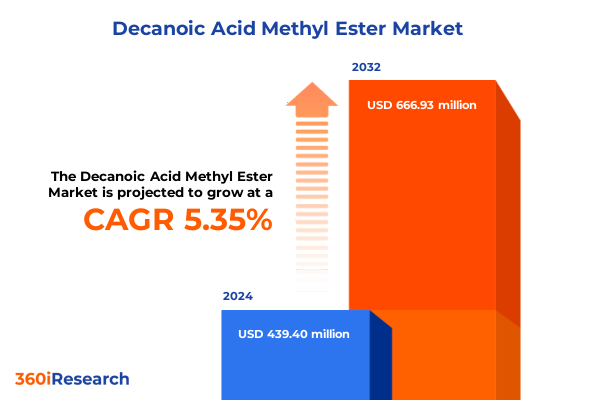

The Decanoic Acid Methyl Ester Market size was estimated at USD 461.54 million in 2025 and expected to reach USD 486.41 million in 2026, at a CAGR of 5.39% to reach USD 666.92 million by 2032.

Decanoic Acid Methyl Ester emerges as a pivotal bio-based chemical offering versatile applications across detergents fuel additives and more

Decanoic Acid Methyl Ester, commonly known as methyl decanoate, is a versatile fatty ester synthesized via the esterification of decanoic acid and methanol. This clear, low-viscosity liquid exhibits excellent solvency properties, making it a strategic intermediate for detergents, plasticizers, and specialty fuel additives. Its fatty, fruity aroma also positions it as a preferred choice in flavors and fragrances. As industries increasingly adopt bio-based chemicals for sustainability objectives, methyl decanoate’s renewable feedstock origin and favorable biodegradability profile have elevated its status across multiple sectors

Industry paradigm shifts driven by sustainability mandates regulatory changes and technological innovations are reshaping Decanoic Acid Methyl Ester production and consumption

The landscape of Decanoic Acid Methyl Ester has undergone profound transformation as regulatory frameworks and market expectations realign with sustainability goals. In early 2025, the U.S. Department of Agriculture consolidated its BioPreferred Program guidelines into a single, streamlined regulation effective January 8, 2025. This update broadened the definition of biobased products to explicitly include renewable chemicals, simplifying certification for end-use markets Continued momentum in renewable chemical incentives has spurred investment in bio-based technologies, catalyzing innovation across the value chain.

Simultaneously, the federal government has injected nearly $180 million into domestic biofuels and clean energy projects under the Rural Energy for America Program and Higher Blends Infrastructure Incentive Program. This capital infusion, funded by the Inflation Reduction Act, directly benefits bio-based chemical producers by enhancing feedstock availability and driving demand for sustainable solvents and additives that integrate decanoic acid methyl ester into fuel blends and industrial applications

Assessment of escalating US trade policies and their aggregate impact on the import costs and supply dynamics of Decanoic Acid Methyl Ester through 2025

The introduction of universal reciprocal tariffs in April 2025 has reshaped import economics for Decanoic Acid Methyl Ester. Under the Administration’s broad use of the International Emergency Economic Powers Act, a 10% tariff on all imported goods-effective April 5, 2025-now applies to fatty acid methyl esters unless specifically exempted. This measure, designed to enhance domestic competitiveness, has raised procurement costs for downstream processors relying on imported methyl decanoate, prompting strategic realignments in sourcing and pricing

Despite decanoic acid itself retaining a duty-free status under the Miscellaneous Tariff Bill Reform Act through December 31, 2025, the overlay of general tariffs has inflated landed costs for esters. Producers and distributors are navigating these trade headwinds by expanding domestic capacities, renegotiating supply contracts, and hedging currency exposure. These adaptive strategies underline the cumulative impact of 2025 tariff policies on the methyl decanoate supply chain and downstream application economics

In-depth segmentation analysis reveals how form distribution channels grade application uses and end-use industries define market dynamics and growth drivers

A nuanced analysis of market segmentation reveals critical levers influencing Decanoic Acid Methyl Ester demand and positioning. In terms of form, liquid methyl decanoate predominates due to its immediate integration into solvents and fuel additives, while solid derivatives find niche applications in controlled-release formulations and specialty plastics. Transitioning between these physical states requires sophisticated handling protocols and customized distribution solutions, emphasizing the role of form-factor innovation in competitive differentiation.

Distribution channel dynamics underscore varied procurement models: direct sales foster long-term agreements with major end users, distributors provide logistical and regulatory support for regional players, and online channels are increasingly leveraged for smaller-scale orders through digital procurement platforms. This multichannel approach reflects evolving customer preferences for speed, transparency, and value-added services.

Grade delineation between industrial and technical certifications drives product specification: industrial-grade methyl decanoate serves bulk solvent and additive markets, while technical-grade variants meet stringent purity demands for flavorings, fragrances, and pharmaceutical intermediates. As quality thresholds escalate, grade-segmentation insights guide R&D investments and production controls.

Application segmentation spans detergent and cleaner formulations, engine oil additives, fuel additives, and plasticizers. Each end-use category subdivides further: household and industrial cleaners harness surfactant efficacy; commercial and passenger vehicle oil treatments leverage lubricity modifiers; diesel and gasoline blends utilize methyl decanoate’s solvency; and polyurethane and PVC plasticizers exploit polymer flexibility enhancements. Tailoring product portfolios to these application nuances is vital for capturing growth opportunities.

Finally, end-use industry focus converges on automotive, chemical, and metalworking sectors, where performance requirements and regulatory scrutiny intersect. Automotive OEMs demand advanced lubrication and emissions-reduction additives; specialty chemical producers integrate methyl decanoate into formulations; and metalworking applications rely on its thermal stability and biodegradability. Understanding how each end-use vertical shapes consumption patterns informs strategic positioning and investment prioritization.

This comprehensive research report categorizes the Decanoic Acid Methyl Ester market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Distribution Channel

- Grade

- Application

- End Use Industry

Regional market landscapes in the Americas Europe Middle East Africa and Asia-Pacific showcase contrasting demand patterns and strategic opportunities for Decanoic Acid Methyl Ester

Regional performance of Decanoic Acid Methyl Ester exhibits distinct demand drivers and competitive landscapes. In the Americas, established automotive and heavy-industry clusters in the United States and Mexico propel solvent, fuel additive, and lubricant formulations, while government incentives for clean energy and biobased chemicals bolster domestic production capacities.

Across Europe, the Middle East, and Africa, regulatory mandates such as the European Green Deal and REACH directives intensify the shift toward bio-based solvents and plasticizers. Stringent environmental standards in Western Europe drive premium pricing for certified renewable esters, while emerging markets in Eastern Europe and North Africa offer growth potential under localized manufacturing partnerships.

The Asia-Pacific region demonstrates accelerated adoption driven by robust petrochemical infrastructure and expanding automotive and industrial sectors in China, India, and Southeast Asia. Rapid urbanization and increasing environmental regulations support the scale-up of domestic methyl decanoate facilities, making APAC a focal point for capacity expansions and strategic alliances.

This comprehensive research report examines key regions that drive the evolution of the Decanoic Acid Methyl Ester market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Major industry participants including Sigma-Aldrich Thermo Fisher Croda BASF and Dow drive strategic advancements in Decanoic Acid Methyl Ester production and applications

Key players in the Decanoic Acid Methyl Ester market are actively leveraging strategic initiatives to fortify their positions. Sigma-Aldrich and Thermo Fisher Scientific dominate on the purity-certified technical-grade front, supplying high-performance esters for pharmaceutical, flavor, and fragrance applications. Their extensive R&D pipelines and global distribution networks ensure rapid response to evolving regulatory standards and customer requirements

On the industrial-grade side, diversified chemical companies such as Archer Daniels Midland, Croda, Solvay, DuPont, BioAmber, Eastman Chemical, BASF, Evonik, Dow, and Cargill are expanding production capacities and optimizing supply chains to meet increasing demand for eco-friendly solvents and fuel additives. Partnerships with feedstock providers, investments in continuous manufacturing technologies, and targeted acquisitions underscore their commitment to securing reliable access to renewable raw materials while scaling methyl decanoate output for global markets

This comprehensive research report delivers an in-depth overview of the principal market players in the Decanoic Acid Methyl Ester market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AAK AB

- Arkema S.A.

- BASF SE

- Croda International plc

- Emery Oleochemicals, LLC

- Evonik Industries AG

- Godrej Industries Limited

- IOI Oleochemical Industries Berhad

- Kao Corporation

- Kuala Lumpur Kepong Berhad

- Merck KGaA

- Musim Mas Group

- Oleon NV

- Procter & Gamble Chemicals

- SABIC

- Solvay S.A.

- Stepan Company

- Thermo Fisher Scientific Inc.

- Tokyo Chemical Industry Co., Ltd.

- Wilmar International Limited

Strategic recommendations for industry leaders emphasize sustainability integration supply chain resilience innovation partnerships and tariff mitigation strategies

Industry leaders should prioritize integrating sustainability across every facet of the Decanoic Acid Methyl Ester value chain. Investing in bio-based feedstock partnerships and circular economy initiatives will not only mitigate raw material volatility but also enhance brand equity among eco-conscious end users. Concurrently, advancing process innovations-such as continuous flow esterification and in-situ purification-can streamline operations and reduce energy intensity.

To navigate evolving trade policies, companies must develop robust tariff mitigation strategies, including dual-sourcing arrangements and bonded warehousing solutions. Cultivating relationships with alternative low-cost suppliers in tariff-friendly jurisdictions and leveraging trade-compliance expertise will minimize exposure to import duties.

Digitalization and data analytics should be harnessed to optimize inventory turnover, forecast demand fluctuations, and enhance customer engagement through digital channels. Implementing end-to-end supply chain visibility tools will strengthen resilience against disruptions and enable agile responses to shifting market conditions.

Finally, forging collaborative R&D partnerships with end-use industries and academic institutions can accelerate the development of high-value, application-specific derivatives. Co-development initiatives that align ester properties with detergent, lubricant, and polymer performance requirements will unlock new growth segments and command premium pricing.

Rigorous research methodology combining primary stakeholder interviews secondary data sources and robust analytical frameworks underpins this Decanoic Acid Methyl Ester market study

This market analysis is underpinned by a comprehensive research methodology that integrates both primary and secondary data sources. Primary insights were garnered through in-depth interviews with key stakeholders across the methyl decanoate value chain, including producers, distributors, and major end users. These conversations provided qualitative perspectives on product specifications, regulatory compliance, and evolving demand drivers.

Secondary research involved exhaustive review of regulatory filings, industry reports, and company disclosures to chart tariff developments, capacity expansions, and sustainability initiatives. Trade databases and customs records were analyzed to quantify import flows, while patent landscapes and academic publications were examined to track technological advancements.

Data triangulation techniques ensured the validation of findings, cross-referencing stakeholder inputs with public data and proprietary databases. Rigorous quality controls, including peer reviews and consistency checks, were applied to guarantee the accuracy and reliability of the insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Decanoic Acid Methyl Ester market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Decanoic Acid Methyl Ester Market, by Form

- Decanoic Acid Methyl Ester Market, by Distribution Channel

- Decanoic Acid Methyl Ester Market, by Grade

- Decanoic Acid Methyl Ester Market, by Application

- Decanoic Acid Methyl Ester Market, by End Use Industry

- Decanoic Acid Methyl Ester Market, by Region

- Decanoic Acid Methyl Ester Market, by Group

- Decanoic Acid Methyl Ester Market, by Country

- United States Decanoic Acid Methyl Ester Market

- China Decanoic Acid Methyl Ester Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Comprehensive concluding perspectives synthesize market drivers tariff implications segmentation insights and strategic imperatives for Decanoic Acid Methyl Ester

Decanoic Acid Methyl Ester occupies a strategic nexus at the intersection of renewable chemistry and high-performance applications. Sustainability mandates and bio-preferred regulations have elevated its profile as a viable alternative to petrochemical solvents, plasticizers, and fuel additives. However, the imposition of universal import tariffs through 2025 has introduced new cost variables, driving a recalibration of sourcing strategies and capacity deployments.

Segmentation analysis highlights the importance of form-factor optimization, multichannel distribution strategies, grade differentiation, and application-specific formulations in capturing diverse end-use demand. Regional insights underscore the Americas’ policy-driven incentives, EMEA’s regulatory rigor, and APAC’s production scale-up as key to global growth dynamics.

Leading companies are responding with targeted investments in sustainable feedstocks, digital supply chain platforms, and collaborative R&D initiatives. For market participants, aligning operational excellence with proactive tariff mitigation and strategic partnerships will be critical to achieving competitive advantage in this evolving landscape.

Contact Ketan Rohom Associate Director Sales Marketing today to purchase and unlock the complete Decanoic Acid Methyl Ester market research report

To explore the comprehensive findings and gain a competitive edge in the evolving Decanoic Acid Methyl Ester market, reach out to Ketan Rohom, Associate Director of Sales & Marketing. His expertise will guide you through the detailed insights and deliver tailored solutions that align with your strategic objectives. Don’t miss the opportunity to secure the full report, equipping your organization with the knowledge needed to navigate market shifts and capitalize on emerging opportunities.

- How big is the Decanoic Acid Methyl Ester Market?

- What is the Decanoic Acid Methyl Ester Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?