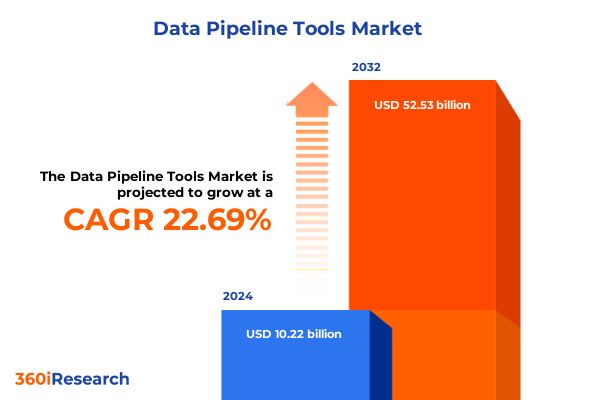

The Data Pipeline Tools Market size was estimated at USD 12.53 billion in 2025 and expected to reach USD 15.14 billion in 2026, at a CAGR of 22.71% to reach USD 52.53 billion by 2032.

Setting the Stage for Modern Data Pipeline Excellence by Examining Core Drivers, Challenges, and Opportunities Shaping the Data-Driven Enterprise

Modern organizations generate and process data at unprecedented volumes, velocity, and variety. As a result, the tools and frameworks that underpin data pipelines have become indispensable for translating raw data into actionable intelligence. By adopting robust ingestion mechanisms, organizations can seamlessly integrate disparate sources, while sophisticated transformation engines normalize and enrich data to drive analytics and decision making. Within this dynamic landscape, the imperative to maintain observability and orchestration ensures end-to-end reliability and efficiency, mitigating risks associated with latency, bottlenecks, and failures.

Against this backdrop, it is essential to recognize the strategic importance of data pipelines in powering advanced analytics, machine learning, and real-time dashboards. In this executive summary, we will explore the transformative shifts shaping the ecosystem, the cumulative impact of United States tariffs in 2025 on core infrastructure, and the critical insights derived from granular segmentation. We will also highlight regional variances, notable vendors, and actionable recommendations designed to guide industry leaders in optimizing their pipeline architectures. Ultimately, our goal is to provide a clear, authoritative understanding of the current state of data pipeline tools, equipping decision-makers with the knowledge needed to architect resilient, future-ready data infrastructures.

Unleashing Next-Generation Data Pipelines Through Cloud Native Architectures, Real-Time Processing Demands, AI-Driven Automation, and Observability Capabilities

Over the past several years, the data pipeline landscape has experienced a series of transformative shifts driven by the convergence of cloud native architectures and the insatiable demand for real-time processing. Organizations are increasingly migrating to cloud platforms to capitalize on elastic scaling and managed services that simplify complexity while reducing operational overhead. Concurrently, the rise of streaming analytics has shifted the focus from batch-oriented ingestion to continuous data flows, empowering businesses to detect anomalies and respond to events as they occur.

In parallel, the integration of artificial intelligence and machine learning capabilities directly into pipeline workflows has elevated the importance of automated metadata management and intelligent orchestration. These advancements, coupled with growing emphasis on observability, have redefined how organizations monitor and troubleshoot pipelines, ensuring data quality and reliability at every stage. As regulatory frameworks around data privacy and security evolve, compliance has become a cornerstone consideration, compelling pipeline architects to embed rigorous auditing and governance controls within their environments. Collectively, these shifts underscore a fundamental evolution toward agile, self-healing pipelines that can adapt to changing business requirements and technological innovations.

Analyzing the Ripple Effects of 2025 United States Tariffs on Data Storage Hardware Costs, Cloud Expenses, Supply Chain Dynamics, and Mitigation Approaches

In 2025, the introduction of new United States tariffs targeted at data storage hardware and select network infrastructure components has had a ripple effect on the broader data pipeline ecosystem. Elevated duties on storage arrays, solid-state drives, and enterprise-grade networking gear have led to increased capital expenditures for on-premises deployments. These cost pressures have prompted organizations to reassess their infrastructure strategies, accelerating shifts toward cloud and hybrid models to mitigate the impact of supply chain slowdowns and tariff-induced price fluctuations.

Moreover, cloud service providers have adjusted their pricing structures in response to increased input costs, leading to moderate upticks in consumption-based storage and data transfer fees. To counteract these financial challenges, many enterprises are deploying optimization frameworks that include tiered storage architectures, data lifecycle management policies, and staged migration of long-tail data to lower-cost cloud archives. Additionally, strategic partnerships with hardware suppliers that offer tariff engineering solutions have proven effective in redirecting shipments and leveraging alternative sourcing routes. Through a combination of cloud-native strategies and supply chain resilience initiatives, organizations can navigate tariff headwinds while preserving data pipeline performance and cost-efficiency.

Exploring Critical Segmentation Frameworks Covering Component to Vertical Perspectives for In-Depth Data Pipeline Market Insights

A nuanced understanding of the market emerges when exploring segmentation through multiple lenses, beginning with component architectures. Data ingestion capabilities, spanning batch and real-time modalities, form the pipeline’s gateway, while observability tools encompassing alerting, logging, and metrics monitoring ensure ongoing health and performance. Workflow orchestration and pipeline automation provide the command center that coordinates complex processes, and underlying storage layers, including data lakes, warehouses, and databases, deliver optimized environments for raw and structured data. Finally, transformation engines operating on ELT and ETL paradigms enrich and prepare data for downstream analytics, each component offering distinct advantages for specific use cases.

Examining deployment environments reveals that cloud-native models dominate new implementations, though hybrid approaches maintain appeal for organizations balancing legacy investments with public cloud agility. On-premises solutions remain relevant where data sovereignty or latency concerns persist, particularly in regulated industries. Analyzing data collection types, batch-oriented workloads coexist with streaming scenarios driven by IoT and real-time analytics. Organizational scale further differentiates requirements: enterprise teams demand enterprise-grade SLAs and cross-geography collaboration, midmarket groups prioritize simplicity and cost management, while small and medium businesses favor turnkey, subscription-based offerings. User personas, from business analysts to data engineers, scientists, and IT administrators, influence feature priorities. Diverse pricing strategies, whether license fees, open-source models, pay-as-you-go billing, or subscription plans, cater to varied budget cycles. Industry verticals such as BFSI, government, healthcare, IT telecom, and retail present unique regulatory and performance considerations that shape solution design and delivery.

This comprehensive research report categorizes the Data Pipeline Tools market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment Mode

- Data Type

- Organization Size

- End User

- Industry Vertical

Delving into Regional Dynamics Shaping Data Pipeline Adoption with Insights into Growth Drivers and Technological Maturity Across Key Global Markets

Regional dynamics profoundly influence data pipeline adoption, reflecting differing regulatory landscapes, technology maturities, and investment priorities. In the Americas, organizations benefit from mature public cloud ecosystems and a strong startup culture, driving rapid uptake of managed services, serverless functions, and edge processing. Cost optimization and scalability remain top priorities, with many enterprises leveraging multi-region deployments to ensure resilience and compliance with data sovereignty regulations. As a result, North and Latin American markets have become proving grounds for innovative pipeline architectures that integrate real-time analytics, AI workflows, and advanced observability frameworks.

In Europe, the Middle East, and Africa, stringent data protection regulations and privacy mandates compel a balanced approach between cloud and on-premises deployments. Organizations in this region place significant emphasis on data governance, interoperability, and vendor neutrality, often selecting hybrid models that align with compliance requirements and local market nuances. By contrast, the Asia-Pacific region is experiencing rapid digital transformation, with emerging economies demonstrating strong investments in cloud infrastructure, edge analytics for IoT, and government-led initiatives that accelerate smart city and healthcare deployments. Across all regions, partnerships with local system integrators and managed service providers play a crucial role in tailoring pipeline solutions to specific market demands.

This comprehensive research report examines key regions that drive the evolution of the Data Pipeline Tools market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Showcasing Strategic Leadership and Disruptive Innovation Among Top Data Pipeline Providers Advancing Integration, Orchestration, Storage, and Transformation

The competitive landscape of data pipeline solutions is characterized by a blend of established leaders and agile disruptors, each driving unique innovations. Longstanding enterprise vendors continue to expand integration suites with prebuilt connectors and low-code interfaces, aiming to streamline complex ingestion and transformation tasks. At the same time, open-source projects have gained momentum by offering modular, community-driven components that foster rapid customization and cost-effective deployments. New entrants focus on specialized capabilities, such as automated metadata management, AI-enabled anomaly detection, and cloud-agnostic orchestration layers that address the growing need for portability and interoperability.

Collaborations and partnerships further distinguish frontrunners, as vendors integrate observability modules from leading monitoring platforms and forge alliances with cloud hyperscalers to deliver fully managed, end-to-end pipelines. These strategic moves not only enhance feature sets but also align pricing models with consumption-driven realities, enabling customers to adopt pay-as-you-go plans or subscription frameworks that match evolving workloads. As competition intensifies, differentiation hinges on the ability to offer seamless user experiences, robust security and governance controls, and the flexibility to handle hybrid and multicloud architectures at scale.

This comprehensive research report delivers an in-depth overview of the principal market players in the Data Pipeline Tools market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture plc

- Airbyte, Inc.

- Amazon Web Services, Inc.

- Confluent, Inc.

- Databricks, Inc.

- DataKitchen, Inc.

- DBT Labs, Inc.

- Deloitte Touche Tohmatsu Limited

- Entrans

- Fivetran, Inc.

- Google LLC

- Hevo Data, Inc.

- Informatica, Inc.

- Matillion, Inc.

- Microsoft Corporation

- Rivery, Inc.

- Snowflake Inc.

- StreamSets, Inc.

- Talend, Inc.

- The Apache Software Foundation

Empowering Industry Leaders with Operational and Strategic Recommendations to Enhance Efficiency, Resilience, and Innovation in Data Pipeline Implementations

To steer data pipeline initiatives toward success, industry leaders should prioritize a set of actionable strategies. First, embracing cloud-native architectures and managed services can reduce operational complexity while enhancing scalability. Adopting unified observability platforms that consolidate logging, metrics, and tracing will provide holistic visibility across distributed components and empower rapid issue resolution. Organizations should also standardize metadata management and implement data contracts to ensure consistent lineage, quality, and compliance throughout pipeline stages.

From an organizational perspective, fostering cross-functional collaboration between data engineers, scientists, and business stakeholders is crucial for aligning technical roadmaps with strategic objectives. Implementing iterative development cycles and integrating automated testing frameworks will accelerate delivery and minimize risk. Financially, firms should leverage flexible pricing models-such as pay-as-you-go or subscription plans-to align costs with usage patterns and avoid overprovisioning. Lastly, cultivating strategic vendor relationships and participating in consortiums or open-source communities can provide early access to emerging innovations and accelerate time-to-value.

Detailing a Robust Research Methodology Integrating Primary and Secondary Data Collection, Expert Interviews, and Validation for Data Pipeline Insights

Our research methodology integrates primary and secondary data sources to deliver a comprehensive, unbiased view of the data pipeline market. Primary inputs include in-depth interviews with technology executives, architects, and engineers responsible for designing and operating high-scale pipelines. These conversations reveal real-world challenges and priorities, from latency optimization to regulatory compliance. Secondary research encompasses industry publications, technical whitepapers, and vendor documentation to map the evolving feature sets and deployment models employed across sectors.

To ensure robustness and accuracy, we applied rigorous validation processes, cross-referencing insights with anonymized usage data from major cloud platforms and open-source community activity. We also conducted scenario-based analyses to evaluate how tariffs, regional regulations, and emerging technologies influence adoption patterns. Our segmentation framework was refined through iterative expert workshops, ensuring that component categories, deployment modes, data collection types, organization scales, user personas, pricing models, and vertical markets accurately reflect diverse use cases and strategic imperatives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Data Pipeline Tools market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Data Pipeline Tools Market, by Component

- Data Pipeline Tools Market, by Deployment Mode

- Data Pipeline Tools Market, by Data Type

- Data Pipeline Tools Market, by Organization Size

- Data Pipeline Tools Market, by End User

- Data Pipeline Tools Market, by Industry Vertical

- Data Pipeline Tools Market, by Region

- Data Pipeline Tools Market, by Group

- Data Pipeline Tools Market, by Country

- United States Data Pipeline Tools Market

- China Data Pipeline Tools Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Summarizing the Critical Role of Advanced Data Pipeline Frameworks in Driving Organizational Agility, Data-Driven Decision Making, and Competitive Advantage

Advanced data pipeline frameworks lie at the heart of organizations’ ability to transform raw information into strategic outcomes. By enabling seamless data flow, automated transformations, and real-time analytics, these pipelines empower businesses to make faster, more informed decisions and maintain a competitive edge. As the landscape continues to evolve with new regulatory requirements, technological breakthroughs, and shifting cost dynamics, a forward-looking approach to pipeline architecture is essential.

Ultimately, success hinges on selecting the right blend of components and deployment models that align with organizational goals, operational constraints, and user needs. By leveraging the insights and recommendations presented in this summary, decision-makers can architect resilient, scalable, and cost-effective data pipelines that drive sustained business value. As the reliance on data intensifies, investing in the right tools and strategies will differentiate industry leaders from followers, ensuring long-term growth and innovation.

Accelerate Your Data Pipeline Strategy with Expert Guidance—Reach Out to Ketan Rohom Today to Secure the Comprehensive Market Research Report and Exclusive Insights

We invite you on a journey to transform data into a strategic asset by leveraging the comprehensive insights contained within our market research report. Our analysis has been carefully crafted to empower your organization to navigate the complexities of modern data pipelines, overcome key challenges, and seize emerging opportunities. By engaging directly with Ketan Rohom, Associate Director of Sales & Marketing, you gain exclusive access to expert guidance tailored to your unique business objectives. Reach out today to request a personalized consultation, secure your copy of the full report, and unlock the actionable intelligence that will accelerate your data pipeline strategy and deliver measurable impact.

- How big is the Data Pipeline Tools Market?

- What is the Data Pipeline Tools Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?