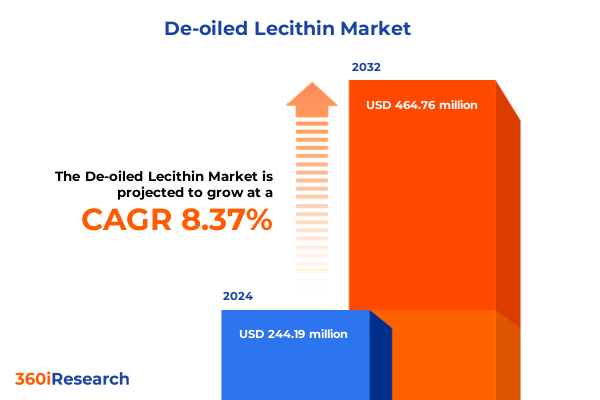

The De-oiled Lecithin Market size was estimated at USD 265.09 million in 2025 and expected to reach USD 284.87 million in 2026, at a CAGR of 8.35% to reach USD 464.76 million by 2032.

Understanding the Evolving Role of De-Oiled Lecithin in Modern Industries Driven by Health, Sustainability, and Technological Innovation

The landscape of functional ingredients has witnessed a significant evolution in recent years, with a growing emphasis on plant-based and natural compounds that deliver multifunctional benefits across various industries. De-oiled lecithin, a phospholipid-rich byproduct derived from the oil extraction process, has emerged as a versatile additive that aligns with clean-label trends and sustainability objectives. Its unique emulsification properties, coupled with its neutral flavor profile and favorable nutritional attributes, have driven increased adoption among formulators seeking to enhance product stability, texture, and health credentials. Innovations in extraction and purification methodologies have further expanded its utility, allowing manufacturers to tailor phospholipid compositions for specific application requirements.

Shifting consumer preferences towards minimally processed and health-promoting ingredients have elevated the importance of de-oiled lecithin in markets ranging from food and beverages to pharmaceuticals and cosmetics. This ingredient’s capacity to improve bioavailability of lipid-soluble nutrients, support cognitive health, and reinforce skin barrier function underscores its cross-sector appeal. As stakeholders become more cognizant of supply chain transparency and environmental stewardship, the demand for responsibly sourced de-oiled lecithin has grown, prompting collaborations between technology providers, agricultural producers, and end users.

In the sections that follow, this executive summary will outline the transformative shifts redefining the market environment, assess the impact of recent United States tariff measures enacted in 2025, and distill key segmentation and regional insights. Furthermore, it will spotlight leading companies pioneering technological advances and offer actionable guidance to capitalize on emerging opportunities. By synthesizing rigorous primary and secondary research, this report aims to equip industry executives and decision-makers with the strategic intelligence necessary to navigate complexities and secure competitive advantage in the evolving de-oiled lecithin market.

Exploring the Key Transformative Shifts Shaping the Global De-Oiled Lecithin Landscape Amidst Regulatory, Technological, and Consumer Dynamics

The de-oiled lecithin market has been fundamentally reshaped by a convergence of regulatory developments, technological breakthroughs, and shifting consumer expectations. Regulatory bodies across key geographies have introduced more stringent standards for purity, residual solvent levels, and allergen declarations, compelling manufacturers to adopt advanced purification techniques and improve traceability within their supply chains. At the same time, sustainability mandates and corporate commitments to lower carbon footprints have accelerated the transition towards greener extraction technologies and renewable feedstocks.

Technological innovation has played a pivotal role in enabling these transformations, with enzymatic hydrolysis, solvent extraction, supercritical extraction, and ultrafiltration techniques each offering distinct advantages. Enzymatic treatments using lipase and phospholipase A2 have improved phospholipid yield and functional performance, while supercritical CO2 and subcritical water extractions have reduced solvent residues and environmental impact. Parallel advancements in membrane-based processes such as diafiltration and reverse osmosis have further refined product quality, expanded customization capabilities, and enhanced cost efficiencies.

Consumer dynamics have also exerted a profound influence, as end users increasingly demand clean-label, non-GMO, and organic-certified ingredients. This has spurred a surge in product innovation within food and beverages, personal care, and nutraceuticals, where formulators leverage de-oiled lecithin to deliver improved mouthfeel, extended shelf life, and enhanced bioactive stability. Collectively, these transformative shifts are redefining competitive parameters, creating new value chains, and setting the stage for sustained growth in the de-oiled lecithin sector.

Assessing the Far-Reaching Cumulative Impact of United States Tariffs Implemented in 2025 on the De-Oiled Lecithin Supply Chain and Market Dynamics

In 2025, the United States implemented a series of tariff measures targeting key agricultural imports, including feedstocks and byproducts integral to lecithin production. These cumulative duties have reverberated throughout the supply chain, leading to upward pressure on raw material costs and prompting recalibrations in sourcing strategies. Domestic processors and end users have grappled with increased variability in input prices, compelling them to explore alternative origins and diversify supplier portfolios to mitigate risk and maintain operational continuity.

The imprint of these tariffs is most pronounced among soy-based lecithin producers, who face elevated import costs for both crude soybean oil and refined lecithin fractions. This has incentivized some manufacturers to shift towards rapeseed and sunflower sources, which have remained relatively unaffected by the duties. However, the transition entails its own complexities, including adjustments to processing parameters and qualification protocols for food safety and allergen labeling. As a result, supply chains have grown more fragmented, with spot market dynamics dictating inventory decisions and creating pockets of short-term scarcity.

Longer-term implications are emerging as well, with several stakeholders initiating domestic capacity expansions to circumvent tariff-induced bottlenecks. Investment in onshore extraction facilities, coupled with strategic partnerships with farmers cultivating lecithin-rich oilseeds, reflects a broader trend towards supply chain resilience. Nevertheless, tariff uncertainties persist, underscoring the importance of dynamic cost modeling, agile procurement frameworks, and forward-looking scenario planning to navigate the intricate interplay between trade policy and market stability.

Unveiling Critical Segmentation Insights Across Source, Form, Technology, Distribution Channels, and Applications in the De-Oiled Lecithin Market

A nuanced understanding of market segmentation offers valuable insight into the diverse drivers shaping demand and supply dynamics. When considering source materials, egg yolk retains a niche position within foodservice and specialty nutrition, while rapeseed and sunflower lecithins have gained prominence thanks to their favorable fatty acid profiles and non-GMO status. Soybean-based lecithin continues to dominate overall volumes, supported by its broad availability and cost-effectiveness, yet shifts towards alternative feedstocks are steadily reshaping the competitive landscape.

Form factor also plays a critical role in application suitability, as granules deliver rapid dispersion in aqueous systems and powder formats facilitate precise dosage control in dry blends. These distinctions inform selection criteria across food, feed, and pharmaceutical formulations, influencing processing efficiency and product performance. On the technology front, enzymatic hydrolysis techniques-specifically lipase treatment and phospholipase A2 treatment-have unlocked novel functionalities, while solvent extraction methods using ethanol or hexane balance extractive efficiency with solvent recovery considerations. Supercritical extraction modalities, including CO2 extraction and subcritical water extraction, offer solvent-free end products, and ultrafiltration practices, encompassing diafiltration and reverse osmosis, ensure high purity levels and customizable phospholipid profiles.

Distribution channels are equally consequential, with offline networks retaining strength in industrial sales and conventional retail, while online platforms have emerged as catalysts for direct-to-consumer and specialty ingredient transactions. Finally, a spectrum of applications-from aquafeed, pet feed, poultry feed, and ruminant feed within the animal nutrition segment to bakery, confectionery, dairy, functional foods, and ready-to-eat offerings in the food and beverage sector-demonstrate lecithin’s versatility. Personal care and cosmetics incorporate formulations in hair care, skin care, and personal hygiene, whereas pharmaceuticals and nutraceuticals deploy capsules, functional nutraceuticals, powder supplements, and tablets to leverage lecithin’s bioavailability enhancement properties.

This comprehensive research report categorizes the De-oiled Lecithin market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Source

- Form

- Technology

- Application

- Distribution Channel

Analyzing Regional Market Dynamics for De-Oiled Lecithin Spanning Americas, Europe Middle East Africa, and Asia Pacific for Strategic Positioning

Regional dynamics underscore the varying pace and nature of demand for de-oiled lecithin across the globe. In the Americas, robust agricultural infrastructure and established port networks facilitate reliable access to soybean and sunflower lecithin. North American formulators are particularly focused on clean-label certifications and non-GMO sourcing, fueling growth in high-value applications such as functional beverages and nutraceuticals. Latin American producers, by contrast, are leveraging local oilseed cultivation to explore value-added downstream processing, supported by government incentives aimed at increasing domestic food processing capacity.

In Europe, Middle East, and Africa, stringent regulatory frameworks and heightened consumer awareness around sustainability have accelerated adoption of green extraction technologies and organic-certified lecithin. European manufacturers prioritize traceability and renewable energy integration in production, while emerging markets in the Middle East and Africa demonstrate strong interest in lecithin’s role in specialty foods and cosmetics. Cross-border collaborations and trade agreements within this region have also facilitated technology transfer, enabling local players to upgrade processing capabilities and meet global quality standards.

The Asia-Pacific region stands out for its dynamic growth trajectory, driven by rising disposable incomes and expanding middle-class populations. Lecithin applications in traditional and functional foods have gained traction, bolstered by investments in advanced extraction installations in key markets such as China, India, and Southeast Asia. The confluence of dietary shifts towards fortified foods and government initiatives supporting agri-processing clusters has heightened competition and innovation, positioning Asia-Pacific as a pivotal growth engine for the de-oiled lecithin market.

This comprehensive research report examines key regions that drive the evolution of the De-oiled Lecithin market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves and Competitive Differentiators of Leading De-Oiled Lecithin Manufacturers Driving Innovation and Market Growth

Leading manufacturers in the de-oiled lecithin sector have differentiated themselves through strategic investments, targeted partnerships, and innovation in extraction processes. Several global players have expanded their geographic footprint by establishing specialized facilities in high-growth regions, enabling localized production and reduced logistical lead times. Collaborative agreements with enzyme technology developers have enhanced capabilities in lipase and phospholipase A2 treatments, delivering tailored phospholipid profiles for premium applications.

Mid-sized regional producers have bolstered their competitive edge by integrating supercritical and subcritical extraction equipment, allowing them to differentiate on solvent-free positioning and organic credentials. These players often emphasize traceability programs and supply chain certifications to meet the evolving demands of food and cosmetics brands. At the same time, strategic alliances between lecithin producers and nutraceutical formulators have given rise to co-development initiatives, underscoring the growing importance of application-specific lecithin blends.

Innovation in digitalization and process automation is another defining trend among top companies, with real-time monitoring of extraction parameters and advanced analytics optimizing yield, quality, and cost efficiency. Investments in research and development, particularly around nanoemulsion technologies and customized phospholipid ratios, signal a shift towards high-margin, performance-driven segments. Collectively, these strategic moves illustrate how leading industry participants are positioning themselves for sustained growth and market leadership in the de-oiled lecithin domain.

This comprehensive research report delivers an in-depth overview of the principal market players in the De-oiled Lecithin market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- American Lecithin Company

- Amitex Agro Product Pvt. Ltd.

- Archer Daniels Midland Company

- Austrade Inc.

- Avi Agri Business Limited

- Bansal Extraction & Exports Private Limited

- BASF Personal Care and Nutrition GmbH

- BioSamara GmbH

- Bunge Limited

- Cargill, Incorporated

- Clarkson Specialty Lecithin

- DuPont de Nemours, Inc.

- Fismer Lecithin

- GIIAVA

- Ingredaco

- LASENOR EMUL, S.L.

- Lecico GmbH

- Lecilite

- Lecital

- Lekithos Inc.

- Nateeo S.R.L.

- NOVASTELL, SAS

- Process Agrochem Industries Pvt Ltd.

- Sonic Biochem Extractions Pvt. Ltd.

- Soya International A/S

- Sternchemie GmbH & Co. KG

- Sun Nutrafoods by Agro Solvent Products Pvt. Ltd.

- SUNKRAFT AGRO LLP

- The Scoular Company

Delivering Actionable Strategic Recommendations for Industry Leaders to Navigate Challenges, Leverage Opportunities, and Accelerate Growth in De-Oiled Lecithin

To navigate the evolving landscape and seize emerging opportunities, industry leaders should prioritize supply chain diversification by establishing relationships with multiple feedstock suppliers and vetting alternative raw material sources. Enhancing procurement agility through advanced cost modeling tools will enable rapid response to tariff fluctuations and commodity price volatility. Simultaneously, targeted investment in advanced extraction technologies-particularly supercritical extraction and ultrafiltration-can drive product differentiation while supporting sustainability objectives.

Partnerships with enzyme technology providers offer another pathway to innovation, facilitating the development of specialized phospholipid formulations that meet exacting performance and regulatory standards. In parallel, forging alliances with end-user segments, including nutraceutical brands and personal care formulators, can yield co-development opportunities that unlock new market niches. A focus on digital transformation, encompassing process automation and data analytics, will further optimize operational efficiency, reduce energy consumption, and strengthen quality assurance protocols.

Finally, proactive engagement with regulatory bodies and industry associations is critical to stay ahead of evolving safety and labeling requirements. By participating in standards-setting initiatives and building transparent traceability systems, organizations can bolster trust with customers and mitigate compliance risks. Collectively, these actionable recommendations provide a clear roadmap for leveraging strengths, addressing vulnerabilities, and accelerating growth in the de-oiled lecithin market.

Detailing the Rigorous and Multidimensional Research Methodology Employed to Generate Comprehensive Insights into the De-Oiled Lecithin Market Landscape

The research methodology underpinning this report integrates both qualitative and quantitative approaches to ensure comprehensive, multi-dimensional insights. Secondary research entailed a systematic review of trade publications, regulatory documents, and academic studies to establish foundational understanding of extraction technologies, feedstock trends, and application landscapes. This phase also involved examination of import-export databases and government trade statistics to map supply chain flows and identify emerging tariff impacts.

Primary research incorporated extensive interviews with key stakeholders, including manufacturers, technology licensors, ingredient formulators, and distribution partners. These discussions provided firsthand perspectives on operational challenges, innovation drivers, and strategic priorities. Data triangulation was employed to reconcile diverse viewpoints and validate findings against empirical market signals. Additionally, proprietary databases were leveraged to analyze company financials, product portfolios, and strategic initiatives, further enriching competitive intelligence.

Segmentation analysis was conducted by disaggregating market dynamics across source types, form factors, processing technologies, distribution channels, and end-use applications. Regional breakdowns examined demand drivers in the Americas, Europe Middle East Africa, and Asia-Pacific, while scenario planning assessed the potential ramifications of policy shifts and technological breakthroughs. This rigorous methodology ensures that conclusions and recommendations are rooted in a robust evidentiary base, offering stakeholders actionable clarity in a complex and rapidly evolving market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our De-oiled Lecithin market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- De-oiled Lecithin Market, by Source

- De-oiled Lecithin Market, by Form

- De-oiled Lecithin Market, by Technology

- De-oiled Lecithin Market, by Application

- De-oiled Lecithin Market, by Distribution Channel

- De-oiled Lecithin Market, by Region

- De-oiled Lecithin Market, by Group

- De-oiled Lecithin Market, by Country

- United States De-oiled Lecithin Market

- China De-oiled Lecithin Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Synthesizing Critical Findings and Strategic Implications from the De-Oiled Lecithin Market Analysis to Inform Decision-Making and Future Directions

This analysis reveals that de-oiled lecithin stands at the intersection of sustainability imperatives, technological innovation, and evolving consumer preferences. The ongoing shift towards alternative feedstocks, combined with adoption of green extraction methods, underscores the industry’s commitment to both environmental and performance excellence. Concurrently, the cumulative effects of United States tariff measures in 2025 have highlighted the imperative for resilient supply chain structures and strategic sourcing flexibility.

Segment-specific insights demonstrate the importance of formulating tailored offerings-whether in granule or powder form-and leveraging advanced technologies such as enzymatic hydrolysis and supercritical extraction to meet stringent purity and functionality standards. Regional market dynamics further underscore the need for adaptive strategies, with growth in Asia-Pacific propelled by rising functional food demand, while regulatory rigor and sustainability priorities shape opportunities in Europe, the Middle East, and Africa.

Leading companies have responded through targeted investments in technology, strategic partnerships, and digital transformation initiatives, reinforcing their positions in high-value segments. Building on these findings, industry participants can derive clear pathways for optimizing operations, innovating product portfolios, and mitigating geopolitical risks. As the de-oiled lecithin market continues to evolve, this report serves as a strategic blueprint for sustainable growth and competitive differentiation.

Take Decisive Action Today by Engaging with Ketan Rohom to Secure the Comprehensive De-Oiled Lecithin Market Research Report and Unlock Competitive Advantage

To capitalize on the strategic intelligence outlined in this report and gain exclusive access to in-depth market analyses, connect with Ketan Rohom, Associate Director of Sales & Marketing. By engaging directly, you can secure the comprehensive market research report tailored to your needs, complete with granular segmentation insights, regional breakdowns, and actionable recommendations. This partnership will empower your organization to make data-driven decisions, stay ahead of regulatory shifts, and foster innovation in de-oiled lecithin applications. Reach out today to unlock customized solutions that will drive growth, optimize supply chain resilience, and strengthen your competitive position in this dynamic market landscape

- How big is the De-oiled Lecithin Market?

- What is the De-oiled Lecithin Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?