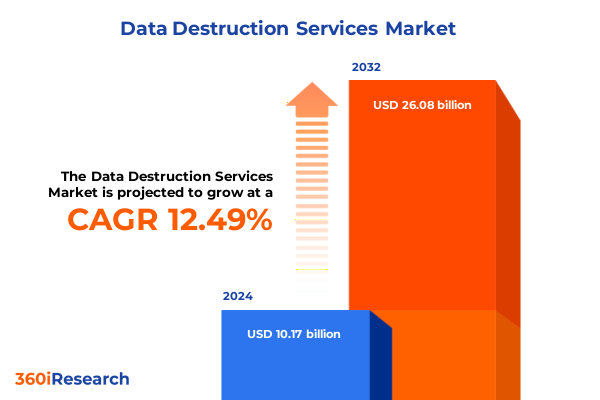

The Data Destruction Services Market size was estimated at USD 11.38 billion in 2025 and expected to reach USD 12.75 billion in 2026, at a CAGR of 12.57% to reach USD 26.08 billion by 2032.

Comprehensive Overview of Evolving Data Destruction Services Shaping Information Security and Compliance in a Rapidly Changing Digital World

In an era defined by relentless digital transformation and escalating cyber threats, the secure and compliant disposal of sensitive information has become a critical imperative for organizations of all sizes. Data destruction services are no longer a peripheral operational concern but stand at the forefront of risk mitigation strategies that protect against breaches, satisfy stringent regulatory demands, and preserve brand reputation.

Regulatory frameworks globally have tightened requirements for data privacy and record retention. The introduction of comprehensive data protection regulations such as the California Consumer Privacy Act (CCPA), the European Union’s General Data Protection Regulation (GDPR), and sector-specific mandates from bodies like the U.S. Federal Trade Commission has transformed data destruction from a best practice into a legal necessity. Companies now face significant penalties for non-compliance, driving demand for certified destruction services that deliver auditable proof of secure disposal.

Amid these dynamics, organizations are navigating a rapidly evolving landscape characterized by technological innovations, heightened end-user security expectations, and the proliferation of data-driven operations. This executive summary outlines the foundational context for understanding how data destruction services have become a strategic priority, setting the stage for deeper analysis of transformative shifts, tariff impacts, segmentation insights, regional variations, and actionable recommendations that can fortify information governance in 2025 and beyond.

Exploring Transformative Shifts Reshaping Data Destruction Practices Through Advanced Technologies and Emerging Global Regulatory Landscapes

The data destruction industry is undergoing transformative shifts driven by breakthroughs in both digital and physical sanitization technologies and the constantly evolving regulatory landscape. Advanced logical destruction methods now leverage cryptographic erasure techniques that render data irretrievable without physically altering storage media, delivering rapid turnaround times with minimal equipment downtime. These methods coexist alongside proven overwriting or wiping processes, offering flexibility for organizations that need to retire devices without destroying hardware value.

Simultaneously, physical destruction capabilities have expanded beyond traditional hard drive shredding to include precision crushing, disintegration, and specialized equipment for mobile device and optical media destruction. Increasingly, service providers are integrating robotic automation into shredding facilities to ensure consistent throughput, reduce human exposure to edge-cutting hazards, and maintain strict chain-of-custody controls through real-time monitoring systems.

On the regulatory front, updates to data privacy laws and sectoral guidelines are mandating higher verification standards for destruction certificates, driving investment in digital verification platforms that record each stage of the destruction process. Meanwhile, digital forensics advancements are enabling third-party auditors to validate destruction protocols more rigorously, reinforcing customer confidence.

Taken together, these converging technological developments and regulatory pressures have reshaped service offerings. Providers are now bundling end-to-end data lifecycle management solutions, which encompass secure decommissioning, destruction, and recycling of assets, ensuring seamless compliance and sustainability.

Assessing the Cumulative Impact of United States Tariffs on Data Destruction Equipment and Services Throughout 2025

The cumulative effect of United States trade policies in 2025 has exerted mounting pressure on both the cost structure and operational strategies of data destruction service providers. Commencing on March 12, 2025, a 25 percent tariff was applied universally to steel and aluminum imports, directly increasing the expense of manufacturing shredding and crushing machinery. Vendors reliant on imported metal components have encountered steeper input costs, prompting them to adjust capital equipment pricing or shift production locally to mitigate these surcharges.

Shortly thereafter, in early April 2025, reciprocal tariffs targeted a broad spectrum of high-tech imports, including a 34 percent duty on Chinese equipment, 32 percent on Taiwanese shipments, 25 percent on South Korean technology goods, and a baseline 10 percent additional tariff across all import categories. These measures have extended to data center hardware and specialized degaussers, compelling service providers to reevaluate procurement strategies and, in some cases, to renegotiate service contracts to accommodate higher maintenance and replacement costs.

Further compounding these pressures, on July 8, 2025, the administration announced a 25 percent tariff on products from Japan and South Korea effective August 1. This sweeping adjustment affects critical storage components such as memory modules and solid state drives-items essential for both temporary data staging and logical destruction processes-thereby escalating overall service delivery costs for providers who depend on imported media sanitization equipment.

Beyond hardware, the broader technology landscape has witnessed price increases in data center-related components, with network cables and semiconductor prices year-over-year rising by 5.6 percent and 3.6 percent respectively in the first quarter of 2026. Although not all data destruction providers directly purchase large server arrays, the ripple effect of elevated chip and board costs ultimately filters into the maintenance of asset recovery lines and the replacement of digital shredding modules.

Looking ahead, the continuation of blanket semiconductor tariffs threatens to sustain high capital equipment costs. Without targeted exclusions for destruction-specific machinery, providers must weigh the choice between absorbing surcharges, passing them on to customers, or investing in domestic manufacturing partnerships-each with trade-offs for competitiveness and margin stability.

Illuminating Key Segmentation Insights to Uncover Diverse Opportunities Across Technologies, Media Types, and Industry Verticals in Data Destruction

When examining the diversity of data destruction offerings, it is vital to recognize the distinction between logical and physical destruction methodologies. Digital destruction techniques encompass cryptographic erasure, which eliminates the encryption keys rendering data irrecoverable without hardware alteration, alongside high-intensity degaussing processes that disrupt magnetic media fields. Traditional overwriting or wiping remains a staple for organizations seeking device reuse, providing multiple data pass-throughs in accordance with standardized protocols.

On the physical side, providers employ a range of destruction modes, including mechanical crushing designed for hard drives and solid state devices, disintegration equipment that pulverizes media into granular byproducts, and specialized shredders configured for hard disk shredding, mobile device fragmentation, optical disc obliteration, and tape shredding. Each technique offers distinct trade-offs between throughput, residual material size, and environmental compliance.

From a media standpoint, service providers address document destruction alongside a spectrum of electronic storage formats. Hard drives, optical media, solid state drives, and magnetic tapes are managed through tailored processes to ensure that every data-bearing asset, whether paper or silicon-based, is rendered unreadable and unreconstructible.

Delivery models further diversify the market. Off-site destruction services leverage secure transport and centralized processing facilities featuring advanced certification systems, while on-site destruction dispatches mobile shredding or degaussing units directly to client premises, catering to organizations with heightened privacy or logistical constraints.

Industry verticals influence service requirements significantly. Financial institutions and healthcare entities demand stringent chain-of-custody documentation, whereas manufacturing and media companies may prioritize fast-turn cycle times. Government bodies often require specialized certifications, and consumer goods, retail, telecommunications, and life sciences sectors balance cost efficiency against compliance imperatives.

Lastly, organizational scale drives variation in provider selection and contract structures. Large enterprises typically engage national network providers offering integrated asset lifecycle management, whereas small and medium enterprises opt for flexible engagement models that allow ad hoc service orders without long-term commitments.

This comprehensive research report categorizes the Data Destruction Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Types

- Media Type

- Delivery Mode

- Industry Vertical

- Organization Size

Deriving Deep Regional Insights Highlighting Unique Market Dynamics Across Americas, Europe Middle East Africa, and Asia Pacific Regions

Across the Americas, the United States remains the epicenter of demand for certified data destruction services, driven by strict federal regulations and state-level privacy statutes that mandate detailed proof of secure disposal. Service providers here differentiate through national footprints offering both on-site and off-site models, focusing on secure transport logistics, chain-of-custody digital platforms, and sustainability initiatives that recycle metal and electronic components.

In Canada, a parallel rise in privacy laws has fueled regional service expansions, with providers emphasizing bilingual certification and compliance documentation. Latin American markets, while nascent, are quickly adopting standardized destruction protocols, propelled by cross-border data sharing requirements within multinational corporations.

Europe, Middle East, and Africa form a highly regulated environment under the umbrella of the EU’s General Data Protection Regulation. Providers in Western Europe have refined comprehensive destruction packages that integrate reverse logistics for devices manufactured in Asia. In the Middle East, growing investment in data center infrastructure has generated new opportunities for secure media disposal, often in partnership with defense and government agencies. African markets are in a developmental phase, with demand concentrated in South Africa and Nigeria, where regulatory frameworks are currently evolving.

The Asia-Pacific region exhibits divergent growth patterns. Established markets in Japan and Australia emphasize mature compliance regimes and advanced technology adoption, whereas emerging markets in Southeast Asia and India are building capacity to handle rising volumes of data assets. Service providers are partnering with local recyclers and leveraging regional hubs to optimize cross-border logistics and capitalize on growing digital transformation initiatives among enterprises.

This comprehensive research report examines key regions that drive the evolution of the Data Destruction Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Key Company Insights Emphasizing Competitive Landscapes, Innovation Drivers, and Strategic Partnerships in Data Destruction Services

The data destruction marketplace is characterized by a mix of global enterprises and specialized regional operators. Iron Mountain, for instance, has leveraged its expansive logistics network to offer integrated on-site and off-site services, augmenting traditional shredding with digital chain-of-custody platforms. Its ongoing investment in sustainability programs further differentiates its positioning for enterprises seeking green certification.

Stericycle’s Shred-It division maintains a strong presence among small and medium businesses, capitalizing on flexibility and modular service packages that enable irregular scheduling. Its proprietary mobile shredding fleet offers secure, on-demand media destruction at customer sites, supported by compliance-verified reporting through an online portal.

Recall Holdings, following acquisitions in Europe and North America, has broadened its global footprint and technology portfolio, integrating document management and secure destruction under a unified service umbrella. This holistic approach caters to multinational corporations that require consistent protocols across multiple jurisdictions.

Kroll Ontrack, specializing in data recovery and digital forensics, has expanded its logical destruction capabilities, offering high-assurance cryptographic erasure services that appeal to clients needing precise data sanitization without hardware disposal. Likewise, Blancco Technology Group has cemented its reputation for certified overwriting solutions, supported by software validations against international standards.

Regional specialists such as Sims Lifecycle Services in Asia-Pacific focus on end-to-end asset retirement services, combining destruction with environmental compliance for recyclable outputs. Their localized knowledge of cross-border regulations enables optimized logistics solutions, particularly in markets with fragmented regulatory frameworks.

Collectively, these providers drive competitive innovation through strategic partnerships, targeted acquisitions, and continuous upgrades to destruction technologies, ensuring they meet the dual imperatives of security and sustainability.

This comprehensive research report delivers an in-depth overview of the principal market players in the Data Destruction Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- CDR Global

- Corpurios, S.A. de C.V.

- DataShield Corp. by Lumifi Cyber, Inc.

- EcoCentric Management Pvt. Ltd.

- Ecoreco Ltd.

- Electronic Recyclers International, Inc.

- GEM Southwest, LLC

- Guardian Data Destruction

- Iron Mountain Incorporated

- Jetico Inc.

- KLDiscovery Ontrack, LLC

- Kuusakoski Group

- McCollister’s Transportation Group

- Mireth Technology

- MRK Group Ltd.

- Northeast Data Destruction by National Waste Management Holdings Inc.

- ProTek Recycling

- RAKI Computer Recycling

- Sims Recycling Solutions, Inc.

- Supportive Recycling GMBH

- Tech Waste Recycling

- Tier 1 Asset Management Ltd

- Veolia Environnement S.A.

- WhiteCanyon Software, Inc. by Blancco Ltd.

Actionable Recommendations for Industry Leaders to Enhance Operational Efficiency, Strengthen Compliance, and Drive Sustainable Growth in Data Destruction

Industry leaders should prioritize developing hybrid data destruction solutions that seamlessly integrate logical and physical sanitization processes. By investing in flexible service models that can pivot between on-site and off-site engagements, providers can cater to clients with varying risk profiles and operational constraints, enhancing market responsiveness.

To navigate evolving regulatory landscapes, organizations must embed compliance intelligence into their service delivery platforms. This entails maintaining up-to-date certifications aligned with regional and sector-specific data protection laws and offering real-time auditability through digital dashboards that deliver transparent chain-of-custody records to customers.

Operational efficiency can be significantly enhanced by adopting robotics and automation in shredding and processing facilities. Automated equipment not only increases throughput but also reduces safety risks, lowers labor costs, and standardizes output material sizes for downstream recycling partners, reinforcing environmental credentials.

Sustainability should be a strategic pillar. Establishing partnerships with certified recycling firms and integrating circular economy principles into asset retirement processes boosts brand reputation and meets the growing client demand for green disposal solutions.

Finally, service providers must invest in end-user education, guiding organizations through best practices for asset decommissioning and secure data handling. Thought leadership initiatives such as white papers, webinars, and compliance checklists can position firms as trusted advisors, fostering long-term customer relationships.

Robust Research Methodology Combining Rigorous Primary and Secondary Approaches for Accurate and Actionable Data Destruction Market Analysis

This analysis is founded on a rigorous two-pronged research approach. Secondary research involved a comprehensive review of publicly accessible company filings, industry white papers, regulatory publications, and trade association reports to establish foundational knowledge of market dynamics and technological developments.

Complementing this, primary research comprised structured interviews with senior executives of data destruction providers, in-depth discussions with regulatory experts, and feedback from enterprise end users responsible for information governance. These qualitative insights were systematically cross-verified with quantitative data points to ensure robustness and minimize bias.

Data triangulation techniques were employed to reconcile any discrepancies between secondary sources and primary interview findings. Key performance indicators such as equipment deployment volumes, service revenue mixes, and compliance certification trends were normalized across geographies and organization sizes.

The result is a holistic view of the data destruction landscape, anchored in both empirical evidence and expert opinion. All findings are synthesized to deliver actionable intelligence that supports strategic decision-making in an evolving regulatory and technological environment.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Data Destruction Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Data Destruction Services Market, by Types

- Data Destruction Services Market, by Media Type

- Data Destruction Services Market, by Delivery Mode

- Data Destruction Services Market, by Industry Vertical

- Data Destruction Services Market, by Organization Size

- Data Destruction Services Market, by Region

- Data Destruction Services Market, by Group

- Data Destruction Services Market, by Country

- United States Data Destruction Services Market

- China Data Destruction Services Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Concluding Summary Underscoring the Strategic Importance of Data Destruction Services for Security, Compliance, and Long Term Resilience

Secure and verifiable data destruction stands as a cornerstone of modern information security strategies, underpinning compliance and safeguarding organizational reputations. The convergence of advanced logical sanitization methods and innovative physical destruction technologies has expanded service capabilities, while shifting regulatory demands and trade policies introduce new considerations for cost management and operational planning.

Understanding segmentation nuances-from service delivery models and media types to industry vertical requirements-enables providers and end users alike to tailor solutions that align with specific risk profiles and sustainability goals. Regional market dynamics further influence strategic priorities, as illustrated by the distinct needs of Americas, EMEA, and Asia-Pacific landscapes.

As providers vie for competitive advantage through technological innovation, partnerships, and sustainability initiatives, organizations must remain vigilant in selecting partners that not only meet security obligations but also deliver transparent, auditable processes. The insights and recommendations presented here equip decision makers with the knowledge required to navigate the data destruction ecosystem and foster resilient, compliant operations.

Contact Ketan Rohom to Secure Your Comprehensive Data Destruction Services Market Research Report and Gain a Competitive Edge Today

For a comprehensive understanding of the data destruction services market, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. Ketan can guide you through the full breadth of insights contained within the complete market research report, helping you tailor strategic decisions to your organization’s unique challenges and goals.

By connecting with Ketan, you will gain access to detailed findings on market dynamics, segmentation nuances, regional developments, and competitive landscapes. This conversation will empower you to leverage expert analysis for operational planning, investment prioritization, and growth strategies.

Take the next step toward securing a robust data destruction strategy. Contact Ketan via LinkedIn or through the professional inquiry form on our website. Elevate your competitive advantage by investing in the full report today.

- How big is the Data Destruction Services Market?

- What is the Data Destruction Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?