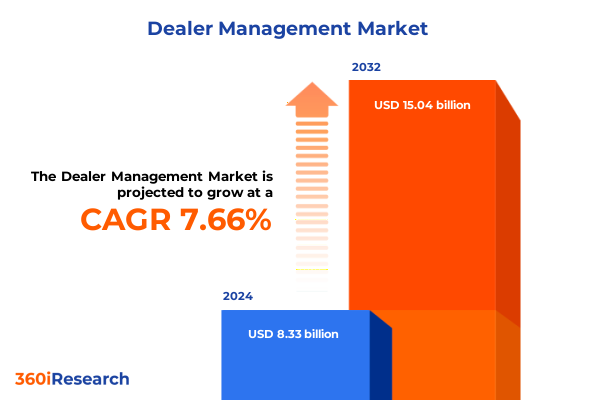

The Dealer Management Market size was estimated at USD 8.95 billion in 2025 and expected to reach USD 9.62 billion in 2026, at a CAGR of 7.69% to reach USD 15.04 billion by 2032.

Engaging Overview Emphasizing the Pivotal Role of Modern Dealer Management Platforms in Streamlining Business Processes and Enhancing Profitability

The dealer management arena has evolved from a traditional, fragmented network of showrooms and service centers into a sophisticated, technology-driven ecosystem that empowers organizations to optimize every facet of their operations. Today’s leaders recognize that an integrated platform can unify sales, inventory control, customer relationship processes, and after-sales service under a single digital roof, dramatically reducing redundant workflows and elevating overall efficiency. This report begins by framing the critical importance of such unified systems, underscoring how they serve as the backbone of modern automotive, industrial machinery, and electronics distribution channels.

Against a backdrop of rapid digital transformation, end-users across geographies are demanding seamless experiences that blend online convenience with in-person expertise. This introduction sets the stage by highlighting the evolution of dealer management from paper-based processes to cloud-enabled architectures, emphasizing the role of data analytics in driving real-time decision-making. It addresses the imperative for businesses to adopt scalable solutions that not only accommodate current operational requirements but also anticipate future market shifts.

In summarizing the core objectives of this study, the introduction outlines how subsequent sections will delve into pivotal market drivers, regulatory influences, segmentation dynamics, regional behaviors, competitive landscapes, and strategic recommendations. It provides readers with a clear roadmap of the analysis that follows, ensuring stakeholders understand how the insights can be applied to inform investment decisions, technology deployments, and broader corporate strategies.

Comprehensive Examination of Market Dynamics Revealing Transformative Shifts Reshaping Dealer Management Strategies Across the Automotive and Industrial Goods Sectors

The dealer management domain is experiencing a confluence of transformative forces that are redefining traditional paradigms. Chief among these shifts is the ascent of digital-first customer expectations, which demand omnichannel engagement and personalized experiences. This trend is driving organizations to embed artificial intelligence and machine learning capabilities into core systems to anticipate customer needs, recommend tailored offerings, and streamline service scheduling.

Simultaneously, the proliferation of connected vehicles and the Internet of Things has introduced new layers of operational complexity and opportunity. Dealerships are now leveraging telematics data to monitor vehicle health in real time, facilitating proactive maintenance and spare parts logistics. This shift toward preventive service models is reshaping the aftermarket segment into a revenue stream grounded in predictive analytics rather than reactive repairs.

Furthermore, regulatory changes across major markets are compelling dealer networks to adopt more stringent compliance and reporting frameworks. From emissions standards to data privacy mandates, the need for integrated governance modules within dealer management platforms has never been more acute. Meanwhile, the maturation of cloud deployment options is enabling organizations to accelerate digital transformation without the capital expenditure traditionally associated with on-premise infrastructure.

Together, these dynamics are forging a new landscape in which agility, intelligence, and compliance converge. By understanding these transformative shifts, industry leaders can anticipate emerging business models and position themselves to leverage innovations that drive long-term competitive advantage.

In-Depth Analysis of the 2025 United States Tariff Implications on Supply Chains Dealer Networks and Operational Costs within the Dealer Management Ecosystem

Since the imposition of new United States tariffs in early 2025, dealer management networks have navigated a complex matrix of cost pressures, supply chain disruptions, and strategic recalibrations. The additional duties on imported hardware components and software licensing agreements have elevated the total cost of ownership for many organizations, prompting a reevaluation of vendor agreements and procurement strategies. These tariff-induced cost adjustments have not only affected on-premise deployments but have also driven a notable uptick in cloud adoption as businesses seek to avoid the capital lock-in associated with locally hosted systems.

Moreover, the ripple effects of tariff escalation have been felt across the aftermarket services spectrum. Parts sourced from tariff-impacted regions are encountering extended lead times and batch variability, underscoring the importance of robust inventory management modules within dealer management platforms. This environment has amplified the value of predictive stocking algorithms, which can mitigate the risk of obsolescence and reduce carrying costs in an era of heightened duty rates.

From a software perspective, the uncertainty surrounding future tariff adjustments has accelerated investment in modular architectures that enable rapid reconfiguration and integration of alternative component suppliers. Dealer networks are prioritizing platforms that offer flexible service bundles and subscription-based licensing, thereby diffusing financial exposure. In sum, the cumulative impact of U.S. tariffs in 2025 has catalyzed both operational ingenuity and strategic partnerships, fostering resilience in an environment marked by evolving trade policies.

Holistic Insight into Diverse Dealer Management Market Segmentation Uncovering Key Divergences Across Solutions Deployment Models and Industry Verticals

A nuanced understanding of market segmentation is essential to unlock targeted value propositions within the dealer management domain. The segmentation based on solution type distinguishes between comprehensive software suites, offering integrated modules for sales, inventory, customer relationship, and aftermarket services, and specialized service offerings that encompass consulting support, maintenance and technical assistance, as well as targeted training programs to optimize system utilization. Each segment presents unique challenges and growth drivers, with software implementations driving scale efficiencies while services deliver tailored expertise and extended support lifecycles.

Diving deeper into deployment modes, cloud-based solutions are rapidly gaining traction due to their scalability, predictable operational expenditures, and reduced need for on-site infrastructure management. Conversely, on-premise configurations remain relevant for organizations with stringent data sovereignty requirements or legacy system dependencies. The choice between these deployment options informs the total cost of ownership profile and dictates the pace of feature rollouts and updates.

When considering organization size, large enterprises often pursue holistic platform rollouts across multiple locations, leveraging their purchasing power to negotiate comprehensive service level agreements and custom integrations. In contrast, small and medium-sized enterprises prioritize modular, cost-effective solutions that enable incremental expansions and lower barrier to entry. These divergent approaches influence vendor go-to-market strategies and partnership models.

Industry vertical segmentation reveals that automotive dealerships require robust warranty management and parts scheduling capabilities, industrial machinery distributors emphasize maintenance forecasting and asset uptime analytics, and electronics resellers focus on integrated service contracts for consumer appliances. Within aftermarket functionality, the ability to manage parts inventories, schedule service appointments proactively, and administer warranty claims coalesces with customer relationship modules built around database management and lead generation flows to deliver seamless end-to-end experiences.

This comprehensive research report categorizes the Dealer Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Solution Type

- Deployment Mode

- Organization Size

- Industry Vertical

- Functionality

Strategic Regional Perspective Highlighting Distinct Market Behaviors and Growth Catalysts Across the Americas Europe Middle East Africa and Asia-Pacific

Regional market behaviors in dealer management exhibit distinct characteristics shaped by regulatory environments, technology adoption rates, and macroeconomic conditions. In the Americas, a mature dealership network underpinned by advanced digital infrastructures drives demand for sophisticated analytics and omnichannel customer engagement platforms. Organizations in North America are investing heavily in artificial intelligence–enhanced modules for predictive maintenance and customer retention, while Latin American markets are embracing cloud solutions to leapfrog traditional on-premise architectures and accelerate deployment timelines.

The Europe, Middle East, and Africa landscape presents a multi-layered environment in which compliance frameworks-particularly those related to emissions and data protection-play a central role in shaping platform feature requirements. European dealerships demand robust governance and reporting capabilities, while Middle Eastern markets focus on scalability and localization to accommodate rapid urbanization and shifting consumer behaviors. African regions, characterized by infrastructure variability, show growing interest in hybrid deployment models that balance cloud flexibility with on-site resiliency.

Asia-Pacific markets, driven by digital sovereignty initiatives and high consumer technology uptake, are at the forefront of connected vehicle integration and mobile-first dealer portals. Japan and South Korea lead in implementing telematics-driven service modules, whereas Southeast Asia exhibits strong momentum toward subscription-based licensing models that align with emerging digital payment ecosystems.

Collectively, these regions underscore the necessity for vendor offerings that are adaptable to local legislative frameworks, network capacities, and customer expectations, making regional customization a non-negotiable criterion for competitive success.

This comprehensive research report examines key regions that drive the evolution of the Dealer Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Detailed Review of Leading Industry Participants Revealing Strategic Approaches Competitive Positioning and Innovation Drivers in Dealer Management

Leading participants in the dealer management sphere are differentiating through a blend of platform innovation, strategic partnerships, and expanded service portfolios. Established enterprise software vendors are integrating advanced analytics and machine learning frameworks to augment core functionalities, enabling customers to engage in predictive inventory replenishment and dynamic pricing optimization. These companies are forging alliances with telematics providers and parts suppliers to create end-to-end ecosystems that span from vehicle diagnostics through service completion.

At the same time, niche service providers are carving out specialized roles in consulting, training, and system integration to support bespoke deployments. These organizations often leverage deep industry expertise to tailor solutions for high-volume dealerships and complex industrial machinery distributors, ensuring that platform configurations align precisely with operational workflows. Their focus on service excellence and ongoing support has led to strong retention rates within specific customer segments.

Meanwhile, cloud-native challengers are attracting attention by offering subscription pricing models and rapid feature releases through continuous integration/continuous deployment pipelines. These emerging vendors emphasize user experience, modular architectures, and developer ecosystems that facilitate third-party extensions, appealing to organizations seeking agility and lower upfront investments.

Regional specialists in Europe and Asia-Pacific are leveraging local market knowledge to address unique compliance and localization requirements. By embedding multilingual interfaces, regional tax modules, and local support networks, these vendors ensure that global dealer management platforms can be tailored to nuanced legal frameworks and cultural preferences. Collectively, these competitive dynamics underscore a market in which scale, specialization, and flexibility drive strategic positioning.

This comprehensive research report delivers an in-depth overview of the principal market players in the Dealer Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Auto/Mate Dealership Systems, Inc.

- Autofusion, Inc.

- Autosoft of America, Inc.

- BiT Dealership Software, Inc.

- Blue Sky Business Solutions, LLC

- CDK Global, LLC

- COGXIM Softwares Pvt. Ltd.

- Cox Automotive Inc.

- DealerSocket, Inc.

- Dealertrack Technologies, Inc.

- Dominion Dealer Solutions, LLC

- e-Emphasys Technologies Inc.

- ELVA BALTIC SIA

- Epicor Software Corporation

- Frazer Computing, Inc.

- GaragePlug Inc.

- PBS Systems, Inc.

- Reynolds & Reynolds Company

- Tekion Corporation

Targeted Actionable Recommendations Guiding Industry Leaders to Leverage Technological Advances Regulatory Adaptations and Market Intelligence for Growth

To thrive in an environment marked by escalating tariff pressures and evolving customer expectations, industry leaders should adopt a multifaceted approach that balances technological innovation with operational resilience. First, organizations must accelerate their migration to cloud-based dealer management platforms that offer dynamic scalability, predictable subscription models, and reduced dependency on localized infrastructure. This strategy not only mitigates legacy capital expenditure risks but also positions businesses to leverage rapid feature updates and embedded intelligence capabilities.

Second, investing in artificial intelligence and advanced analytics modules will enable predictive maintenance and parts procurement optimization, which are critical in an era of disrupted supply chains. By harnessing telematics data and historical service records, dealer networks can anticipate equipment failures and streamline inventory replenishment, minimizing downtime and excess carrying costs.

Third, leaders should cultivate strategic alliances with telematics providers, parts manufacturers, and local system integrators to create interconnected ecosystems capable of delivering end-to-end customer experiences. Such partnerships foster data sharing, enhance process efficiencies, and establish integrated value propositions that differentiate offerings in competitive markets.

Fourth, tailored workforce training programs must be implemented to maximize adoption and proficiency across all user groups, from service technicians to sales professionals. Empowering employees with targeted workshops and certification tracks ensures that new platform functionalities are utilized effectively to drive performance gains.

Finally, companies should maintain flexibility in vendor agreements, preferring modular licensing and subscription-based service bundles that allow rapid reconfiguration in response to future tariff adjustments and regulatory changes. This approach safeguards operational continuity and preserves financial agility.

Transparent Overview of the Rigorous Research Methodology Underpinning Data Collection Analytical Frameworks and Validation Processes Employed in this Study

This study employs a rigorous mixed-method research methodology to ensure the validity and reliability of its findings. Primary research involved in-depth interviews with senior executives across dealer networks, software providers, and service integrators. These conversations provided qualitative insights into evolving pain points, technology adoption patterns, and strategic priorities across different regions and organization sizes. In parallel, an extensive survey was conducted among end-users to capture quantitative metrics on deployment preferences, feature utilization, and satisfaction levels.

Secondary research sources included publicly available corporate filings, regulatory publications, trade association reports, and industry white papers. Data points were cross-referenced and triangulated to detect anomalies, confirm consistency, and refine segmentation frameworks. Financial disclosures and case study analyses supplemented this effort, shedding light on vendor performance benchmarks and best-practice implementations.

Analytical frameworks such as SWOT analysis, Porter’s Five Forces, and scenario modeling were applied to interpret competitive dynamics and forecast potential trajectories under varying tariff and regulatory conditions. Each step of the research process underwent rigorous validation by a panel of industry experts, ensuring that assumptions remained grounded in real-world operational contexts.

Finally, all findings were reviewed by an internal quality assurance team that verified compliance with research ethics, data security standards, and transparency guidelines. This layered methodology guarantees that the insights presented in the report are both comprehensive and actionable for decision-makers seeking to navigate the dealer management landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Dealer Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Dealer Management Market, by Solution Type

- Dealer Management Market, by Deployment Mode

- Dealer Management Market, by Organization Size

- Dealer Management Market, by Industry Vertical

- Dealer Management Market, by Functionality

- Dealer Management Market, by Region

- Dealer Management Market, by Group

- Dealer Management Market, by Country

- United States Dealer Management Market

- China Dealer Management Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Concise Synthesis of Key Findings Emphasizing Strategic Imperatives and Future Directions for Organizations Operating within the Dealer Management Landscape

In synthesizing the key findings of this report, it becomes clear that dealer management systems have transcended their historical role as transaction recorders to become strategic engines that drive revenue, optimize resources, and enhance customer loyalty. The convergence of digital transformation imperatives, regulatory complexities, and tariff-induced cost pressures has accelerated the shift toward cloud deployments and modular architectures infused with artificial intelligence and predictive analytics.

Segmentation analysis reveals distinct priorities across solution type, deployment mode, organization size, industry vertical, and functionality, underscoring the importance of tailored value propositions and flexible licensing models. Regional insights further highlight the need for localized compliance features and adaptive deployment strategies that accommodate infrastructure variability and evolving consumer behaviors.

Competitive dynamics are shaped by a diverse roster of vendors, ranging from established enterprise software titans to niche service specialists and agile cloud-native challengers. Each participant brings unique strengths in areas such as telematics integration, modular feature releases, and specialized training services.

The actionable recommendations distilled from this analysis emphasize cloud migration, AI-driven maintenance optimization, strategic ecosystem partnerships, workforce enablement, and flexible vendor agreements as critical levers to navigate ongoing trade uncertainties and technological disruptions.

Ultimately, organizations that embrace these imperatives will be well-positioned to transform their dealer networks into resilient, customer-centric platforms capable of supporting sustained innovation and competitive advantage.

Compelling Call to Action Encouraging Stakeholders to Connect with Ketan Rohom for Bespoke Insights and Acquisition of the Comprehensive Dealer Management Market Report

To unlock the full scope of insights and strategic guidance curated in this comprehensive dealer management market research report, we invite decision-makers and stakeholders to connect directly with Ketan Rohom, Associate Director, Sales & Marketing. Ketan brings extensive expertise in translating market intelligence into actionable plans that align with corporate growth objectives and operational realities. By engaging with Ketan, you will receive personalized consultation on how the report’s findings apply to your organization’s unique challenges and ambitions, ensuring you derive maximum value from the analysis.

A partnership with Ketan offers tailored briefings on critical topics such as tariff mitigation strategies, technology adoption roadmaps, and competitive benchmarking. His in-depth understanding of the dealer management landscape positions him to guide you through complex data sets, highlight untapped opportunities, and recommend optimal go-to-market approaches. Secure your advance copy of the study to stay ahead of industry disruptions and capitalize on emerging market segments.

Contact Ketan to schedule a one-on-one discussion and explore bespoke offerings that include executive summaries, in-depth workshops, and custom research extensions. Empower your organization with the evidence-based insights needed to navigate evolving market dynamics, optimize dealer networks, and drive sustainable growth.

- How big is the Dealer Management Market?

- What is the Dealer Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?