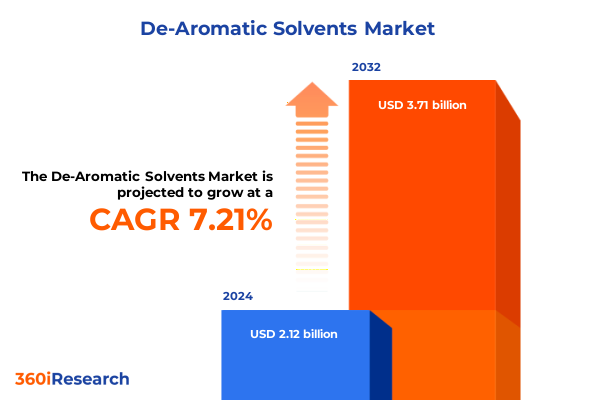

The De-Aromatic Solvents Market size was estimated at USD 2.27 billion in 2025 and expected to reach USD 2.43 billion in 2026, at a CAGR of 7.25% to reach USD 3.71 billion by 2032.

An Overview of the De-Aromatic Solvents Market Dynamics Shaping Performance and Compliance in Modern Industrial Applications

The evolving landscape of de-aromatic solvents is driven by an intricate blend of regulatory imperatives, performance requirements, and sustainability commitments. As industries seek to replace traditional aromatic solvents, which are associated with higher volatility and environmental concerns, the market has witnessed a growing appetite for low-aromatic alternatives. These specialized solvents provide enhanced safety profiles, reduced emissions, and compatibility with a wide range of application environments, positioning them as strategic enablers for companies striving to meet stringent environmental standards.

Over the past decade, de-aromatic solvents have garnered attention for their capacity to deliver comparable solvency strength while minimizing health risks and ecological footprints. End-users from cleaning and degreasing operations to coatings manufacturers have increasingly adopted these solutions to reduce volatile organic compound (VOC) outputs and achieve higher flash points, thereby aligning operational efficiency with regulatory compliance. Moreover, advancements in hydrogenation processes have expanded the portfolio of available grades, enabling practitioners to select products tailored to specific process requirements.

This report offers a holistic view of the de-aromatic solvent market, unearthing the transformative shifts underway, assessing the cumulative impact of recent United States tariff measures, and delivering granular segmentation insights. Through a robust examination of regional dynamics and competitive strategies, this executive summary sets the stage for an in-depth understanding of market opportunities and challenges. Decision-makers and industry stakeholders can leverage this analysis to frame strategic priorities and inform investment planning.

Emerging Technological Innovations and Sustainability Regulations Accelerating the Shift Toward De-Aromatic Solvent Adoption Across Industries

Technological breakthroughs and tightening environmental regulations have catalyzed a fundamental reconfiguration of the de-aromatic solvents landscape. Innovations in catalytic hydrogenation have enhanced the conversion efficiency of naphthenic and paraffinic feedstocks, resulting in solvents with significantly reduced aromatic content. These advancements not only improve product consistency and purity grades but also reduce energy consumption during manufacturing, thereby addressing cost pressures and carbon footprint considerations simultaneously.

Concurrently, regulatory bodies across North America, Europe, and Asia-Pacific have introduced more stringent VOC restrictions, propelling manufacturers to reassess solvent portfolios and invest in greener alternatives. Companies are increasingly integrating lifecycle assessments into product development to validate the environmental benefits of de-aromatic solvents. Moreover, the pursuit of circular economy principles has spurred initiatives to recycle and reclaim spent solvents, further diminishing waste streams.

These forces converge to shape a dynamic market environment in which sustainable innovation and compliance obligations drive competitive differentiation. As the industry transitions toward decarbonization and resource efficiency, de-aromatic solvents are emerging as cornerstone materials for organizations committed to balancing operational performance with environmental stewardship.

Assessment of the Cumulative Impact Caused by 2025 United States Tariffs on De-Aromatic Solvent Trade Flows and Competitive Dynamics

The imposition of new and sustained tariffs by the United States in 2025 has materially influenced global trade flows of de-aromatic solvents and related feedstocks. Targeted primarily at imported chemical products originating from key producing regions, these measures have altered cost structures for importers while incentivizing domestic production. As a result, end-users have faced upward pressure on inbound pricing, prompting a re-evaluation of supplier partnerships and procurement strategies.

Import duties have translated into differential cost burdens depending on the origin of supply, leading to strategic sourcing shifts. Some companies have relocated contracting toward local or tariff-exempt markets, whereas others have absorbed incremental expenses to maintain continuity of high-performance grades. In parallel, domestic producers have ramped up capacity expansions to capitalize on the protective effect of tariffs, although lead times for new plant installations and feedstock access remain potential bottlenecks.

Market participants are navigating this environment by forging long-term supply agreements, diversifying feedstock sources, and exploring tolling arrangements to mitigate capital outlays. These adaptations underscore the importance of agile supply chain management and highlight opportunities for strategic collaborations that realign production closer to end-use markets while circumventing tariff barriers.

Comprehensive Analysis of De-Aromatic Solvent Market Segmentation Revealing Application and End-Use Industry Growth Drivers and Profitability Patterns

A detailed examination of market segmentation reveals that application diversity is central to unlocking value across the de-aromatic solvent landscape. Agrochemical processing demands high-octane solvents that facilitate efficient formulation of active compounds, while chemical processing operations leverage tailored grades to optimize reaction kinetics. The cleaning and degreasing segment, encompassing electronics cleaning, industrial cleaning, and metal surface cleaning, has emerged as a critical growth area due to the superior solvency power and high flash points of de-aromatic alternatives. Paints and coatings manufacturers exploit these solvents to achieve rapid drying times and low VOC emissions, and solvent extraction processes benefit from selective solubility characteristics that enhance yield and purity.

End-use industry analysis indicates that agrochemicals, including fungicides, herbicides, and insecticides, constitute a significant demand center, driven by rising global food production needs and a preference for formulations that minimize residual toxicity. The chemicals sector bifurcates between bulk and specialty segments, where bulk chemicals rely on cost-effective grades and specialty chemicals emphasize performance attributes. Within coatings and paints, automotive, decorative, and industrial categories each require bespoke solvent profiles to balance drying performance, substrate compatibility, and regulatory compliance. Pharmaceuticals leverage de-aromatic solvents in active pharmaceutical ingredient synthesis and formulated drug products, with high purity grades being especially critical for stringent quality requirements.

Product type segmentation differentiates between hydrogenated naphtha, hydrotreated heavy, and hydrotreated light grades, each selected based on boiling range and aromatic content. Purity grade dynamics distinguish high purity grades for sensitive applications from technical grades for general industrial use. Finally, sales channel insights underscore the relevance of direct relationships for large volume purchasers, while distributor networks serve smaller or geographically dispersed end-users by offering flexible delivery and inventory solutions.

This comprehensive research report categorizes the De-Aromatic Solvents market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Flash Point

- Purity Grade

- Product Type

- Application

- End-Use Industry

- Sales Channel

Regional Market Dynamics Revealing Unique Growth Drivers and Strategic Imperatives Across Americas Europe Middle East Africa and Asia-Pacific Markets

Regional nuances play an instrumental role in shaping de-aromatic solvent market trajectories. In the Americas, stringent environmental regulations in the United States and Canada have accelerated adoption in high-value applications such as electronics cleaning and specialty coatings. The presence of substantial hydrocarbon feedstock reserves in North America supports robust domestic production, while South American markets are witnessing gradual uptake driven by industrial modernization and agrochemical expansion.

Across Europe, Middle East, and Africa, regulatory frameworks such as the European Green Deal have set aggressive targets for VOC reduction, fostering demand for low-aromatic solutions in coatings and solvent extraction. Middle Eastern and North African refineries have begun integrating hydrotreatment units to produce local hydrotreated solvents, decreasing reliance on imports. Meanwhile, Africa’s developing economies are gradually incorporating modern-grade solvents into agrochemicals and paints segments as part of broader infrastructure growth.

In Asia-Pacific, growth is underpinned by rapid industrialization in China, India, and Southeast Asia, where expanding chemical and pharmaceutical manufacturing hubs drive demand. Local petrochemical complexes are investing in advanced hydrogenation technologies to capture value downstream. Market access strategies in this region often involve joint ventures and technology licensing, positioning Asia-Pacific as a pivotal growth arena for de-aromatic solvent suppliers seeking scale and cost competitiveness.

This comprehensive research report examines key regions that drive the evolution of the De-Aromatic Solvents market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Deep Dive into Competitive Strategies Research and Innovation Portfolios of Leading De-Aromatic Solvent Producers Transforming the Industry

Competitive intensity in the de-aromatic solvent market is defined by a handful of global players that have established vertically integrated production platforms. Major energy and chemical conglomerates have leveraged refining assets to produce hydrogenated naphtha and hydrotreated solvent grades at scale, while specialized chemical firms have concentrated on high-purity offerings to serve niche applications such as electronics cleaning and pharmaceutical manufacturing. Recent years have seen strategic alliances and joint ventures emerge as critical mechanisms for sharing technology and expanding geographic reach.

Industry leaders are pursuing a multipronged approach to sustain differentiation. Research and development investments focus on optimizing catalyst performance, reducing aromatic content to mid- and ultra-low levels, and enhancing solvent recovery processes. Capacity expansions, particularly in regions with favorable feedstock economics or burgeoning end-use demand, underscore a commitment to securing supply chains. Concurrently, digital tools for predictive maintenance, real-time quality monitoring, and supply chain analytics are being adopted to drive operational efficiencies and improve customer responsiveness.

These strategic priorities highlight how leading companies are balancing scale-driven cost advantages with targeted innovation to maintain a competitive edge. By cultivating partnerships with technology providers and end-users, they are aligning product roadmaps with evolving market needs and regulatory trajectories.

This comprehensive research report delivers an in-depth overview of the principal market players in the De-Aromatic Solvents market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arham Petrochem Private Limited

- Avani Petrochem Pvt Ltd

- BP p.l.c.

- Calumet, Inc.

- CEPSA QUÍMICA, S.A.

- Chevron Phillips Chemical Company LLC

- China Petroleum & Chemical Corporation

- DHC Solvent Chemie GmbH

- Eastman Chemical Company

- Exxon Mobil Corporation

- Gandhar Oil Refinery (India) Limited

- HCS Group GmbH

- INEOS Group Limited

- Isu Exachem Co, Ltd

- Maoming Zhengmao Petrochemical Co., Ltd.

- Mehta Petro Refineries Limited

- Neste Corporation

- Oleotecnica S.p.A.

- Phillips 66 Company

- Pon Pure Chemicals Group

- Recochem Corporation

- Repsol S.A.

- Royal Dutch Shell plc.

- Sasol Limited

- TotalEnergies S.A.

- UTS GROUP

Strategic Roadmap Guiding Industry Leaders to Leverage Technological Advancements and Regulatory Trends for Sustainable Growth

Industry leaders seeking to capitalize on the accelerating shift toward de-aromatic solvents should direct research investments toward next-generation hydrogenation catalysts that deliver ultra-low aromatic content with reduced processing costs. Emphasizing high-purity grades tailored for sensitive applications-including pharmaceuticals and electronics cleaning-will unlock premium margin potential and reinforce product differentiation. At the same time, continuous improvement initiatives in solvent recovery and recycling can mitigate feedstock volatility and support circular economy objectives.

To navigate evolving regulatory landscapes, companies should engage proactively with policymakers and standards bodies, ensuring that product specifications anticipate future VOC limits and occupational safety requirements. Strategic collaborations with downstream partners can yield co-innovation opportunities, aligning development roadmaps with end-user performance demands. Moreover, diversifying feedstock sources and establishing tolling arrangements in regions subject to tariff constraints will bolster supply chain resilience.

Finally, leveraging digital platforms for demand forecasting, inventory optimization, and customer engagement will enhance go-to-market effectiveness. By integrating data-driven insights across commercial and operations functions, organizations can respond swiftly to market shifts and emerging opportunities. These actionable steps provide a roadmap for industry participants to achieve sustainable growth while maintaining compliance and driving innovation.

Robust Research Methodology Combining Primary Intelligence and Secondary Sources to Deliver Accurate and Actionable Market Insights

The findings presented in this report are underpinned by a rigorous research methodology that synthesizes primary and secondary data sources. Primary research included in-depth interviews with senior executives, technical experts, and procurement managers across the de-aromatic solvents value chain. Additionally, qualitative insights were supplemented by quantitative surveys of end-users in key industries to validate adoption drivers and performance criteria.

Secondary research encompassed a comprehensive review of company disclosures, patent filings, industry publications, and regulatory documents. Trade association reports and sustainability frameworks provided contextual benchmarks for environmental compliance and lifecycle analyses. Data triangulation techniques ensured consistency and reliability, with cross-verification of production capacities, trade volumes, and pricing trends.

Quality assurance measures included peer reviews by subject-matter specialists and methodological audits to confirm data integrity. The research process also incorporated scenario planning to account for potential regulatory changes, supply disruptions, and technology breakthroughs. This methodological rigor equips decision-makers with robust, actionable insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our De-Aromatic Solvents market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- De-Aromatic Solvents Market, by Flash Point

- De-Aromatic Solvents Market, by Purity Grade

- De-Aromatic Solvents Market, by Product Type

- De-Aromatic Solvents Market, by Application

- De-Aromatic Solvents Market, by End-Use Industry

- De-Aromatic Solvents Market, by Sales Channel

- De-Aromatic Solvents Market, by Region

- De-Aromatic Solvents Market, by Group

- De-Aromatic Solvents Market, by Country

- United States De-Aromatic Solvents Market

- China De-Aromatic Solvents Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesis of Strategic Imperatives and Future Outlook for Stakeholders Navigating the Dynamic De-Aromatic Solvents Ecosystem

This executive summary highlights the pivotal role of de-aromatic solvents in meeting contemporary industrial challenges, from stringent environmental mandates to performance expectations in high-value applications. As technological innovations continue to lower aromatic content and enhance solvent recovery, these products will remain integral to sectors such as cleaning and degreasing, coatings, agrochemicals, and pharmaceuticals.

The cumulative effect of tariff measures, regional regulatory frameworks, and evolving customer requirements underscores the necessity for agile strategic planning. Companies that invest in advanced R&D, cultivate diversified supply chains, and engage proactively with policy developments will secure competitive advantages. Regional differences in demand and production economics present both challenges and opportunities, and tailored approaches are required to align with local market conditions.

Looking ahead, industry stakeholders should embrace digitalization, circular economy principles, and collaborative innovation to sustain growth. By synthesizing the insights and recommendations outlined herein, decision-makers can chart a course that balances compliance, performance, and profitability, ensuring a resilient and forward-looking position in the de-aromatic solvents ecosystem.

Empower Your Decision-Making Process by Engaging Directly with Ketan Rohom for Customized De-Aromatic Solvent Market Intelligence and Report Access

To gain access to the comprehensive market research report on de-aromatic solvents and to tailor insights to your unique business objectives, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. Engaging with Ketan provides an opportunity to discuss specific areas of interest, whether it involves delving deeper into tariff impacts, segmentation nuances, or regional growth drivers.

Partnering with Ketan unlocks personalized support in extracting the most relevant intelligence from the study, from strategic recommendations to supply chain optimization tactics. By collaborating closely with him, you can ensure that the research aligns precisely with your decision-making requirements.

Take the next step toward enhancing your competitive positioning by scheduling a consultation to explore report packages, customization options, and advisory services. Secure the insights you need to navigate evolving regulations, capitalize on emerging opportunities, and stay ahead in the dynamic de-aromatic solvents market landscape. Contact Ketan today to access the full report and begin driving actionable outcomes for your organization.

- How big is the De-Aromatic Solvents Market?

- What is the De-Aromatic Solvents Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?