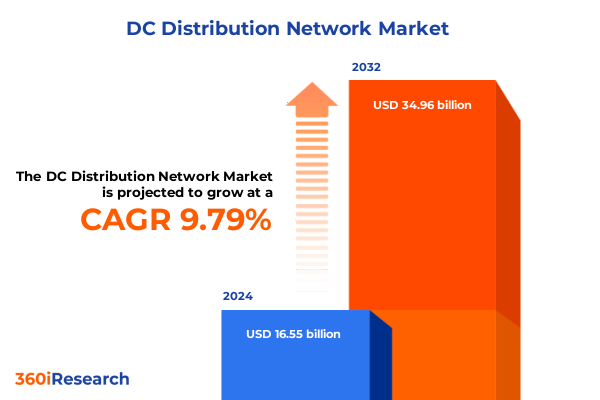

The DC Distribution Network Market size was estimated at USD 18.12 billion in 2025 and expected to reach USD 19.84 billion in 2026, at a CAGR of 9.84% to reach USD 34.96 billion by 2032.

Setting the Stage for DC Distribution Networks Amid Rapid Digital Transformation and Evolving Power Infrastructure in Critical Sectors

The rapid acceleration of digitization and infrastructure modernization has elevated direct current power distribution from niche applications to a cornerstone of resilient energy systems. As data centers push the boundaries of computational density and electric vehicle charging stations demand high-efficiency architectures, the imperative for streamlined, reliable DC distribution networks has never been more critical. This executive summary outlines the pivotal forces at play, setting the stage for decision-makers to understand how the convergence of advanced power electronics, emerging regulatory landscapes, and strategic investments are shaping the future of DC power delivery.

Across sectors ranging from industrial facilities to commercial buildings, the transition toward decentralized energy paradigms underscores the importance of robust DC infrastructure. Stakeholders are navigating a complex interplay of technological innovations such as modular power converters, integrated energy storage solutions, and intelligent monitoring systems that enhance operational agility. Moreover, the drive for carbon neutrality and grid resilience is compelling organizations to rethink traditional alternating current topologies, embracing DC architectures for their potential to reduce energy losses and simplify integration with renewable sources.

In this dynamic environment, clarity around market segmentation, regional variations, and competitive positioning becomes paramount. The chapters ahead delve into transformative landscape shifts, the implications of recent tariff reforms, segmentation insights, and actionable guidance for industry leaders. Together, these findings illuminate strategic opportunities and provide a roadmap for navigating the rapidly evolving DC distribution network ecosystem.

The Evolution of DC Power Delivery Driven by Convergence of Distributed Generation Energy Storage and Intelligent Grid Technologies

The landscape of DC distribution networks is undergoing transformative shifts driven by the maturation of distributed generation assets and the proliferation of intelligent grid technologies. Recent innovations in power conversion and storage have enabled seamless integration of photovoltaic arrays and battery systems, ushering in a new era of modular energy solutions. As organizations prioritize uptime and energy efficiency, smart power electronics are increasingly embedded with real-time analytics, enabling predictive maintenance and dynamic load balancing that significantly enhance system resilience.

Concurrent advances in digital twin modeling and edge computing are reshaping design and operational paradigms. Engineers can now simulate end-to-end power flows under varying environmental conditions, optimizing component selection and reducing commissioning timelines. This digital-first approach dovetails with the rise of interoperability standards that facilitate plug-and-play compatibility across batteries and energy storage systems, circuit breakers, converters, and controllers.

Moreover, the growing emphasis on electrification in sectors such as remote communications, defense, and transportation underscores the critical role of DC distribution infrastructure. From high-voltage microgrids supporting remote cell towers to compact low-voltage systems powering EV fast charging hubs, the ability to tailor solutions across diverse voltage ranges and applications is unlocking new revenue streams. The chapters that follow examine how market players are capitalizing on these shifts to deliver end-to-end solutions that align with sustainability mandates and operational excellence.

Assessing How US Tariff Measures in 2025 Are Reshaping Supply Chain Dynamics Strategic Sourcing and Cost Structures in DC Distribution Equipment

The introduction of revised US tariffs in 2025 has prompted supply chain reevaluations across the DC distribution equipment landscape. Manufacturers reliant on imported electronic components and raw materials have encountered altered cost benchmarks, catalyzing a strategic pivot toward supplier diversification and nearshoring initiatives. Amid these changes, procurement teams are renegotiating contracts to mitigate exposure to import duties while exploring alternative sourcing corridors in Latin America and Southeast Asia.

At the same time, original equipment manufacturers are rethinking their design-for-manufacturability processes to accommodate local content requirements. This evolution is accelerating investments in domestic assembly capabilities and bolstering partnerships with contract manufacturers that can navigate complex compliance frameworks. As a result, lead times for critical items such as high-voltage converters and DC distribution boards are gradually stabilizing, even as global shipping constraints persist.

Furthermore, service providers and end-users are recalibrating total cost of ownership analyses to account for tariff-induced shifts in component pricing. Lifecycle cost assessments now incorporate scenarios that factor in fluctuating import duties alongside operational benefits such as enhanced energy savings and reduced maintenance overhead. These strategic adjustments underscore the intricate balancing act between cost management and the pursuit of next-generation DC distribution architectures.

Deep Dive into DC Distribution Network Segments Unveiling Component Voltage Application Installation and End User Dynamics for Targeted Strategies

Understanding the nuanced drivers of demand within DC distribution networks requires an in-depth exploration of component, voltage, application, installation, environment, and end-user factors. By component type, stakeholders analyze performance trade-offs among batteries and energy storage systems, circuit breakers, converters and inverters, DC distribution boards, power regulators, and switches, tailoring configurations to meet specific operational criteria and resilience objectives.

Voltage range segmentation further informs system architecture decisions, distinguishing between high-voltage solutions ideal for long-distance microgrids, medium-voltage configurations optimized for industrial complexes, and low-voltage designs suited to residential and small commercial environments. Application-centric insights reveal divergent requirements across data centers demanding ultra-low latency power delivery, EV fast charging systems prioritizing rapid energy transfer, military platforms emphasizing ruggedized reliability, and remote cell towers valuing minimal footprint and autonomy.

Installation types split along the lines of new projects-where greenfield planning allows holistic integration of advanced power electronics-and retrofit scenarios that challenge engineers to overlay modern DC networks onto legacy AC infrastructures. Environmental considerations differentiate indoor deployments offering controlled climates and streamlined cable management from outdoor systems requiring weatherproofing and enhanced surge protection.

Finally, end-user segmentation underscores the tailored value propositions for commercial buildings encompassing offices and retail spaces, industrial facilities including manufacturing plants and warehouses, institutional settings such as hospitals and schools, and residential developments pursuing smart home and microgrid aspirations. Integrating these six lenses equips decision-makers with the clarity needed to prioritize investments, optimize system designs, and align deployment strategies with evolving operational imperatives.

This comprehensive research report categorizes the DC Distribution Network market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component Type

- Voltage Range

- Application

- Installation Type

- Installation Environment

- End-User

Unraveling Regional Dynamics Shaping DC Distribution Network Adoption Patterns across the Americas Europe Middle East and Africa and the Asia Pacific

Regional dynamics exert a profound influence on the adoption and evolution of DC distribution networks. In the Americas, regulatory incentives for grid modernization and sustainability initiatives are steering utilities and large enterprises toward pilot microgrid projects that leverage localized renewable integration and energy storage. This region’s diverse climate zones and infrastructure maturity levels require flexible designs that can scale from dense urban environments to remote industrial outposts.

Across Europe, the Middle East, and Africa, the interplay between stringent carbon reduction targets and ambitious electrification programs is shaping project pipelines. Western European markets are characterized by advanced smart grid deployments and regulatory frameworks that encourage private investment in DC infrastructure. In contrast, emerging markets in the Middle East and Africa prioritize rapid deployment and resilience, driving demand for turnkey solutions capable of functioning in harsh climates and unstable grid conditions.

In the Asia-Pacific region, robust manufacturing ecosystems and supportive government policies are accelerating the commercialization of DC-based power systems. Rapid urbanization, the proliferation of data centers, and soaring EV adoption rates are fostering a competitive landscape where both international conglomerates and regional innovators vie to deliver next-generation distribution platforms. These divergent regional imperatives underscore the need for adaptable strategies that account for policy landscapes, supply chain capabilities, and end-user expectations across global markets.

This comprehensive research report examines key regions that drive the evolution of the DC Distribution Network market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players Propelling Innovation Strategic Partnerships and Competitive Positioning in DC Distribution Solutions

Leading companies are leveraging expertise, strategic alliances, and modular technology platforms to gain competitive advantage in DC distribution solutions. Several global power electronics manufacturers have expanded their portfolios through targeted acquisitions of specialized converter and inverter producers, enhancing their ability to offer integrated systems that streamline procurement and commissioning processes.

At the same time, technology innovators are forging partnerships with software and controls developers to embed advanced monitoring and analytics capabilities into DC distribution boards and regulators. These collaborations are yielding platforms that deliver end-to-end visibility, from cell-level battery health diagnostics to system-wide load balancing metrics, enabling customers to optimize performance in real time.

In addition, key players are differentiating through service-oriented business models, bundling installation consultancy, on-site commissioning, and long-term maintenance agreements. This shift toward value-added services not only deepens customer relationships but also creates recurring revenue streams and fosters continuous feedback loops for product improvement.

Finally, cross-industry consortia are emerging as catalysts for standardization, pooling resources to drive interoperability protocols and certification programs. By collectively addressing compatibility challenges, these initiatives reduce integration risks and accelerate time to market for DC distribution innovations, reinforcing the strategic positioning of participating companies.

This comprehensive research report delivers an in-depth overview of the principal market players in the DC Distribution Network market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- AcBel Polytech Inc.

- Allis Electric Co., Ltd.

- Alpine Power Systems

- Cence Power

- Cisco Systems, Inc.

- Delta Electronics, Inc.

- Eaton Corporation PLC

- Emerson Electric Co.

- EnerSys

- Fuji Electric Co., Ltd.

- GE Vernova

- Helios Power Solutions Pty Ltd

- Hitachi Energy Ltd.

- LS ELECTRIC Co., Ltd.

- Mitsubishi Electric Corporation

- Myers Power Products, Inc.

- Norwegian Electric Systems

- Panasonic Holdings Corporation

- Powell Industries, Inc.

- Robert Bosch GmbH

- Schneider Electric SE

- Siemens AG

- Signify Netherlands B.V.

- Sumitomo Electric Industries, Ltd.

- Sécheron SA

- Terasaki Electric Co., Ltd.

- Toshiba Corporation

- Vertiv Group Corporation

- Victron Energy B.V.

Strategic Imperatives and Actionable Roadmaps for Industry Leaders to Navigate Disruption and Capitalize on DC Distribution Ecosystem Opportunities

Industry leaders must adopt a dual focus on technological innovation and operational agility to capture growth opportunities in DC distribution networks. First, investing in modular, scalable power electronics architectures will enable rapid adaptation to evolving voltage requirements and application profiles, facilitating seamless integration with renewable energy assets and digital control platforms.

Next, strengthening supply chain resilience through multi-source procurement strategies and regional assembly capabilities can mitigate the impact of tariff fluctuations and logistical disruptions. By cultivating local partnerships and leveraging nearshore production, companies can maintain stable lead times and cost predictability.

Furthermore, embedding advanced analytics and predictive maintenance tools within distribution equipment will unlock new value for end-users, empowering proactive decision-making and reducing unplanned downtime. Service providers should develop comprehensive data-driven offerings that bundle hardware, software, and advisory services, reinforcing customer loyalty and creating recurring revenue models.

Finally, engaging in industry consortia and standardization efforts will accelerate interoperability and reduce integration complexity for ecosystem stakeholders. By championing open protocols and certification schemes, companies can broaden market access and establish themselves as trusted partners in the global shift toward resilient, efficient DC power delivery.

Methodological Rigor and Comprehensive Analytic Frameworks Underpinning the Study of DC Distribution Networks across Multiple Data Sources

This study is underpinned by a rigorous multi-phase research methodology designed to ensure data integrity and analytical depth. Primary research involved in-depth interviews and workshops with senior executives across utilities, data center operators, EV infrastructure firms, and defense contractors to validate key trends and capture firsthand insights into operational challenges and strategic priorities.

Secondary research encompassed a comprehensive review of technical journals, industry reports, regulatory filings, and standards documentation to map the evolution of DC distribution technologies and policy frameworks. This process included comparative analyses of regional incentive structures, tariff regimes, and grid modernization initiatives to contextualize market drivers.

Quantitative analysis integrated supplier and end-user surveys to identify adoption patterns across component types, voltage ranges, and application verticals. Data triangulation techniques were applied to reconcile divergent viewpoints and ensure the robustness of segmentation insights. Scenario modeling further examined the potential ramifications of evolving tariff policies and technology maturation curves on supply chain dynamics.

Finally, all findings were subjected to expert validation sessions with a panel of engineers, consultants, and academic researchers, ensuring that conclusions and recommendations reflect real-world feasibility and strategic relevance for stakeholders navigating the DC distribution network landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our DC Distribution Network market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- DC Distribution Network Market, by Component Type

- DC Distribution Network Market, by Voltage Range

- DC Distribution Network Market, by Application

- DC Distribution Network Market, by Installation Type

- DC Distribution Network Market, by Installation Environment

- DC Distribution Network Market, by End-User

- DC Distribution Network Market, by Region

- DC Distribution Network Market, by Group

- DC Distribution Network Market, by Country

- United States DC Distribution Network Market

- China DC Distribution Network Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Synthesizing Insights to Illuminate Future Pathways for DC Distribution Networks amid Decentralization Sustainability and Emerging Technology Demands

The accelerating shift toward DC distribution architectures signals a transformative juncture for power delivery systems worldwide. As industries pursue higher efficiency, grid resilience, and seamless integration with renewable energy, the strategic importance of modular DC networks continues to grow. The insights presented in this overview underscore the critical interplay between technology innovation, policy environments, and market segmentation dynamics.

Key trends such as the convergence of advanced power electronics, the impact of updated tariff structures, and the rise of data-driven service models point to a future defined by flexibility and interoperability. Regional nuances-from the Americas’ push for sustainability pilots to the EMEA’s varied regulatory landscapes and Asia-Pacific’s manufacturing-driven momentum-highlight the need for tailored strategies that address specific market cadences.

In an era of rapid electrification and digital transformation, stakeholders that embrace agile development practices, invest in resilient supply chains, and foster collaborative ecosystems will be best positioned to lead the next wave of DC distribution network deployments. The collective imperative for efficiency, reliability, and sustainability will catalyze further innovation, heralding a new paradigm in how power is generated, distributed, and managed.

Engage with Ketan Rohom Associate Director Sales and Marketing to Secure Tailored DC Distribution Network Research that Drives Strategic Decisions

Every industry leader must translate insights into decisive action to stay ahead in the evolving landscape of DC distribution networks. For bespoke consultation and to unlock the full depth of this comprehensive analysis, connect directly with Ketan Rohom, Associate Director, Sales and Marketing. By engaging with Ketan, organizations can tailor strategic roadmaps that align with unique operational requirements, leverage targeted intelligence on component integration, and anticipate tariff-driven supply chain realignments. This collaboration ensures that your stakeholders receive customized briefings, scenario planning tools, and ongoing advisory support to navigate market complexities. Reach out today to transform research findings into competitive advantage and chart a forward-looking strategy that optimizes performance, resilience, and innovation in your DC distribution network implementation.

- How big is the DC Distribution Network Market?

- What is the DC Distribution Network Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?