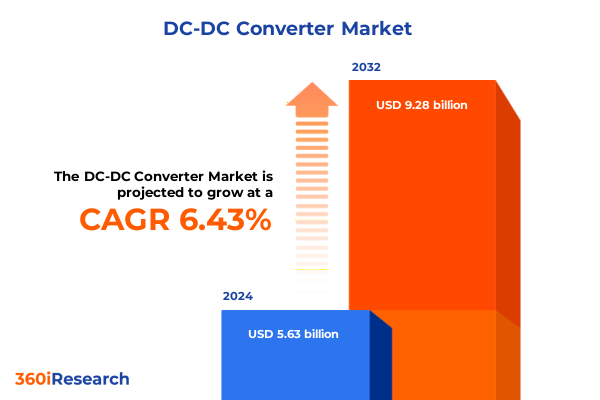

The DC-DC Converter Market size was estimated at USD 5.99 billion in 2025 and expected to reach USD 6.33 billion in 2026, at a CAGR of 6.43% to reach USD 9.28 billion by 2032.

Defining the Critical Role of DC-DC Converters in Modern Power Management Architectures for High-Efficiency Applications Across Industries

DC-DC converters serve as the cornerstone of modern power management, transforming fluctuating input voltages into stable, regulated outputs that power a vast array of electronic systems. In an era defined by electrification, digitalization, and stringent energy efficiency mandates, these devices have transcended traditional applications to become critical enablers of emerging technologies. Designed to balance performance, size, and thermal characteristics, DC-DC converters optimize the energy flow within electric vehicles, portable electronics, industrial automation systems, and telecommunications networks, ensuring reliable operation under dynamic load conditions.

The integration of advanced semiconductor materials and intelligent control architectures has elevated the role of DC-DC converters from simple voltage regulators to multifunctional power modules with adaptive capabilities. As power density requirements escalate and thermal management becomes more complex, designers are compelled to refine converter topologies and adopt novel packaging techniques. This evolution mirrors the broader trend toward miniaturization and system-level integration, where higher switching frequencies, digital control loops, and wide bandgap devices coalesce to drive unprecedented gains in efficiency and power density. Consequently, stakeholders across OEMs, system integrators, and component suppliers prioritize converter design as a strategic lever for differentiation and value creation.

Looking ahead, the DC-DC converter segment is poised for sustained growth, propelled by the proliferation of electrified transportation, renewable energy integration, and the expansion of 5G infrastructure. With regulatory bodies introducing stricter efficiency benchmarks and end users demanding enhanced reliability, the converter landscape is evolving rapidly. To remain competitive, industry participants must stay abreast of technological innovations, policy developments, and shifting customer requirements, underscoring the imperative for a comprehensive analysis of current trends and future trajectories.

Unraveling the Technological and Market Demands That Are Driving Transformative Shifts in DC-DC Converter Design and Deployment Landscape

The landscape of DC-DC converter design and deployment is undergoing transformative shifts driven by breakthroughs in semiconductor physics and escalating application demands. At the forefront of this revolution is the adoption of wide bandgap materials such as gallium nitride (GaN) and silicon carbide (SiC), which enable switching frequencies well beyond conventional silicon limits while minimizing conduction and switching losses. This shift facilitates the downsizing of passive components and advances the development of ultra-compact, high-power-density modules that align with the rigorous space and thermal constraints of electric vehicles, aerospace platforms, and high-density computing environments.

Simultaneously, the rise of digital control methodologies has ushered in a new generation of programmable converters, offering real-time adaptability and predictive maintenance capabilities. By integrating microcontrollers and digital signal processors directly within power modules, manufacturers can fine-tune dynamic response characteristics and implement advanced diagnostics. This convergence of power electronics and embedded software is fostering greater design agility, enabling rapid customization to meet specialized end-user requirements.

Moreover, accelerating trends in system-level integration are driving converter topology innovation. Hybrid architectures that blend boost, buck, and bidirectional functionalities streamline powertrain configurations in electric vehicles and energy storage systems. The modularization of converter solutions simplifies scalability and maintenance in industrial automation, promoting plug-and-play interoperability. Taken together, these technological and market imperatives are reshaping the DC-DC converter ecosystem, positioning it at the heart of next-generation energy and mobility solutions.

Evaluating the Ongoing Effects of Newly Imposed United States Tariffs on DC-DC Converter Supply Chains and Manufacturer Strategies in 2025

In 2025, newly enacted United States tariffs targeting electronic components and associated subassemblies have introduced significant disruptions within the DC-DC converter supply chain. By extending duty rates to encompass a broader category of power management ICs and converter modules, policy makers have effectively increased landed costs for manufacturers relying on imported components. As a result, converter providers have been forced to reevaluate sourcing strategies, often shifting production to tariff-exempt jurisdictions or investing in domestic assembly capabilities.

The tariff-driven cost pressures have reverberated downstream, prompting OEMs to reassess their converter specifications and supplier partnerships. Some manufacturers have absorbed incremental duties through margin compression to maintain competitive pricing, while others have passed costs through to end users, who now face heightened capital expenditures on power electronics. This dual response underscores the strategic tightrope that industry participants must navigate between preserving profitability and sustaining market share.

To mitigate the impact of trade policy volatility, companies are increasingly diversifying their supplier base, exploring nearshoring opportunities in Mexico and Southeast Asia, and forging partnerships with domestic fabricators. Concurrently, we observe a growing emphasis on design modularity and component standardization as mechanisms to reduce lead times and logistical complexity. This recalibration of supply chains exemplifies the ripple effects of tariff interventions, reshaping industry structures and compelling stakeholders to adopt more resilient, agile operating models.

Deriving Strategic Insights from Topology Architecture End Use Output Power Input Voltage and Mounting and Frequency Based Segmentation

A granular understanding of DC-DC converter segmentation reveals nuanced opportunities and challenges across topology, architecture, end use, output power, input voltage, mounting type, and switching frequency. Converters based on buck topology continue to dominate applications requiring step-down voltage regulation, owing to their simplicity and high efficiency, particularly in consumer electronics and computing platforms. In contrast, boost topologies find favor in energy harvesting and renewable energy interfaces where voltage needs to be elevated from low-level sources. Buck-boost architectures, offering bidirectional power flow and wider voltage conversion ranges, have become essential in automotive battery management systems, while Cuk and Sepic topologies serve niche markets that demand low ripple and isolated control loops, such as precision instrumentation.

Within the isolated versus non-isolated architecture dichotomy, non-isolated converters maintain primacy in cost-sensitive applications due to their reduced component counts and straightforward designs. However, isolated topologies are indispensable in medical and industrial sectors where galvanic separation ensures operator safety and system integrity. The requirement for reinforced insulation and stringent safety certifications continues to reinforce the value proposition of isolated power modules in these high-stakes environments.

Examining end-use categories illuminates the pivotal role of automotive electrification, where converters tailored for traction inverters and on-board chargers exhibit rigorous thermal and reliability benchmarks. Meanwhile, consumer electronics converters emphasize miniaturization and transient response to support burgeoning IoT and wearable device markets. Healthcare converters adhere to strict regulatory and electromagnetic compatibility standards, whereas industrial applications prioritize robustness against harsh operating conditions. Telecommunications infrastructure demands high-power-range converters, often exceeding 150 watts, to support base station power supplies and network edge computing, reflecting a confluence of performance and reliability imperatives.

Output power segmentation spans low-power modules under 10 watts for portable devices to high-power units greater than 150 watts for telecommunications and industrial drives. Input voltage segmentation likewise ranges from sub-12-volt converters suited to USB-powered systems to modules designed for input rails above 48 volts in heavy machinery. Mounting type selection between surface mount, through hole, and chassis mount influences thermal management strategies and assembly costs, with surface-mounted modules leading in miniaturized consumer and telecom hardware, while chassis-mounted units retain relevance in industrial power distribution. Finally, switching frequency segmentation, from below 500 kilohertz to above 1 megahertz, underscores the trade-offs between efficiency, electromagnetic interference, and component sizing. Higher frequencies facilitate compact designs at the expense of complex filtering, whereas lower frequencies favor simplified passive component requirements.

This comprehensive research report categorizes the DC-DC Converter market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Topology

- Architecture

- End Use

- Output Power Range

- Input Voltage Range

- Mounting Type

- Switching Frequency

Mapping Regional Dynamics That Shape DC-DC Converter Adoption Trends in the Americas Europe Middle East Africa and Asia-Pacific Markets

Regional dynamics exert a profound influence on DC-DC converter adoption, reflecting diverse regulatory frameworks, industrial strengths, and customer priorities. In the Americas, North American automakers and aerospace integrators drive demand for high-efficiency, high-reliability converters, stimulated by federal incentives for electric vehicle infrastructure and renewable energy projects. The presence of major semiconductor foundries and power electronics design centers fosters an ecosystem of innovation, while reshoring initiatives aim to reduce dependence on offshore manufacturing and streamline compliance with evolving trade policies.

Across Europe, the Middle East, and Africa, regulatory emphasis on carbon reduction and renewable integration has accelerated deployment of DC-DC converters in smart grid installations and microgrid controllers. European manufacturers lead in implementing safety standards and eco-design requirements, prompting converter suppliers to optimize materials and end-of-life recyclability. In the Middle East, legacy oil and gas applications coexist with emerging renewable projects, creating a bifurcated market for both robust, high-power units and compact, efficiency-optimized modules. African markets, though nascent, are beginning to adopt DC-DC solutions in off-grid solar and telecommunications backhaul, signaling future growth corridors.

In the Asia-Pacific region, production hubs in China, Taiwan, South Korea, and Japan anchor the global supply chain for power semiconductors and converter modules. Domestic OEMs in consumer electronics and mobile infrastructure drive large-scale demand, while industrial automation and renewable energy installations are fueling additional growth. Recent shifts in manufacturing strategy, including moves toward ASEAN locales, reflect both tariff mitigation and labor arbitrage considerations. Innovation in materials science and rapid prototyping facilities also position Asia-Pacific as a hotbed for advanced converter designs, blending aggressive cost structures with cutting-edge technology adoption.

This comprehensive research report examines key regions that drive the evolution of the DC-DC Converter market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Manufacturers and Innovators Shaping the Competitive DC-DC Converter Ecosystem with Pioneering Technologies and Partnerships

The competitive landscape of DC-DC converters is characterized by a blend of incumbent semiconductor giants and agile boutique specialists. Key players have leveraged deep R&D investments and global distribution networks to establish comprehensive converter portfolios. Leading manufacturers have introduced modular power stages, integrated digital controls, and extended temperature range options to meet rigorous industry demands. Partnerships between semiconductor suppliers and OEM design houses have yielded co-engineered solutions that accelerate time-to-market and reduce system-level integration complexity.

Strategic acquisitions remain a prominent avenue for expanding technological capabilities, particularly in wide bandgap semiconductors and power management software tools. Companies are also forging alliances with research institutions to drive breakthroughs in packaging, thermal management, and magnetic component design. The emphasis on ecosystem development has prompted the creation of online design centers, evaluation kits, and collaborative forums, enabling faster design cycles and knowledge sharing across the industry.

In parallel, smaller specialty firms continue to carve out niches by focusing on high-voltage, high-frequency, or ultra-low-noise converter applications. Their success underscores the importance of specialized expertise and customer-focused customization in a market where one-size-fits-all approaches often fall short. Collectively, these dynamics illustrate a market in which innovation, strategic partnerships, and customer-centric strategies define competitive advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the DC-DC Converter market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Analog Devices, Inc.

- Artesyn Embedded Power Inc.

- Bel Fuse Inc.

- BorgWarner Inc.

- Cincon Electronics Co., Ltd.

- Crane Holdings, Co.

- CUI Inc.

- Delta Electronics, Inc.

- Diodes Incorporated

- Eaton Corporation plc

- Efficient Power Conversion Corporation

- Infineon Technologies AG

- Murata Manufacturing Co., Ltd.

- NXP Semiconductors N.V.

- RECOM Power GmbH

- Renesas Electronics Corporation

- STMicroelectronics N.V.

- TDK Corporation (TDK-Lambda)

- Texas Instruments Incorporated

Formulating Actionable Strategic Recommendations for Industry Leaders to Navigate Technological Disruption Trade Policy Shifts and Evolving Customer Demands

Industry leaders must adopt a proactive stance to capitalize on evolving DC-DC converter opportunities and mitigate emergent risks. Prioritizing investment in wide bandgap materials will be essential to achieving next-generation power density and efficiency targets, especially for automotive and high-performance computing applications. Simultaneously, diversifying the supplier network across multiple geographies can insulate operations from tariff fluctuations and geopolitical uncertainties.

Collaboration on industry standards and open design platforms will streamline interoperability and reduce integration overhead. By contributing to standards bodies and consortium initiatives, companies can influence emerging protocols and ensure timely adoption of innovations. Internally, organizations should enhance design workflows through digital twin simulations and model-based development, enabling rapid validation of thermal, electromagnetic, and mechanical performance under realistic operating conditions.

To address shifting customer demands, firms should develop modular converter architectures that support scalable power levels and flexible mounting options. This approach allows OEMs to customize solutions while benefiting from economies of scale. Further, establishing robust aftermarket services, including remote diagnostics and predictive maintenance, will differentiate offerings in markets where uptime and reliability are paramount. Finally, proactive engagement with policy makers to advocate for conducive trade frameworks can shape a more predictable operating environment, fostering long-term strategic planning.

Detailing Rigorous Research Methodology Combining Qualitative Expert Interviews Primary Secondary Data Collection and Analytical Frameworks

This research employs a rigorous methodology combining qualitative expert interviews, primary data collection, and comprehensive secondary research to ensure robust and actionable findings. Industry veterans from leading converter manufacturers and end-user segments were consulted to capture firsthand insights on design challenges, market dynamics, and emerging applications. Concurrently, primary data from supplier surveys and trade associations was synthesized to quantify technology adoption patterns and supply chain configurations.

Secondary sources, including academic journals, regulatory filings, and technical whitepapers, provided contextual understanding of material innovations and efficiency regulations. All data underwent a multi-stage validation process, incorporating cross-referencing between primary inputs and authoritative publications. Segmentation analysis was conducted by mapping converter attributes across topology, architecture, end use, power range, input voltage, mounting type, and switching frequency, enabling precise identification of niche opportunities and risk profiles.

Analytical frameworks such as SWOT and PESTLE were applied to assess competitive positioning and external influences, while scenario modeling elucidated potential market trajectories under various policy and technology adoption assumptions. The synthesis of quantitative data and qualitative narratives ensures a holistic perspective, equipping stakeholders with the insights necessary to make informed strategic decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our DC-DC Converter market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- DC-DC Converter Market, by Topology

- DC-DC Converter Market, by Architecture

- DC-DC Converter Market, by End Use

- DC-DC Converter Market, by Output Power Range

- DC-DC Converter Market, by Input Voltage Range

- DC-DC Converter Market, by Mounting Type

- DC-DC Converter Market, by Switching Frequency

- DC-DC Converter Market, by Region

- DC-DC Converter Market, by Group

- DC-DC Converter Market, by Country

- United States DC-DC Converter Market

- China DC-DC Converter Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1272 ]

Synthesizing Core Findings and Highlighting the Strategic Implications of DC-DC Converter Market Dynamics for Stakeholders and Decision Makers

The confluence of advanced semiconductor materials, digital control integration, and geopolitical trade considerations defines the current state of the DC-DC converter market. Topology and architecture innovations are unlocking new performance thresholds, while tariffs and supply chain realignments compel stakeholders to adopt more agile sourcing strategies. Segmentation analysis reveals differentiated value pools across end uses and regional markets, underscoring the importance of targeted product and go-to-market planning.

Leading companies are consolidating their positions through strategic partnerships, acquisitions, and investments in modular, high-density converter platforms. At the same time, new entrants continue to challenge incumbents with specialized offerings tailored to unique reliability, size, or noise requirements. Against this backdrop, industry leaders must balance innovation, standardization, and supply chain resilience to capture growth opportunities.

Ultimately, the DC-DC converter segment is poised for further expansion as electrification, digitalization, and energy efficiency mandates accelerate. Stakeholders equipped with a deep understanding of technological trends, segmentation nuances, and regional dynamics will be best positioned to seize market share and drive sustainable value creation.

Driving Immediate Engagement and Purchase of the In-Depth DC-DC Converter Market Research Report with a Direct Call-to-Action Led by Ketan Rohom

Elevate your strategic decision-making by acquiring our comprehensive DC-DC converter market research report, expertly curated to deliver actionable insights and competitive differentiation. Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to tailor the report’s findings to your unique business objectives and unlock superior growth potential. Secure your organization’s advantage in navigating emerging technologies, supply chain challenges, and policy shifts by requesting a personalized briefing with Ketan Rohom today.

- How big is the DC-DC Converter Market?

- What is the DC-DC Converter Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?