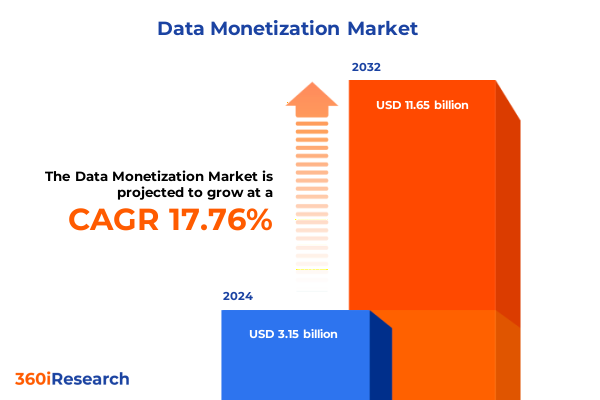

The Data Monetization Market size was estimated at USD 3.68 billion in 2025 and expected to reach USD 4.30 billion in 2026, at a CAGR of 17.89% to reach USD 11.65 billion by 2032.

Executive overview of data monetization as a strategic growth engine amid AI adoption, regulatory evolution, and shifting global trade dynamics

Data has shifted from a passive byproduct of operations to one of the most powerful levers of competitive advantage. Across sectors such as banking, healthcare, manufacturing, retail, telecom, and logistics, organizations are recognizing that their structured records, semi-structured interaction logs, and unstructured content represent monetizable assets rather than mere storage costs. At the same time, advances in cloud computing, artificial intelligence, and privacy-enhancing technologies are making it technically feasible to unlock this value at scale while maintaining compliance and trust.

Within this context, data monetization is emerging as a disciplined business capability that blends technology, governance, and commercial strategy. Internal monetization focuses on using data products and AI models to improve productivity, reduce risk, and boost existing revenue lines. External monetization extends those same assets to customers and partners through APIs, embedded analytics, and insights services, creating entirely new revenue streams. Leading organizations increasingly manage data as a portfolio of products with defined service levels, quality standards, and commercialization roadmaps, rather than as fragmented datasets scattered across business units.

At the same time, the environment in which monetization occurs is becoming more complex. Regulatory regimes such as GDPR in Europe, CCPA in California, and a growing number of national privacy and data localization laws are reshaping how data can be collected, combined, and shared. Trade policy and tariffs are influencing the economics of digital infrastructure, from semiconductors and servers to connected devices. Competitive intensity is increasing as hyperscale cloud platforms, telecom operators, and specialized data providers all seek to become the preferred channels through which data flows and value is captured. Against this backdrop, executives need a clear, segmented view of where monetization opportunities are most attractive, how regional conditions differ, and which strategic moves can deliver sustainable, compliant growth from data assets.

Transformative shifts redefining the data monetization landscape through Data as a Service, AI-driven insight delivery, and privacy-first innovation

Several powerful shifts are reshaping how organizations design and execute data monetization strategies. One of the most significant is the rise of data-as-a-service and insights-as-a-service models, where companies package curated datasets, scores, or predictions and deliver them via cloud-based platforms and APIs. Instead of selling one-off reports, providers are moving toward continuous, subscription-style access to high-value data products that can be consumed directly by customer systems. This shift rewards providers that invest in data quality, documentation, and reliability, and it pushes them to clarify the business outcomes each product supports.

AI and advanced analytics are also transforming monetization by elevating raw data into context-rich, domain-specific intelligence. Machine learning models now enable real-time customer segmentation, fraud detection, dynamic pricing, and predictive maintenance, which can be monetized internally for efficiency gains or externally as premium services. Leading enterprises are building AI-driven data platforms that treat data products as reusable building blocks, making it easier to create new monetization offerings without re-engineering pipelines each time. This product-led approach reduces time to market and encourages experimentation with new combinations of structured operational data, semi-structured interaction data, and unstructured text, image, and video assets.

Another critical shift is the growing importance of privacy and ethics as differentiators rather than constraints. The proliferation of privacy regulations and growing public concern have spurred adoption of privacy-enhancing technologies such as differential privacy, secure multiparty computation, and federated learning. These tools allow organizations to build monetization models that respect individual rights while still extracting aggregate patterns and signals. Providers that can demonstrate privacy-by-design, transparent consent management, and auditable data lineage are finding it easier to form ecosystem partnerships and secure premium pricing for their data products.

Finally, data ecosystems are becoming more collaborative and cross-industry. Banks, retailers, manufacturers, and logistics firms are partnering with technology specialists to create shared platforms where anonymized or tokenized data can be pooled to generate richer insights than any single party could achieve alone. These ecosystems rely on strong governance frameworks, standardized APIs, and shared economic models that allocate value fairly among participants. As these collaborations mature, monetization is increasingly about orchestrating flows of semi-structured and unstructured data across organizational and sector boundaries, not just monetizing isolated internal data silos.

Assessing the cumulative impact of United States tariffs through 2025 on digital infrastructure, data-rich supply chains, and monetization investment decisions

Although data itself is rarely the direct target of tariffs, the cumulative effect of United States trade measures through 2025 is reshaping the economics of the infrastructure and devices that underpin data monetization. Tariffs announced in 2024 on Chinese-made electric vehicles, lithium batteries, critical minerals, solar cells, semiconductors, and certain metals were designed to protect domestic clean-tech and advanced manufacturing but also increased the cost of key hardware inputs for data centers, networks, and connected devices. These measures have encouraged many organizations to diversify supply chains, consider nearshoring or reshoring of critical components, and renegotiate long-term infrastructure contracts.

In parallel, the second Trump administration’s reciprocal tariff regime has created significant volatility in the pricing of Chinese imports. While steep tariffs were imposed across a broad range of goods, smartphones, computers, and several categories of semiconductor devices and displays received partial relief in 2025 through specific exemptions. This carve-out reduced immediate cost pressure on endpoint devices and some hardware used in digital infrastructure, but a baseline duty on Chinese imports remains, and the threat of additional investigations into semiconductors and other strategic technologies has kept uncertainty high. For data monetization leaders, this uncertainty translates into a need for more flexible sourcing strategies, contract structures that can absorb price swings, and a stronger focus on capital-light, cloud-based deployment models where possible.

Proposed legislation such as the Foreign Pollution Fee Act of 2025 points to a future in which tariffs may increasingly be tied to the carbon intensity of production. If enacted in some form, this type of eco-tariff would raise the cost of emissions-intensive imports used in infrastructure, from steel for data centers to components in renewable energy projects that power digital facilities. Providers of data monetization solutions will need to account for these potential cost uplifts in their own capital planning and in the pricing of their services. At the same time, such policies can open new monetization avenues, such as offering emissions intelligence, supply chain transparency dashboards, and scenario analytics that help customers navigate carbon-linked trade rules.

Taken together, these trade developments are pushing organizations to design data monetization architectures that are more resilient to hardware price shocks and regional fragmentation. Strategies include multi-region cloud deployments that avoid overdependence on any single supplier, greater emphasis on software and algorithmic differentiation rather than hardware-based advantages, and monetization offerings that explicitly address customers’ needs to manage tariff and regulatory risk within their own operations.

Interpreting data monetization demand patterns across data types, pricing models, sources, applications, deployment models, industries, and firm sizes

A nuanced understanding of demand patterns across data types reveals where monetization value is most accessible. Structured data from core systems remains foundational because it provides reliable, well-governed records of transactions, customer profiles, and operational events. However, semi-structured formats such as JSON and XML have become critical in exposing that information through APIs and event streams, enabling real-time sharing with partners and customers. Unstructured content, including text, images, and video, is increasingly where differentiation occurs. Text from customer interactions and documents, images from industrial inspection or retail environments, and video from logistics and security systems can all be transformed into proprietary signals when combined with robust annotation and AI models.

Monetization strategies also hinge on the choice of pricing model. Freemium approaches, often with basic and premium tiers, are widely used to seed adoption of data products, allowing customers to experiment with low-risk access before upgrading to more comprehensive features or higher usage limits. Pay-per-use structures, based on metrics such as API calls or data storage consumption, align cost with actual usage and are favored by developers and digital-native firms that value flexibility. Subscription models, offered in monthly or annual forms, provide predictable revenue for providers and predictable budgeting for buyers, especially when tied to tiered feature bundles. Transaction-based pricing, whether measured by the number of data transactions processed or the volume of queries executed, is gaining traction where data services are tightly coupled to business outcomes such as payments, orders, or risk decisions.

The source of data plays an equally important role. Internal data from CRM, ERP, and IoT systems underpins many high-margin monetization initiatives because it is proprietary and often difficult for competitors to replicate. When this internal data is enhanced with external sources such as market intelligence and social media signals, or with partner-contributed datasets from third parties and vendors, it becomes possible to generate cross-industry insights and benchmarks that command premium pricing. Successful monetization programs therefore invest heavily in integrating internal and external feeds, harmonizing schemas across semi-structured and unstructured formats, and establishing governance frameworks that clarify rights and restrictions for each source.

End-use industries demonstrate distinct patterns of adoption. In financial services, banking, capital markets, and insurance institutions focus monetization on credit risk models, fraud analytics, regulatory reporting, and personalized product recommendations. Government agencies at federal, state, and local levels leverage data to improve citizen services, optimize resource allocation, and support transparency, but they must balance monetization with strong public interest and privacy obligations. Healthcare organizations, spanning diagnostic providers, hospitals, and pharmaceutical companies, are using clinical, operational, and real-world evidence data to support research collaborations and outcome-based models while navigating strict confidentiality and ethical requirements. IT and telecom firms monetize network, device, and service usage data by offering analytics and platform capabilities to other industries. Manufacturers, in both discrete and process segments, are driving revenue through equipment performance and supply chain visibility data, while retailers, across offline and online channels, are monetizing customer journey and basket data to support suppliers and advertisers. Transportation and logistics providers in air, rail, road, and sea are building value-added services around shipment tracking, route optimization, and capacity intelligence.

Deployment choices further influence monetization economics. Cloud-native delivery, whether in public or private environments, makes it easier to scale data products globally, rapidly launch new features, and use pay-as-you-go economics to align infrastructure cost with usage. Hybrid deployments, including multi-cloud and more traditional hybrid architectures, enable organizations to keep sensitive data on-premise or in private environments while exposing aggregated or anonymized outputs through external channels. Pure on-premise deployments remain relevant in highly regulated sectors or where latency and control requirements are particularly strict, but even here, organizations are modernizing with containerization and data fabrics to enable more agile monetization.

Applications of data monetization span the full customer and risk lifecycle. Marketing optimization use cases, such as campaign management and granular customer segmentation, enable organizations to package audience insights and performance benchmarks as services to brands and agencies. Predictive analytics, including churn prediction and demand forecasting, supports subscription-based insight offerings where customers pay for forward-looking indicators rather than raw historical data. Reporting and business intelligence applications, from ad hoc reporting environments to executive dashboards, are increasingly offered as embedded analytics within broader platforms, creating opportunities to upsell premium visualization, benchmarking, and governance features. Risk management use cases, covering credit and operational risk, are being commercialized as decision engines and scoring services. Text and sentiment analysis, applied to customer feedback and social media monitoring, underpins a growing class of reputational and experience analytics products.

Organization size shapes how these opportunities are realized. Large enterprises typically have broader datasets, more complex governance structures, and the resources to build sophisticated internal and external monetization capabilities. They often establish centralized data product teams and marketplaces to coordinate demand across business units. Small and medium enterprises, by contrast, tend to adopt modular, cloud-based offerings that allow them to monetize specific data assets or integrate third-party data without heavy upfront investment. For both segments, success depends on aligning monetization initiatives with clear business outcomes and ensuring that pricing, delivery, and support models are appropriate for their customer base.

This comprehensive research report categorizes the Data Monetization market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Data Type

- Pricing Model

- Data Source

- End Use Industry

- Deployment Model

- Application

- Organization Size

Regional perspectives on data monetization maturity and opportunity across the Americas, Europe, Middle East and Africa, and Asia-Pacific ecosystems

Regional conditions strongly influence how data monetization strategies are designed and executed. In the Americas, the United States and Canada anchor a mature ecosystem of cloud platforms, analytics providers, and digital-native enterprises. Organizations operate under a patchwork of federal and state or provincial regulations, including strong privacy and consumer protection rules, yet they benefit from deep capital markets and a high concentration of technical talent. Latin American markets are advancing rapidly as financial inclusion initiatives, e-commerce growth, and public-sector digitalization create rich data sources that can be monetized through risk models, alternative credit scoring, and cross-border trade intelligence. Across the region, firms are investing in interoperable platforms that can serve multiple jurisdictions while respecting local data residency requirements.

Europe, the Middle East, and Africa present a diverse but increasingly interconnected landscape. European Union member states operate under GDPR and a suite of emerging regulations governing data sharing, AI, and data intermediaries, which place rigorous obligations on consent, transparency, and purpose limitation. These frameworks have encouraged organizations to formalize governance and invest in privacy-enhancing technologies, making European providers well positioned to offer trusted, compliance-centric data products. In the Middle East, ambitious national digital strategies and smart-city programs are driving large-scale investments in cloud infrastructure and AI capabilities, opening monetization opportunities in public services, energy, and transportation. African markets are building digital financial services, mobile connectivity, and government data platforms that generate high-value datasets, though infrastructure gaps and capacity constraints remain challenges that providers must address through lightweight, mobile-first solutions.

Asia-Pacific is emerging as one of the most dynamic regions for data monetization. Countries such as China, India, and several Southeast Asian economies are experiencing rapid digitization across payments, commerce, manufacturing, and logistics. At the same time, many markets in the region are implementing data localization rules and sector-specific regulations that shape how data can cross borders and be commercialized. Digital hubs such as Singapore, Hong Kong, and parts of Australia are positioning themselves as regional centers for data-driven finance and platform businesses, providing stable regulatory environments and advanced connectivity. Across Asia-Pacific, providers must navigate a mix of high-growth, innovation-friendly environments and more restrictive regulatory regimes, adapting their deployment and pricing models to local expectations while maintaining a coherent global strategy.

Across all three broad regions, organizations are increasingly sensitive to the geopolitical and trade dynamics that affect digital infrastructure supply chains. Tariffs, export controls, and cross-border data rules can influence where data centers are located, how redundancy is designed, and which partners are chosen for connectivity and cloud services. As a result, leading data monetization strategies are explicitly regionalized, with differentiated offerings, routing, and governance tailored to the Americas, Europe–Middle East–Africa, and Asia-Pacific while still leveraging global platforms and common data product frameworks where feasible.

This comprehensive research report examines key regions that drive the evolution of the Data Monetization market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic positioning of leading technology, telecom, financial, and platform providers shaping competition in enterprise data monetization solutions

The competitive landscape in data monetization is shaped by several interlocking groups of companies. Large cloud and platform providers sit at the center of many strategies, offering infrastructure, data stores, machine learning services, and marketplaces that enable enterprises to build and distribute data products. Their platforms increasingly support native capabilities for cataloging, privacy controls, lineage, and monetization workflows, positioning them as both enablers and competitors for enterprises that might otherwise build their own channels.

Enterprise software vendors and consulting firms play a complementary role, providing tools and services that help organizations identify monetizable data assets, design data products, and operationalize governance. They often combine domain knowledge in sectors such as banking, insurance, manufacturing, and retail with horizontal capabilities in analytics, integration, and AI. This enables them to package industry-specific solutions, such as risk scoring engines, demand forecasting services, or supply chain visibility platforms, that can be adopted by multiple clients and monetized through subscription or outcome-based models.

Telecommunications operators and network providers are increasingly important players, leveraging their visibility into device, location, and traffic patterns to offer analytics and data services to advertisers, urban planners, and enterprise customers. With 5G and edge computing deployments, these firms can deliver low-latency insights and support monetization of IoT, connected vehicle, and industrial applications. Financial data providers, including credit bureaus and payment networks, continue to be central to monetization ecosystems through their deep stores of behavioral and transactional data, but they are under pressure to enhance transparency, fairness, and explainability in their models.

A growing cohort of specialized data marketplaces, aggregators, and vertical-focused startups is adding competitive intensity. Some focus on particular data types, such as geospatial, environmental, or IoT telemetry, while others concentrate on verticals like healthcare, retail media, or logistics. They differentiate through curation quality, domain-specific schemas, privacy-by-design architectures, and flexible pricing models that span freemium access, pay-per-use APIs, and transaction-linked fees. Partnerships, joint ventures, and acquisitions are frequent as companies seek to combine complementary data assets, expand their geographic footprint, or gain access to niche capabilities such as privacy-enhancing technologies or explainable AI.

Overall, competition is shifting from simple access to raw data toward the delivery of integrated, outcome-oriented solutions. Providers that can combine robust data engineering, strong governance, sophisticated modeling, and intuitive interfaces into coherent offerings are best positioned to capture a disproportionate share of value, even as they rely on broader ecosystems for infrastructure and distribution.

This comprehensive research report delivers an in-depth overview of the principal market players in the Data Monetization market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture plc

- Alphabet Inc.

- Amazon.com, Inc.

- Cloudera, Inc.

- Domo, Inc.

- International Business Machines Corporation

- Microsoft Corporation

- Oracle Corporation

- Salesforce, Inc.

- SAP SE

- Snowflake Inc.

- Teradata Corporation

Actionable strategic recommendations to accelerate responsible data monetization, strengthen governance, and unlock resilient, recurring digital revenue streams

To translate the structural trends described in this analysis into tangible outcomes, industry leaders need deliberate, staged action. A practical starting point is to establish a comprehensive inventory of data assets across structured systems, semi-structured logs, and unstructured repositories such as documents, multimedia, and sensor feeds. By evaluating each asset in terms of uniqueness, quality, regulatory sensitivity, and potential use cases, organizations can prioritize which datasets merit investment as formal data products. This exercise should be tightly linked to business strategy so that monetization efforts focus on problems that matter, such as customer retention, risk reduction, or operational efficiency.

Strengthening governance is equally critical. Executives should sponsor unified policies for data ownership, access, consent, and retention that apply consistently across business units and regions. Implementing robust metadata management, lineage tracking, and automated controls helps ensure that monetization initiatives remain compliant with evolving privacy and industry regulations. Investing in privacy-enhancing technologies and ethical review processes enables organizations to design products that can scale globally while maintaining trust with customers, partners, and regulators.

On the commercial side, leaders should move beyond ad hoc pricing to deliberate experimentation with multiple models. For some products, a freemium entry point with basic functionality or limited volume can accelerate adoption, while premium tiers unlock richer features, broader coverage, or advanced analytics. In other cases, pay-per-use, subscription, or transaction-linked structures may better align with customer value realization. Systematically testing different models, monitoring customer behavior, and iterating on packaging can significantly increase revenue yield from the same underlying datasets.

Ecosystem partnerships are another essential pillar of an actionable strategy. By collaborating with technology platforms, industry consortia, and complementary data providers, organizations can enrich their offerings, expand distribution, and access new segments without bearing all the infrastructure and go-to-market costs themselves. These partnerships should be grounded in clear contractual frameworks that define rights to derived insights, revenue-sharing mechanisms, and responsibilities for governance and security.

Finally, leaders should invest in culture and skills. Monetization success depends on cross-functional teams that combine data engineering, data science, product management, legal, and commercial capabilities. Establishing incentives that reward data-driven innovation, training programs that build literacy in AI and analytics, and leadership narratives that position data as a strategic asset all help embed monetization into the fabric of the organization rather than leaving it as a side project within IT or analytics teams.

Research methodology combining primary insights, secondary intelligence, and rigorous analytical frameworks to contextualize global data monetization dynamics

The findings summarized in this executive overview are grounded in a structured research methodology that integrates multiple sources and analytical approaches. Primary research includes interviews and briefings with executives, product leaders, and technical specialists across key end-use industries such as financial services, government, healthcare, telecommunications, manufacturing, retail, and transportation. These conversations provide firsthand perspectives on adoption patterns, governance challenges, and the commercial performance of different monetization models.

Secondary research draws on publicly available policy documents, regulatory guidance, vendor white papers, academic literature, technology blogs, news coverage, and corporate disclosures related to data platforms, AI, privacy, and trade policy. Particular attention is given to the evolution of major regulatory frameworks, cross-border data rules, and tariff measures that affect digital infrastructure, as well as to documented best practices in data product management and AI-driven analytics.

Analytically, the research employs a combination of qualitative and quantitative techniques. Segmentation models are used to structure the market by data type, pricing model, data source, deployment model, application, end-use industry, and organization size, enabling consistent comparison of trends across these dimensions. Scenario-based reasoning is applied to assess the implications of regulatory and tariff developments for infrastructure strategy and monetization economics. Throughout, the emphasis remains on practical implications for decision-makers rather than on deriving numerical estimates, ensuring that the conclusions are both robust and directly actionable for executives seeking to align data strategy with broader business objectives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Data Monetization market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Data Monetization Market, by Data Type

- Data Monetization Market, by Pricing Model

- Data Monetization Market, by Data Source

- Data Monetization Market, by End Use Industry

- Data Monetization Market, by Deployment Model

- Data Monetization Market, by Application

- Data Monetization Market, by Organization Size

- Data Monetization Market, by Region

- Data Monetization Market, by Group

- Data Monetization Market, by Country

- United States Data Monetization Market

- China Data Monetization Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 4929 ]

Conclusion on the strategic trajectory of data monetization as enterprises integrate AI, compliance, and ecosystem partnerships into value creation

The analysis of data monetization presented in this executive summary underscores that data is now central to value creation across industries and geographies. Organizations are moving from viewing data as a byproduct of operations to managing it as a portfolio of products that can improve internal performance and generate external revenue. AI, cloud platforms, and privacy-enhancing technologies are extending what is technically feasible, while stricter regulation and shifting trade policies are raising the bar for governance and strategic resilience.

Segmentation by data type, source, pricing, deployment, application, industry, and organization size reveals that monetization opportunities are widely distributed but not evenly accessible. Structured datasets provide essential backbone value, semi-structured formats enable interoperability and real-time access, and unstructured content increasingly delivers differentiation when paired with advanced analytics. Industry-specific requirements, regional regulatory differences, and organizational capabilities all shape which combinations of assets and models are most effective.

Looking ahead, the organizations most likely to succeed will be those that treat data monetization as an enduring, cross-functional capability rather than a series of isolated projects. They will invest in strong governance, flexible architectures, and ecosystem partnerships, while continuously experimenting with new products and pricing schemes. By doing so, they can not only generate incremental revenue but also build more adaptive, insight-driven business models that remain resilient amid technological disruption, regulatory evolution, and geopolitical uncertainty.

Call to engage with Ketan Rohom for tailored guidance and access to the comprehensive data monetization market intelligence report

Turning insight into impact ultimately depends on decisive action. The analysis presented here demonstrates that data monetization is no longer an experimental initiative but a core strategic capability that separates leaders from laggards across industries and regions. Organizations that move quickly to formalize data products, strengthen governance, and activate commercial models can transform data from a byproduct of operations into a durable, compounding revenue engine.

To translate these opportunities into tangible outcomes, industry executives are encouraged to engage directly with Ketan Rohom, Associate Director, Sales & Marketing. He can guide decision-makers through the full findings of the research, including deeper views of data type and application opportunities, regional adoption patterns, competitive positioning, and best practices in governance and pricing design. This dialogue can help tailor the report’s insights to specific strategic priorities, whether that means accelerating external data partnerships, optimizing internal analytics monetization, or navigating new tariff and regulatory pressures on digital infrastructure.

By securing access to the comprehensive market intelligence report through Ketan Rohom, leaders gain more than a static document. They gain a structured blueprint for building monetization roadmaps, aligning stakeholders, and sequencing investments to deliver measurable financial and strategic value from data assets. In an environment where technology, policy, and competition are shifting in tandem, this level of clarity and guidance can be the difference between incremental improvement and transformative advantage.

- How big is the Data Monetization Market?

- What is the Data Monetization Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?