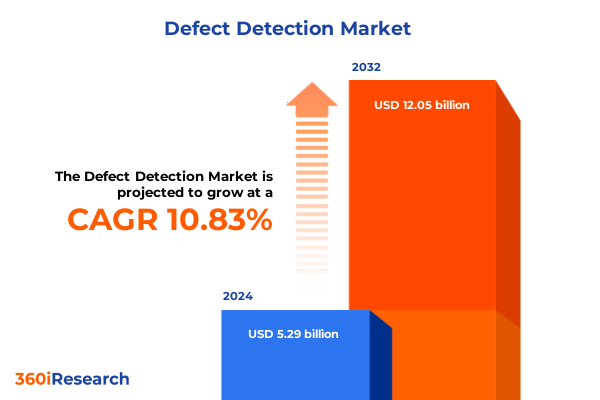

The Defect Detection Market size was estimated at USD 5.80 billion in 2025 and expected to reach USD 6.37 billion in 2026, at a CAGR of 10.99% to reach USD 12.05 billion by 2032.

Understanding the Evolving Terrain of Defect Detection Technologies in Manufacturing and Quality Assurance Environments to Drive Operational Excellence

Quality assurance has become a critical differentiator in modern manufacturing environments, where even minor defects can lead to costly recalls, regulatory non-compliance, and reputational damage. As production volumes and part complexity continue to rise, traditional manual inspection methods struggle to keep pace with the speed and precision required. In response, defect detection technologies have evolved rapidly, leveraging advancements in sensor integration, data analytics, and machine learning to deliver automated, real-time quality assurance across diverse industries.

This report’s introduction lays the groundwork by exploring how defect detection solutions-from optical inspection to ultrasonic and X-ray systems-have shifted from standalone tools to interconnected platforms within smart factories. It highlights the convergence of hardware evolution and software intelligence, enabling systems to detect sub-micron anomalies, adapt to new part geometries, and seamlessly integrate with enterprise resource planning and manufacturing execution systems. The introduction also frames the commercial drivers behind this shift, including rising cost pressures, sustainability goals, and the imperative to maintain zero-defect tolerances in safety-critical applications.

By understanding the foundational trends and technological enablers shaping defect detection, decision-makers can appreciate the strategic importance of investing in next-generation inspection architectures. This context sets the stage for the following sections, which delve into transformative industry shifts, regulatory impacts, segmentation insights, and practical recommendations to guide successful implementation.

Examining the Transformative Shifts Redefining the Defect Detection Landscape with AI, Automation, and Industry 4.0 Integration at the Forefront

In recent years, the defect detection landscape has undergone transformative shifts fueled by breakthroughs in artificial intelligence, machine vision, and edge computing. Inspection systems have transitioned from rule-based algorithms to adaptive, self-learning models that refine detection accuracy over time, reducing false rejects while identifying increasingly subtle surface and structural irregularities. Meanwhile, the proliferation of Internet of Things–enabled sensors and collaborative robots has created a distributed network of data capture points, enabling continuous monitoring across production lines and real-time feedback loops for rapid corrective action.

Another pivotal shift is the move toward modular and scalable inspection architectures. Manufacturers no longer view defect detection as a monolithic necessity but as a flexible service layer that can be deployed incrementally and customized for specific workflows. This modularity accelerates time to value and lowers adoption barriers for small and mid-size enterprises that previously lacked the capital to invest in comprehensive end-to-end solutions. Furthermore, open standards and interoperable protocols are fostering an ecosystem where inspection equipment, analytics engines, and enterprise software collaborate seamlessly, paving the way for unified quality control across global operations.

Together, these shifts herald a new era of proactive quality management, where defect detection is embedded into the fabric of digital manufacturing. Organizations that embrace these changes gain the agility to scale inspection capabilities dynamically, leverage predictive maintenance insights, and uphold stringent tolerances, all while driving continuous improvement in product quality and production efficiency.

Evaluating the Comprehensive Effects of Recent United States Tariffs on Imported Defect Detection Equipment and the Implications for Supply Chains

The imposition of new tariffs by the United States in early 2025 has reverberated across global supply chains for defect detection equipment, altering cost structures and sourcing strategies. Imported inspection devices, particularly high-precision optical scanners and advanced computed tomography systems, now carry additional duties that have raised acquisition costs by up to 15 percent. This change has prompted many end users to reevaluate vendor relationships, negotiate long-term supply contracts, and explore alternative procurement channels to mitigate budget overruns.

Simultaneously, the tariffs have stimulated domestic manufacturing of key inspection components, including camera modules, laser triangulation heads, and ultrasonic transducers. Local OEMs have invested in scaling production capacity, supported by government incentives aimed at bolstering high-technology supply resilience. As a result, a new ecosystem of regional suppliers has emerged, offering competitive lead times and service agreements that rival traditional imports. However, the maturity of these suppliers varies widely, and buyers must undertake rigorous due diligence to ensure quality and reliability standards are met.

Looking beyond immediate cost pressures, the tariff landscape has also catalyzed strategic industry alliances. International technology leaders are forming joint ventures with U.S. partners to localize final assembly and circumvent duty burdens. These collaborations often include knowledge transfer arrangements, ensuring domestic capabilities keep pace with global innovations. For manufacturers and integrators navigating this evolving environment, a balanced approach that combines diversified sourcing, partnership opportunities, and proactive contract management will be essential to sustain operational continuity and control total cost of ownership.

Uncovering Critical Insights from Multiple Market Segmentation Frameworks That Illuminate Key Drivers across Technologies, Applications, and Deployment Models

A nuanced understanding of market segmentation provides invaluable clarity on where defect detection technologies deliver maximum value and where future investments should be targeted. When analyzed by inspection method, the landscape encompasses Automated Optical Inspection, Eddy Current Inspection, Thermal Imaging Inspection, Ultrasonic Inspection, and X-Ray Inspection. Automated Optical Inspection further branches into 2D Vision Inspection and 3D Vision Inspection, with the latter subdividing into Laser Triangulation and Stereoscopic Vision. Ultrasonic Inspection divides into Contact Ultrasonic Inspection and Immersion Ultrasonic Inspection, whereas X-Ray Inspection spans 2D X-Ray Inspection and Computed Tomography Inspection, the latter of which includes both Industrial CT and Micro CT.

Turning to applications, defect detection spans critical use cases such as Aerospace Component Inspection, Automotive Component Inspection, Electronic Component Inspection, Medical Device Inspection, Printed Circuit Board Inspection, and Semiconductor Inspection. Each application brings distinct performance requirements, from the sub-micron precision needed to detect cracks in turbine blades to the high throughput needed for inspecting mass-produced electronic assemblies.

Sectoral adoption further varies by end user industry. Aerospace and Defense, Automotive, Electronics, Healthcare and Medical, and Industrial Manufacturing each exhibit unique regulatory frameworks, quality thresholds, and deployment preferences. Meanwhile, deployment models range from Cloud to Hybrid to On Premise, reflecting differing priorities around data security, latency, and integration complexity. Finally, inspection mode is broadly categorized into Offline Inspection and Real Time Inspection, illustrating the trade-off between comprehensive post-process analysis and immediate feedback during production. By weaving together these segmentation dimensions, stakeholders can pinpoint high-impact opportunities and tailor investment roadmaps to align with both technical requirements and strategic business goals.

This comprehensive research report categorizes the Defect Detection market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Inspection Method

- Inspection Mode

- Application

- Deployment Model

Mapping Regional Variations in Defect Detection Adoption and Growth Trajectories across the Americas, EMEA, and Asia-Pacific Markets

Regional dynamics in defect detection reflect both established industrial strength and emerging growth pockets. In the Americas, advanced manufacturing hubs in the United States, Canada, and Mexico lead adoption of high-speed optical inspection and computed tomography, propelled by robust capital investment and stringent regulatory demands. Meanwhile, end users in South America are increasingly embracing cloud-enabled analytics to optimize quality processes at scale, buoyed by improvements in digital infrastructure.

Across Europe, the Middle East, and Africa, the market exhibits a mix of mature economies with deep roots in aerospace and automotive engineering alongside rapidly developing regions investing in industrial automation. In Western Europe, domestic OEMs and tier-one suppliers drive demand for hybrid inspection platforms that integrate multiple sensor modalities. The Middle East is focusing on technology indigenization and knowledge transfer initiatives, while select African markets are prioritizing cost-effective ultrasonic and thermal imaging solutions for mining and energy sectors.

Asia-Pacific remains the fastest-growing region, with China, Japan, South Korea, and Southeast Asia at the vanguard of semiconductor and electronics manufacturing. These markets are characterized by a relentless pursuit of zero-defect targets, leading to widespread deployment of real-time inspection systems in high-volume production lines. Government programs promoting smart factories and Industry 4.0 standards further bolster adoption, making Asia-Pacific an epicenter of both innovation and economies of scale.

This comprehensive research report examines key regions that drive the evolution of the Defect Detection market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Key Industry Players Driving Innovation and Strategic Partnerships to Elevate Defect Detection Capabilities Globally

Innovation leadership in defect detection is concentrated among a cluster of technology providers that combine deep application expertise with advanced sensor and software portfolios. Several global manufacturers are differentiating through high-resolution vision modules, AI-driven anomaly classification, and turnkey integration services that simplify deployment. These companies have established strategic partnerships with leading equipment vendors and systems integrators, embedding their inspection engines into larger production ecosystems.

In parallel, specialized AI and analytics start-ups have carved out niches by offering cloud-native platforms that accelerate algorithm development and deployment. Their open architecture frameworks enable rapid customization, allowing end users to train models on proprietary defect libraries without extensive programming. These entrants are reshaping the vendor landscape by challenging incumbent hardware-centric players to adopt more service-oriented business models.

Meanwhile, regional champions in key markets are gaining traction by tailoring offerings to local regulatory requirements and supply chain structures. These firms often lead in turn-key project execution, from initial process audits to ongoing remote monitoring support. As competitive intensity increases, partnerships and acquisitions are driving consolidation, with established vendors acquiring niche specialists to bolster their portfolios and expand into adjacent geographies. This dynamic underscores the importance of strategic alliances and technology roadmaps that anticipate evolving customer demands and regulatory changes.

This comprehensive research report delivers an in-depth overview of the principal market players in the Defect Detection market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Basler AG

- Cognex Corporation

- Datalogic S.p.A.

- ISRA VISION AG

- Keyence Corporation

- National Instruments Corporation

- Omron Corporation

- Perceptron Inc.

- Perceptron, Inc.

- SGS S.A.

- SICK AG

- T.D. Williamson, Inc.

- Teledyne Technologies Incorporated

Proposing Actionable Recommendations for Industry Leaders to Capitalize on Emerging Trends in Defect Detection and Sustain Competitive Advantage

Industry leaders should prioritize the integration of advanced analytics and machine learning into existing inspection infrastructures to unlock deeper operational insights. Investing in modular, future-proof architectures that support incremental upgrades will help mitigate the risk of obsolescence and maximize return on capital expenditures. Furthermore, organizations must develop cross-functional teams that bridge quality engineering, IT, and operations to ensure seamless data flow and coordinated response to detected anomalies.

Risk diversification in the supply chain is equally critical. Companies should establish dual-sourcing strategies for core inspection components, negotiate long-term service level agreements with suppliers, and explore opportunities for localized manufacturing partnerships to navigate shifting tariff landscapes. To accelerate adoption, forging strategic alliances with technology integrators and independent software vendors can streamline deployment and provide access to best-in-class implementation expertise.

Talent development remains a pivotal enabler of successful defect detection programs. Industry leaders should invest in upskilling initiatives that combine data science with domain-specific inspection knowledge, ensuring teams can manage increasingly complex systems and interpret insights with confidence. By fostering a culture of continuous learning and cross-disciplinary collaboration, organizations will be better positioned to harness emerging technologies, maintain stringent quality standards, and sustain competitive differentiation in a rapidly evolving market.

Outlining the Rigorous Research Methodology That Ensures Data Integrity, Expert Validation, and Comprehensive Analysis of Defect Detection Markets

This research employs a rigorous multi-stage methodology to ensure the highest degree of accuracy and reliability. The process began with extensive secondary research, leveraging peer-reviewed journals, patent databases, and regulatory filings to map the technological landscape and historical trends. Key terminologies and conceptual frameworks were validated through expert interviews with quality engineers, process automation specialists, and supply chain managers across diverse industry verticals.

Primary research encompassed structured surveys and in-depth discussions with stakeholders ranging from OEMs and system integrators to end users in aerospace, automotive, electronics, healthcare, and industrial manufacturing. Quantitative data points were triangulated with vendor financial disclosures and trade association statistics to reinforce findings. Qualitative inputs were synthesized in thematic analyses that highlighted pain points, adoption barriers, and emerging use cases.

To maintain impartiality, all data underwent cross-verification against independent third-party sources, and conclusions were reviewed by an advisory panel of industry experts. Geographic coverage ensured representation from North America, Latin America, Europe, Middle East, Africa, and Asia-Pacific. Finally, iterative validation workshops were conducted to refine insights and ensure alignment with evolving market realities. This comprehensive approach guarantees that the report’s strategic recommendations rest on a solid foundation of empirical evidence and stakeholder consensus.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Defect Detection market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Defect Detection Market, by Inspection Method

- Defect Detection Market, by Inspection Mode

- Defect Detection Market, by Application

- Defect Detection Market, by Deployment Model

- Defect Detection Market, by Region

- Defect Detection Market, by Group

- Defect Detection Market, by Country

- United States Defect Detection Market

- China Defect Detection Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Summarizing the Core Findings and Strategic Implications of the Defect Detection Market Analysis to Guide Stakeholders with Clarity and Confidence

The analysis of defect detection technologies reveals a market at the intersection of rapid innovation and evolving operational demands. Key findings underscore the central role of AI-enabled inspection, modular architectures, and real-time monitoring in driving quality improvements and cost efficiencies. Meanwhile, the 2025 tariff adjustments in the United States have reshaped procurement strategies, accelerating the development of domestic supply capabilities and strategic alliances.

Segmentation insights demonstrate that high-precision methods such as computed tomography and 3D vision inspection will continue to expand in sectors requiring zero-defect tolerances, while cloud and hybrid deployment models gain traction among users seeking scalable analytics and reduced infrastructure overhead. Regionally, Asia-Pacific maintains its leadership in volume-driven applications, while the Americas and EMEA focus on specialized use cases in aerospace and automotive.

The competitive landscape is increasingly characterized by partnerships between established hardware providers and agile software innovators, forcing incumbents to evolve toward service-oriented business models. For industry leaders, the imperative is clear: embrace adaptable inspection frameworks, diversify supply chains, and cultivate cross-functional expertise to navigate emerging challenges and capture new growth avenues.

Encouraging Decision-Makers to Engage with Ketan Rohom and Secure This Authoritative Defect Detection Market Research Report to Inform Strategy

To take the next step in strengthening your quality assurance strategies and unlocking the full potential of defect detection innovations, reach out today to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. His deep understanding of market dynamics and tailored consultative approach will help you identify the precise insights and tools your organization needs to outperform competitors and drive sustained operational excellence into the future. By engaging directly with Ketan, you will gain exclusive access to the complete market research report, enriched with in-depth analyses, proprietary data, and customized recommendations that align with your strategic objectives. Don’t let uncertainty in defect detection technologies undermine your product quality goals; connect with Ketan now to secure your copy of this comprehensive study and begin harnessing actionable intelligence that empowers informed decision-making and accelerates your path to market leadership

- How big is the Defect Detection Market?

- What is the Defect Detection Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?