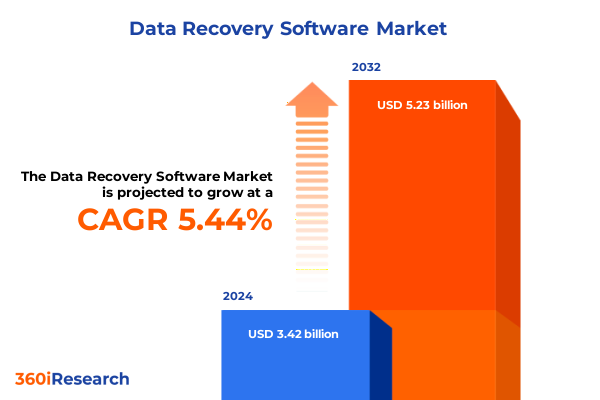

The Data Recovery Software Market size was estimated at USD 3.59 billion in 2025 and expected to reach USD 3.77 billion in 2026, at a CAGR of 5.52% to reach USD 5.23 billion by 2032.

Understanding the Critical Role of Data Recovery Solutions in Safeguarding Enterprise Continuity Amid Increasing Digital Threats in 2025

The exponential growth of data generation coupled with escalating cyber threats has elevated data recovery from a back‐office support function to a strategic imperative. Organizations across sectors recognize that downtime not only erodes revenue but can irreparably damage brand reputation and customer trust. In recent years, the convergence of digital transformation initiatives and ransomware proliferation has created an environment where proactive data recovery planning is essential for maintaining continuity and resilience. This introduction provides a foundational overview of the core drivers influencing the demand for advanced data recovery solutions, emphasizing their pivotal role in aligning IT strategies with broader business objectives.

As enterprises increasingly rely on digital platforms for critical operations, the capability to restore data swiftly and reliably has become synonymous with operational agility. Whether recovering from logical failures-such as file corruption, accidental deletion, or software glitches-or addressing physical hardware damage caused by component failures or environmental factors, robust recovery technologies serve as the backbone of modern information governance. Moreover, with heightened regulatory scrutiny around data retention and confidentiality, organizations must implement recovery processes that adhere to compliance mandates while minimizing risk. This section sets the stage for a deep dive into transformative market shifts and strategic considerations that are reshaping the data recovery software landscape.

Charting the Impact of Cloud Adoption, Artificial Intelligence Integration, and Evolving Cybersecurity Risks on Modern Data Recovery Software Offerings

The data recovery software market is undergoing a profound transformation driven by several converging technological and regulatory trends. Foremost among these is the widespread adoption of cloud architectures, which has shifted recovery strategies from traditional on‐premises backup appliances to hybrid and fully cloud‐native approaches. This paradigm shift demands solutions that can orchestrate seamless data restoration across distributed environments, enabling organizations to achieve near‐zero recovery point objectives while leveraging elastic storage and compute resources.

In parallel, artificial intelligence and machine learning capabilities are being embedded into recovery platforms to automate root‐cause analysis, predict potential data loss scenarios, and optimize restoration workflows. These innovations not only reduce manual intervention and human error but also accelerate recovery times in critical situations. Concurrently, regulatory frameworks-ranging from data sovereignty mandates in Europe to sector‐specific compliance requirements in healthcare and finance-are forcing vendors to refine their offerings with enhanced encryption, audit trails, and role‐based access controls. As ransomware actors evolve their tactics through ransomware‐as‐a‐service models and double‐extortion schemes, the symbiotic integration of security and recovery functions has become a non‐negotiable requirement for enterprise IT teams.

Analyzing the Cumulative Implications of 2025 United States Tariff Policies on Data Recovery Hardware Costs and Software Deployment Strategies

In 2025, tariffs imposed by the United States on imported storage components, memory modules, and semiconductor devices have created headwinds for hardware‐dependent recovery solutions. As duties on critical hardware spiked, recovery appliance manufacturers and integrators faced increased input costs, which were frequently passed on to end users through higher equipment pricing. This shift pushed many organizations to reassess their reliance on physical media and appliance‐centric recovery kits, accelerating the transition toward software‐driven and virtualized recovery models that minimize hardware dependencies.

The cumulative effect of these tariff policies also reverberated through supply chains, leading to prolonged lead times for specialized recovery hardware and repair services. In response, recovery software providers intensified their focus on subscription‐based licensing, where software updates, virtual appliances, and cloud credits can be delivered with minimal hardware intervention. This strategic pivot allowed enterprises to insulate their operations from tariff volatility while ensuring access to the latest features and performance optimizations. Ultimately, the 2025 tariff environment catalyzed a shift in procurement strategies and vendor offerings, underscoring the importance of agility and flexibility in recovery solution design and deployment.

Uncovering Critical Market Segmentation Insights Across Recovery Types, Licensing Models, Applications, End Users, Deployments, and Organization Sizes

A nuanced understanding of market segmentation reveals where data recovery solution providers must tailor their offerings to meet diverse customer needs. Recovery type segmentation distinguishes between logical recovery methods-such as file system restoration and database rollbacks-and physical recovery techniques targeting damaged storage media. Licensing models further segment the market into perpetual licenses that appeal to organizations preferring capital expenditure control and subscription models that resonate with enterprises seeking operational expenditure predictability and continuous feature updates.

Application‐specific segmentation highlights the growing demand for specialized capabilities, including database recovery engines optimized for high‐volume transactional systems, email recovery utilities designed for complex messaging platforms, and RAID recovery tools capable of handling multi‐disk array failures. In addition, sectors such as banking, financial services, and insurance (BFSI) require stringent recovery guarantees, while government agencies prioritize data sovereignty and archival integrity. Deployment models likewise bifurcate along cloud and on‐premises lines, with the cloud segment further differentiated by private and public deployments to align with distinct security and compliance imperatives. Finally, organizational size influences purchasing behavior, as large enterprises often engage in multi‐vendor, enterprise‐wide recovery strategies, whereas small and medium‐sized businesses typically favor turnkey solutions with rapid deployment cycles.

This comprehensive research report categorizes the Data Recovery Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Recovery Type

- Charge Mode

- Application

- End User

- Deployment Model

- Organization Size

Revealing Key Regional Dynamics Shaping the Data Recovery Software Market Across the Americas, Europe Middle East Africa, and Asia Pacific Territories

Regional dynamics play a pivotal role in shaping the competitive landscape of data recovery software. In the Americas, elevated IT spending and stringent regulatory frameworks-particularly in sectors such as finance and healthcare-have driven rapid adoption of hybrid and multi‐cloud recovery solutions. Enterprises in North America are increasingly partnering with hyperscale cloud providers to leverage advanced recovery orchestration and disaster recovery as a service offerings.

Across Europe, the Middle East, and Africa, data sovereignty regulations and GDPR compliance requirements exert a strong influence on vendor selection. Organizations in these regions are gravitating toward recovery platforms that offer localized data storage controls, enhanced encryption, and comprehensive audit reporting. Meanwhile, the Asia‐Pacific market exhibits robust growth potential driven by expanding digital transformation initiatives in emerging economies. Cost sensitivity in these markets has fueled demand for scalable, subscription‐based recovery models and modular solutions that can address both on‐premises and cloud use cases. Together, these regional variations underscore the importance of adaptive go‐to‐market strategies capable of addressing diverse regulatory landscapes and technological maturity levels.

This comprehensive research report examines key regions that drive the evolution of the Data Recovery Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Data Recovery Software Vendors and Innovators Driving Competitive Differentiation Through Technology, Partnerships, and Service Excellence

Leading players in the data recovery software space are differentiating themselves through technological innovation, strategic alliances, and comprehensive service portfolios. Established vendors with decades of domain expertise are expanding their offerings to include AI‐driven analytics, cloud orchestration modules, and ransomware detection integrations. Emerging specialists are carving out niches by focusing on high‐performance database restore engines, rapid file‐level recovery for virtual environments, and lightweight mobile recovery utilities.

Partnerships with cloud service providers have become a hallmark of competitive differentiation, enabling vendors to embed their recovery orchestration capabilities directly into public and private cloud platforms. In parallel, collaborations with storage hardware manufacturers ensure optimized performance for hybrid deployments. Some companies are investing heavily in research and development to introduce comprehensive APIs, enabling seamless integration with broader backup, disaster recovery, and security ecosystems. As market maturity deepens, the ability to deliver end‐to‐end recovery ecosystems, backed by proactive support services and continuous feature enhancements, is emerging as a key battleground for vendor leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Data Recovery Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acronis International GmbH

- Carbonite, Inc.

- CGSecurity

- CHENGDU YIWO Tech Development Co., Ltd.

- CleverFiles, Inc.

- CrashPlan, Inc.

- Data Care Zone, LLC

- Data Storage Solutions, LLC

- DataTech Labs, Inc.

- Dell EMC, Inc.

- DEX Data Recovery Lab Pvt. Ltd.

- Disc Technology Services Private Limited

- DMDE, Ltd.

- DriveSavers, Inc.

- Druva Inc.

- iMyFone Technology Co., Ltd.

- International Business Machines Corporation

- Ontrack Data Recovery

- Piriform Ltd.

- SALVAGEDATA Recovery Services, Inc.

- Secure Data Recovery Services, LLC

- SERT Data Recovery Services

- Stellar Information Technology Pvt. Ltd.

- Wise Data Recovery

Formulating Strategic and Actionable Recommendations for Industry Leaders to Enhance Data Resilience, Operational Efficiency, and Competitive Advantage

Industry leaders seeking to maintain or enhance their market position must adopt a multi‐pronged approach that balances innovation with operational discipline. First, organizations should invest in hybrid recovery architectures that combine on‐premises speed with cloud scalability, ensuring rapid recovery of mission‐critical workloads regardless of failure scenarios. Second, embracing AI and machine learning capabilities within recovery workflows can optimize performance, automate routine tasks, and reduce the risk of human error during high‐stress restoration events.

Furthermore, aligning recovery strategies with enterprise risk management processes will enable more comprehensive business continuity planning. This alignment involves integrating recovery metrics into broader resilience dashboards and conducting regular failover testing to validate recovery objectives. Strategic partnerships with cloud providers, storage vendors, and security solution vendors can augment internal capabilities, providing greater flexibility and access to emerging technologies. Finally, continuous skills development for IT and operations teams-through certification programs and hands‐on workshops-will ensure that organizations can fully leverage the advanced features of modern recovery platforms and respond effectively to evolving threat landscapes.

Outlining a Robust Research Methodology Combining Qualitative and Quantitative Approaches to Ensure Data Accuracy and Comprehensive Market Analysis

This research employs a hybrid methodology combining primary and secondary research techniques to ensure comprehensive and accurate market insights. Secondary research involved an extensive review of publicly available documents, regulatory filings, vendor white papers, technical product guides, and industry publications to establish a robust foundational understanding of market dynamics.

Primary research was conducted through in‐depth interviews with senior IT decision‐makers, storage architects, and cybersecurity professionals across enterprise organizations in key verticals. Surveys were administered to capture quantitative data on recovery objectives, deployment preferences, and purchasing criteria. Expert panels and validation workshops were convened to triangulate findings, identify emerging trends, and refine the analytical framework. Data from multiple sources were cross‐verified through a rigorous data triangulation process, ensuring consistency and reliability of the presented insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Data Recovery Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Data Recovery Software Market, by Recovery Type

- Data Recovery Software Market, by Charge Mode

- Data Recovery Software Market, by Application

- Data Recovery Software Market, by End User

- Data Recovery Software Market, by Deployment Model

- Data Recovery Software Market, by Organization Size

- Data Recovery Software Market, by Region

- Data Recovery Software Market, by Group

- Data Recovery Software Market, by Country

- United States Data Recovery Software Market

- China Data Recovery Software Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Concluding Insights Highlighting the Imperative of Advanced Data Recovery Solutions for Sustained Business Continuity and Digital Transformation Success

As organizations continue to navigate a complex digital environment marked by escalating cyber threats, stringent regulatory demands, and dynamic cost pressures, the importance of advanced data recovery solutions cannot be overstated. By leveraging hybrid architectures, integrating AI‐driven automation, and adopting subscription‐based licensing models, enterprises can build resilient recovery frameworks that align with both operational needs and financial strategies.

Ultimately, the capacity to recover swiftly from data loss events-whether they stem from logical corruption, physical damage, or targeted cyberattacks-will differentiate market leaders from laggards. Vendors that excel in delivering comprehensive, interoperable recovery ecosystems, supported by proactive services and continuous innovation, will capture the strategic high ground. This conclusion underscores the imperative for organizations to prioritize advanced recovery planning as a core element of their digital transformation journeys and resilience strategies.

Initiate Your Engagement Today to Discuss and Procure the Definitive Data Recovery Software Market Research Report with Associate Director Ketan Rohom

To obtain a detailed, data-driven understanding of the evolving data recovery software landscape, readers are encouraged to reach out directly to Associate Director, Sales & Marketing, Ketan Rohom. Engaging in a one-on-one consultation will provide tailored insights to address your organization’s unique challenges and objectives. By partnering with Ketan, you can secure immediate access to the comprehensive market research report, complete with in-depth analysis, strategic recommendations, and actionable intelligence designed to inform your software procurement, technology roadmaps, and go-to-market strategies. Take the next step toward strengthening your data resilience and unlocking new growth opportunities by initiating a conversation today.

- How big is the Data Recovery Software Market?

- What is the Data Recovery Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?