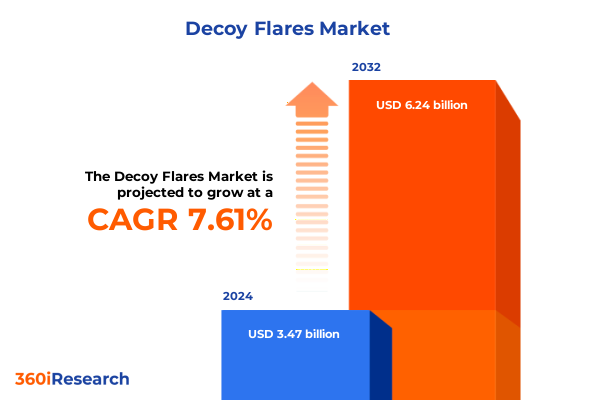

The Decoy Flares Market size was estimated at USD 3.73 billion in 2025 and expected to reach USD 3.98 billion in 2026, at a CAGR of 7.63% to reach USD 6.24 billion by 2032.

Unveiling the Strategic Significance and Operational Evolution of Decoy Flares in Contemporary Aerial and Naval Defense Technological and Tactical Paradigms

The decoy flare market has evolved into a cornerstone of modern defense countermeasure strategies, safeguarding critical aerial and naval assets against advanced infrared guided threats. Initially conceived as rudimentary pyrotechnic devices, contemporary decoy flares now integrate precision design and material science to create spectral signatures that mimic or outpace aircraft heat profiles. This evolution has been driven by the intensification of global security challenges and the proliferation of sophisticated missile systems requiring increasingly refined countermeasure solutions.

Transitioning from early-generation magnesium-based compositions to advanced composite formulations and zirconium mixtures, manufacturers leverage multi-spectrum flare outputs that effectively confuse emerging dual-band and imaging infrared seekers. As defense budgets rebalance in response to shifting geopolitical landscapes, air forces and naval fleets globally have adopted decoy flares not only as reactive defenses but also as proactive deterrents. These developments underscore the strategic significance of decoy flares within integrated protection suites, complementing directed energy systems and electronic warfare capabilities.

Moreover, continuous investments in research and development are accelerating the introduction of modular flare cartridges and adaptable dispenser systems. These enhancements enable seamless integration across diverse platforms, enhancing survivability for fixed wing aircraft, rotary wing vehicles, unmanned platforms, and maritime vessels in contested environments. Such multifaceted innovation reaffirms the decoy flare’s critical role in comprehensive defense architectures.

Examining the Recent Disruptive Technological and Geopolitical Shifts Redefining the Role of Decoy Flares in Global Countermeasure Strategies

Recent technological breakthroughs and shifting geopolitical dynamics are reshaping how defense planners approach countermeasure solutions. The advent of dual-band infrared seekers and machine-learning guided missiles has challenged traditional flare designs, prompting a wave of innovation toward multi-spectral and extended-endurance decoy solutions. As a result, research teams are now combining advanced material chemistries with intelligent dispenser algorithms to deploy flares in optimized sequences that maximize decoy effectiveness against rapidly adapting threats.

Simultaneously, heightened geopolitical tensions and rising defense expenditures in key regions are driving procurement cycles toward next-generation flares that offer scalable block upgrades. This trend is further accelerated by collaborative defense partnerships, where leading OEMs and specialized flare producers share intellectual property and co-develop tailored solutions. Consequently, production platforms have shifted from bespoke, low-volume assemblies to flexible manufacturing lines capable of rapid reconfiguration, supporting agile responses to emergent threat profiles.

Furthermore, the integration of flare launchers with advanced avionics and platform management systems reflects a broader shift toward network-centric warfare doctrines. In these environments, decoy flares serve not only as individual countermeasures but also as critical nodes within interconnected defensive ecosystems. This transformative landscape underscores the imperative for stakeholders to adapt procurement, development, and training strategies in order to maintain operational superiority.

Analyzing the Multifaceted Consequences of United States 2025 Tariff Policies on Decoy Flare Supply Chains Production Costs and Market Access Dynamics

Tariff measures enacted by the United States in early 2025 have introduced new variables into the decoy flare supply chain, affecting both raw material imports and finished product flows. Heightened duties on specialty alloys and composite intermediates have led suppliers to reassess sourcing strategies and to explore regional material hubs as alternative procurement bases. This has resulted in extended lead times for critical components, requiring programs to build higher inventory buffers to sustain uninterrupted production runs.

The ripple effects of these policies are most pronounced among composite formulation producers and zirconium mixture fabricators, which traditionally rely on competitively priced imports from Asia-Pacific markets. With increased cost pressure, some manufacturers have initiated domestic joint ventures to localize material blending operations and mitigate exposure to tariff volatility. As a result, price structures have become more transparent, but program planners must now navigate more complex multi-tier supply architectures.

In parallel, export compliance adjustments have emerged as a new layer of regulatory compliance, especially for small-scale suppliers and aftermarket distributors. These entities face increased scrutiny over technology transfer and classification procedures, prompting investments in compliance training and automated shipping validation systems. Consequently, defense integrators and fleet operators are reexamining procurement pathways to ensure readiness objectives remain unimpeded despite evolving trade landscapes.

Illuminating Critical Platform Material Distribution and Application Segment Dynamics to Uncover Targeted Opportunities within the Decoy Flares Value Chain Landscape

Segment analysis reveals that platform diversity profoundly influences decoy flare design requirements and market focus. In fixed wing aircraft, variations among fighter aircraft, trainer jets, and transport planes demand tailored flare signatures and dispenser integration. Helicopter operations, with unique cold-start thermal profiles, further extend material customization. Naval vessels impose spatial and environmental constraints that shape dispenser geometry for aircraft carriers, destroyers, and frigates alike. Unmanned aerial vehicles present an additional layer of complexity; high altitude long endurance UAVs require lightweight extended-burn flares, while medium altitude long endurance systems and tactical UAVs prioritize compact form factors with optimized spectral output.

Material selection also delineates critical product differentiators. Advanced composite formulations deliver multi-phase spectral bursts but carry higher production intricacies. Magnesium powder offers cost advantages and rapid ignition, whereas zirconium mixtures yield prolonged burn durations suitable for extended decoy windows. Distribution modalities carve distinct engagement pathways; original equipment manufacturers embed flares within new platform builds, aligning lifecycle sustainment cycles, while aftermarket channels cater to retrofit programs and surge requirements. Application contexts complete the segmentation narrative: combat operations demand immediate response and maximum decoy intensity, whereas field testing and laboratory testing environments focus on performance validation and standardization protocols. Training regimes, covering live fire exercises and simulated scenarios, drive demand for reusable or low-residue flare variants, underscoring the necessity for flexible manufacturing and modular dispenser designs.

This comprehensive research report categorizes the Decoy Flares market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Platform

- Material

- Distribution Channel

- Application

Mapping the Diverse Operational Requirements Regulatory Environments and Demand Drivers across the Americas Europe Middle East Africa and Asia Pacific Markets

Regional dynamics underscore nuanced demand drivers and regulatory frameworks that shape decoy flare adoption. In the Americas, established air and naval forces prioritize high-reliability solutions for fleet modernization, leveraging domestic manufacturing capabilities and streamlined procurement processes. Regulatory harmonization among allies further supports interoperability and joint exercise programs, reinforcing supply chain resilience.

Across Europe, the Middle East, and Africa, customers navigate diverse defense priorities-from maritime security operations in the Mediterranean to border surveillance initiatives in sub-Saharan Africa. These programs emphasize configurable flare inventories that adapt to both conventional and asymmetric threat environments. Collaborative procurement consortia and offset agreements are prevalent, incentivizing local value-add activities and knowledge transfer.

In the Asia-Pacific region, rapid fleet expansions and evolving aerial threat profiles are catalyzing investments in next-generation countermeasure suites. Regional OEMs partner with international technology leaders to co-develop flares optimized for regional climatic conditions, including high humidity and variable temperature extremes. This dynamic, multi-faceted landscape highlights the importance of aligning product roadmaps with each region’s strategic objectives and operational doctrines.

This comprehensive research report examines key regions that drive the evolution of the Decoy Flares market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Strategies Technological Advancements and Collaborative Initiatives among Leading Decoy Flare Manufacturers and Defense Technology Providers

Leading technology providers are executing differentiated strategies to maintain competitive positions in the decoy flare market. One approach centers on vertical integration of key material processes, enabling tighter control over composite formulation quality and cost efficiencies. Parallel endeavors focus on collaborative platforms with defense primes to embed intelligent dispenser controls, leveraging integrated sensors and predictive analytics to optimize deployment patterns.

Strategic acquisitions have also featured prominently as firms seek to augment their product portfolios and geographic footprints. Targeted buyouts of specialized flare fabricators provide immediate access to proprietary chemistries and manufacturing certifications, while licensing agreements facilitate broader distribution without heavy capital investment. Collaborative research partnerships with academic institutions and government laboratories further accelerate the development of next-generation spectral decoys that meet evolving seeker counter-countermeasure requirements.

Market participants increasingly emphasize life-cycle support programs that extend beyond initial delivery. Comprehensive field service offerings, including on-site training, readiness assessments, and replenishment logistics, enable deeper customer engagement and recurring revenue streams. This holistic approach to customer value underscores a shift from transactional sales toward integrated program support models that reinforce long-term partnerships.

This comprehensive research report delivers an in-depth overview of the principal market players in the Decoy Flares market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Armtec Defense Technologies

- BAE Systems plc

- Bharat Dynamics Limited

- Chemring Group PLC

- Cobham Limited

- Elbit Systems Ltd.

- Israel Aerospace Industries

- Kongsberg Gruppen ASA

- L3Harris Technologies, Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- MBDA

- Meggitt PLC

- Northrop Grumman Corporation

- Rafael Advanced Defense Systems Ltd.

- Rheinmetall AG

- RTX Corporation

- Saab AB

- Thales Group

- Titan Dynamics Systems, Inc.

Outlining Strategic Imperatives and Tactical Recommendations for Industry Leaders to Navigate Technological Innovation Geopolitical Risks and Evolving Procurement Trends

To navigate the rapidly evolving countermeasure landscape, industry leaders must prioritize integrated innovation roadmaps that couple advanced material research with smart dispenser technologies. By investing in multi-spectral flare formulations and algorithm-driven deployment sequencing, organizations can address emergent seeker adaptations and maintain superior decoy efficacy. Establishing collaborative research consortia with defense agencies and specialized laboratories will further accelerate time-to-market for breakthrough solutions.

In parallel, companies should refine supply chain architectures to mitigate geopolitical and tariff-related disruptions. Diversifying raw material sourcing through strategic partnerships in emerging production hubs and adopting dual-sourcing strategies can balance cost considerations with security of supply. Implementing digital twin simulations for production planning and logistics operations will enable proactive identification of bottlenecks, ensuring resilient program execution.

Additionally, embedding life-cycle support offerings into value propositions enhances customer retention and unlocks aftermarket growth opportunities. Tailoring training packages that combine live fire exercises with simulated threat environments will drive customer confidence and foster deeper program integration. Finally, monitoring evolving regulatory frameworks and participating in standards development bodies will ensure compliance readiness and position firms as trusted thought leaders.

Detailing the Robust Multi Source Research Framework Data Triangulation Expert Interviews and Comprehensive Analytical Techniques Underpinning the Decoy Flare Market Study

This study employs a rigorous multi-source research framework encompassing both secondary and primary data inputs. Authoritative defense publications, government procurement records, and academic journals formed the basis for market mapping and trends analysis. Data triangulation techniques cross-validate material composition innovations, platform integration case studies, and regional procurement patterns to ensure robust findings.

Primary insights derive from structured interviews with subject matter experts, including defense program managers, material scientists, and systems integrators. These engagements provided nuanced perspectives on operational performance requirements and commercial considerations. Additionally, workshops with end-users and simulation teams yielded firsthand feedback on deployment scenarios, burner signature fidelity, and dispenser ergonomics.

Quantitative analysis leverages statistical models to assess supply chain dynamics, tariff impact scenarios, and life-cycle support revenue streams. Qualitative assessments focus on technology roadmaps, competitive positioning, and regulatory compliance mechanisms. Together, these methodologies deliver a comprehensive intelligence package designed to underpin strategic decision making and investment prioritization for stakeholders across the defense countermeasure ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Decoy Flares market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Decoy Flares Market, by Platform

- Decoy Flares Market, by Material

- Decoy Flares Market, by Distribution Channel

- Decoy Flares Market, by Application

- Decoy Flares Market, by Region

- Decoy Flares Market, by Group

- Decoy Flares Market, by Country

- United States Decoy Flares Market

- China Decoy Flares Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Summarizing Core Findings Strategic Imperatives and Future Outlook for Stakeholders Engaged in the Development Deployment and Acquisition of Decoy Flares

The convergence of advanced material science, intelligent dispenser integration, and shifting geopolitical imperatives underscores a pivotal moment for the decoy flare market. Stakeholders must navigate complex segmentation dynamics spanning platforms from fixed wing fighters to tactical unmanned systems, materials ranging from composite blends to zirconium formulations, and applications extending from combat operations to rigorous testing protocols.

Regional overlays reflect distinct demand drivers and regulatory environments, with the Americas emphasizing interoperability, EMEA prioritizing flexible procurement pathways, and Asia-Pacific accelerating collaborative innovation to address emerging threats. Concurrently, tariff landscapes and supply chain realignments are reshaping production strategies, compelling market participants to adopt resilient sourcing models and invest in localized material hubs.

Collectively, these insights highlight the critical need for integrated program support models, collaborative R&D initiatives, and agile supply chain architectures. By embracing these strategic imperatives, defense organizations and technology providers alike can enhance survivability, drive operational readiness, and sustain competitive advantage in an increasingly contested global environment.

Engaging with Our Associate Director Sales and Marketing to Secure Comprehensive Decoy Flare Market Intelligence and Drive Informed Strategic Decision Making

For a deep dive into the strategic intelligence and actionable market analysis on decoy flares, reach out to our Associate Director, Sales and Marketing, Ketan Rohom. He can guide you through tailored solutions that align with your organization’s mission-critical objectives and provide timely access to comprehensive insights. Position your team to anticipate evolving defense countermeasure trends, refine procurement strategies, and capitalize on emerging innovations by securing the full market research report today through direct engagement with Ketan Rohom.

- How big is the Decoy Flares Market?

- What is the Decoy Flares Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?