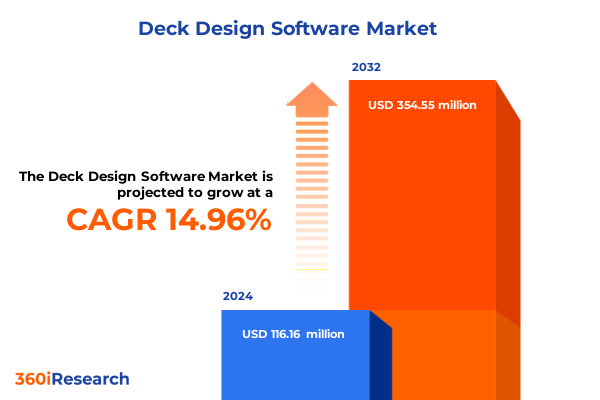

The Deck Design Software Market size was estimated at USD 133.25 million in 2025 and expected to reach USD 153.04 million in 2026, at a CAGR of 15.00% to reach USD 354.55 million by 2032.

Unveiling the Evolution of Deck Design Software Innovations Driving Seamless Collaboration, Engaging Visual Narratives, and Informed Decision Making

Deck design software has rapidly emerged as a foundational element of modern business communication, redefining how organizations craft and deliver strategic narratives. In the face of increasingly dispersed workforces, these platforms act as virtual collaboration spaces where cross-functional teams can co-create compelling visual stories without geographic constraints. The democratization of design capabilities has empowered professionals from marketing to executive leadership to articulate complex ideas with clarity and impact, transcending the limitations of traditional presentation tools.

In recent years, artificial intelligence has accelerated this evolution by automating design recommendations, optimizing visual hierarchies, and even generating complete slide decks from simple outlines. Consequently, design processes that once required specialized expertise have become accessible to a broader user base, driving adoption across diverse industries. Furthermore, the integration of collaboration features-such as version control, live commenting, and multi-user editing-has strengthened the role of deck design software as a critical hub for iterative content development.

Moreover, the shift toward cloud-based deployments has expanded the potential for seamless integration with complementary applications like video conferencing, project management systems, and enterprise content repositories. This synergy has facilitated a more cohesive digital ecosystem, enabling organizations to maintain consistent branding and messaging across all stakeholder touchpoints. As companies continue to prioritize agility and efficiency, the strategic significance of deck design software will only intensify, setting the stage for the transformative shifts explored in the subsequent sections.

Charting the Paradigm Shifts Reshaping Deck Design Software Through AI Integration, Cloud Collaboration, and Enhanced Cross-Platform Accessibility

The landscape of deck design software is undergoing paradigm shifts propelled by advancements in artificial intelligence, cloud computing architectures, and a renewed emphasis on user-centric design philosophies. Artificial intelligence has swiftly moved from peripheral add-on to a core component, enabling automatic formatting, intelligent content recommendations, and even sentiment analysis to guide tone and style. These capabilities not only accelerate the slide creation process but also ensure that presentations resonate with intended audiences by aligning visual elements and messaging with best practice guidelines.

In tandem, the growing reliance on cloud platforms has fostered unprecedented levels of accessibility and collaboration. Teams distributed across multiple time zones now experience real-time co-authoring, instantaneous asset synchronization, and secure version management without the latency constraints of legacy on-premise solutions. This transition has also paved the way for cross-platform interoperability, allowing users to seamlessly switch between desktop, web, and mobile interfaces without sacrificing functionality or design fidelity.

Moreover, the integration of open APIs and modular plugin ecosystems has empowered developers to extend core capabilities, embedding features like advanced analytics, third-party content libraries, and specialized interactive elements. Consequently, deck design software is evolving into a flexible, extensible environment that supports unique industry workflows, from investor pitch preparation to educational content delivery. Collectively, these shifts are redefining expectations around speed, scalability, and customization in visual communication.

Evaluating the Cascading Effects of 2025 United States Tariff Measures on Technological Investments, Operational Costs, and Software Accessibility

The introduction of United States tariff measures in 2025 has reverberated across the technology supply chain, indirectly influencing the economics and accessibility of deck design software solutions. As tariffs on key hardware components such as high-performance processors and memory modules were enacted, data center operators and hardware manufacturers faced elevated costs that have, in turn, affected the pricing structures of cloud services. This ripple effect has prompted many software providers to reassess subscription rates and support fees to maintain margin integrity while delivering uninterrupted service quality.

Furthermore, enterprises considering on-premise deployments now confront higher capital expenditures for server infrastructure and networking equipment. Such dynamics are accelerating the migration toward cloud-native models, as organizations seek to avoid the upfront cost spikes by leveraging elastic consumption-based billing. Consequently, subscription-based software offerings have gained traction, with vendors emphasizing transparent pricing and predictable operational expenses to mitigate the impact of external trade policies.

In addition, the reshuffling of global supplier relationships has prompted software distributors and partner networks to diversify procurement avenues, exploring alternative hardware sources and strategic alliances to buffer against tariff volatility. This proactive adaptation has enabled many resellers to sustain competitive pricing schemes in online marketplaces and through direct sales channels, ensuring continuity for end users despite the broader economic headwinds.

Collectively, the cumulative effects of the 2025 tariff measures underscore the interconnected nature of hardware and software markets, reinforcing the value proposition of flexible deployment options and dynamic pricing models in today’s deck design software ecosystem.

Uncovering Strategic User Profiles Through Deployment, Organizational Scale, Industry Applications, Pricing Models, and Distribution Channel Analysis

A nuanced understanding of user segments reveals distinct preferences and priorities across deployment modes, organizational scales, industry verticals, pricing approaches, and distribution pathways. Organizations opting for cloud-based environments often leverage a mix of public, private, and hybrid configurations to balance cost efficiency with regulatory compliance. Within this spectrum, hybrid deployments have emerged as the preferred choice for enterprises that require data sovereignty and on-demand scalability, while private cloud infrastructures cater to sectors with stringent security mandates.

By contrast, on-premise implementations continue to resonate with organizations maintaining legacy systems or those requiring tight integration with proprietary databases. Deployment mode choices are further influenced by organizational size; large enterprises frequently maintain a multi-tiered infrastructure strategy that combines cloud and local resources, whereas small and medium enterprises typically favor simpler models. Medium-sized groups place premium value on managed subscription services, micro-enterprises prioritize pay-as-you-go flexibility to conserve working capital, and small enterprises seek intuitive, turnkey solutions with minimal administrative overhead.

Industry-specific requirements also shape software preferences, as financial institutions demand robust encryption and audit trails, healthcare providers require seamless integration with electronic health record platforms to uphold patient privacy standards, and IT and telecommunications firms emphasize collaborative features that align with agile development methodologies. Meanwhile, manufacturing and retail organizations often depend on offline authoring capabilities and rich template libraries tailored to training modules and product pitch decks.

Moreover, the adoption of different pricing formats highlights the trade-offs between long-term commitment and short-term agility. Perpetual licenses with maintenance agreements appeal to organizations that possess dedicated IT support teams, while perpetual solutions without maintenance capture the interest of budget-conscious buyers. Subscription plans offered on annual terms provide predictable budgeting, and monthly options resonate with project-based users who need temporary access. Distribution strategies further enhance these dynamics, as direct sales remain integral for high-touch enterprise deals, online marketplaces-both third-party and vendor-operated-facilitate rapid discovery and deployment, and partner networks led by system integrators and value-added resellers deliver tailored end-to-end service packages.

This comprehensive research report categorizes the Deck Design Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Industry Vertical

- Deployment Mode

- Organization Size

- Distribution Channel

Illuminating Regional Dynamics Shaping Deck Software Adoption Across the Americas, EMEA, and Asia-Pacific Innovation Hubs

Adoption of deck design software varies significantly across the Americas, Europe–Middle East & Africa, and Asia-Pacific regions, each driven by unique economic conditions, regulatory landscapes, and prevailing technology ecosystems. Within the Americas, enterprises benefit from advanced digital infrastructures and early-stage adoption of artificial intelligence features, with North American organizations leveraging integrated collaboration suites to accelerate remote teamwork. Latin American markets are beginning to embrace cloud-first strategies, spurred by improved connectivity and competitive on-premise alternatives tailored to local cost structures.

In EMEA, stringent data protection laws such as the General Data Protection Regulation have led many companies to prioritize solutions that can be deployed in private or hybrid cloud environments, ensuring compliance without compromising collaborative functionality. Meanwhile, initiatives in the Middle East to bolster digital transformation across government and private sectors are fueling demand for scalable presentation tools that support multilingual content and right-to-left language editing. Across Africa, start-up ecosystems are increasingly reliant on subscription-based software accessible via online marketplaces, permitting entrepreneurs to craft high-impact pitches for investment without heavy upfront expenses.

Asia-Pacific markets present a diverse tapestry of technology adoption patterns. Developed economies in East Asia are integrating mobile-first design paradigms, optimizing interfaces for on-the-go editing and reviewing. Southeast Asian organizations, balancing cost sensitivity with rapid growth, favor subscription models that can be scaled incrementally. Meanwhile, South Asian and Oceania enterprises are forging strategic partnerships with regional system integrators and reseller networks to customize features for local language support and integration with popular indigenous productivity platforms.

Collectively, these regional dynamics underscore the importance of flexibility in deployment, pricing, and distribution strategies, as software providers navigate a complex patchwork of technical requirements and market expectations.

This comprehensive research report examines key regions that drive the evolution of the Deck Design Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting Leading Innovators and Strategic Partnerships That Are Redefining Functionality, User Experience, and Market Reach in Deck Design Software

The competitive landscape of deck design software is defined by a blend of established technology giants and specialized innovators forging strategic alliances to drive differentiated value. Major providers have expanded core offerings through targeted acquisitions and partnerships, integrating advanced AI engines to automate design workflows and predictive content curation. These alliances enhance user ecosystems by providing seamless transitions between authoring environments, video conferencing tools, and enterprise knowledge repositories.

Simultaneously, agile start-ups are gaining traction with niche capabilities such as interactive data visualizations, dynamic storytelling modules, and template marketplaces. Their emphasis on user experience has led to streamlined onboarding processes and intuitive interfaces that reduce the learning curve for non-technical professionals. Collaboration with cloud infrastructure vendors has enabled these companies to deliver enterprise-grade security and uptime guarantees, making them viable alternatives for decentralized teams seeking agile deployment options.

Furthermore, partnerships between software vendors and global system integrators have catalyzed end-to-end solutions that encompass customization, training, and ongoing support. These collaborations often include co-developed add-ons for popular customer relationship management and project management platforms, ensuring that visual communications are embedded directly into strategic planning workflows. As a result, organizations benefit from cohesive toolchains that span ideation, design, review, and delivery phases.

Looking forward, competitive differentiation will hinge on the ability to cultivate vibrant developer ecosystems and to leverage open standards that facilitate smooth data portability. Vendors that can balance rapid feature development with robust governance and compliance frameworks will maintain an edge, while those that foster community-driven innovation will attract a loyal customer base seeking continuous improvement and extensibility.

This comprehensive research report delivers an in-depth overview of the principal market players in the Deck Design Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Autodesk Inc.

- Cedreo

- Chief Architect, Inc.

- Dassault Systèmes SE

- Delta Software International LLC

- Drafix Software, Inc.

- Idea Spectrum, Inc.

- MoistureShield

- Punch! Software

- Simpson Strong-Tie Company, Inc.

- SmartDraw, LLC

- The AZEK Company Inc.

- Trex Company, Inc.

- Trimble Inc.

Empowering Industry Leaders with Tactical Roadmaps to Enhance Innovation, Streamline Adoption, and Capitalize on Emerging Trends in Deck Design Software

To capitalize on evolving market dynamics, industry leaders should focus on embedding intelligence at every stage of the deck creation journey. First, investing in advanced AI modules that offer context-aware design suggestions and automated content enhancement will empower users to produce professional-quality slides with minimal manual effort. Concurrently, robust integration with popular collaboration suites and cloud storage platforms will ensure frictionless teamwork and secure asset management across dispersed teams.

Moreover, optimizing user experiences through continual usability testing and iterative interface improvements will drive adoption among non-design professionals. Tailoring onboarding workflows for specific verticals-whether healthcare, finance, or manufacturing-can accelerate time to value by delivering role-specific templates and regulatory compliance features out of the box. In addition, flexible pricing structures that blend subscription tiers with project-based licensing will appeal to organizations with diverse budgeting practices and fluctuating demand cycles.

Strategic expansion of distribution channels is equally vital. By strengthening relationships with system integrators and value-added resellers, vendors can tap specialized consulting expertise to co-develop bespoke implementations that address complex enterprise requirements. At the same time, curated presence on third-party and vendor marketplaces will enhance product visibility for smaller businesses and department-level purchasers.

Finally, prioritizing data security certifications, privacy controls, and audit readiness will build trust among risk-averse buyers. As organizations continue to navigate an increasingly digital business environment, those that adopt a holistic approach-combining technological innovation, user-centric design, and adaptive commercial models-will be well positioned to lead in the dynamic space of deck design software.

Detailing Rigorous Research Methodology Combining Primary Interviews, Secondary Analysis, and Data Triangulation to Ensure Comprehensive Deck Software Insights

This research initiative was guided by a rigorous methodology designed to deliver balanced perspectives and actionable intelligence on the deck design software domain. Primary research comprised in-depth interviews with senior stakeholders across technology vendors, system integrators, and end-user organizations spanning multiple industry verticals. These conversations provided nuanced insights into strategic priorities, feature adoption patterns, and evolving purchase criteria.

Complementing this qualitative exploration, secondary research involved the systematic review of publicly available technical whitepapers, industry thought-leadership articles, vendor product documentation, and credible media coverage. This phase ensured that findings were grounded in the latest technological advancements and industry best practices. Data points were then validated through cross-referencing with reputable third-party reports, academic studies, and insights from recognized analytics platforms.

A robust data triangulation process was employed to reconcile differing viewpoints and to identify converging trends. Segmentation definitions for deployment modes, organizational size, vertical applications, pricing models, and distribution channels were applied consistently to analyze user preferences and vendor strategies. Quality assurance measures included peer reviews by subject-matter experts and iterative feedback loops to refine interpretations and conclusions.

Through this multi-layered approach, the research delivers a comprehensive, evidence-based portrayal of current market dynamics, equipping stakeholders with the intelligence needed to make informed strategic decisions in an ever-evolving landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Deck Design Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Deck Design Software Market, by Product Type

- Deck Design Software Market, by Technology

- Deck Design Software Market, by Industry Vertical

- Deck Design Software Market, by Deployment Mode

- Deck Design Software Market, by Organization Size

- Deck Design Software Market, by Distribution Channel

- Deck Design Software Market, by Region

- Deck Design Software Market, by Group

- Deck Design Software Market, by Country

- United States Deck Design Software Market

- China Deck Design Software Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Concluding Perspective on How Deck Design Software Evolution and Emerging Technologies Will Shape Future Organizational Communication and Workflow Efficiency

In an era defined by rapid digital transformation and heightened demand for visual storytelling, deck design software stands at the intersection of innovation and strategic communication. The confluence of artificial intelligence, cloud collaboration, and extensible architectures has elevated these platforms from static presentation tools to dynamic co-creation environments. As organizations strive to differentiate their narratives, the ability to craft polished, persuasive decks with speed and precision will remain a critical differentiator.

Looking forward, the integration of advanced analytics and audience engagement metrics promises to deepen the strategic value of these tools, enabling presenters to tailor content in real time based on viewer responses. Furthermore, emerging paradigms such as immersive data visualization and augmented reality enhancements are poised to expand the expressive capabilities of deck design software, creating richer, more impactful experiences.

Organizations that embrace these technological evolutions while maintaining a steadfast commitment to user experience, data security, and flexible commercial models will unlock significant competitive advantages. By aligning deployment strategies with regulatory requirements, optimizing pricing formats for diverse budgets, and cultivating strong partner ecosystems, decision-makers can ensure that their communication infrastructures remain adaptive and resilient.

Ultimately, the future of organizational storytelling will be shaped by platforms that seamlessly blend creative empowerment with strategic rigor, supporting teams in delivering narratives that inspire action and foster enduring connections.

Drive Decision-Making Excellence with Customized Deck Design Intelligence: Engage Ketan Rohom to Secure Your Comprehensive Analytical Report Today

Engaging with Ketan Rohom presents a unique opportunity for decision-makers to secure tailored insights that align closely with organizational objectives and emerging industry demands. By connecting with him, your team will access a meticulously crafted report integrating qualitative expertise and quantitative analysis, ensuring that every strategic recommendation resonates with real-world business challenges. This personalized engagement also includes a detailed walkthrough of key findings, a discussion on specific pain points, and an outline of actionable steps that can be seamlessly integrated into existing workflows.

To initiate this partnership and obtain immediate access to the full comprehensive analytical report, reach out to Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). His guidance will streamline the procurement process and deliver the insights you need to elevate your presentation strategies, optimize technology investments, and maintain a competitive edge in the evolving deck design software landscape. Contact Ketan today to transform insights into impactful business outcomes.

- How big is the Deck Design Software Market?

- What is the Deck Design Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?