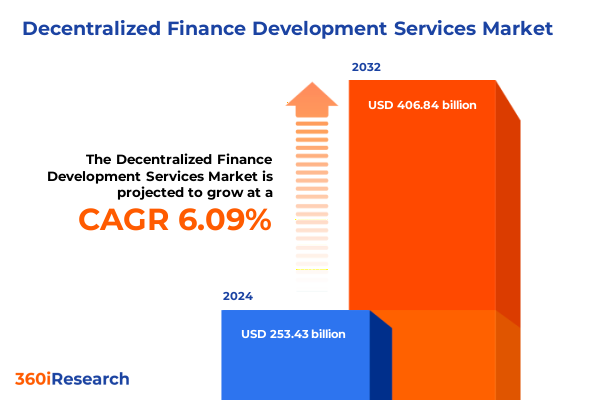

The Decentralized Finance Development Services Market size was estimated at USD 267.95 billion in 2025 and expected to reach USD 283.31 billion in 2026, at a CAGR of 6.14% to reach USD 406.84 billion by 2032.

Navigating the Emerging Ecosystem of Decentralized Finance Development Services to Empower Strategic Innovation and Drive Competitive Differentiation

Decentralized finance, or DeFi, has emerged as a revolutionary paradigm, fundamentally redefining how value is created, transferred, and managed across global networks. This landscape is driven by breakthroughs in distributed ledger technology, token economics, and smart contract automation, each contributing to a rapidly evolving ecosystem of financial products and services. As organizations grapple with bridging traditional financial infrastructure and decentralized architectures, the demand for specialized development services has intensified. Stakeholders across industries now seek partners who can deliver robust, scalable, and secure DeFi solutions that not only facilitate efficient transactions but also ensure regulatory adherence and resilience against cyber threats.

This executive summary distills critical insights into the decentralized finance development services sector, offering a concise yet comprehensive overview of technological innovations, regulatory influences, and strategic segmentation driving market dynamics. It highlights the pivotal shifts reshaping service delivery models, examines the implications of recent policy changes, and elucidates key player strategies. With strategic decision-makers and technical teams in mind, this summary serves as a navigational tool, illuminating the most relevant trends and considerations essential for capitalizing on the opportunities and mitigating the risks inherent in DeFi development. By synthesizing diverse perspectives, the document sets the stage for informed action and sustainable growth in what is poised to be one of the most transformative domains of the digital economy.

Examining Major Technological and Regulatory Transformations Reshaping the Decentralized Finance Development Landscape in 2025

The decentralized finance development landscape has experienced seismic shifts propelled by advancements in blockchain scalability, cross-chain interoperability, and the integration of artificial intelligence. Layer-2 scaling solutions and sharding mechanisms have addressed throughput bottlenecks, enabling high-frequency transaction capabilities that rival traditional payment networks. Meanwhile, cross-chain bridges and automated relay protocols have minimized isolation between disparate blockchain environments, fostering a more interconnected DeFi ecosystem. At the same time, AI-driven analytics have elevated risk modeling and automated compliance monitoring, rendering operations more predictive and resilient.

Regulatory frameworks are likewise in transition, with jurisdictions refining digital asset classifications and establishing compliance guardrails. Proactive regulators have introduced licensing regimes that simultaneously encourage innovation and protect end-users, while others remain cautious, resulting in a patchwork approach that service providers must navigate meticulously. Additionally, the surge in tokenized real-world assets has broadened the scope of DeFi applications, extending beyond liquidity pools and yield farming into asset management, insurance, and supply chain financing. These multifaceted transformations underscore the imperative for service providers to adopt agile architectures, embed rigorous security protocols, and cultivate close collaboration with regulatory bodies to stay ahead of the curve.

Assessing the Comprehensive Economic and Strategic Consequences of 2025 United States Tariffs on Decentralized Finance Service Providers and Ecosystem Growth

In 2025, newly enacted United States tariffs targeting technology services and cross-border data processing have had profound implications for decentralized finance development service providers. Although software and data transmission are traditionally exempt from classical customs duties, the extension of tariffs to digital services has increased the cost of engaging with specialized development teams based outside the country. Consequently, organizations have experienced margin compression, as the higher indirect costs of remote development have eroded the competitive pricing of offshore and nearshore partners.

This policy shift has prompted some leading DeFi development firms to establish onshore entities or partner with domestic contractors to bypass elevated duty structures. However, these strategic realignments have required substantial investments in local infrastructure, lengthening project timelines and driving up overhead. From a broader perspective, the tariffs have accelerated the trend toward regional self-sufficiency, prompting consortiums to develop localized blockchain networks and standardized tooling within the Americas. Although this has partially mitigated supply-chain friction, it has also fragmented innovation efforts, necessitating interoperable design practices to ensure solutions remain global in scope. As a result, service providers are now prioritizing modular architectures and leveraging automated compliance frameworks to manage the evolving landscape of cross-border fees and duties.

Unveiling In-Depth Segmentation Insights for Service Types Deployment Modes Organization Sizes and End-Use Verticals Driving Market Dynamics

A granular view of market segmentation reveals the nuanced drivers that dictate service selection and project direction. When classified by service type, auditing and security stand at the forefront, with penetration testing complementing security consulting and smart contract audits to safeguard protocol integrity. Consulting and advisory services offer specialized compliance and risk management guidance alongside strategy and technical consulting to align blockchain initiatives with corporate objectives. Decentralized application development spans staking platforms, trading interfaces, digital wallets, and yield aggregators, each tailored to distinct user experiences. Integration services encompass cross-chain integration, oracle integration, and wallet integration to unify disparate networks, while smart contract development covers infrastructure and middleware, protocol development-including decentralized exchanges, derivatives and synthetic assets, and lending protocols-and token development to facilitate programmable economic models.

Deployment mode further distinguishes offerings between cloud and on-premise options. Cloud-based solutions leverage hybrid, private, or public cloud environments to optimize scalability and cost efficiency, whereas on-premise configurations utilize co-located servers and enterprise data centers to meet stringent data sovereignty requirements. Corporate scale introduces another dimension of differentiation. Large enterprises command extensive resources to underwrite end-to-end DeFi platform builds and bespoke security solutions, while small and medium enterprises-ranging from medium to micro and small entities-tend to seek modular, cost-effective offerings that accelerate time to market.

End-use segmentation sheds light on demand patterns across diverse customer profiles. Enterprises such as gaming, retail, and technology companies adopt DeFi services to streamline digital asset integration and enhance user engagement. Financial institutions, including asset managers, banks, and insurance companies, employ decentralized solutions to augment traditional custody and settlement workflows. Fintech companies, whether lending platforms, neobanks, or payment platforms, rely on specialized development expertise to expand product portfolios rapidly. Individual developers, from hobbyists experimenting with token creation to independent consultants advising early-stage projects, require flexible tooling and support to deliver innovative proofs of concept.

This comprehensive research report categorizes the Decentralized Finance Development Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Deployment Mode

- Organization Size

- End Use

Analyzing Critical Regional Variations in Decentralized Finance Development Services Across the Americas EMEA and Asia-Pacific Jurisdictions

Regional dynamics continue to shape the decentralized finance development services landscape in profound ways. In the Americas, leading-edge innovation hubs in North America are supported by robust infrastructure and a favorable regulatory climate in certain states, driving significant demand for scalable applications and institutional-grade security. Meanwhile, Latin American markets exhibit a hunger for remittance-focused DeFi solutions and stablecoin-based financial rails to navigate local currency volatility. This fragmentation within the Americas underscores the importance of adaptable service models that can address varied risk profiles and user expectations.

The Europe, Middle East and Africa region presents a tapestry of regulatory experimentation and adoption. European Union initiatives around digital asset regulation have provided clarity for service providers, encouraging compliance-first development practices. Conversely, emerging markets in the Middle East and Africa are leveraging DeFi to enhance financial inclusion, with pilot projects in cross-border payments and agricultural financing gaining traction. These divergent use cases highlight the need for providers to maintain a flexible regulatory playbook and cultivate partnerships with local authorities to secure market entry.

In Asia-Pacific, government attitudes range from stringent controls in certain jurisdictions to proactive licensing frameworks in centers like Singapore, Japan, and Australia. This region is notable for its rapid embrace of blockchain infrastructure and the proliferation of decentralized exchange platforms. High levels of mobile penetration and digital gamefi integrations further spur demand for wallet solutions and yield optimization tools. To succeed across Asia-Pacific, service providers must balance compliance with innovation, aligning development roadmaps to both regional regulatory timelines and the dynamic preferences of tech-savvy user communities.

This comprehensive research report examines key regions that drive the evolution of the Decentralized Finance Development Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Established Providers Shaping the Competitive Contours of the Decentralized Finance Development Sector

Amidst the rapid expansion of decentralized finance, a cadre of specialist firms has emerged as industry vanguards, each leveraging unique capabilities to address market pain points. Security-focused teams are led by contenders that have built reputations on meticulous smart contract audits and threat modeling, employing proprietary frameworks to uncover vulnerabilities before deployment. In parallel, full-stack blockchain developers offer end-to-end platform creation, integrating user interfaces, liquidity management modules, and back-end consensus mechanisms with seamless interoperability.

Consulting outfits with deep regulatory expertise have distinguished themselves by helping clients navigate evolving compliance regimes, producing tailored risk assessments and governance structures. On the infrastructure side, players specializing in node orchestration and layer-2 deployment have streamlined the onboarding process for enterprises, reducing operational complexity and accelerating go-live timelines. Meanwhile, integration service providers excel at bridging legacy systems with decentralized components, often leveraging oracles and API-first architectures to ensure real-time data fidelity.

Token engineering firms and protocol architects round out the competitive field, driving innovations in decentralized exchange mechanisms, synthetic asset minting, and programmable lending markets. These organizations collaborate with academic institutions and standards bodies to validate economic models and governance frameworks, cementing their reputations as thought leaders. Collectively, these leading companies set benchmarks for quality, security, and scalability, advancing the sector while fostering an ecosystem in which emerging providers can flourish.

This comprehensive research report delivers an in-depth overview of the principal market players in the Decentralized Finance Development Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Altoros IT, Inc.

- Blockchain App Factory Ltd.

- ChainSafe Systems Inc.

- ChromaWay AB

- ConsenSys Inc.

- HashCash Consultants Pvt. Ltd.

- HashChain Technology Ltd.

- OpenZeppelin Inc.

- SettleMint NV

- Sofocle Technologies Pvt. Ltd.

Actionable Strategic Roadmap Recommendations for Industry Leaders to Capitalize on Emerging Opportunities in Decentralized Finance Development

To thrive in the dynamic world of decentralized finance development, industry leaders must adopt a strategic, forward-looking posture. First, it is critical to prioritize security by integrating continuous testing and automated audit pipelines within development cycles, ensuring that code vulnerabilities are detected and remediated early. Equally important is the adoption of interoperable standards for cross-chain communication, enabling seamless asset transfers and composability across diverse protocols.

Organizations should also cultivate close collaboration with regulatory bodies and trade associations to anticipate policy shifts and embed compliance frameworks from project inception. Investing in modular architectures that separate core protocol logic from business-specific features can reduce time to market and support iterative upgrades in response to user feedback. Furthermore, forging partnerships with leading cloud and infrastructure providers will bolster scalability, while localized data center strategies can address geopolitical and data sovereignty concerns.

Talent acquisition and continuous upskilling remain vital, as competition for blockchain engineers, security experts, and token economists intensifies. Developing in-house centers of excellence and sponsoring open-source initiatives can attract top-tier talent while contributing to industry standards. Lastly, adopting a customer-centric mindset-rooted in in-depth user research and real-world pilot programs-will ensure solutions not only meet technical requirements but also deliver compelling, user-friendly experiences that foster widespread adoption.

Detailing Rigorous Research Methodology Approaches Employed to Ensure Robust Data Integrity and Comprehensive Market Analysis

This research combines a multilayered approach to gather, validate, and analyze data from diverse sources. Primary insights were obtained through structured interviews with senior executives, chief technology officers, and blockchain architects across leading development firms. Complementary quantitative data were collected via surveys that captured service adoption trends, pricing structures, and project timelines, ensuring statistical robustness.

Secondary research involved a disciplined review of white papers, technical specifications, regulatory filings, and technology standards documentation. This process was augmented by close monitoring of open-source repositories and developer forums to track emerging best practices. Expert panels convened throughout the research cycle provided qualitative validation, offering real-world context and challenging preliminary findings.

Data triangulation techniques were employed to reconcile discrepancies between sources, while sensitivity analyses tested the resilience of key insights against varying assumptions. The methodology prioritized transparency and repeatability by documenting data collection instruments and analysis frameworks. This rigorous approach guarantees that the conclusions drawn reflect real-time developments and deliver actionable intelligence to decision-makers in the decentralized finance development ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Decentralized Finance Development Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Decentralized Finance Development Services Market, by Service Type

- Decentralized Finance Development Services Market, by Deployment Mode

- Decentralized Finance Development Services Market, by Organization Size

- Decentralized Finance Development Services Market, by End Use

- Decentralized Finance Development Services Market, by Region

- Decentralized Finance Development Services Market, by Group

- Decentralized Finance Development Services Market, by Country

- United States Decentralized Finance Development Services Market

- China Decentralized Finance Development Services Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2862 ]

Synthesizing Key Findings and Strategic Imperatives to Define the Path Forward in the Decentralized Finance Development Landscape

The analysis presented herein illuminates the multifaceted forces shaping decentralized finance development services, underscoring the importance of technological agility, security excellence, and regulatory adaptability. Breakthroughs in scalability and interoperability are catalyzing new use cases, while the evolving tariff environment underscores the need for strategic supply-chain planning. Segment insights reveal differentiated demand profiles, guiding providers to tailor their offerings across service types, deployment modes, organizational scales, and end-use sectors. Regional variations further spotlight the necessity of bespoke market entry strategies and compliance roadmaps, while company profiles showcase leading practices that set quality benchmarks.

Looking ahead, organizations equipped with these insights are better positioned to harness the next wave of DeFi innovation, from tokenized assets to real-world finance integrations. By internalizing the recommendations and methodological rigor outlined in this summary, stakeholders can advance robust, secure, and compliant solutions that meet diverse user requirements. Ultimately, success in this rapidly evolving domain will hinge on a balanced approach that marries technical prowess with strategic foresight, ensuring that decentralized finance development services continue to unlock value and drive sustainable growth across the global economy.

Engage with Ketan Rohom to Unlock Exclusive Insights and Secure Your Comprehensive Decentralized Finance Development Services Market Research Report Today

To explore this in depth and gain a competitive advantage, reach out to Ketan Rohom to secure your access to the full market research report. His expertise in decentralized finance development services and strong understanding of emerging market dynamics will ensure you obtain tailored insights and practical guidance. By engaging directly, you can discuss customized analyses, detailed company benchmarking, and region-specific breakdowns that will empower your strategic decision-making. Ketan is prepared to guide you through the report’s comprehensive findings, address any specific queries, and outline how this research can be operationalized within your organization. Don’t miss the opportunity to leverage exclusive data and nuanced perspectives designed to help you navigate regulatory shifts, optimize service offerings, and capitalize on growth areas. Contact Ketan today to unlock the critical intelligence needed to stay ahead in the rapidly evolving decentralized finance development landscape and transform market insights into actionable strategies.

- How big is the Decentralized Finance Development Services Market?

- What is the Decentralized Finance Development Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?