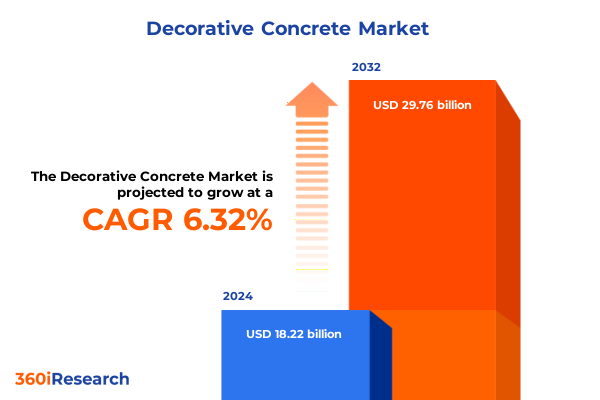

The Decorative Concrete Market size was estimated at USD 19.35 billion in 2025 and expected to reach USD 20.56 billion in 2026, at a CAGR of 6.34% to reach USD 29.76 billion by 2032.

Shaping Tomorrow’s Architectural Canvas: A Comprehensive Introduction to the Evolution and Significance of Decorative Concrete that merges artistry with performance

Decorative concrete has transcended its traditional role as a utilitarian building material to become a defining element of contemporary architectural aesthetics. Over the past decade, innovations in pigment technologies, surface treatments, and finishing techniques have elevated concrete from an inert substrate to a dynamic visual medium that can simulate everything from natural stone to vibrant mosaics. Design professionals and end users alike now recognize decorative concrete as a versatile solution that satisfies both functional requirements and artistic ambitions. Consequently, this material has secured its place in projects ranging from sleek urban plazas to high-end residential interiors, reflecting a convergence of durability and design potential that underpins its growing appeal.

This introduction provides context for the subsequent analysis of market dynamics, with an emphasis on how decorative concrete intersects with broader trends in sustainability, customization, and digital fabrication. As stakeholders across architectural firms, contracting businesses, and distribution channels seek to differentiate their offerings, decorative concrete has emerged as a frontier for innovation. The narrative ahead examines how the market’s trajectory is influenced by shifts in raw material sourcing, regulatory developments, and the rapid adoption of new application methods. Understanding these drivers is essential for decision-makers aiming to harness the full spectrum of decorative concrete’s capabilities in both new construction and renovation contexts.

Exploring the Converging Forces of Technology Advancements and Sustainability Imperatives That Are Redefining the Decorative Concrete Market Landscape

The landscape of decorative concrete is undergoing a profound metamorphosis driven by the intersection of technological advancements, evolving client expectations, and an intensified focus on environmental stewardship. Digital tools, such as 3D modeling platforms and computer-controlled stamping machinery, are enabling contractors and artisans to execute complex patterns and textures with unprecedented precision. This integration of technology not only enhances design fidelity but also accelerates project timelines and reduces on-site labor requirements. Moreover, innovations in UV-resistant pigments and high-performance sealants are expanding the material’s application into outdoor and high-traffic environments, where long-term color stability and wear resistance are paramount.

Concurrently, sustainability considerations have become a central axis of transformation, prompting manufacturers and end users to prioritize low-VOC additives, recycled content, and carbon-efficient cement alternatives. These initiatives are reshaping supply chains and prompting a re-evaluation of traditional mix designs, thus creating new opportunities for eco-conscious product development. As regulatory frameworks evolve to incentivize green building practices, decorative concrete suppliers are increasingly integrating life-cycle assessment tools and material transparency declarations into their go-to-market strategies. This dual emphasis on technical innovation and environmental responsibility is redefining the market’s value proposition and establishing fresh benchmarks for performance and accountability.

Analyzing How Recent U.S. Trade Tariffs on Specialized Cements, Pigments, and Reinforcements in 2025 Are Impacting Cost Structures and Strategic Sourcing Decisions

In 2025, a series of tariff adjustments enacted by the United States government have cumulatively shaped the cost structure of both raw materials and specialized additives used in decorative concrete production. Tariffs on imported specialty cements and color pigments have led to incremental cost increases for manufacturers, prompting them to reassess sourcing strategies and hedge against currency fluctuations. Meanwhile, levies on steel rebar and reinforcing mesh have contributed to elevated installation expenses, influencing project budgets across both new builds and renovation initiatives. These policy measures have reverberated through the value chain, from distributors grappling with margin compression to end users reexamining the total cost of ownership for decorative concrete installations.

To mitigate these impacts, some market participants have pursued alternative supply partnerships within domestic or low-tariff regions, while others have invested in research to optimize on-site mix ratios and reduce reliance on imported components. Additionally, collaborative ventures between material producers and application firms have emerged to explore co-development of tariff-exempt formulations and to leverage economies of scale. This environment of increased input cost volatility underscores the necessity for agile procurement practices and underscores the strategic importance of maintaining robust supplier diversification.

Looking ahead, continued monitoring of trade policies and proactive engagement with regulatory stakeholders will be essential for industry leaders seeking to navigate the cumulative effects of U.S. tariffs. Embracing flexible contract structures and exploring localized manufacturing models can provide resilience against further policy shifts, ensuring that decorative concrete remains a cost-effective and competitive choice across diverse construction segments.

Unveiling Strategic Segmentation Perspectives to Navigate Diverse Product, Application, and Distribution Verticals Within the Decorative Concrete Market

The decorative concrete market can be understood through multiple lenses of segmentation, each offering distinct pathways to targeted strategy development. When viewing the market by product type, it becomes clear that solutions ranging from basic dyed concrete to intricate stamped patterns resonate with different project requirements. Overlays & toppings, including decorative overlays, microtoppings, and self-leveling overlays, are particularly popular among end users seeking rapid refurbishment options, while polished and stamped finishes cater to clients prioritizing high-gloss aesthetics or textured depth.

Shifting focus to applications, commercial floors and parking decks demand robust wear resistance and straightforward maintenance, whereas retail spaces and warehouses may prioritize customizable brand-focused aesthetics. In residential contexts, the allure of decorative concrete spans driveway resurfacing to elegant pool decks, with homeowners embracing both patio accents and seamless interior floors that echo luxury tile at a fraction of the maintenance overhead.

From the perspective of end users, architectural firms drive early specification and design innovation, while general contractors focus on delivering reliable, cost-effective installations. Government institutions impose stringent durability and safety standards, and homeowners exercise discretion based on long-term value and curb appeal. Installation type also differentiates market opportunities: new construction projects often incorporate decorative concrete from the ground up, whereas renovation initiatives leverage repair, restoration, and resurfacing to rejuvenate existing structures.

Finally, distribution channels shape market access and customer experience, with direct sales offering bespoke consultation, distributors - both national and regional - providing logistical breadth, and e-commerce platforms via manufacturer websites or third-party portals delivering convenience and streamlined product selection.

This comprehensive research report categorizes the Decorative Concrete market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Installation Type

- Application

- End User

- Distribution Channel

Examining Key Regional Drivers and Adoption Patterns Across the Americas, Europe Middle East Africa, and Asia Pacific Decorative Concrete Markets

Regional dynamics play an instrumental role in shaping decorative concrete adoption and innovation. In the Americas, demand is driven by booming infrastructural projects and commercial real estate expansions across North and South America. Urbanization trends coupled with revitalization of historic districts fuel growth in overlays and stamped finishes, while residential homeowners in suburban and coastal regions increasingly embrace decorative floor systems for aesthetics and durability. Market leaders in this region leverage strong logistics networks and established distributor relationships to serve a spectrum of end users, from large industrial contractors to boutique architectural practices.

Across Europe, the Middle East, and Africa, decorative concrete benefits from ambitious architectural feats and infrastructure investments, particularly in the Gulf Cooperation Council and select European urban centers. The region’s emphasis on landmark public spaces and high-end residential developments has elevated demand for premiumized finishes and bespoke patterning techniques. Regulatory frameworks emphasizing carbon footprint reduction have propelled the adoption of low-carbon cement alternatives and recycled aggregates, influencing product portfolios and application methods.

In Asia-Pacific, rapid urban expansion across China, Southeast Asia, and India is catalyzing demand across both commercial and industrial segments. The prevalence of large-scale manufacturing facilities and logistics hubs underscores opportunities in resilient flooring solutions, while coastal tourist destinations drive interest in decorative pool decks and outdoor patios. Manufacturers in this region are increasingly focusing on scalable production capacities and localizing formulations to meet diverse climatic and regulatory requirements, fostering a deeply competitive environment marked by innovation in pigment pigmentation and application speed.

This comprehensive research report examines key regions that drive the evolution of the Decorative Concrete market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Navigating the Competitive Terrain Where Leading Material Manufacturers, System Integrators, and Regional Specialists Are Collaborating to Drive Innovation

The competitive landscape of decorative concrete features a blend of global chemical suppliers, specialized system integrators, and regional contractors offering turnkey solutions. Leading material manufacturers have differentiated themselves through proprietary colorant technologies, rapid-setting overlay formulas, and comprehensive training programs for applicators. Their extensive product portfolios span from self-leveling overlays designed for fast track projects to high-performance decorative sealers engineered for UV resistance and chemical resilience.

Emerging system integrators have capitalized on niche segments by bundling design consultation with on-site execution services, ensuring consistency in quality and finishing. These firms frequently partner with architects to co-create pattern libraries and sample installations, reinforcing their value proposition through bespoke capabilities. Meanwhile, regional players leverage deep connections with local distributors and contractors, tailoring product formulations to specific climatic conditions and regulatory norms.

Strategic alliances are growing in importance, as collaborations between pigment suppliers and overlay manufacturers enable integrated offerings that simplify procurement and installation. In parallel, digital platforms connecting end users with local installation experts are gaining traction, offering seamless ordering, scheduling, and after-sales support. These evolving business models are reshaping competitive dynamics, compelling traditional players to innovate their go-to-market approaches and service portfolios.

This comprehensive research report delivers an in-depth overview of the principal market players in the Decorative Concrete market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Akzo Nobel N.V.

- Ardex GmbH

- BASF SE

- Boral Limited

- Cemex S.A.B. de C.V.

- Fosroc International Ltd.

- Heidelberg Materials AG

- Holcim Ltd.

- Laticrete International, Inc.

- MAPEI S.p.A.

- PPG Industries, Inc.

- RPM International Inc.

- Saint-Gobain S.A.

- Sika AG

- The Sherwin-Williams Company

- UltraTech Cement Limited

Implementing Proactive Partnerships, Digital Innovation, and Supply Chain Resilience Strategies to Elevate Market Leadership in Decorative Concrete

Industry leaders must adopt a multifaceted approach to capitalize on decorative concrete’s expanding opportunities. First, forging deeper partnerships with suppliers of eco-efficient cements and recycled aggregates can help mitigate tariff-related cost pressures and align with sustainability mandates. By integrating life-cycle assessment data into product development cycles, companies can enhance transparency and differentiate on environmental performance.

Secondly, investing in advanced digital tools-such as mobile application platforms that simulate finish options in real-time and cloud-based project management systems-will streamline client engagement and accelerate decision-making processes. Training programs that equip applicators with proficiency in automated stamping technologies and precision polishing equipment will further reinforce quality consistency and operational efficiency.

Moreover, pursuing strategic alliances with architectural firms and general contractors will foster early-stage specification of decorative solutions, embedding these materials in project blueprints rather than retroactive add-ons. Concurrently, expanding e-commerce capabilities to encompass augmented reality configurators and online design libraries will cater to the growing segment of homeowners seeking convenience and customization.

Finally, scenario-based planning to anticipate potential trade policy adjustments-alongside the development of versatile formulations that can accommodate both domestic and imported raw materials-will strengthen supply chain resilience and protect margins against future volatility.

Detailing the Rigorous Mixed-Methods Research Framework Leveraging Executive Interviews, Secondary Literature, and Quantitative Validation

This research report draws upon a multi-pronged methodology combining both primary and secondary data collection to ensure comprehensive coverage and analytical rigor. Primary insights were garnered through in-depth interviews with senior executives from material manufacturers, system integrators, distributors, and end-user groups, offering firsthand perspectives on market drivers, challenges, and emerging trends. These qualitative findings were triangulated with an extensive review of industry white papers, regulatory documents, and patent filings to validate thematic hypotheses and identify innovation trajectories.

Secondary research included an exhaustive analysis of trade association publications, government tariff schedules, and academic studies focused on cement chemistry and surface treatment technologies. Market intelligence from regional electricity and infrastructure development reports informed assessments of application demand across geographic clusters. Data from logistics and distribution analytics provided context on channel dynamics and delivery efficiencies.

Quantitative validation was achieved by examining project case studies spanning both new construction and renovation segments, allowing for the extraction of key performance indicators related to installation costs, material longevity, and decorative fidelity. Finally, cross-functional workshops with subject-matter experts in engineering, sustainability, and finance refined the report’s strategic recommendations, ensuring that they are actionable, measurable, and aligned with the evolving priorities of industry stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Decorative Concrete market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Decorative Concrete Market, by Product Type

- Decorative Concrete Market, by Installation Type

- Decorative Concrete Market, by Application

- Decorative Concrete Market, by End User

- Decorative Concrete Market, by Distribution Channel

- Decorative Concrete Market, by Region

- Decorative Concrete Market, by Group

- Decorative Concrete Market, by Country

- United States Decorative Concrete Market

- China Decorative Concrete Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Bringing Together Insights on Innovation, Sustainability, and Market Dynamics to Illuminate the Future Trajectory of Decorative Concrete

Decorative concrete stands at the cusp of a new era, driven by the dual imperatives of aesthetic innovation and operational efficiency. As technological breakthroughs democratize complex finishing techniques and sustainability frameworks reshape material design, the market is poised for continued evolution. The interplay between trade policies, regional growth dynamics, and the expanding palette of product and application segments underscores the need for agility and foresight among all participants.

By embracing strategic partnerships, investing in digital and sustainable capabilities, and reinforcing supply chain resilience, stakeholders can secure a competitive edge in a landscape marked by both opportunity and disruption. Whether aiming to captivate homeowners with bespoke patio designs or specifying large-scale commercial flooring systems, the nuanced understanding of segmentation, regional drivers, and competitive dynamics outlined in this report will serve as a foundational guide.

Ultimately, decorative concrete’s capacity to merge artistry with performance positions it as a transformative element in the built environment. Armed with the insights contained herein, decision makers are well equipped to navigate uncertainties, capitalize on emerging trends, and shape the next generation of inspired, durable design solutions.

Unlock Strategic Growth Opportunities by Partnering with Ketan Rohom for Tailored Insights and Access to the Decorative Concrete Market Research Report

To explore the depth and breadth of this comprehensive decorative concrete market research report and leverage its strategic insights for your organization’s growth, please connect with Ketan Rohom, Associate Director of Sales & Marketing. Engaging with Ketan will ensure you gain tailored guidance in interpreting the data, aligning the findings with your business objectives, and identifying the most impactful pathways forward. Acting today will empower your team with the intelligence needed to navigate evolving market dynamics, capitalize on emerging opportunities, and strengthen your competitive position. Reach out to secure your copy and discover how this report can become an instrumental asset in shaping your strategic decisions and driving sustainable success within the decorative concrete sector.

- How big is the Decorative Concrete Market?

- What is the Decorative Concrete Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?