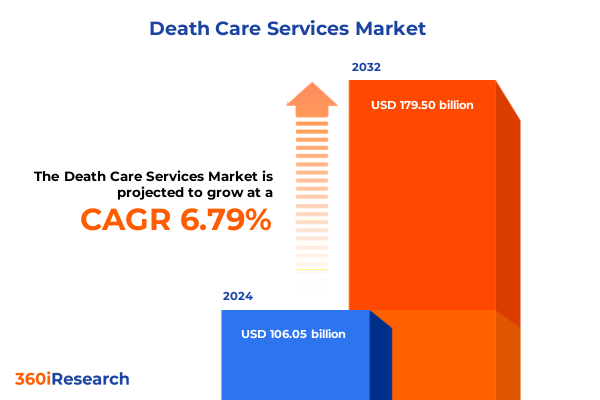

The Death Care Services Market size was estimated at USD 113.01 billion in 2025 and expected to reach USD 120.42 billion in 2026, at a CAGR of 6.83% to reach USD 179.50 billion by 2032.

Exploring the Evolving Dynamics of the Death Care Services Industry Amidst Shifting Demographics Technological Advancements and Consumer Preferences

The death care services sector has undergone a period of profound transformation driven by shifting demographics, evolving cultural practices, and accelerating technological advancements. What was once a highly traditional and often opaque industry is now embracing new models of service delivery that prioritize customization, digital engagement, and sustainability. Over the past decade, providers have expanded their offerings beyond conventional burial and memorialization to include a wider array of grief support, legal assistance, and keepsake options designed to meet modern consumer expectations.

Amid these changes, the interplay of demographic trends and consumer preferences has become increasingly central to strategic planning. As the population ages and diverse value systems influence perceptions of end-of-life care, stakeholders must balance respect for tradition with innovative approaches that cater to a broader clientele. Moreover, regulatory shifts and a heightened regulatory focus on environmental impact have spurred the adoption of greener practices. Consequently, businesses within the sector are reevaluating their core propositions, investing in new capabilities, and forging partnerships that enhance their value proposition and resilience against future disruptions.

Uncovering the Key Forces Redefining the Death Care Services Landscape Through Digital Innovation Sustainability and Personalization Trends

Throughout the death care ecosystem, providers are witnessing structural shifts that challenge conventional wisdom and open pathways to new growth. Digital platforms are transforming the customer journey by enabling virtual arrangements, live-streamed services, and online memorial spaces, which in turn have broadened access for remote participants. At the same time, the rise of eco-conscious consumer segments is accelerating demand for biodegradable caskets, green burials, and carbon-neutral transportation, prompting funeral homes and cemeteries to integrate sustainable offerings into their standard portfolios.

Furthermore, personalization has emerged as a cornerstone of competitive differentiation. Modern families seek bespoke tributes that reflect unique life stories, driving innovation in memorial design, keepsake production, and digital storytelling solutions. These transformative shifts are underpinned by regulatory developments that govern everything from embalming standards to digital data privacy, requiring organizations to maintain rigorous compliance frameworks. Together, these forces are reshaping the landscape, compelling stakeholders to reinvent their service models, realign operational processes, and cultivate new expertise to stay ahead in a rapidly evolving market.

Analyzing the Cumulative Effects of 2025 United States Tariffs on Imported Funeral Merchandise Supply Chains and Provider Margins

In 2025, a series of tariff adjustments on imported funeral merchandise introduced new cost dynamics across the supply chain. Metal casket manufacturers and memorial monuments producers have seen input costs increase due to duties on steel, bronze, and granite imported from key overseas partners. As a result, providers reliant on these goods have faced margin pressures and have scrambled to diversify their procurement strategies to mitigate the financial impact.

Consequently, many industry players are exploring domestic partnerships and near-shore suppliers to secure materials at stable price points. At the same time, some organizations have accelerated investment in manufacturing automation to offset higher unit costs. While end customers may not always be fully aware of these underlying shifts, they can feel the effect through adjusted pricing structures and modified service packages. Ultimately, the cumulative impact of the 2025 United States tariff measures underscores the importance of supply chain agility and strategic sourcing for maintaining operational resilience.

Deriving Strategic Insights from Service Type Arrangement Preferences and End Use Dynamics Within the Death Care Sector Segmentation

Evaluating the death care market through multiple lenses reveals nuanced demand patterns and strategic imperatives for providers. When examining offerings, burial services, cremation services, grief support and counseling services, legal and administrative assistance, memorials and keepsakes, and transportation and repatriation services each contribute distinct revenue drivers and operational requirements. The convergence of these service lines highlights the need for integrated platforms that can seamlessly coordinate end-to-end customer experiences, from initial arrangement to aftercare.

Meanwhile, arrangement timing influences how providers engage with families. At-need arrangement remains the cornerstone of immediate end-of-life services, demanding rapid coordination and emotional support. In contrast, pre-need arrangement programs allow organizations to secure future commitments, manage long-term capacity, and strengthen client relationships through ongoing communication. Finally, the settings in which services are delivered-cemeteries and funeral homes-represent the primary end-use categories. Cemeteries focus on memorialization, plot management, and grounds maintenance, whereas funeral homes provide comprehensive arrangement, ceremony, and logistical coordination services. Understanding these intersecting segmentation dimensions enables stakeholders to tailor product strategies, optimize resource allocation, and capture value across the spectrum of customer touchpoints.

This comprehensive research report categorizes the Death Care Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Services

- Arrangement

- End-use

Revealing Regional Variations in Death Care Services Across the Americas Europe Middle East Africa and Asia Pacific Markets

Across the Americas, providers have capitalized on technological integration and eco-friendly practices to meet the expectations of a diverse and aging population. In North America, high cremation rates coexist with robust demand for green burials, leading stakeholders to develop hybrid operating models that accommodate both preferences. Latin American markets, where cultural traditions place strong emphasis on family-centered memorial events, are witnessing gradual shifts toward more formalized grief support and counseling services.

Europe, the Middle East, and Africa present a mosaic of regulatory frameworks and cultural norms. Western European nations lead in sustainable burial regulations and digital record-keeping, while Eastern European and Middle Eastern regions are expanding infrastructure to improve access to professional death care services. In Africa, urbanization and rising middle-class segments are driving the formalization of markets that were historically dominated by informal or community-based rites. Meanwhile, Asia-Pacific markets balance deep-rooted cultural rituals with emerging demand for international repatriation services and digital commemoration. Providers in this region are increasingly collaborating with global logistics firms to ensure seamless transport and remote participation options.

This comprehensive research report examines key regions that drive the evolution of the Death Care Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players Strategic Initiatives and Competitive Dynamics Shaping the Future of Death Care Services

Leading companies have adopted differentiated strategies to secure market leadership and foster long-term growth. Major service networks are diversifying their portfolios through acquisitions and strategic partnerships, expanding into ancillary offerings such as grief counseling, aftercare membership programs, and digital legacy solutions. Other influential players are focusing on operational excellence, investing in state-of-the-art facilities, and integrating advanced planning software to enhance customer engagement and streamline internal workflows.

At the same time, specialized providers are carving out niche positions by emphasizing sustainability credentials, artisan-level memorial design, or culturally tailored services. These firms often collaborate with local communities and environmental groups to validate their green credentials, while also leveraging storytelling platforms to cultivate authentic connections with families. Across the competitive landscape, decisive investment in technology, talent development, and brand differentiation has emerged as the common denominator for companies seeking to thrive amid intensifying competition and evolving customer demands.

This comprehensive research report delivers an in-depth overview of the principal market players in the Death Care Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aftermath Services by ServiceMaster Company, LLC

- Anthyesti Funeral Service

- Arbor Memorial Inc.

- Baalmann Mortuary

- Batesville Services, LLC

- Carriage Services, Inc.

- Charbonnet Labat Funeral Home

- Citizens Funeral Services, Inc.

- Classic Memorials Inc.

- Co-operative Group Limited

- Creter Vault Corporation

- Dignity PLC

- Doric Products Inc.

- Foundation Partners Group LLC

- Fu Shou Yuan International Group Limited

- Giles Memory Gardens

- InvoCare Limited

- Kepner Funeral Homes

- Matthews International Corporation

- McMahon, Lyon & Hartnett Funeral Home, Inc.

- Musgrove Mortuaries & Cemeteries

- Nirvana Asia Ltd.

- NorthStar Memorial Group, LLC

- OGF Group

- Park Lawn Corporation

- Propel Funeral Partners

- Recompose

- Service Corporation International

- Westerleigh Group

- Withum Smith+Brown, PC

Identifying High Impact Strategic Actions to Elevate Market Position and Operational Resilience in the Death Care Services Industry

Organizations seeking to elevate their market position should prioritize the expansion of sustainable offerings by partnering with eco-certified suppliers and securing certification under recognized green burial standards. Concurrently, investing in digital service platforms that facilitate virtual arrangement processes, live-streamed ceremonies, and online memorialization tools will create new engagement channels and strengthen client loyalty beyond traditional in-person interactions.

To address the supply chain disruptions posed by recent tariff policies, providers must diversify sourcing strategies by cultivating relationships with domestic manufacturers and exploring near-shore alternatives. Equally important is the ongoing training of staff in cultural competency and digital facilitation, ensuring that teams can adeptly guide families through both traditional and technology-driven service options. In addition, establishing pre-need planning programs can generate stable forward visibility into capacity requirements and reinforce customer relationships through proactive communication.

Finally, stakeholders should leverage data analytics to monitor evolving preferences across service types, arrangement modes, and end-use settings. By harnessing customer insights, companies can refine their product mix, optimize resource allocation, and identify white-space opportunities for service innovation. Such an integrated approach will not only mitigate risks associated with external shocks but also position organizations to capture value in the most promising market segments.

Explaining the Robust Research Approach Combining Secondary Analysis Expert Interviews and Qualitative Data in Death Care Services Study

This study synthesizes insights derived from a robust research framework combining extensive secondary research with targeted primary engagements. Foundational data were gathered through a thorough review of industry publications, regulatory filings, and reputable news outlets to establish a comprehensive view of market dynamics and emerging trends. These findings were then validated and enriched through in-depth interviews with C-level executives, funeral directors, and key stakeholders across different regions, providing nuanced perspectives on strategic priorities and operational challenges.

Qualitative data were further supported by structured surveys with families who have recently arranged end-of-life services, uncovering firsthand insights into consumer behaviors and unmet needs. To ensure methodological rigor, data triangulation techniques were employed to cross-verify insights across multiple sources and mitigate potential biases. Ethical considerations, including respondent confidentiality and sensitivity to cultural practices, were integral to the research design. This multi-method approach has yielded a robust analysis that informs strategic recommendations and supports decision-making for industry leaders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Death Care Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Death Care Services Market, by Services

- Death Care Services Market, by Arrangement

- Death Care Services Market, by End-use

- Death Care Services Market, by Region

- Death Care Services Market, by Group

- Death Care Services Market, by Country

- United States Death Care Services Market

- China Death Care Services Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 636 ]

Summarizing Critical Insights and Strategic Imperatives to Guide Decision Makers in Navigating the Evolving Death Care Services Ecosystem

The collective insights presented in this report underscore the critical importance of embracing innovation, sustainability, and strategic agility within the death care services industry. By dissecting the effects of recent tariff measures, exploring consumer segmentation across services and arrangement modes, and analyzing regional market variations, decision-makers gain a holistic understanding of the forces shaping the sector.

Moreover, the competitive landscape demonstrates that companies committed to digital transformation, eco-certification, and customer-centric service design are best positioned to capture emerging opportunities and withstand external shocks. The strategic imperatives outlined herein provide a clear roadmap for enhancing value propositions, optimizing operations, and fostering long-term resilience. As the industry continues to evolve, proactive adaptation and evidence-based decision-making will distinguish market leaders from those left behind in an increasingly complex and dynamic environment.

Engaging with Our Associate Director to Unlock Comprehensive Death Care Industry Intelligence and Access the Full Market Research Report Today

Our team stands ready to provide you with unparalleled insights that will empower your organization to navigate market complexities with confidence and precision. To access the depth and breadth of our analysis, and to obtain actionable intelligence that can shape your strategic decisions, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. Engaging with him ensures you receive dedicated guidance, personalized service, and immediate access to the comprehensive report that will illuminate opportunities, mitigate risks, and drive growth in the evolving death care services sector.

- How big is the Death Care Services Market?

- What is the Death Care Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?