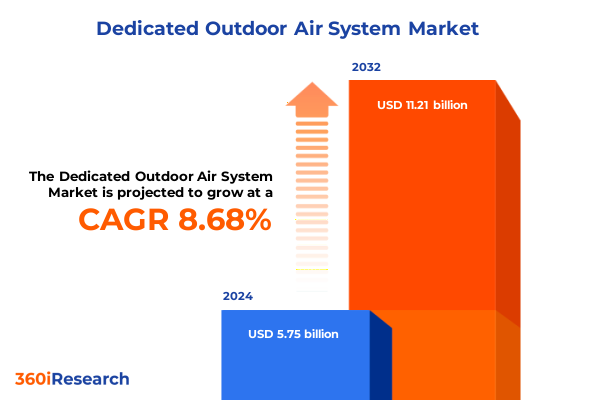

The Dedicated Outdoor Air System Market size was estimated at USD 6.26 billion in 2025 and expected to reach USD 6.73 billion in 2026, at a CAGR of 8.66% to reach USD 11.21 billion by 2032.

Unveiling the Critical Role of Dedicated Outdoor Air Systems in Advancing Energy Efficiency and Indoor Air Quality Across Commercial Environments

Dedicated outdoor air systems have emerged as pivotal components in modern HVAC design, offering a dedicated ventilation pathway that decouples outdoor air treatment from indoor thermal control. By separating latent load management from the building’s primary heating and cooling systems, these solutions deliver precise humidity regulation, improved indoor air quality, and enhanced energy efficiency. In recent years, the conversation around air quality has intensified, driven by heightened awareness of airborne contaminants, stringent wellness standards, and evolving building electrification strategies.

This introduction examines how dedicated outdoor air systems align with today’s sustainability imperatives and occupant health priorities. It considers the broader context of regulatory mandates, technological evolution, and market expectations that have elevated the importance of optimized ventilation. As we proceed, this document will explore critical shifts, tariff impacts, and segmentation insights that shape decision-making for industry stakeholders seeking resilient, efficient, and future-ready air management solutions.

Exploring the Paradigm-Shifting Technological Advances and Regulatory Drivers Redefining Dedicated Outdoor Air System Capabilities and Performance

The landscape of dedicated outdoor air systems is undergoing transformative shifts driven by regulatory evolution and technological innovation. In May 2025, the Department of Energy finalized minimum efficiency standards for direct expansion–dedicated outdoor air systems, aligning them with the latest AHRI 920-2020 benchmark and redefining compliance requirements for manufacturers and specifiers. As engineers adapt to these regulations, emphasis on energy recovery and humidity control has intensified, reinforcing DOAS as a cornerstone of sustainable building strategies.

Simultaneously, energy codes are promoting balanced ventilation models, incorporating heat recovery ventilators and energy recovery ventilators as prescriptive options. These requirements underscore the necessity for systems capable of modulating airflow, filtering at high MERV ratings, and preventing pollutant cross-contamination, thereby solidifying DOAS as a preferred solution for central balanced ventilation in multi-unit and mixed-use developments.

Beyond compliance, manufacturers are integrating advanced energy recovery technologies, from enthalpy wheels to heat pipes, to maximize latent and sensible load exchange. Such innovations reduce chiller and fan energy consumption while maintaining supply air quality, signaling a shift toward truly high-performance ventilation systems.

Building automation and smart facility platforms are further enhancing DOAS value by embedding predictive maintenance, fault detection, and adaptive controls. Leveraging IoT sensors and AI-enabled analytics, system performance is continuously optimized, resulting in uptime improvements and operational cost reductions.

Examining How Recent Tariff Measures in the United States Have Altered Supply Chains and Cost Structures for Dedicated Outdoor Air Systems in 2025

In 2025, new U.S. tariffs on imported steel and aluminum have imposed a 25% duty on essential HVAC metals, leading manufacturers to reevaluate supply chains and cost structures. This policy has increased raw material costs, which cascade through production and distribution channels, effectively raising the landed expense of coils, casing, and duct assemblies used in DOAS units. Contractors are reporting that these surcharges are already reflected in equipment quotations, pressuring budgets for new installations and retrofits.

The impact extends beyond structural components: many dedicated outdoor air systems rely on compressors, motors, and electronic control boards sourced from global suppliers. With tariffs ranging from 25% on Mexican-made compressors to as high as 145% on Chinese imports, manufacturers have been forced to absorb or pass on steep price adjustments. Industry experts note that the tariff burden has accelerated conversations around domestic sourcing and vertical integration, yet the transition requires time and capital investment, perpetuating near-term cost volatility.

Furthermore, contractors and end users face longer lead times and availability risks as firms seek alternative suppliers outside tariff-affected regions. Supply chain disruptions are particularly acute during peak seasons, heightening the risk of project delays and budget overruns. While some stakeholders anticipate relief if manufacturers retool production domestically, the cumulative impact of these tariffs in 2025 continues to influence procurement strategies and capital planning across commercial and institutional sectors.

Deriving Actionable Insights from Comprehensive Segment Analysis Spanning Applications, Technologies, Product Types, Airflow Capacities, Mount Types, and Control Mechanisms

Driven by diverse end-use requirements, the market for dedicated outdoor air systems spans applications from mission-critical environments in data centers and cleanrooms to educational campuses, healthcare facilities, and corporate offices. Each segment demands specific performance attributes: data centers require stringent humidity control to protect sensitive electronics, while healthcare settings prioritize contamination prevention and isolation pressure management. Across hospitality, retail, and manufacturing, the emphasis shifts to occupant comfort and process stability, underscoring how application-based segmentation shapes system design and specification.

Technological differentiation further segments the landscape. Systems utilizing desiccant wheels excel at latent load removal in high-humidity climates, whereas enthalpy wheels balance both sensible and latent recovery with lower operational overhead. Heat pipe modules offer passive thermal exchange without moving parts, appealing to low-maintenance environments, and run-around coil arrays provide modular flexibility for large-scale, phased installations. These varied recovery technologies influence capital expenditure, maintenance profiles, and lifecycle efficiency considerations.

Product type classification-whether constant air volume, dual-duct variable air volume, modular units, or single-duct variable air volume solutions-determines how DOAS integrates with building HVAC systems. Constant air volume units deliver stable fresh air supply, while VAV configurations offer demand-driven modulation to match occupancy patterns, optimizing energy use. Modular designs facilitate scalable installations in expanding facilities, and single-duct VAV units streamline controls in multi-zone deployments.

Airflow capacity segmentation categorizes systems as high flow for large-scale industrial or commercial projects, medium flow for typical office environments, and low flow for specialized or retrofit applications. Mount type options range from ceiling-hung units in drop-ceiling scenarios to floor-standing systems in mechanical rooms, rooftop installations for minimal footprint, and wall-mounted units for corridor or small space ventilation. Finally, control type-automated or manual-dictates the level of integration within building management frameworks, balancing user engagement with advanced predictive control logic.

This comprehensive research report categorizes the Dedicated Outdoor Air System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Application

- Technology

- Product Type

- Airflow Capacity

- Mount Type

- Control Type

Analyzing Regional Dynamics and Growth Factors Impacting Dedicated Outdoor Air System Adoption in the Americas, EMEA, and Asia-Pacific Regions

Regional demand for dedicated outdoor air systems reflects distinct drivers and maturity levels. In the Americas, sustainability programs and retrofit initiatives underpin significant uptake, especially in mature North American markets where energy codes are stringent and facility owners pursue carbon reduction targets. Early adoption of heat recovery wheels and advanced filtration solutions demonstrates a focus on resilience and occupant well-being.

Across Europe, Middle East & Africa, diverse climatic conditions shape regional preferences. Northern Europe favors enthalpy wheel systems to balance sensible and latent recovery, while Mediterranean markets lean toward desiccant technology to manage high humidity. The Middle East’s rapid commercial construction drives rooftop DOAS installations, with emphasis on modular, high-capacity units to address extreme outdoor temperature loads. In Africa, infrastructure investments in healthcare and educational facilities are spurring demand for reliable, low-maintenance ventilation packages.

Asia-Pacific remains a growth frontier, driven by urbanization and stringent air quality regulations in megacities. Rapid development of data centers and manufacturing hubs is creating demand for specialized DOAS configurations tailored to cleanroom and process-critical environments. Local manufacturers are ramping up production of cost-effective units, while global players introduce high-efficiency models to capture premium segments. Regional collaborations and joint ventures are emerging, enhancing technology transfer and market access.

This comprehensive research report examines key regions that drive the evolution of the Dedicated Outdoor Air System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Leveraging Innovation, Strategic Partnerships, and Sustainability Initiatives to Shape the Future of Dedicated Outdoor Air Systems

Leading companies are capitalizing on their global footprints and extensive R&D capabilities to drive dedicated outdoor air system innovation. Daikin, with its longstanding expertise in air-treatment technology, has expanded its portfolio to include modular DOAS solutions that integrate advanced heat recovery and IoT-enabled monitoring for predictive maintenance. Carrier Global leverages its brand legacy and deep engineering resources to offer turnkey packages that combine DOAS with built-in economizer functionality for large commercial buildings.

Johnson Controls, through strategic partnerships and acquisitions, has strengthened its position in the DOAS segment by embedding building automation controls that interface seamlessly with its OpenBlue digital platform. This integration delivers centralized management and real-time performance analytics, aligning with emerging smart facility mandates. Trane Technologies, meanwhile, emphasizes sustainability credentials, offering products that meet or exceed the latest efficiency standards and supporting lifecycle service agreements to optimize system performance.

Expanding beyond traditional HVAC leaders, specialized manufacturers such as Munters and Desert Aire are carving niches with humidity-centric solutions and high-performance dehumidification modules. These players focus on sectors with stringent moisture control requirements, including battery manufacturing and pharmaceuticals. Price Industries and other regional specialists provide tailored configurations for institutional projects, emphasizing local support and rapid deployment to meet tight construction schedules.

This comprehensive research report delivers an in-depth overview of the principal market players in the Dedicated Outdoor Air System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AAON, Inc.

- Addison HVAC, Inc.

- Carrier Global Corporation

- Daikin Industries, Ltd.

- Desert Aire LLC

- Desiccant Rotors International Pvt. Ltd. (DRI)

- Fujitsu General Limited

- Greenheck Fan Corporation

- Johnson Controls International plc

- Lennox International Inc.

- LG Electronics Inc.

- Mitsubishi Electric Corporation

- Munters Group AB

- Nn Aircon Systems Private Limited

- Samsung Electronics Co., Ltd.

- Symphony Limited

- Trane Technologies plc

- United CoolAir Corp.

- Voltas Limited

- XeteX, Inc.

Formulating Pragmatic Strategies and Tactical Initiatives for Industry Leaders to Enhance Competitiveness and Drive Market Penetration in Dynamic Air Management Sectors

As the market landscape evolves, industry leaders must prioritize technological differentiation to maintain a competitive edge. Implementing the latest heat recovery and desiccant technologies can reduce overall energy consumption and deliver superior humidity control. By integrating these solutions into holistic building management platforms, organizations can offer end users real-time visibility into performance metrics, enabling data-driven decision-making and continuous optimization.

Furthermore, establishing resilient supply chains is critical in light of tariff volatility and component scarcity. Cultivating relationships with diversified suppliers, exploring regional manufacturing partnerships, and investing in modular system architectures will help mitigate cost pressures and logistical risks. Importantly, aligning procurement strategies with sustainability objectives-such as sourcing low–global-warming-potential refrigerants-can enhance brand reputation and appeal to ESG-focused customers.

Finally, cultivating stakeholder awareness through targeted education and demonstration projects will drive broader adoption. Collaborating with code bodies and industry associations to shape standards, and providing compelling case studies that highlight total cost of ownership benefits, will empower specifiers, architects, and facility owners to champion dedicated outdoor air systems in their projects.

Detailing the Rigorous Research Methodology Underpinning the Comprehensive Analysis of Dedicated Outdoor Air System Market Trends and Drivers

This analysis is grounded in a rigorous research framework combining primary and secondary data collection. Primary insights were obtained through interviews with design engineers, facility managers, and equipment distributors across North America, Europe, and Asia-Pacific. These conversations provided real-world perspectives on performance requirements, procurement challenges, and emerging technology preferences.

Complementing these qualitative insights, secondary research drew upon industry publications, regulatory filings, technical standards, and patent databases to map the competitive landscape and identify innovation trends. Data triangulation techniques were employed to validate findings, ensuring consistency across sources. Where possible, technical specifications were cross-checked against manufacturer literature and independent test data to confirm performance claims.

To contextualize market dynamics, the methodology incorporated scenario analysis to assess regulatory impacts, such as the 2025 DOE efficiency rule and recent U.S. tariff measures. This multidimensional approach enabled a comprehensive understanding of both macro-level drivers and micro-level decision factors, ensuring the recommendations align with current industry trajectories.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Dedicated Outdoor Air System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Dedicated Outdoor Air System Market, by Application

- Dedicated Outdoor Air System Market, by Technology

- Dedicated Outdoor Air System Market, by Product Type

- Dedicated Outdoor Air System Market, by Airflow Capacity

- Dedicated Outdoor Air System Market, by Mount Type

- Dedicated Outdoor Air System Market, by Control Type

- Dedicated Outdoor Air System Market, by Region

- Dedicated Outdoor Air System Market, by Group

- Dedicated Outdoor Air System Market, by Country

- United States Dedicated Outdoor Air System Market

- China Dedicated Outdoor Air System Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Summarizing Key Findings and Critical Takeaways Illuminating Opportunities and Challenges in the Dedicated Outdoor Air System Landscape

In summary, dedicated outdoor air systems have transitioned from niche solutions to integral components of high-performance building design. Regulatory momentum, exemplified by stringent energy efficiency standards and balanced ventilation requirements, is accelerating adoption, while technology advancements in heat recovery and digital controls are expanding system capabilities. However, 2025’s U.S. tariffs have underscored the need for supply chain flexibility and cost-management strategies.

Segmentation analysis reveals that tailored solutions-whether by application, technology, or control type-are essential for meeting diverse performance requirements. Regional dynamics demonstrate that local climate, regulatory environments, and construction practices will continue to shape deployment patterns. Leading firms are responding with robust portfolios, strategic partnerships, and integrated digital offerings, while specialized players focus on niche humidity and dehumidification needs.

Looking ahead, success will belong to those who can merge cutting-edge ventilation technologies with resilient procurement models and compelling stakeholder engagement. The combination of stringent performance mandates and evolving sustainability agendas positions dedicated outdoor air systems as catalysts for next-generation indoor environmental quality and energy efficiency.

Engage Directly with Ketan Rohom to Access Customized Dedicated Outdoor Air System Research Insights

If you are prepared to deepen your understanding of dedicated outdoor air system dynamics and unlock actionable insights tailored to your strategic objectives, reach out to Ketan Rohom, Associate Director, Sales & Marketing. He can guide you through the comprehensive research, clarify any nuances, and help you determine which package best suits your organization’s needs.

Engaging directly with Ketan ensures you receive personalized support to navigate market complexities, harness emerging opportunities, and reinforce your competitive positioning. Begin the conversation today and secure the intelligence that will empower your next phase of growth.

- How big is the Dedicated Outdoor Air System Market?

- What is the Dedicated Outdoor Air System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?