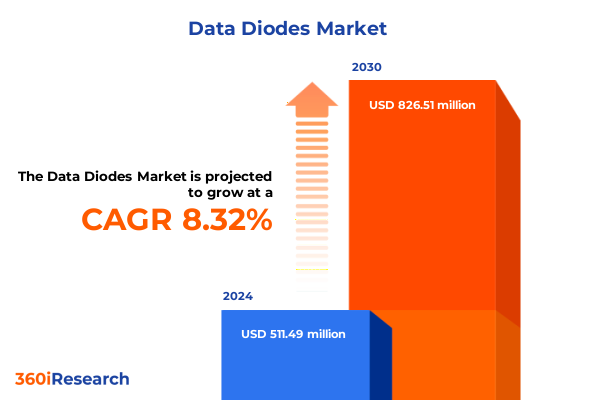

The Data Diodes Market size was estimated at USD 511.49 million in 2024 and expected to reach USD 552.71 million in 2025, at a CAGR of 8.32% to reach USD 826.51 million by 2030.

Innovative Unidirectional Security Solutions: Exploring the Core Principles Applications and Strategic Imperatives Driving Data Diode Technology Adoption

A data diode is a network appliance engineered to enforce one-way data transmission, utilizing hardware-based constraints to physically prevent any reverse data flow. This unidirectional gateway model delivers a level of assurance beyond software-only security controls, guaranteeing the confidentiality and integrity of critical systems by design.

Originally conceived within government and defense environments to protect high-security networks, data diodes have transcended their military origins. They are now integral to industrial operations across energy, oil and gas, water and wastewater management, rail systems, and cloud-connected IoT deployments. This transition has been fueled by the convergence of operational technology and information technology, as well as by regulatory mandates that require robust network segmentation and unidirectional data transfer to mitigate cyber-physical risks.

In recent years, data diode solutions have evolved beyond simple optical isolation devices. Modern implementations combine dedicated hardware modules with proxy software layers to replicate databases and emulate protocol services, supporting a variety of data types and transfer protocols while enforcing physical one-way flow. Advanced features such as forward error correction, certificate-based authentication, and secure TLS communication have expanded their applicability in real-time industrial monitoring, safety instrumented systems, and critical infrastructure operations.

Navigating Paradigm Shifts in Secure Network Architecture: Key Technological Advancements and Operational Drivers Transforming the Data Diode Landscape

Data diodes have undergone a technological metamorphosis, integrating hardware-enforced unidirectionality with sophisticated protocol translation and error-correcting mechanisms. Early designs relied solely on optical or electrical isolation to block reverse data flow, but contemporary architectures incorporate proxy servers that reconstruct protocols and replicate data in near real-time. This hybrid approach balances the need for stringent physical controls with the operational demand for diverse application support across industrial networks.

Simultaneously, the expansion of regulations such as the EU’s NIS2 Directive has elevated the strategic importance of network segmentation in Europe. By mandating risk management measures and incident reporting across critical sectors, NIS2 encourages unidirectional gateways to safeguard essential services. As industrial and manufacturing enterprises align with these requirements, data diodes are increasingly deployed to isolate sensitive process control networks from corporate IT environments, ensuring regulatory compliance and operational continuity.

In parallel, the demand for ruggedized and compact data diode solutions has surged, driven by applications in extreme environments. Providers now offer hardened form factors certified for use in offshore platforms, rail yards, and defense installations. These designs incorporate shock- and vibration-resistant enclosures, extended temperature range components, and optical isolation technologies to maintain one-way data flows under harsh conditions. As a result, organizations can deploy resilient unidirectional gateways in remote or safety-critical sites without compromising performance or reliability.

Assessing the Cumulative Ramifications of 2025 U.S. Tariff Policies on Network Hardware Procurement Data Flow Security and Operational Resilience

The introduction of steep U.S. tariffs on semiconductors and telecommunications equipment in 2025 has reverberated across critical infrastructure supply chains, elevating the total cost of ownership for data diode deployments. A sustained 25 percent duty on semiconductor imports is projected to suppress overall U.S. economic growth and inflate hardware costs for devices reliant on processors and memory modules. This scenario promises to accentuate capital expenditure pressures for organizations upgrading or expanding unidirectional security gateways across their networks.

Network components central to data diode integration-such as industrial routers, switches, and firewalls-have also been subject to new tariff schedules. Key vendors have publicly reported price hikes of up to 15 percent on advanced routing series and up to 12 percent on wireless access controllers. These cost increases compel procurement teams to reconsider upgrade cycles, consolidate orders, or negotiate long-term supply agreements to mitigate financial impacts on unidirectional gateway rollouts.

To navigate this evolving tariff landscape, industry stakeholders are accelerating efforts to diversify supply chains and expand domestic manufacturing. Leading semiconductor and networking firms are investing in U.S. facility expansions, while end users are exploring alternative sourcing hubs in Southeast Asia. These strategic adjustments aim to reduce import dependency, stabilize equipment pricing, and ensure uninterrupted deployment of data diodes within critical network segments.

Decoding Market Segmentation Dynamics: In-Depth Insights into Offerings Products Form Factors Industry Verticals Enterprise Sizes and Distribution Channels

The Data Diode market’s diversity is reflected in its layered segmentation, each catering to specific operational and strategic needs. Offering-level distinctions separate hardware-only systems from service-enhanced solutions, with managed services delivering remote monitoring, maintenance, and rapid incident response, while professional services focus on customized network design and integration. Product segmentation further differentiates standard non-rugged data diodes from specialized rugged variants engineered for extreme temperature, shock, and vibration conditions.

Form factor considerations influence installation and footprint requirements, with DIN rail modules favored in control panel assemblies for their compact width and ease of mounting, while rack mount units accommodate higher throughputs and dense port configurations within data center cabinets. Industry-focused insights highlight that sectors such as banking, energy, government, healthcare, manufacturing, telecommunications, and logistics each impose unique performance and certification criteria. Within energy and utilities, the emphasis on oil and gas refining and power generation and distribution drives demand for SIL-rated unidirectional gateways, whereas transportation verticals prioritize aviation, maritime, and railway safety network segmentation.

Enterprise size segmentation reveals distinct buying behaviors, as large corporations often mandate end-to-end service contracts and centralized management, while small and medium entities seek cost-effective, plug-and-play hardware offerings. Distribution channels further adapt to customer preferences, with traditional offline routes through system integrators and value-added resellers complementing direct online procurement via company-owned portals and e-commerce platforms.

This comprehensive research report categorizes the Data Diodes market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Product

- Form Factor

- Industry Vertical

- Enterprise Size

- Distribution Channel

Analyzing Regional Demand Patterns and Regulatory Drivers Shaping Data Diode Adoption Across the Americas EMEA and Asia-Pacific Markets

In the Americas, historic leadership in operational technology security and directives such as the U.S. Nuclear Regulatory Commission’s requirement for unidirectional gateways in safety instrumented systems have driven widespread data diode deployments. Federal initiatives aimed at modernizing grid resilience and safeguarding critical infrastructure continue to reinforce demand, with both public utilities and energy majors integrating unidirectional gateways to shield control networks from external threats.

Across Europe, Middle East & Africa, regulatory frameworks like the European Union’s NIS2 Directive have heightened the imperative for robust network segmentation. By embedding unidirectional security measures into national cybersecurity strategies, governments and utilities sectors are standardizing data diode utilization. This compliance landscape, while varied in enforcement timelines, underscores an EMEA-wide commitment to structured, hardware-backed defenses against evolving cyber-physical risks.

In the Asia-Pacific region, the convergence of rapid industrial digitalization and the expansion of critical infrastructure projects has accelerated data diode adoption. Key technology providers with strong regional footholds, including ST Engineering and local systems integrators, are supplying resilient unidirectional gateways tailored to manufacturing plants, oil and gas facilities, and smart grid deployments. This APAC momentum reflects a strategic balance between performance requirements and environmental ruggedness in unidirectional gateway solutions.

This comprehensive research report examines key regions that drive the evolution of the Data Diodes market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Competitive Strategies and Innovation Trends of Leading Data Diode Providers to Identify Differentiation and Growth Opportunities in Cybersecurity

Owl Cyber Defense has distinguished itself by coupling patented optical isolation modules with an extensive service suite, enabling continuous monitoring and rapid incident remediation for high-security environments. Its emphasis on iterative product innovation-such as high-assurance FEC engines and centralized management platforms-has solidified its leadership across government and energy verticals. Concurrently, Fox-IT, now part of a global cybersecurity group, leverages deep cryptographic and secure protocol expertise to deliver data diodes with enhanced tamper-evidence features and advanced protocol converters, addressing the most stringent classified use cases.

Waterfall Security Solutions offers a comprehensive portfolio of unidirectional gateways renowned for their out-of-band threat detection and real-time network visibility. Its solutions integrate seamlessly into SCADA and DCS environments within oil and gas, utilities, and manufacturing sectors, underscored by certifications for critical infrastructure standards. Advenica has carved a niche in the defense and government segment, combining hardened proxies with military-grade assurance levels and unique national certifications, which has resonated strongly with European armed forces and intelligence agencies.

Additional competitors such as BAE Systems and Belden extend the landscape by embedding unidirectional modules into broader cyber-physical system offerings, while ST Engineering’s ruggedized products cater to extreme environmental requirements across maritime and rail applications. This competitive ecosystem underscores a convergence of specialized hardware, service-driven models, and compliance-focused innovation to meet diverse operator demands across global critical infrastructure sectors.

This comprehensive research report delivers an in-depth overview of the principal market players in the Data Diodes market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 4Secure Ltd

- 63 moons technologies Ltd.

- Advenica AB

- BAE Systems PLC

- Belden Inc.

- Bharat Electronics Limited

- Chipspirit Technologies Pvt Ltd

- Data Device Corporation

- Deep Secure Ltd.

- Everfox Holdings LLC

- Fend Incorporated

- Fibersystem AB

- FOX-IT

- Garland Technology LLC

- genua GmbH by Bundesdruckerei GmbH

- HAVELSAN Inc.

- Infodas GmbH

- LEROY AUTOMATION S.A.S

- Nexor Limited

- OPSWAT Inc.

- Owl Cyber Defense Solutions, LLC

- Sertalink BV

- Singapore Technologies Engineering Ltd

- SolutionsPT Limited

- Sunhillo Corporation

- Thales Group

- Valiant Communications Limited

- Waterfall Security Solutions Ltd.

Implementing Strategic Roadmaps for Data Diode Integration: Actionable Recommendations to Enhance Security Posture Supply Chain Resilience and Market Competitiveness

Industry leaders should prioritize holistic integration of unidirectional gateways within defense-in-depth architectures, ensuring data diodes are synchronized with existing intrusion detection systems, security information and event management platforms, and physical access controls. By embedding one-way data transfer as a foundational layer, organizations can isolate critical operational networks while maintaining centralized threat intelligence and anomaly detection workflows.

To buffer against geopolitical and supply chain volatility, enterprises are advised to diversify procurement strategies by establishing multi-source relationships and qualifying domestic suppliers for key diode components. Advancing local assembly capabilities and forging partnerships with regional integrators can mitigate tariff impacts and accelerate deployment timelines, preserving both cost efficiency and network resilience.

Finally, fostering robust stakeholder engagement with regulatory bodies and industry consortia will help shape emerging cybersecurity frameworks and standards, ensuring that unidirectional gateway initiatives align with evolving compliance requirements. By participating in working groups and contributing empirical deployment insights, organizations can influence policy direction, streamline certification processes, and reinforce the role of data diodes in national critical infrastructure protection strategies.

Outlining Robust Research Methodology for Unidirectional Security Market Analysis Incorporating Primary Secondary Data Triangulation and Expert Validation Processes

Our analysis employed a rigorous multi-stage research methodology encompassing both primary and secondary data collection. Primary research involved structured interviews with cybersecurity architects, control system engineers, network operations managers, and regulatory experts to capture firsthand perspectives on unidirectional gateway deployment, performance requirements, and compliance drivers.

Secondary research leveraged technical literature, standards publications, industry whitepapers, and open-source intelligence to map technological advancements, regulatory landscapes, and competitive positioning. Data triangulation techniques were applied to reconcile disparate information sources, enhancing the validity and reliability of key findings.

Quantitative insights were refined through iterative expert validation workshops, where preliminary conclusions were reviewed and stress-tested against real-world case studies in energy, transportation, and government sectors. This systematic approach ensures that our reporting delivers actionable, evidence-based intelligence on market segmentation, regional dynamics, and strategic imperatives for data diode adoption.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Data Diodes market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Data Diodes Market, by Offering

- Data Diodes Market, by Product

- Data Diodes Market, by Form Factor

- Data Diodes Market, by Industry Vertical

- Data Diodes Market, by Enterprise Size

- Data Diodes Market, by Distribution Channel

- Data Diodes Market, by Region

- Data Diodes Market, by Group

- Data Diodes Market, by Country

- United States Data Diodes Market

- China Data Diodes Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Synthesizing Key Findings to Illuminate Future Directions in Data Diode Deployment Cybersecurity Strategies and Critical Infrastructure Protection Initiatives

The growing convergence of operational and information networks has propelled data diodes from niche government applications into mainstream industrial cybersecurity strategies. Advances in hardware-enforced unidirectionality combined with proxy-based protocol support have expanded their deployment across energy, manufacturing, transportation, and critical infrastructure.

Simultaneously, regulatory mandates such as the EU’s NIS2 Directive and U.S. nuclear safety requirements underscore the criticality of robust network segmentation. However, the 2025 U.S. tariff environment introduces cost and supply chain complexities that necessitate resilient procurement strategies and regional manufacturing partnerships.

Key segmentation and regional trends highlight differentiated demand patterns, from high-assurance solutions in defense and utilities to ruggedized modules in harsh environments and cloud-connectivity gateways for industrial IoT. Competitive dynamics reflect a balance between specialized hardware innovation and service-oriented models, with leading providers distinguishing themselves through certification, integration capabilities, and global reach.

Ultimately, organizations that adopt a comprehensive, compliance-aligned approach to data diode integration-bolstered by diversified supply chains, strategic supplier alliances, and active policy engagement-will be best positioned to safeguard critical systems and secure future operational resilience.

Take the Next Step in Safeguarding Critical Systems Secure Your Organization’s Future with a Comprehensive Data Diode Market Research Report

Ready to fortify your organization’s defenses against evolving cyber threats? Connect with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to secure your copy of the comprehensive Data Diode market research report. Gain exclusive access to in-depth analysis, strategic insights, and bespoke guidance tailored for decision-makers. Don’t leave critical systems unprotected-take decisive action today and partner with us to elevate your security posture and operational resilience.

- How big is the Data Diodes Market?

- What is the Data Diodes Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?