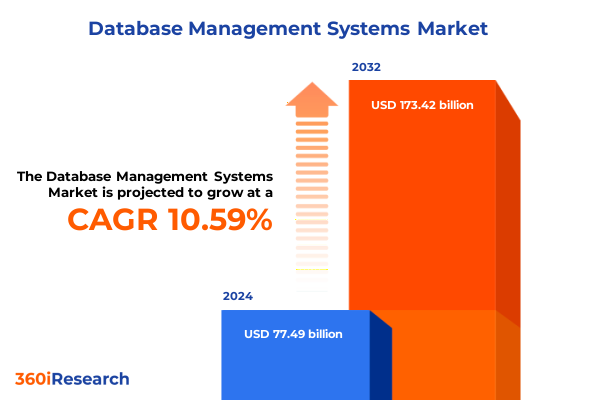

The Database Management Systems Market size was estimated at USD 84.43 billion in 2025 and expected to reach USD 91.99 billion in 2026, at a CAGR of 10.82% to reach USD 173.42 billion by 2032.

Capturing the Evolution of Database Management Systems Amidst Rapid Digital Transformation and the Growing Imperative for Intelligent Data Strategies

The opening section of this executive summary underscores the accelerating pace at which organizations are adopting and integrating advanced database management solutions to power digital transformation initiatives. As enterprises navigate vast volumes of structured and unstructured information, the need for reliable, scalable, and intelligent data platforms has risen to the forefront of strategic priorities. In recent years, the maturation of cloud-native architectures, advances in in-memory processing, and the proliferation of real-time analytics have redefined expectations around performance and responsiveness. Consequently, decision-makers now demand database systems that not only store and retrieve data with high efficiency but also embed sophisticated intelligence to uncover actionable insights.

Transitioning from traditional monolithic relational systems to more versatile, hybrid, and distributed models, enterprises have sought tools capable of addressing challenges such as latency, concurrency, and complex query processing at scale. This shift reflects a broader industry recognition that data is both an operational asset and a catalyst for innovation. Organizations have begun to outweigh considerations of upfront cost in favor of agility, dynamic provisioning, and seamless integration with AI and machine learning frameworks. As a result, the contemporary database management landscape thrives on a blend of architectural diversity and strategic intelligence that supports critical business outcomes.

Looking ahead, the continued interplay between global economic factors, emerging technologies, and evolving regulatory requirements is poised to shape database management strategies even further. Stakeholders are cultivating ecosystems that leverage multiple database paradigms concurrently, optimizing workloads for speed, reliability, and security. Amidst this complexity, the ability to orchestrate heterogeneous environments while maintaining data integrity and adherence to compliance standards emerges as a defining competency for tomorrow’s data-driven enterprises.

Examining the Transformative Shifts in Database Architecture Driven by Cloud Adoption Real-Time Analytics and Emerging Edge and Quantum Computing Trends

In today’s data-centric environment, cloud adoption has reoriented the foundation of database architectures, ushering in a paradigm where agility and elasticity supersede rigid infrastructure constraints. Enterprises are increasingly migrating critical workloads to cloud platforms, drawn by the promise of rapid provisioning, global scalability, and managed services that offload infrastructural burdens. This migration has fostered a growing reliance on multi-cloud strategies, empowering organizations to optimize cost, performance, and risk distribution across diverse cloud ecosystems. Simultaneously, the rise of platform-as-a-service offerings has streamlined deployment and maintenance, enabling developers to focus on application logic rather than database administration.

Moreover, the integration of real-time analytics capabilities has transformed how businesses extract value from streaming and transactional data. Embedding event-driven processing and in-memory computation within database engines has shortened feedback loops, driving immediacy in decision-making across use cases such as fraud detection, dynamic pricing, and personalized customer experiences. Concurrently, cutting-edge edge computing deployments have extended database services beyond centralized data centers, placing lightweight instances closer to data sources and enabling ultra-low-latency operations in scenarios ranging from industrial IoT to autonomous vehicles.

Looking further into the horizon, early explorations of quantum computing paradigms hint at the potential for revolutionary improvements in complex query optimization and secure cryptographic functions. Pilot programs exploring quantum-inspired algorithms for database indexing and search promise to accelerate workloads that challenge classical architectures. While commercial quantum database solutions remain nascent, these initiatives underscore the industry’s commitment to exploring every frontier of computational capability. Together, these transformative shifts illustrate a landscape in flux, characterized by continuous innovation and the blending of traditional and emergent technologies.

Assessing the Cumulative Impact of 2025 United States Tariffs on Hardware Imports Software Services and the Resulting Supply Chain and Cost Adjustments

The introduction of expanded United States tariffs in early 2025 has exerted pronounced effects on the database management ecosystem, particularly in relation to hardware procurement and software services. By imposing higher duties on imported server components, networking equipment, and data storage devices, the policy has elevated total cost of ownership for organizations dependent on offshore manufacturing. This shift has prompted enterprises to reevaluate vendor sourcing strategies, balancing immediate budgetary pressures against performance requirements and long-term operational resilience.

In addition, software services tied to cross-border data centers have encountered new compliance complexities, as service providers navigate patchwork regulations and altered pricing structures. Consequently, some organizations have accelerated transitions toward onshore or regional cloud providers to mitigate exposure to tariff-driven cost escalations. This geographic redistribution has also spurred investment in domestic manufacturing capabilities, with original equipment manufacturers and third-party assemblers scaling production to satisfy renewed demand for locally sourced infrastructure.

Moreover, the ripple effects of these tariff measures have reached consulting and integration services that support database deployments. Firms specializing in migration, optimization, and system integration have adjusted their service models, offering tailored cost management and total spend visibility programs to help clients offset tariff impacts. As a result, enterprises now place increased emphasis on total lifecycle cost planning and supply chain transparency, adopting a more holistic view of expenditure beyond initial hardware or license fees.

Revealing Insights from Segmentation of Database Types Pricing Models Technological Integrations Deployment Organization Size Applications and End User Verticals

A nuanced exploration of market segmentation reveals distinct usage patterns and strategic priorities across database types. In-memory databases have gained traction among latency-sensitive applications, offering speed for session caching and real-time analytics. NewSQL systems serve enterprises seeking horizontal scalability without compromising transactional integrity, while relational databases maintain dominance in workloads that demand strict ACID compliance. The rise of NoSQL databases-columnar, document-oriented, and graph-based-underscores a shift toward structures optimized for flexible schema design and complex relationship mapping.

License-based agreements remain common for predictable budgeting and customization, especially in on-premises deployments among large organizations, while subscription-based models have become the norm for cloud-native use cases, enabling pay-as-you-go agility. Increasingly, usage-based pricing aligns costs with query volume or storage consumption, improving efficiency for variable workloads and project pilots.

Technological integration segmentation highlights the interplay between database platforms and analytical frameworks. AI capabilities like automated index tuning and anomaly detection streamline administrative workflows. Big data analytics integrations optimize pipelines between data lakes and transactional stores. Blockchain supports immutable audit trails and permission models for secure operations. Machine learning extensions across reinforcement, supervised, and unsupervised methods embed predictive functionalities that dynamically adapt performance and resource utilization.

Deployment segmentation shows a dominant shift toward cloud environments for most workloads, while on-premises deployments persist where compliance or data residency is critical. Large enterprises typically embrace hybrid architectures that blend local infrastructure with public cloud, whereas small and medium organizations often rely exclusively on managed cloud services to minimize operational overhead. Application requirements split between data processing and streaming tasks, which demand versatile platforms, and warehousing scenarios that favor columnar and parallel processing engines. Vertical segmentation spans sectors including banking, education, government, healthcare, IT and telecommunications, manufacturing, and media and entertainment, each prioritizing features such as security, real-time analytics, and schema flexibility.

This comprehensive research report categorizes the Database Management Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Database Type

- Technological Integration

- Application

- Deployment Model

- End User

- Organization Size

Highlighting Key Regional Dynamics Shaping Database Management Adoption and Innovation across the Americas Europe Middle East Africa and Asia Pacific Markets

The Americas continue to lead in rapid adoption of cloud-native database platforms, driven by a mature ecosystem of hyperscale providers and robust infrastructure. In North America, enterprises emphasize integrated AI and analytics capabilities to support digital business models, while Latin American organizations focus on cost-effective solutions that align with evolving data privacy regulations. This regional disparity underscores a balancing act between innovation ambitions and compliance frameworks, prompting tailored deployment strategies that reflect local market conditions.

In Europe, Middle East and Africa, regulatory standards such as GDPR and emerging data sovereignty requirements heavily influence database management decisions. Enterprises in Western Europe increasingly invest in secure, encryption-enabled systems to maintain compliance, whereas organizations across the Middle East and Africa prioritize solutions capable of operating in hybrid cloud scenarios, addressing connectivity constraints and regional hosting mandates. Cross-border data flows, particularly within the European Union, drive demand for unified governance and interoperability across multi-cloud environments.

Asia Pacific markets exhibit diverse maturity levels, from advanced digital infrastructures in Japan, South Korea, and Australia to burgeoning adoption in Southeast Asian economies. Enterprise users in the region often embrace localized cloud services to ensure data localization and optimize latency. Furthermore, rapid growth in e-commerce, gaming, and mobile applications has spurred high-performance in-memory and NoSQL deployments, with many organizations piloting machine learning-infused databases to enhance user experiences and operational agility. Across all regions, partnerships between global software vendors and local integrators accelerate knowledge transfer and foster innovation, driving a global convergence toward next-generation database management frameworks.

This comprehensive research report examines key regions that drive the evolution of the Database Management Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategies and Innovations from Leading Database Management Players Driving Technological Advancements Differentiation and Market Collaboration

Global database management leaders are pursuing a variety of strategic initiatives to outpace competitors and capture evolving enterprise requirements. Major software vendors have intensified efforts to integrate native AI modules into their flagship offerings, enabling features such as self-healing indexing, adaptive caching, and predictive capacity planning. Concurrently, cloud service providers have expanded managed database portfolios, offering fully automated patching, backup orchestration, and serverless scaling to reduce operational burden for development teams and accelerate time to value.

Open source database communities continue to play a vital role in shaping the competitive landscape. Leading projects have introduced multi-model support and enhanced security frameworks, attracting contributions from both established organizations and agile startups. This collaborative dynamic fosters a fertile environment for innovation, as commercial vendors often incorporate popular open source capabilities into proprietary distributions or offer cloud-hosted versions under subscription models.

Partnerships and acquisitions have emerged as a key tactic for achieving differentiation. Recent movements include software vendors acquiring analytics startups to embed specialized engines within existing databases, as well as alliances between cloud platforms and storage vendors to deliver optimized data pipelines. These collaborations extend to certification programs and joint go-to-market initiatives, which help clients navigate complex migrations and ensure performance benchmarks.

Finally, agile challengers have focused on niche segments such as graph processing, time-series data, and geospatial analytics, leveraging lightweight architectures to address specialized use cases. By carving out distinct value propositions, these innovators compel larger players to refine product roadmaps, accelerate feature releases, and introduce flexible licensing options. The net result is a dynamic ecosystem where continuous improvement and cross-industry collaboration accelerate the evolution of database management technologies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Database Management Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Altibase Corp.

- Amazon Web Services, Inc.

- Cloudera, Inc.

- Couchbase, Inc.

- Datadog, Inc.

- DbVis Software AB

- ForeSoft Corporation

- Google LLC

- Idera, Inc.

- International Business Machines Corporation

- JFrog Ltd.

- MariaDB Foundation

- Microsoft Corporation

- MongoDB, Inc.

- Neo4j, Inc.

- Oracle Corporation

- PremiumSoft CyberTech Ltd.

- Quest Software Inc.

- Redis Ltd.

- Richardson Software, LLC

- Salesforce, Inc.

- SAP SE

- Sequel Pro

- Snowflake Inc.

- Softonic International S.A.

- SolarWinds Worldwide, LLC

- TablePlus Inc.

- Teradata Operations, Inc.

- The Postgresql Global Development Group

- Zoho Corporation Pvt. Ltd.

Delivering Actionable Recommendations to Guide Industry Leaders in Optimizing Database Management Strategies Efficiency and Strategic Growth Initiatives

Leaders seeking to enhance database management effectiveness should prioritize the adoption of hybrid architectures that seamlessly blend cloud and on-premises resources. By balancing the agility of cloud-native services with the control and security of local deployments, organizations can optimize latency-sensitive workloads while protecting critical data assets. Moreover, aligning deployment choices with regulatory and data residency requirements will ensure both compliance and performance objectives are met.

Organizations should also invest in tightly integrating AI and machine learning capabilities within database platforms. Automated performance tuning, anomaly detection, and predictive capacity forecasting not only reduce administrative overhead but also yield actionable insights in real time. To capitalize on these benefits, enterprises must develop governance frameworks for model validation and ethical data use, ensuring reliable outcomes and mitigating bias.

Evaluating pricing models against projected workload patterns is essential. In scenarios with predictable volumes, license or subscription models may offer cost stability, while usage-based structures excel when handling spiky or exploratory workloads. A comprehensive total cost of ownership analysis that factors in hidden operational expenses will guide leaders toward the most economical approach.

Furthermore, industry leaders should foster strong partnerships with cloud providers, system integrators, and specialist vendors. Collaborative engagements accelerate innovation through access to best practices, technical expertise, and co-development opportunities. Investing in talent and skill development remains critical; equipping teams with knowledge of modern database features and DevOps practices drives faster adoption and maximizes return on technology investments. Ultimately, these integrated recommendations form a strategic blueprint for sustained growth and operational excellence.

Outlining Rigorous Research Methodology Incorporating Primary and Secondary Data Collection Expert Validation and Robust Data Triangulation Processes

This study employs a comprehensive research framework that combines primary and secondary data collection methods to ensure the reliability and relevance of insights. Primary research consisted of in-depth interviews with senior IT executives, database architects, and solution providers, complemented by surveys targeting technical and business stakeholders across multiple industries. These engagements produced qualitative perspectives on adoption drivers, pain points, and anticipated evolution of database management practices.

Secondary research involved a systematic review of publicly available literature, including vendor whitepapers, industry publications, academic journals, and regulatory documentation. This process provided contextual understanding of technological trends, historical developments, and competitive dynamics. Additionally, publicly disclosed financial reports and case studies offered real-world examples of deployment outcomes and performance benchmarks.

To validate findings, the research applied data triangulation techniques, cross-referencing insights from primary interviews with quantitative data drawn from usage statistics, patent filings, and open source repository activity. This multifaceted approach minimized bias and reinforced the robustness of conclusions. Furthermore, an expert advisory panel reviewed preliminary results to ensure accuracy, relevance, and completeness, providing iterative feedback that refined the final analysis.

Quality assurance measures included consistency checks, peer reviews, and adherence to ethical guidelines for data collection and privacy. The resulting methodology delivers a transparent and repeatable framework that underpins the strategic recommendations and insights within this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Database Management Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Database Management Systems Market, by Database Type

- Database Management Systems Market, by Technological Integration

- Database Management Systems Market, by Application

- Database Management Systems Market, by Deployment Model

- Database Management Systems Market, by End User

- Database Management Systems Market, by Organization Size

- Database Management Systems Market, by Region

- Database Management Systems Market, by Group

- Database Management Systems Market, by Country

- United States Database Management Systems Market

- China Database Management Systems Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Concluding the Executive Summary with a Synthesis of Key Findings Reinforcing the Critical Role of Database Management in Driving Innovation and Resilience

In synthesizing the key findings, it is evident that database management systems have evolved from passive repositories into dynamic platforms at the heart of digital innovation. The convergence of cloud-native architectures, advanced analytics, and emerging technologies such as edge computing has redefined performance expectations, while shifting economic and regulatory landscapes continue to influence deployment decisions. Segmentation analysis highlights how distinct database types, pricing frameworks, and integration capabilities align with specific organizational needs, underscoring the importance of a tailored approach.

Regional and vendor insights reveal a landscape marked by strategic partnerships, competitive specialization, and an accelerating shift toward hybrid models that optimize for both agility and compliance. The actionable recommendations outlined above provide a roadmap for decision-makers seeking to harness these trends, balance cost efficiency with performance, and foster resilient, future-ready infrastructures. As enterprises continue to navigate complexity, robust database management strategies will remain essential to sustaining growth and achieving strategic objectives.

Empowering Decision Makers to Secure In-Depth Database Management Insights and Connect with Ketan Rohom to Access the Definitive Market Research Report Today

For organizations poised to advance their data strategies, the definitive market research report offers unparalleled depth and actionable clarity. By engaging with the associate director of sales and marketing, Ketan Rohom, enterprises can explore customized packages, gain access to exclusive expert briefings, and obtain tailored insights that align with their unique strategic imperatives. This report delivers comprehensive segmentation analysis, in-depth regional perspectives, and competitive benchmarking designed to empower informed decision-making.

Reaching out today ensures early access to the latest industry intelligence, enabling teams to plan effectively for emerging opportunities and potential risks. Whether your focus lies in optimizing total cost of ownership, integrating next-generation technologies, or navigating complex regulatory environments, this resource equips stakeholders with the knowledge required to achieve sustainable success. Contact Ketan Rohom to secure your copy and embark on a journey toward data-driven excellence.

- How big is the Database Management Systems Market?

- What is the Database Management Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?