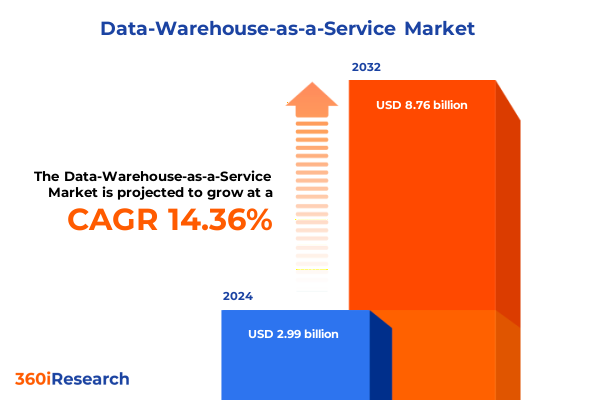

The Data-Warehouse-as-a-Service Market size was estimated at USD 3.42 billion in 2025 and expected to reach USD 3.91 billion in 2026, at a CAGR of 14.37% to reach USD 8.76 billion by 2032.

Understanding the Emergence of Data-Warehouse-as-a-Service as a Strategic Catalyst for Agile Analytics and Enterprise Intelligence

Data-Warehouse-as-a-Service represents a paradigm shift in how organizations store, manage, and analyze their most critical information assets. By leveraging cloud-native architectures, enterprises can now access elasticity, scalability, and advanced analytics capabilities without the burden of maintaining physical infrastructure. This emerging model empowers IT teams and business stakeholders alike to deploy new data environments in a fraction of the time previously required, enabling them to respond more swiftly to evolving market conditions and strategic imperatives.

Furthermore, the consolidation of data management processes into a managed service framework abstracts the complexity of software upgrades, performance tuning, and capacity planning. As a result, organizations can redirect technical resources toward high-value initiatives, such as building predictive models, enhancing data governance, and fostering a culture of data-driven decision making. Overall, the advent of Data-Warehouse-as-a-Service is ushering in a new era of agile analytics and enterprise intelligence, serving as a foundational catalyst for digital transformation across multiple sectors.

Exploring the Pivotal Technological and Operational Transformations Reshaping Data Warehousing into a Service-Oriented Model for Modern Businesses

Over the past few years, the data warehousing landscape has undergone profound technological and operational transformations. Organizations have shifted from monolithic, on-premises solutions toward microservices-driven, cloud-native platforms that decouple compute resources from storage. This separation enables elastic scaling, allowing businesses to accommodate unpredictable workloads and deliver consistent performance regardless of query complexity. In parallel, serverless architectures have gained traction, minimizing idle compute costs and simplifying capacity management for data teams.

Another pivotal trend is the integration of artificial intelligence and machine learning directly within the data warehouse environment. Embedded analytical engines can now deliver automated insights, anomaly detection, and real-time recommendations at scale. Self-service capabilities are also on the rise, empowering non-technical users to explore data through intuitive interfaces, reducing dependency on centralized IT support. Additionally, open-source technologies and standards have fostered interoperability, enabling organizations to avoid vendor lock-in and stitch together best-of-breed components to address unique requirements. These transformative shifts are redefining what data warehousing means in the modern enterprise.

Assessing the Far-Reaching Consequences of 2025 United States Tariff Measures on Data Warehousing Services and Supply Chain Dynamics

The introduction of new United States tariff measures in 2025 has imparted significant ripple effects across the global data infrastructure ecosystem. Tariffs targeting the importation of memory modules, solid-state storage devices, and networking equipment have elevated operational expenses for managed service providers. In turn, these cost pressures have necessitated reassessments of pricing models, supply chain strategies, and vendor relationships to maintain competitive service offerings.

Moreover, secondary impacts have emerged in the form of extended lead times for hardware procurement and heightened volatility in component availability. Some providers have mitigated these challenges by expanding localized data center footprints, forging strategic partnerships with domestic component manufacturers, and negotiating multi-year supply agreements with international suppliers to hedge against future tariff escalations. Despite these proactive measures, organizations reliant on Data-Warehouse-as-a-Service must remain vigilant, as ongoing trade policy developments could continue to influence cost structures and service-level commitments.

Deriving Deep Insights from Service, Organization, Deployment, and Industry Segmentation Trends Driving Data-Warehouse-as-a-Service Adoption and Performance

Segment-specific behaviors are illuminating the pathways through which Data-Warehouse-as-a-Service solutions deliver differentiated value. Based on Service Type, adoption unfolds across two distinct modes: one that prioritizes turnkey, subscription-based analytics platforms that abstract infrastructure management entirely, and another that offers platform-level flexibility, enabling deep customization and integration with proprietary analytics pipelines.

Meanwhile, when examining Organizational Size, there is a clear divergence in drivers and implementation strategies. Large enterprises often pursue Data-Warehouse-as-a-Service as part of broader digital transformation programs, integrating extensive security controls and governance frameworks. In contrast, small and medium enterprises gravitate toward these services for rapid deployment and lower entry barriers, leveraging built-in analytics to compensate for limited in-house technical expertise.

Deployment Mode further refines these choices. Hybrid cloud scenarios appeal to regulated industries seeking to balance performance and compliance, while private cloud deployments are preferred by organizations with stringent data sovereignty requirements. Public cloud environments, by contrast, continue to gain momentum among companies that prioritize rapid scalability and consumption-based pricing.

Finally, End User Industry segmentation reveals an array of use cases driving adoption. Banking, financial services, and insurance institutions use these solutions for real-time fraud detection and regulatory reporting. Government and public sector entities rely on centralized data management to support citizen services and policy analysis. Healthcare and life sciences organizations leverage advanced analytics for clinical trial optimization and patient outcome research. Information technology and telecommunications providers harness high-performance querying to monitor network performance and customer experience. Manufacturing firms deploy predictive maintenance models to reduce downtime, and retail and e-commerce companies apply dynamic segmentation to personalize customer engagement and supply chain planning.

This comprehensive research report categorizes the Data-Warehouse-as-a-Service market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Organization Size

- Deployment Mode

- End User Industry

Analyzing Regional Adoption Patterns and Growth Drivers across the Americas, Europe Middle East Africa, and Asia-Pacific Data Warehousing Ecosystems

Geographic markets exhibit varied maturity levels and growth trajectories in the adoption of Data-Warehouse-as-a-Service. In the Americas, long-established cloud infrastructures and a robust ecosystem of hyperscale providers have fostered rapid uptake among both enterprises and high-growth startups. Organizations in this region benefit from advanced connectivity and a regulatory environment that encourages innovation, enabling swift migrations from legacy data centers to fully managed cloud warehouses.

Across Europe, the Middle East, and Africa, data governance and sovereignty concerns often shape deployment decisions. Enterprises in these territories are balancing the imperative for cloud-enabled analytics with stringent compliance frameworks, leading to a proliferation of localized service offerings and regional data center investments. Public sector agencies and highly regulated industries are particularly vigilant, adopting hybrid architectures to maintain data residency while also exploiting the agility of managed services.

In the Asia-Pacific region, rising digitization initiatives and substantial infrastructure investments are driving momentum. Manufacturing and telecommunications verticals are at the forefront, deploying advanced analytics to enhance operational efficiencies and customer experiences. Emerging markets within this region are also capitalizing on managed warehouse services to bypass traditional infrastructure bottlenecks, accelerating time to insight and fostering data-centric business models.

This comprehensive research report examines key regions that drive the evolution of the Data-Warehouse-as-a-Service market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating the Strategic Initiatives and Competitive Positioning of Leading Providers Shaping the Data-Warehouse-as-a-Service Market Landscape

The competitive landscape of Data-Warehouse-as-a-Service is characterized by a blend of hyperscale cloud providers, specialized platform vendors, and innovative startups. Leading hyperscalers continue to leverage their global infrastructure footprints, extensive partner networks, and integrated AI services to capture a broad range of enterprise accounts. Their strategies often include aggressive feature roadmaps, consumption-based pricing tiers, and deep integration with complementary cloud-native analytics tools.

Conversely, specialized platform vendors differentiate themselves through vertical-specific capabilities, enhanced data governance controls, and open ecosystem compatibility. These providers frequently establish alliances with system integrators and analytics consultancies to deliver end-to-end solutions for niche markets. Meanwhile, emerging entrants are capitalizing on novel architectural approaches-such as serverless query engines or blockchain-based audit trails-to carve defensible positions in high-growth segments.

Strategic initiatives among these competing entities include the acquisition of data integration startups, partnerships with AI and BI solution providers, and the expansion of global data center footprints to meet localized compliance requirements. As a result, organizations seeking a Data-Warehouse-as-a-Service partner must navigate an increasingly nuanced vendor landscape, weighing factors such as performance SLAs, ecosystem interoperability, and long-term innovation roadmaps.

This comprehensive research report delivers an in-depth overview of the principal market players in the Data-Warehouse-as-a-Service market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Actian Corporation

- Amazon Web Services, Inc.

- Databricks, Inc.

- Exasol AG

- Google LLC

- IBM Corporation

- MarkLogic Corporation

- Micro Focus International plc

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- Snowflake Inc.

- Teradata Corporation

Recommending Targeted Strategic Actions for Industry Leaders to Navigate Technological Disruption and Maximize Value from Data-Warehouse-as-a-Service Investments

To harness the full potential of Data-Warehouse-as-a-Service, industry leaders should prioritize the development of a flexible and modular architecture that can accommodate evolving analytics workloads. By standardizing on a unified data platform, organizations can minimize data silos, accelerate time to insight, and streamline governance processes. Establishing cross-functional teams that include data engineers, data scientists, and business analysts will foster a culture of shared ownership and continuous improvement.

Security and compliance must be embedded from the outset through comprehensive policies, role-based access controls, and ongoing monitoring. Organizations are advised to adopt proactive data lineage tools and automated auditing mechanisms to ensure regulatory adherence while supporting expansive analytics use cases. Investing in robust training programs and change management frameworks will empower end users to leverage self-service analytics effectively, driving broader organizational adoption.

Furthermore, leaders should negotiate flexible consumption agreements with service providers, enabling cost optimization during periods of fluctuating demand. Strategic partnerships with hyperscale vendors and niche technology specialists can help organizations stay ahead of emerging trends in AI and real-time analytics. By aligning investment priorities with business outcomes-such as revenue growth, operational efficiency, and customer satisfaction-executives can ensure that Data-Warehouse-as-a-Service initiatives deliver measurable value.

Detailing a Rigorous Research Framework Combining Qualitative and Quantitative Approaches to Uncover Actionable Insights in Data Warehousing as a Service

The research methodology underpinning this analysis combines rigorous qualitative and quantitative approaches to deliver a comprehensive view of the Data-Warehouse-as-a-Service market. Primary research involved in-depth interviews with senior executives from end-user organizations across multiple industries, as well as technology leaders from provider firms. These conversations provided firsthand perspectives on adoption drivers, implementation challenges, and emerging use cases.

Quantitative data was gathered through structured surveys distributed to a broad sample of companies, capturing metrics related to deployment modes, service-level satisfaction, and projected growth plans. Secondary sources included publicly available financial reports, technical whitepapers, regulatory filings, and industry webinars to triangulate findings and ensure accuracy. Vendor benchmarking sessions were conducted to compare feature sets, performance benchmarks, and pricing models across the competitive landscape.

Data validation techniques included cross-referencing multiple input sources, conducting follow-up interviews to clarify discrepancies, and leveraging statistical analysis methods to identify significant trends. The combined insights form a robust foundation for strategic decision making, ensuring that recommendations reflect both current realities and forward-looking market dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Data-Warehouse-as-a-Service market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Data-Warehouse-as-a-Service Market, by Service Type

- Data-Warehouse-as-a-Service Market, by Organization Size

- Data-Warehouse-as-a-Service Market, by Deployment Mode

- Data-Warehouse-as-a-Service Market, by End User Industry

- Data-Warehouse-as-a-Service Market, by Region

- Data-Warehouse-as-a-Service Market, by Group

- Data-Warehouse-as-a-Service Market, by Country

- United States Data-Warehouse-as-a-Service Market

- China Data-Warehouse-as-a-Service Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Summarizing Critical Takeaways on Innovation, Market Dynamics, and Strategic Imperatives for Data-Warehouse-as-a-Service Stakeholders

Data-Warehouse-as-a-Service has emerged as a transformative force, redefining enterprise analytics by delivering on-demand scalability, streamlined management, and integrated intelligence. The convergence of cloud-native architectures, AI-embedded query engines, and flexible consumption models is driving unprecedented levels of agility and efficiency. Organizations are leveraging these capabilities to streamline operations, accelerate innovation cycles, and maintain a competitive edge in an increasingly data-driven landscape.

At the same time, external factors such as evolving trade policies and regional compliance frameworks are shaping strategic decisions around deployment models and vendor selection. Segmentation insights highlight that service type, organizational scale, deployment preferences, and industry-specific requirements each play a critical role in determining the optimal Data-Warehouse-as-a-Service approach. Additionally, regional analyses underscore the importance of aligning data strategies with local regulatory environments and infrastructure capacities.

In this dynamic environment, the ability to anticipate emerging trends and proactively adapt will distinguish market leaders from laggards. By synthesizing technological innovations with pragmatic governance and cost management strategies, enterprises can ensure that their Data-Warehouse-as-a-Service investments deliver sustained value and pave the way for next-generation analytics capabilities.

Encouraging Decision Makers to Engage with Ketan Rohom for Tailored Data-Warehouse-as-a-Service Market Intelligence and Customized Research Solutions

To explore deeper insights or to secure a comprehensive copy of the full market research on Data-Warehouse-as-a-Service, please reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. Engaging with Ketan Rohom will ensure you receive a tailored demonstration of key findings, custom data segments specific to your strategic objectives, and guidance on how to leverage this intelligence to accelerate your organization’s analytics capabilities. Connect today to discuss flexible licensing options, complimentary executive briefings, and priority access to upcoming industry webinars that will keep you ahead of the curve.

- How big is the Data-Warehouse-as-a-Service Market?

- What is the Data-Warehouse-as-a-Service Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?