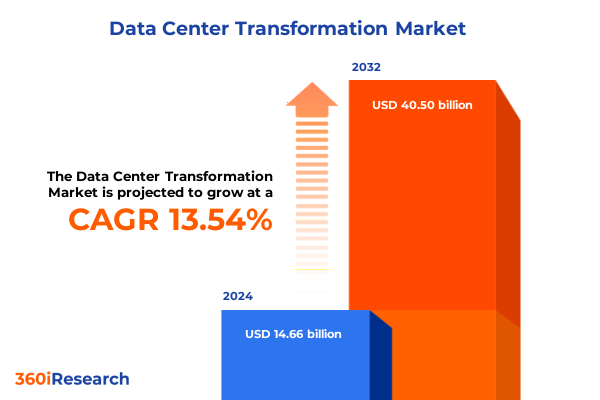

The Data Center Transformation Market size was estimated at USD 13.77 billion in 2025 and expected to reach USD 14.96 billion in 2026, at a CAGR of 8.85% to reach USD 24.95 billion by 2032.

Data Center Transformation Unveiled: Steering Infrastructure Evolution for Agility, Sustainability, and Artificial Intelligence Integration

The data center landscape is undergoing a profound metamorphosis driven by accelerating demands for cloud services, artificial intelligence, and edge computing. Organizations are migrating critical workloads from on-premises environments to hyperscale facilities that can scale elastically, while enterprises explore hybrid architectures to balance performance and control. Across industries, digital transformation initiatives hinge on resilient infrastructure capable of supporting real-time data analytics, advanced machine learning workloads, and the proliferation of IoT devices. This dynamic environment places a premium on flexibility and rapid adaptation, ensuring that facilities can accommodate emerging technologies without compromising reliability

Sustainability has emerged as a fundamental requirement rather than a differentiator, as stakeholders demand greater transparency around energy consumption and carbon footprints. Regulatory bodies and investors alike are imposing stringent environmental standards, compelling operators to integrate renewable energy sources and adopt innovative cooling techniques such as direct liquid cooling and immersion cooling. These measures not only reduce greenhouse gas emissions but also address the challenges of power density and thermal management inherent in AI-driven computing loads

Recruiting and retaining qualified talent remains one of the industry’s most persistent challenges. With data centers projected to require millions of skilled professionals by the middle of the decade, competition for network engineers, thermal specialists, and automation experts is fierce. Forward-looking organizations are leveraging AI-driven maintenance, robotic process automation, and upskilling programs to close the skills gap. Partnerships with academic institutions and military transition programs are proving effective in cultivating a pipeline of capable operators and engineers who can sustain the next wave of infrastructure innovation

How AI-Driven Infrastructure, Edge Computing, Modular Construction Approaches, and Sustainability Mandates Are Reshaping Data Center Landscapes

The integration of artificial intelligence into data center operations is redefining efficiency and reliability. Predictive analytics tools enable operators to anticipate equipment failures, optimize workload distributions, and reduce energy wastes before outages occur. Hyperscale providers are embedding custom AI accelerators and GPU-optimized hardware into their facilities, driving the development of AI-native architectures that streamline training and inference tasks. Meanwhile, colocation operators are positioning AI-ready spaces with enhanced power and cooling capabilities to accommodate enterprise customers with bespoke machine learning demands

Edge computing continues its ascent as the explosion of IoT and latency-sensitive applications requires processing closer to end users. Modular and prefabricated edge sites are deployed in locations ranging from urban micro-hubs to remote industrial facilities, delivering low-latency connectivity and localized analytics. These compact, energy-efficient edge nodes extend cloud-like capabilities to diverse environments, enabling real-time decision-making in autonomous vehicles, telemedicine, and smart manufacturing. Leading vendors are standardizing modular designs to accelerate deployment cycles and simplify maintenance

Modular construction techniques and prefabrication are transforming how data center campuses are built and expanded. By fabricating standardized components offsite, organizations minimize on-site disruptions, compress construction timelines, and mitigate supply chain risks. This approach also facilitates incremental scaling, allowing operators to add capacity in response to demand with minimal capital outlay. The shift toward standardized, repeatable designs enhances operational consistency and reduces total cost of ownership, especially in multi-site and distributed network architectures.

Quantum computing, once confined to research laboratories, is entering pilot stages within specialized data center environments. Hybrid classical-quantum facilities are emerging to support niche workloads such as complex financial simulations, molecular modeling, and cryptographic analysis. Although broad commercialization of quantum hardware remains on the horizon, early adopter data centers are collaborating with quantum startups and hyperscalers to explore integration pathways. This nascent trend underscores the need for flexible infrastructure that can accommodate unconventional power, cooling, and connectivity requirements.

Assessing the Cumulative Effects of Recent U.S. Trade Tariffs on the Data Center Ecosystem Through 2025 and Beyond

Since the initial introduction of reciprocal tariffs on key data center equipment, U.S. operators have faced rising capital expenditures and prolonged project timelines. Recent duties of 34% on Chinese imports, 32% on Taiwanese products, and baseline tariffs of 10% on other critical components have disrupted procurement strategies and threatened to derail expansion initiatives across hyperscale, colocation, and enterprise segments. As equipment costs escalate, some providers are reevaluating the viability of new builds and contemplating offshore alternatives in regions with more stable trade environments

Beyond hardware, the supply chain ramifications extend into operational facility management. Tariffs on construction materials, including steel and aluminum, have translated into steeper build costs and supply bottlenecks for structural components and cooling infrastructure. Data center builders report extended lead times and accelerated raw material expenses, compelling some to postpone groundbreakings or pivot to local suppliers at a premium. This environment has also magnified margin pressures as operators balance competitive pricing with cost recovery imperatives

The impact on construction inputs is profound: a 25% steel tariff and 10% duty on aluminum have heightened the cost of building shells and power distribution frames, while duties on electronic subsystems have driven up prices for servers, storage arrays, switches, and UPS units. These material surcharges amplify the financial risk for early-stage developments and retrofits alike, reinforcing the importance of robust cost-management frameworks and contingency planning in project scopes

To mitigate tariff-driven uncertainties, industry participants are diversifying supply chains, reshoring critical component production, and leveraging alternative trade agreements. Some hyperscale and colocation providers are forging partnerships with domestic manufacturers or relocating assembly lines to Malaysia and Mexico. Others are activating continuous inventory hedging strategies, pre-stockpiling essential equipment to buffer against further duty escalations. These strategic adjustments underscore the sector’s resilience and highlight the importance of agile procurement models in an increasingly complex global trade landscape

Unlocking Market Insights Through Comprehensive Segmentation Analysis Spanning Services, Tiers, Data Center Types, Sizes, Enterprises, and Verticals

By analyzing service type segmentation, leaders can discern that automation services are becoming the linchpin of highly efficient operations, while consolidation services are streamlining legacy asset transitions into modernized, converged environments. Infrastructure management services now underpin the orchestration of hybrid architectures, ensuring consistent performance across on-premises, colocation, and cloud nodes. Optimization services are enabling continuous refinement of power and cooling parameters to meet sustainability and cost objectives.

Tier type segmentation highlights distinct investment patterns: Tier III data centers command preference for mission-critical workloads with high availability, whereas Tier II facilities serve as cost-effective hubs for backup and non-production tasks. Tier IV sites cater to ultra-resilient environments where zero-downtime mandates prevail. Within this tiered framework, Tier I centers support entry-level implementations, offering basic capacity for non-redundant applications.

Data center type segmentation reveals that colocation operators focus on multi-tenant economies of scale, leveraging dense network interconnects. Enterprise data centers maintain dedicated assets for sensitive or proprietary workloads. Hyperscale centers continue to expand under the stewardship of cloud giants, driving AI and big data workloads at unprecedented scale.

Size segmentation underscores that mid-sized data centers optimize efficiency and provide a balance of agility and scale, while large data centers accommodate extensive hyperscale deployments. Small data centers use modular designs to deliver mission-specific capabilities in edge and enterprise contexts. Enterprise size segmentation further differentiates requirements, with large enterprises provisioning global, multi-site footprints, while small and medium enterprises prioritize cost-effective, managed services deployments.

Vertical segmentation illuminates nuanced adoption trends: banking, financial services, and insurance sectors demand robust security and compliance frameworks; energy and utilities focus on grid reliability and renewable integrations; government and defense emphasize sovereignty and resilience; healthcare and life sciences prioritize data privacy and high-throughput analytics; IT and telecom pursue network density and low-latency infrastructures; manufacturing requires industrial edge ecosystems; and retail explores real-time consumer data processing to enhance omnichannel experiences.

This comprehensive research report categorizes the Data Center Transformation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Data Center Types

- Tier Type

- Data Center Size

- Enterprise Size

- Verticals

Discerning Regional Dynamics: How Americas, Europe, Middle East & Africa, and Asia-Pacific Markets Drive Unique Data Center Growth Trajectories

In the Americas, hyperscale development continues to define the market, with Northern Virginia, Chicago, Atlanta, and Phoenix leading capacity expansions. Hyperscalers such as Amazon Web Services, Microsoft Azure, and Google Cloud are driving over 40% year-over-year inventory growth by constructing AI-optimized campuses and expanding edge footprints to support burgeoning North American digital demand. Meanwhile, Latin American markets like São Paulo and Santiago are emerging as strategic nodes for regional enterprises seeking onshore cloud services and localized colocation offerings

Europe, Middle East, and Africa are experiencing record capacity roll-outs, driven by robust government incentives and hyperscaler ambitions in FLAPD markets-Frankfurt, London, Amsterdam, Paris, and Dublin. With power availability and regulatory frameworks favoring green energy, the region anticipates a 43% increase in new developments over the previous year. Secondary markets in Milan, Madrid, and emerging Nordic and Middle Eastern hubs are also gaining traction, diversifying the regional supply landscape and supporting data sovereignty mandates

Asia-Pacific continues to post the strongest growth rate globally, having delivered the largest live supply increases between 2018 and 2023. Countries such as India, Malaysia, Australia, and South Korea each contributed over 1GW of new capacity, reflecting heavy investments in AI, cloud, and digital transformation initiatives. While established markets in Singapore and Tokyo remain critical, secondary markets like Johor, Batam, and Melbourne are expanding rapidly to absorb rising colocation and hyperscale demands. This rapid expansion underscores the region’s pivotal role as a driver of global digital infrastructure growth

This comprehensive research report examines key regions that drive the evolution of the Data Center Transformation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Data Center Operators: Strategic Moves by Equinix, Digital Realty, Amazon Web Services, and Hyperscalers Driving Industry Innovation

Equinix has attracted significant investor attention as its global footprint and energy transition initiatives come under scrutiny. Recent engagement by activist investors underscores opportunities to optimize capital allocation across its portfolio of colocation, interconnection, and edge assets. At the same time, Equinix Malaysia’s proactive exploration of alternative energy sources anticipates rising utility costs and reinforces the company’s commitment to sustainability across Southeast Asia. These strategic moves illustrate the growing emphasis on operational efficiency and green power procurement among leading operators

Amazon Web Services is pioneering carbon innovation within data centers by piloting AI-designed materials that selectively remove CO2 emissions, furthering its net-zero ambitions. This collaboration with advanced startups aims to reduce operational carbon footprints and optimize resource usage, positioning AWS at the forefront of sustainable infrastructure innovation. By leveraging AI-driven material science, AWS is charting a path toward resource-efficient operations that can scale alongside its global data center portfolio

Digital Realty continues to future-proof its global campus network by enhancing AI workload capabilities and addressing water and energy constraints through advanced cooling methods. With a target to double capacity by 2029, the company leverages its leading market share in Northern Virginia and expansive REIT structure to facilitate large-scale deployments. Portfolio diversification strategies and high-density power offerings underscore the company’s focus on balancing growth with resilience amid evolving environmental and supply chain challenges

This comprehensive research report delivers an in-depth overview of the principal market players in the Data Center Transformation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Accenture PLC

- AdaniConneX by Adani Group

- Alibaba Group Holding Limited

- Arista Networks, Inc.

- Atos SE

- BMC Software, Inc.

- Bytes Technology Group PLC

- Capgemini SE

- Cisco Systems, Inc.

- Cognizant Technology Solutions Corporation

- Criticalcase Srl

- Dell Technologies Inc.

- DXC Technology Company

- DynTek, Inc.

- e-Zest Solutions

- Eaton Corporation PLC

- Emerson Electric Co.

- Equinix, Inc.

- exIT Technologies

- Fujitsu Limited

- General Datatech, L.P.

- Google LLC by Alphabet Inc.

- HCL Technologies Limited

- Hewlett Packard Enterprise Development LP

- Hitachi, Ltd.

- Honeywell International Inc.

- Huawei Technologies Co., Ltd.

- InknowTech Pvt. Ltd.

- Intel Corporation

- International Business Machines Corporation

- Johnson Controls International PLC

- Juniper Networks, Inc.

- Lenovo Group Limited

- Lunavi, Inc.

- Mantis Innovation Group, LLC

- MetalSoft Cloud Inc.

- Micro Focus International Limited by OpenText Corporation

- Microsoft Corporation

- Mindteck

- NetApp, Inc.

- Nippon Telegraph and Telephone Corporation

- Oracle Corporation

- Redwood Software, Inc.

- SAP SE

- Schneider Electric SE

- Siemens AG

- Sunbird Software, Inc.

- Tech Mahindra Limited

- Tencent Holdings Ltd.

- VMware, Inc.

- Wipro Limited

Strategic Recommendations for Data Center Leaders to Enhance Resilience, Drive Sustainable Growth, and Capitalize on Emerging Technology Trends

Industry leaders should prioritize the integration of AI and automation not only for customer workloads but also for facility management. By deploying advanced predictive analytics and robotics, operators can reduce unplanned downtime and optimize resource allocation. Collaboration with AI startups and cross-industry partnerships will facilitate the rapid adoption of these capabilities, enhancing operational resilience and cost efficiency.

To counter the uncertainties introduced by global trade policies, organizations must develop agile supply chain strategies. This includes diversifying vendor portfolios, establishing regional manufacturing partnerships, and leveraging alternative trade corridors. By embedding flexible procurement frameworks and continuous inventory planning into capital projects, data center developers can insulate themselves from sudden duty escalations and component shortages.

Sustainability commitments must extend beyond carbon and energy targets to encompass holistic lifecycle management. Industry participants should adopt renewable energy power purchase agreements, explore emerging technologies such as small modular reactors, and commit to circular economy principles for hardware recycling. Engaging with regulatory bodies and participating in industry alliances will ensure compliance with evolving environmental standards while enhancing corporate reputation.

Robust Research Methodology Combining Primary Interviews, Secondary Data Analysis, and Triangulation to Deliver Actionable Data Center Market Insights

This research synthesizes insights derived from primary interviews with C-level executives, infrastructure engineers, and sustainability officers across hyperscale, colocation, and enterprise data centers. These detailed discussions informed the identification of critical trends, challenges, and opportunities shaping the transformation landscape. Interview protocols were designed to capture quantitative data on technology deployments as well as qualitative perspectives on strategic priorities.

Complementing primary inputs, secondary research encompassed an exhaustive review of industry publications, regulatory filings, trade association reports, and proprietary company disclosures. Data triangulation methods were applied to ensure accuracy and mitigate bias, comparing multiple sources for critical metrics such as power demand growth, capacity expansions, and technology adoption rates. This dual-layered approach provides a robust foundation for actionable insights and strategic decision-making within the data center ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Data Center Transformation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Data Center Transformation Market, by Service Type

- Data Center Transformation Market, by Data Center Types

- Data Center Transformation Market, by Tier Type

- Data Center Transformation Market, by Data Center Size

- Data Center Transformation Market, by Enterprise Size

- Data Center Transformation Market, by Verticals

- Data Center Transformation Market, by Region

- Data Center Transformation Market, by Group

- Data Center Transformation Market, by Country

- United States Data Center Transformation Market

- China Data Center Transformation Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Final Thoughts on the Imperatives of Agility, Sustainability, and Technological Innovation in Shaping the Future of Data Center Transformations

As data centers continue to underpin the digital economy, the convergence of artificial intelligence, edge computing, and sustainability imperatives will dictate future infrastructure architectures. Organizations that embrace modular designs, energy-efficient cooling, and advanced automation will be best positioned to meet evolving workloads while optimizing capital and operational efficiencies.

The interplay of regional dynamics, evolving trade policies, and competitive landscapes underscores the necessity for agile strategies. Operators who proactively address supply chain volatility, regulatory requirements, and customer demands for secure, resilient, and sustainable environments will secure leadership positions in the rapidly transforming data center market.

Take the Next Step with Ketan Rohom to Empower Your Business with In-Depth Data Center Transformation Insights and Tailored Market Intelligence

To embark on a tailored exploration of data center transformation best practices, market dynamics, and strategic roadmaps, we invite you to engage directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. By connecting with Ketan, you gain access to a comprehensive market research report that distills complex trends into actionable intelligence. This conversation will equip your organization with the insights needed to optimize infrastructure investments, navigate regulatory and trade environments, and enhance operational efficiency.

Reach out today to secure exclusive guidance and unlock the full potential of your data center strategy with bespoke recommendations based on the latest research and industry benchmarks.

- How big is the Data Center Transformation Market?

- What is the Data Center Transformation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?