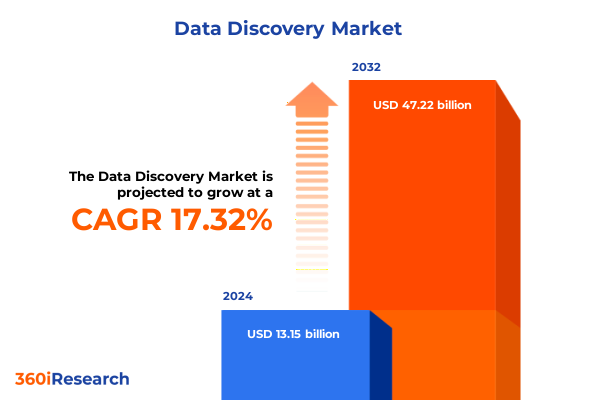

The Data Discovery Market size was estimated at USD 15.35 billion in 2025 and expected to reach USD 17.92 billion in 2026, at a CAGR of 17.41% to reach USD 47.22 billion by 2032.

Embarking on a New Era of Data Discovery That Catalyzes Intelligent Decision Making and Unleashes Strategic Potential Across the Modern Enterprise

In today’s hyperconnected world, organizations are inundated with massive volumes of data generated across myriad touchpoints. This surge in data generation has intensified the imperative for tools and methodologies that transcend traditional reporting and dashboards, enabling decision makers to unearth hidden patterns and actionable insights. As businesses aspire to harness information as a strategic asset, the role of data discovery platforms has evolved from niche analytics solutions into core components of enterprise intelligence frameworks. These platforms empower stakeholders across functions to interrogate complex datasets, explore relationships, and visualize trends without dependence on IT or specialized analysts.

Against this backdrop, the convergence of artificial intelligence, machine learning, and advanced visualization techniques has created unprecedented opportunities to accelerate insight generation. Augmented analytics features such as automated data preparation, anomaly detection, and natural language querying democratize exploration, allowing users at all levels to pose sophisticated questions and derive meaningful answers. The integration of these capabilities within scalable architectures ensures that organizations can adapt to dynamic workloads and shifting regulatory requirements. By adopting a data discovery mindset, companies can foster a culture of evidence-based decision making, enhance agility, and maintain a competitive edge in rapidly evolving markets.

Navigating Dramatic Technological Transformations and Shifting Market Dynamics That Are Redefining the Data Discovery Landscape at Unprecedented Speed

Technological innovation has catalyzed a profound transformation in the data discovery landscape, driven by breakthroughs in artificial intelligence and cloud computing architectures. The proliferation of generative AI and embedded analytics capabilities has shifted platforms from static dashboards to proactive decision engines that autonomously surface recommendations and predictive insights. Organizations increasingly rely on machine learning algorithms to detect anomalies, forecast outcomes, and assist users in interpreting complex datasets through visual narratives and augmented storytelling interfaces.

Parallel to these advancements, the acceleration of cloud adoption has reshaped deployment paradigms and cost structures. Public, private, and community cloud models now coexist alongside hybrid solutions, catering to data sovereignty concerns and performance requirements. The expansion of edge computing further extends processing capabilities closer to data sources, enabling real-time analytics for Internet of Things applications and distributed operations. Consequently, vendors and enterprises are collaborating to refine composable, modular architectures that deliver flexible scaling and seamless orchestration across multi-cloud environments.

Furthermore, escalating regulatory pressures around data privacy and governance have prompted market participants to embed lineage tracking, encryption, and policy enforcement directly within discovery tools. This integration ensures compliance with frameworks such as GDPR and CCPA while preserving agility. Natural language interfaces and low-code/no-code environments have also gained prominence, democratizing advanced analytics and fostering citizen data science. These convergent shifts underscore a new landscape in which intelligence-driven data discovery is both a technological imperative and a strategic differentiator.

Assessing the Broad Repercussions of Recent United States Tariff Measures on the Data Discovery Ecosystem and Technology Supply Chains

In early 2025, the United States implemented a series of escalating tariff measures that have significantly affected the technology sector and supply chains integral to data discovery solutions. On March 4, the administration imposed a 10 percent levy on all imports, supplemented by an increase from 10 percent to 20 percent on Chinese electronics, machinery, and industrial components. These initial actions were followed by a national emergency declaration on April 2, authorizing additional tariffs that raised duties to 54 percent on imports from China and imposed heightened rates on 57 other trading partners. Subsequent announcements on April 8 targeted semiconductors, electric vehicles, and robotics with an extra 50 percent tariff, creating a layered duty structure across critical technology categories.

These reciprocal tariffs have driven up the cost of core hardware components, including servers, networking equipment, and semiconductors. Industry reports indicate that high-end networking hardware such as routers and switches may experience price increases of 10 to 15 percent, while leading server manufacturers have reported hikes in the range of 12 to 20 percent. Organizations are responding by diversifying supplier networks, extending hardware refresh cycles, and shifting workloads to cloud environments to mitigate capital expenditures. Moreover, domestic chip fabrication initiatives have accelerated, although significant upfront investments are required to scale these operations. The cumulative impact of these policies underscores a strategic pivot toward resilient supply chains and cost optimization in the data discovery ecosystem.

Unveiling Critical Segmentation Perspectives That Illuminate How Component Types Deployment Models And Enterprise Scales Drive Data Discovery Adoption

Understanding the nuances of market segmentation is critical for tailoring data discovery strategies to diverse customer needs. Component specialization differentiates hardware solutions from software and professional services, and this distinction shapes the value proposition for each stakeholder. Hardware categories span networking equipment, servers, and storage, each delivering distinct performance and scalability characteristics. Within services, consulting engagements, system integration, and ongoing support and maintenance collectively determine successful implementation and user adoption. Software segmentation encompasses application software, middleware, and operating systems, with customer relationship management, enterprise resource planning, and supply chain management applications further specializing functionality.

Deployment mode defines how organizations balance control, flexibility, and cost. Pure cloud environments offer rapid scalability and reduced infrastructure overhead, while on-premises solutions deliver direct governance and lower latency for mission-critical workloads. Hybrid architectures merge these approaches, and cloud submodels such as community, private, and public clouds cater to different levels of control and collaboration. Enterprise size also influences deployment choices: large corporations often command dedicated resources and bespoke customizations, whereas small and medium enterprises, including micro and small segments, prioritize ease of use and cost efficiency.

Industry verticals drive solution requirements, with sectors such as banking, insurance, healthcare, manufacturing, and transportation each presenting unique data characteristics and regulatory frameworks. Finally, application use cases range from analytics and reporting to network and security management, with subcategories such as business intelligence, operational analytics, customer service management, and sales force automation guiding feature demand. By weaving these segmentation dimensions into market analysis, vendors and buyers alike can align offerings with specific operational contexts and strategic priorities.

This comprehensive research report categorizes the Data Discovery market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Enterprise Size

- Deployment Mode

- Industry Vertical

- Application

Drawing Strategic Conclusions From Regional Variations Across The Americas Europe Middle East Africa And Asia Pacific Data Discovery Landscapes

Regional patterns in data discovery adoption reveal divergent drivers and barriers that shape technology investments and strategic priorities. In the Americas, strong digital infrastructure, high levels of cloud adoption, and an established culture of analytics have positioned North American enterprises at the forefront of data-driven initiatives. According to recent industry surveys, approximately 70 to 80 percent of organizations in the United States and Canada are advancing digital transformation efforts across sectors, with significant investment in cloud services, automation, and AI technologies. Transitioning from centralized reporting to self-service platforms, businesses are fostering cross-functional teams to accelerate decision cycles and enhance governance frameworks.

Across Europe, Middle East, and Africa, regulatory frameworks such as GDPR and data sovereignty mandates have influenced deployment strategies. Companies in the United Kingdom, Germany, and France are integrating robust privacy controls and compliance mechanisms within discovery platforms, while the Nordic region leads in adoption rates due to government-backed digital initiatives and strong technical skill sets. Investments in smart manufacturing, IoT, and collaborative analytics are prevalent, although public sector caution and budget constraints temper rapid expansion in certain markets.

In Asia-Pacific, the pace of emerging technology uptake is among the highest globally, with cloud computing adoption reaching 85 percent in several markets. Developing economies, including China and India, are outpacing mature markets by embracing generative AI tools at rates 30 percent higher than their developed counterparts. National strategies promoting digital self-reliance and stimulus programs have fueled growth in edge analytics, AI-driven platforms, and data marketplaces. As connectivity improves and talent pools expand, regional diversity in use cases underscores the need for flexible, localized data discovery solutions.

This comprehensive research report examines key regions that drive the evolution of the Data Discovery market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players And Their Strategic Roles In Shaping The Competitive Data Discovery Market Dynamics And Innovation Pathways

A select group of vendors continues to shape the competitive contours of the data discovery market, each distinguished by unique capabilities and strategic positioning. Microsoft’s Power BI has emerged as the value leader, leveraging seamless integration with Microsoft 365 and Azure ecosystems. The platform’s Copilot feature enables conversational report generation, and its extensible connector library supports over 500 data sources, making it a top choice for organizations deeply embedded in the Microsoft stack.

Tableau remains the pinnacle of visual analytics, renowned for pixel-perfect, drag-and-drop interfaces and a vibrant user community that drives continuous innovation. Its AI-driven Pulse feature proactively surfaces insights and trends, enabling users to explore data narratives without requiring extensive coding expertise. Qlik Sense differentiates itself through an associative data engine that allows free-form exploration, augmented by integrated AutoML and catalog capabilities within a hybrid deployment model that balances on-premises and cloud workloads.

Emerging platforms such as ThoughtSpot harness search-driven and AI-powered analytics, empowering nontechnical users to ask questions in natural language and receive instant visualizations. The tool’s emphasis on embedded analytics and scalability positions it as a disruptor in product-centric environments. TIBCO’s Spotfire portfolio integrates advanced data science, in-memory processing, and enterprise governance, appealing to organizations with complex analytics requirements and stringent compliance needs. Meanwhile, SAS Visual Analytics continues to innovate in responsible AI and hybrid cloud architectures, offering a unified environment for reporting, exploratory discovery, and machine learning workflows that address both governance and scalability imperatives.

This comprehensive research report delivers an in-depth overview of the principal market players in the Data Discovery market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alation Inc.

- Collibra Inc.

- Google LLC

- IBM Corporation

- Informatica Inc.

- Microsoft Corporation

- MicroStrategy Incorporated

- Oracle Corporation

- QlikTech International AB

- SAP SE

- SAS Institute Inc.

- Tableau Software LLC

- TIBCO Software Inc.

Delivering Pragmatic Strategic Recommendations To Enable Industry Leaders To Harness Emerging Technologies And Maximize Data Discovery Capabilities

To navigate the rapidly evolving data discovery landscape, industry leaders must take decisive actions that balance technological innovation with pragmatic governance. Executives should prioritize the integration of augmented analytics engines within existing platforms to automate data preparation, anomaly detection, and narrative generation. By embedding AI-driven capabilities at the point of need, organizations can reduce time to insight, empower citizen analysts, and alleviate resource constraints on centralized data teams.

Simultaneously, establishing a robust data governance framework is essential to maintain trust and compliance. Leaders should implement policy-driven controls and lineage tracking that seamlessly accompany data as it flows through discovery workflows. This approach ensures adherence to regulatory requirements and protects sensitive information without impeding user agility. Cross-functional data stewards can bridge gaps between IT, legal, and business units, accelerating adoption and reducing risk.

Finally, securing strategic partnerships with cloud hyperscalers, semiconductor manufacturers, and managed service providers can mitigate supply chain uncertainties amplified by recent tariff measures. Executives should explore vendor diversification strategies and hybrid infrastructure models that optimize cost efficiency while preserving performance. By aligning investment decisions with clear use-case roadmaps and iterative pilot programs, leaders can scale solutions effectively and maintain a competitive advantage in the dynamic data discovery market.

Illustrating A Robust Research Methodology That Integrates Primary And Secondary Data Sources To Ensure Rigorous Insights And Analytical Integrity

This research is grounded in a multi-stage approach that combines quantitative surveys, qualitative interviews, and comprehensive secondary analysis. Initially, a global online survey captured insights from over three hundred enterprise decision makers across technology, finance, healthcare, manufacturing, and retail sectors. Respondents provided detailed feedback on adoption drivers, deployment preferences, and technology roadmaps, enabling statistical analysis of trends and emerging use cases.

Complementing the primary data collection, in-depth interviews were conducted with twenty senior executives and technology architects at leading vendors, service providers, and end user organizations. These dialogues illuminated strategic priorities, implementation challenges, and best practices for operationalizing data discovery initiatives. Insights from these dialogues informed the thematic framing of market dynamics and vendor positioning.

Extensive secondary research leveraged industry publications, regulatory filings, and reputable technology blogs to validate findings and ensure alignment with the latest market developments. Data triangulation techniques were applied to reconcile disparate sources, and an expert panel review provided a final layer of quality assurance. Throughout the research process, rigorous protocols were maintained to uphold objectivity, confidentiality, and analytical integrity.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Data Discovery market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Data Discovery Market, by Component

- Data Discovery Market, by Enterprise Size

- Data Discovery Market, by Deployment Mode

- Data Discovery Market, by Industry Vertical

- Data Discovery Market, by Application

- Data Discovery Market, by Region

- Data Discovery Market, by Group

- Data Discovery Market, by Country

- United States Data Discovery Market

- China Data Discovery Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2703 ]

Synthesizing Key Findings And Strategic Imperatives To Illuminate The Future Trajectory Of Data Discovery Innovation And Organizational Value Creation

In synthesizing the findings of this executive summary, it is clear that data discovery platforms have transitioned from passive reporting tools to active intelligence hubs. Organizations that embrace augmented analytics, cloud-native architectures, and robust governance frameworks stand to unlock unprecedented levels of insight and innovation. The strategic recalibration of internal processes, coupled with targeted investments in AI-driven capabilities, will differentiate leaders from laggards in a landscape defined by rapid technological convergence.

Regional disparities underscore the necessity of tailored deployment strategies, as adoption patterns in the Americas, EMEA, and Asia-Pacific reflect varying priorities around compliance, infrastructure, and talent. Similarly, the response to U.S. tariff measures highlights the importance of supply chain resilience and cost optimization in hardware and component sourcing. Competitive positioning continues to be shaped by a core group of vendors whose evolving feature sets and partnership ecosystems define the industry’s trajectory.

Ultimately, the future of data discovery hinges on collaborative ecosystems that fuse operational data, advanced analytics, and user-centric design. By adopting a unified approach that marries technological innovation with disciplined governance, organizations can elevate decision-making, foster a data-driven culture, and realize sustainable competitive advantage.

Seize The Opportunity To Unlock Comprehensive Data Discovery Market Insights By Engaging With Ketan Rohom And Accelerating Your Strategic Advantage Today

To explore the full breadth of in-depth insights and data-driven strategies within this comprehensive executive summary, please connect with Ketan Rohom, Associate Director of Sales & Marketing. Ketan brings a wealth of industry knowledge and can guide you through tailored solutions designed to propel your organization toward sustained success in the data discovery arena. Engaging directly will grant you preferential access to supplementary analyses, custom briefings, and priority support for strategic decision making. Elevate your understanding of market dynamics and secure your competitive advantage by partnering with an expert who is committed to delivering actionable intelligence on demand. Reach out today to accelerate your journey toward unlocking transformative insights and securing a leadership position in tomorrow’s data-first economy.

- How big is the Data Discovery Market?

- What is the Data Discovery Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?