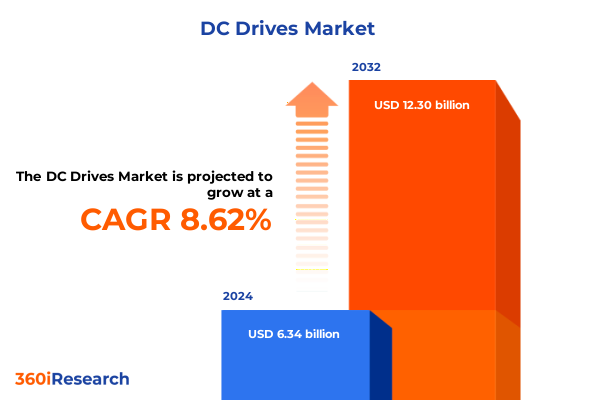

The DC Drives Market size was estimated at USD 6.87 billion in 2025 and expected to reach USD 7.45 billion in 2026, at a CAGR of 8.66% to reach USD 12.30 billion by 2032.

Setting the Scene for DC Drives: Unveiling the Core Role and Strategic Significance of DC Drives in Modern Industrial Applications

DC drives represent the essential link between electrical power and mechanical motion, providing precise speed control and torque modulation for a broad spectrum of industrial applications. From conveyor belts and robotic arms to electric vehicle charging stations and renewable energy systems, these drives underpin critical operational processes that demand both reliability and high performance. The growing emphasis on energy efficiency and automation has elevated the strategic role of DC drives in enabling manufacturers and service providers to optimize throughput, minimize downtime, and align with tightening regulatory requirements.

Against this backdrop, this executive summary outlines the key dimensions of the DC drives landscape, offering an integrated perspective on technological trends, regulatory influences, and market dynamics that will shape stakeholder decisions. Our analysis delves into transformative shifts driven by digitalization and advanced power electronics, assesses the cumulative impact of evolving U.S. tariff policies, and distills insights across segmentation, regional variations, and leading industry players. By synthesizing these findings, decision-makers will be equipped with the critical context needed to refine sourcing strategies, prioritize innovation investments, and reinforce supply chain resilience in an increasingly competitive environment.

In subsequent sections, we examine how emerging technologies and policy developments intersect to create new opportunities and challenges for participants in the DC drives value chain. Transitioning seamlessly from high-level trends to granular operational considerations, this summary aims to illuminate strategic pathways and actionable tactics for organizations poised to lead in this dynamic sector.

Navigating the Technological Revolution in DC Drives as IoT Integration, Predictive Maintenance, and Advanced Power Electronics Redefine Industry Standards

The DC drives sector is experiencing a profound transformation as digital signal processing and microcontroller integration have become standard practice in drive architecture. Sophisticated control algorithms now enable precision adjustments to motor speed and torque, delivering enhanced performance in applications ranging from high-speed packaging lines to slow-roll conveyor systems. As a result, organizations are achieving greater operational agility and tighter process control, fostering a shift toward higher throughput and leaner maintenance schedules.

Concurrently, integration with Internet of Things platforms is empowering predictive maintenance strategies that fundamentally change how service cycles are planned. Real-time monitoring of voltage, current, temperature, and vibration metrics, combined with machine learning–driven analytics, allows maintenance teams to identify early warning signs of component wear before failures occur. This proactive approach not only reduces unplanned downtime but also extends drive lifecycle performance by scheduling interventions precisely when they are needed.

Furthermore, advances in power electronics, notably the deployment of silicon carbide and gallium nitride semiconductors, are enabling more compact and efficient DC drive designs. These materials support higher switching frequencies and lower losses, which translate into reduced heat generation and smaller form factors. The convergence of these technological shifts is redefining industry standards, compelling original equipment manufacturers and system integrators to adopt more versatile, data-centric drive solutions that align with smart factory objectives and stringent energy efficiency mandates.

Assessing the Far-Reaching Consequences of the 2025 United States Section 301 Tariff Structure on DC Drive Supply Chains and Cost Dynamics

Since 2018, Section 301 tariffs on imports from China have imposed additional duties on machinery and motor-related products, including DC drives and associated components. The U.S. Trade Representative’s office extended tariff exclusions covering motors and machinery until May 31, 2025 to mitigate supply shortages and maintain production continuity. However, as these temporary protections lapse, imports of Chinese-origin DC drives face reinstatement of up to 25% duties, driving up landed costs and forcing procurement teams to reassess sourcing strategies.

In parallel, the September 27, 2024 tariff modifications introduced a suite of increases affecting strategic sectors such as semiconductors, solar cells, batteries, and steel- inputs integral to DC drive manufacturing. Rates on electric vehicles rose to 100%, while duties on battery parts climbed to 25%, a change that indirectly amplifies input costs for battery-coupled drive solutions and ancillary power modules. Critical minerals and permanent magnets also saw scheduled increases through 2025 and early 2026, heightening cost uncertainties for high-performance brushless drives.

These layered tariff measures have catalyzed a shift toward supply chain diversification and regional nearshoring. Many drive manufacturers are expediting capacity expansions in North America and Southeast Asia to hedge against future duty hikes, while engineering teams are investigating alternative materials and modular designs to reduce reliance on tariff-exposed components. As a result, the cumulative impact in 2025 encompasses not only direct cost inflation but also strategic repositioning across the value chain- from component sourcing to assembly footprints-redefining competitive dynamics in the DC drives market.

Deciphering Critical Market Segmentation Layers to Illuminate Growth Opportunities Across Diverse DC Drive Types, End-Use Industries, Voltage and Power Ratings

Analysis of DC drives by type reveals a clear dichotomy between brushed and brushless architectures. Brushed systems continue to deliver cost-effective solutions for lower-duty applications, yet brushless drives are gaining traction due to their enhanced lifespan, reduced maintenance requirements, and superior performance in high-precision environments. This evolution is particularly evident in end-use segments such as automotive conveyor systems, where the need for predictable, uninterrupted operations elevates the value of brushless designs.

Turning to end-use industries, the automotive sector’s reliance on DC drives spans conveyor systems in assembly lines to fast-charging electric vehicle stations, where precise power modulation is critical to efficiency and safety. In manufacturing, DC drives serve indispensable roles in food and beverage processing lines, where sanitary design and speed regulation are vital for compliance. Metal processing applications prioritize torque-density and regenerative braking to optimize energy recovery, while textile operations demand smooth speed transitions to protect delicate fibers during production.

Voltage ratings further refine market positioning, as high-voltage drives address heavy industrial loads and long-distance power transmission, while medium-voltage units balance performance and cost for midscale facilities. Low-voltage drives proliferate in small machinery and localized automation cells, offering simplified integration with standard control panels. Similarly, power-rating distinctions shape product portfolios: microdrives under 1 horsepower find homes in laboratory instruments and robotics, 1–10 Hp units power general-purpose motors, midrange 10–100 Hp drives anchor larger conveyors or pumps, and above-100 Hp installations meet the demands of heavy-duty processing plants.

This comprehensive research report categorizes the DC Drives market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Voltage Rating

- Power Rating

- End-Use Industry

Unearthing Regional Variations in DC Drive Adoption Trends and Infrastructure Developments Across Americas, EMEA, and Asia-Pacific Markets

In the Americas, robust investments in industrial automation and renewable energy infrastructure are driving DC drive uptake across manufacturing clusters and grid-tied storage systems. OEMs in the United States and Canada are integrating advanced drives into legacy production lines and greenfield facilities alike, with particular emphasis on energy efficiency initiatives that align with regulatory incentives and corporate sustainability commitments.

Europe, the Middle East, and Africa present a heterogeneous landscape shaped by divergent regulatory frameworks and adoption rates. Western Europe’s stringent energy directives and carbon-reduction targets accelerate uptake in sectors such as wind energy and water treatment, while the Middle East’s investments in petrochemical and desalination infrastructure drive demand for high-reliability drives. Across Africa, growing mining and mineral processing operations are beginning to embrace DC drives for their resilience in harsh environments, although market penetration remains nascent.

Asia-Pacific stands out for its expansive manufacturing ecosystem and competitive production costs. Leading economies such as China, Japan, and South Korea leverage local supply chains and digitalization programs to deploy sophisticated drive solutions in automotive, electronics, and semiconductor fabrications. Southeast Asian regions, buoyed by favorable trade agreements and nearshoring trends, are emerging as alternative manufacturing hubs, further diversifying the global landscape for DC drive sourcing and deployment.

This comprehensive research report examines key regions that drive the evolution of the DC Drives market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading DC Drive Manufacturers and Technology Innovators Shaping Competitive Dynamics and Collaboration Trends in the Sector

Major players are intensifying investment in digital services and partnership ecosystems to fortify their market positions. ABB has expanded its Ability platform to include predictive analytics modules tailored for DC drive installations, enabling customers to optimize energy use and maintenance cycles. Siemens continues to enhance its Sinamics portfolio with modular hardware and open communication protocols, facilitating seamless integration with MES and SCADA platforms.

Rockwell Automation’s PowerFlex series emphasizes scalability and lifecycle support, while Schneider Electric’s Lexium drives showcase embedded safety functions and remote diagnostic capabilities. Japanese manufacturers such as Yaskawa and Mitsubishi Electric maintain their dominance by combining legacy expertise in motor control with next-generation drive features, including integrated condition monitoring and adaptive control algorithms. These companies are also advancing collaborative initiatives with software providers, signaling a convergence between traditional drive hardware and data-driven service offerings.

Meanwhile, smaller specialized firms are carving out niches through bespoke engineering solutions that address industry-specific challenges, such as corrosion-resistant drives for offshore platforms or ultra-compact units for cleanroom operations. As consolidation and strategic alliances accelerate, the competitive landscape is shifting toward value-added services and full-system lifecycle management, positioning key companies for sustained leadership in a rapidly evolving DC drive ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the DC Drives market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Danfoss A/S

- Delta Electronics, Inc.

- Eaton Corporation plc

- Emerson Electric Co.

- Fuji Electric Co., Ltd.

- General Electric Company

- Hitachi, Ltd.

- Mitsubishi Electric Corporation

- Nidec Corporation

- Parker-Hannifin Corporation

- Rockwell Automation, Inc.

- Schneider Electric SE

- Siemens AG

- Toshiba Corporation

- WEG S.A.

- Yaskawa Electric Corporation

Strategic Imperatives for Industry Leaders to Future-Proof Their DC Drive Portfolios Through Innovation, Supply Chain Diversification, and Policy Engagement

To navigate the complex interplay of technological advances and trade policy shifts, industry leaders should prioritize supply chain diversification by developing alternative sourcing agreements outside high-tariff jurisdictions. Establishing regional assembly or manufacturing centers in key markets reduces exposure to duty fluctuations and enhances responsiveness to local demand patterns. Simultaneously, investing in brushless drive technologies and advanced power electronics will deliver long-term reliability gains and align product offerings with the escalating performance expectations of end users.

Moreover, building an ecosystem of predictive maintenance and remote monitoring services can transform maintenance contracts into strategic revenue streams. By leveraging data analytics platforms, organizations can shift from time-based interventions to condition-based servicing, reducing total cost of ownership for customers and creating recurring service engagements. Complementing this, expanding local service networks- through authorized distributors and certified technicians- enhances customer trust and accelerates after-sales support metrics.

Engagement with policy stakeholders is also essential. Active participation in industry forums and trade associations empowers companies to influence evolving tariff negotiations and regulatory directives. Finally, adopting modular, scalable drive architectures facilitates faster time to market and allows for incremental technology upgrades. This approach not only reduces capital intensity but also positions manufacturers to capitalize on emerging opportunities in smart manufacturing and energy transition initiatives.

Transparent Methodological Framework Combining Primary Intelligence, Secondary Research and Triangulation to Ensure Rigorous DC Drive Market Analysis

This research employed a blend of primary and secondary methodologies to ensure analytical rigor and market relevance. Primary investigations included in-depth interviews with senior executives, field service engineers, and procurement managers across automotive, manufacturing, oil and gas, and renewable energy sectors. These conversations yielded firsthand insights into real-world application challenges, performance criteria, and evolving procurement strategies.

Secondary research encompassed a systematic review of trade publications, government tariff notifications, company annual reports, and publicly available technical specifications. Proprietary trade and customs databases were leveraged to validate component flow patterns and tariff classification impacts. All quantitative findings were triangulated against multiple data sources to enhance validity, while qualitative observations underwent peer review by industry experts to eliminate bias and reinforce objectivity.

Segmentation analysis was built upon clearly defined categories: drive type as brushed versus brushless; end-use industries ranging from automotive conveyors and EV charging to food and beverage, metal processing, textile, oil and gas, and renewable energy; voltage tiers spanning low, medium, and high; and power ratings from below 1 Hp to above 100 Hp. Regional mapping aligned with Americas, Europe, Middle East & Africa, and Asia-Pacific zones. This structured approach and methodical data triangulation underpin the robustness of the conclusions and recommendations presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our DC Drives market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- DC Drives Market, by Type

- DC Drives Market, by Voltage Rating

- DC Drives Market, by Power Rating

- DC Drives Market, by End-Use Industry

- DC Drives Market, by Region

- DC Drives Market, by Group

- DC Drives Market, by Country

- United States DC Drives Market

- China DC Drives Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesizing Key Findings to Reinforce Strategic Pathways for Stakeholders Navigating the Evolving DC Drive Ecosystem

The DC drives market is at a pivotal juncture, defined by the convergence of digitalization, advanced power electronics, and shifting trade policies. Emerging technologies, such as IoT-enabled predictive maintenance and wide-bandgap semiconductor components, are setting new performance benchmarks, while evolving tariff structures are reshaping cost calculus and supply chain configurations. In this environment, both incumbent manufacturers and agile challengers must recalibrate their strategies to harness technological opportunities and mitigate policy-driven risks.

Segmentation and regional analyses underscore the importance of tailoring solutions to specific application needs and market conditions. Brushless drives are gaining traction where reliability and efficiency are paramount, and voltage or power considerations dictate nuanced product designs. Regional hubs in the Americas, EMEA, and Asia-Pacific each present distinct regulatory landscapes and adoption drivers, highlighting the necessity of flexible business models that can swiftly adapt to local requirements.

Ultimately, the capacity to combine technological innovation with supply chain resilience and policy foresight will define competitive leadership. Organizations that proactively engage in transformative R&D, cultivate strategic partnerships, and embed data-driven service offerings into their portfolios are best positioned to capitalize on the growth trajectory of the DC drives sector. As the industry continues to evolve, these strategic imperatives will serve as the foundation for sustained success and market differentiation.

Engage with Associate Director Ketan Rohom to Acquire Comprehensive DC Drives Market Research and Gain Tailored Competitive Intelligence

To deepen your strategic understanding and gain exclusive competitive intelligence, we invite you to partner with Ketan Rohom, Associate Director, Sales & Marketing, to acquire the comprehensive DC Drives market research report. This report delivers enriched insights derived from rigorous primary and secondary investigations, offering you actionable analyses and forward-looking perspectives tailored to your organization’s needs. Connect with Ketan Rohom to explore customized engagement models, unlock detailed segmentation breakdowns, and secure intelligence that empowers you to anticipate market shifts with confidence and chart a clear roadmap for growth in the dynamic DC Drives landscape

- How big is the DC Drives Market?

- What is the DC Drives Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?