements.

Secondary research encompassed comprehensive reviews of publicly available press releases, regulatory filings, and company presentations to track product announcements, investment commitments, and ecosystem partnerships. We further conducted a detailed review of trade publications, financial disclosures, and academic literature to triangulate findings related to silicon innovations, energy-efficiency benchmarks, and deployment case studies.

To quantify market dynamics and segmentation insights, we employed quantitative modeling techniques that integrate publicly reported procurement volumes, tariff duty schedules, and published vendor performance metrics. This structured approach ensures that our segmentation analysis, regional breakdowns, and competitive profiles rest on transparent and replicable methodologies. Together, these research pillars enable a holistic understanding of the data center switch market landscape and support strategic decision-making for technology leaders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Data Center Switch market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Data Center Switch Market, by Type

- Data Center Switch Market, by Port Speed

- Data Center Switch Market, by Topology

- Data Center Switch Market, by End User

- Data Center Switch Market, by Application

- Data Center Switch Market, by Region

- Data Center Switch Market, by Group

- Data Center Switch Market, by Country

- United States Data Center Switch Market

- China Data Center Switch Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Summarizing key insights and strategic imperatives shaping the evolving landscape and future trajectory of data center switching technology

As data center networks continue to evolve in response to AI-driven workloads, regulatory shifts, and sustainability mandates, the strategic selection and deployment of switching infrastructure will determine operational agility and competitive differentiation. This report has highlighted how architectural innovations-ranging from DPU-enabled security integrations to one-tier AI-optimized fabrics-are reshaping performance paradigms and simplifying operational complexity.

We have also examined the compounding effects of U.S. tariff policies on procurement strategies, underscoring the importance of supply chain resilience and cost-mitigation tactics. Segmentation insights revealed distinct requirements across switch types, port speeds, topologies, end-user categories, and application domains, while regional analyses showcased how investment trends in the Americas, EMEA, and Asia-Pacific inform localized technology priorities. Competitive profiling of leading vendors illustrated the diverse approaches to silicon roadmaps, software ecosystems, and partnership orchestration that define market leadership.

Looking ahead, organizations that embrace open, programmable, and energy-efficient switch architectures, while proactively navigating policy landscapes and sustainability expectations, will position themselves to harness the full potential of network-driven innovation. The recommendations herein provide a strategic blueprint for technology leaders aiming to secure resilient, future-proof data center networks, ensuring that the fabric remains a catalyst for digital transformation rather than a constraint.

Engage with Ketan Rohom to secure your comprehensive data center switch market research report and empower strategic decision-making with expert guidance

To explore the full breadth of detailed insights, market intelligence, and strategic foresight presented in this comprehensive data center switch research, we invite you to engage directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. By connecting with Ketan, you can secure your copy of the report, tailor solutions to your organization’s specific network challenges, and gain access to expert guidance on how to leverage these findings for competitive advantage. Reach out to Ketan to initiate a personalized briefing and unlock the data-driven strategies that will propel your data center switching initiatives forward

- How big is the Data Center Switch Market?

- What is the Data Center Switch Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?