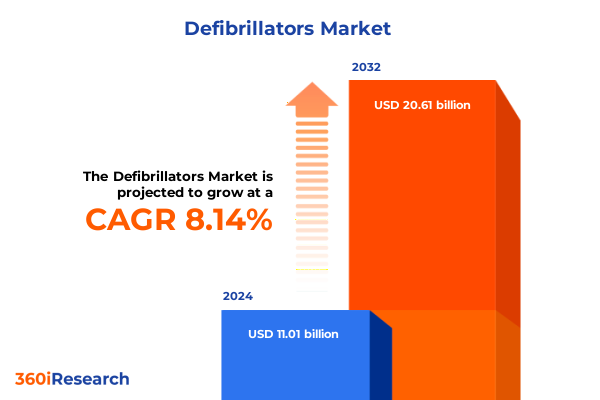

The Defibrillators Market size was estimated at USD 11.86 billion in 2025 and expected to reach USD 12.79 billion in 2026, at a CAGR of 8.20% to reach USD 20.61 billion by 2032.

Understanding How Defibrillator Market Dynamics Are Shaped by Technological Evolution, Regulatory Pressures, and Emerging Global Health Challenges

The defibrillator market occupies a critical position at the intersection of acute cardiac care, emergency response, and advanced medical device innovation. By delivering a life-saving electrical shock during sudden cardiac arrest events, these devices have transformed patient outcomes over the past several decades, reducing mortality and setting new standards for pre-hospital and in-hospital interventions. Technological advancements, from the transition between monophasic to biphasic waveforms to the emergence of wearable cardioverter technologies, have spurred continuous evolution in device efficacy, usability, and patient safety, driving both clinical adoption and public deployment strategies.

Against the backdrop of increasing prevalence of cardiovascular disease, aging populations, and growing emphasis on community health preparedness, the demand for next-generation defibrillators is intensifying across all care settings. Concurrently, regulatory frameworks and reimbursement paradigms are undergoing significant review, as stakeholders seek to balance cost containment with the imperative to expand access to proven, evidence-based resuscitation therapies. This introduction lays the foundation for a detailed exploration of the forces reshaping the global defibrillator landscape, an analysis of the latest policy shifts, a deep examination of segmentation and regional dynamics, and clear recommendations for leaders aiming to navigate this complex, high-stakes environment with confidence.

Identifying the Transformative Shifts That Are Driving Unprecedented Innovation and Adoption in the Defibrillator Landscape Globally

Rapid innovation cycles and shifting care delivery models have fundamentally altered the defibrillator landscape in recent years. Initially defined by manual external defibrillators with monophasic waveforms, the industry has embraced biphasic technologies, which offer greater energy efficiency and reduced myocardial damage risks. In parallel, automated external defibrillators have proliferated across public spaces-from airports to schools-reflecting a paradigm shift toward bystander-enabled emergency response. Wearable cardioverter defibrillators now provide continuous monitoring and automatic therapy delivery, amplifying protection for high-risk cohorts while also catalyzing new reimbursement and training considerations.

Simultaneously, digital health integration has emerged as a transformative force, linking defibrillators to cloud-based platforms for real-time performance monitoring, data analytics, and preventative maintenance alerts. This connectivity empowers stakeholders to optimize device deployment, track usage patterns, and preempt potential device failures. Moreover, regulatory agencies have accelerated their pathways for devices that demonstrate superior safety profiles and clinical efficacy, prompting manufacturers to pursue expedited clearances and robust post-market surveillance strategies. As a result, the industry is witnessing consolidation among leading manufacturers, strategic partnerships with software developers, and geographic expansion into emerging markets where local adaptation and regulatory navigation are proving essential.

Analyzing the Cumulative Impact of the Latest United States Import Tariffs on Defibrillator Supply Chains and Cost Structures in 2025

In early 2025, United States import policies introduced a 10 percent tariff on all medical device imports originating from China, effective April 5, reflecting a broader trade policy recalibration aimed at addressing perceived manufacturing imbalances. This adjustment departed from previous exemptions for certain humanitarian health products, prompting industry bodies such as the American Hospital Association to petition for carve-outs to prevent critical device shortages and cost inflation. While tariffs on imports from Canada and Mexico were paused at 25 percent, manufacturers of defibrillator components have nonetheless encountered rising raw material costs, particularly for specialized capacitors, printed circuit boards, and proprietary sensor elements sourced from Asia and Latin America.

Front-line investors and equity analysts immediately adjusted their outlooks, driving declines in major medical device stocks as markets anticipated compressed margins and temporary earnings hits. In response, leading manufacturers have announced supply chain realignment initiatives, including localized production investments and long-term contracts with domestic suppliers designed to mitigate incremental duty exposure. For instance, a prominent healthcare technology firm disclosed an anticipated net impact from these tariffs in the range of €250 to €300 million for its medical device segment, indicating the materiality of these duties and catalyzing accelerated reshoring strategies in the United States.

Revealing Key Segmentation Patterns That Illuminate Diverse Patient Needs and Technology Preferences Across the Defibrillator Market Spectrum

Market participants segment the defibrillator landscape by device type, with external defibrillators-comprising automated external defibrillators, manual external defibrillators, and wearable cardioverter systems-serving as the primary interface for community responders and clinical staff. Implantable cardioverter defibrillators subdivided into dual-chamber, single-chamber, and subcutaneous configurations form the backbone of long-term patient management strategies, underscoring how differing risk profiles and anatomical considerations guide device selection. Technological segmentation further differentiates devices by waveform delivery, delineating those that utilize biphasic technology with optimized energy protocols from legacy monophasic platforms that remain in service in select markets.

Beyond technical specifications, patient type emerges as a critical segmentation axis. Adult patients account for the majority of devices deployed in both ambulatory and inpatient settings, yet pediatric cohorts with congenital or acquired cardiac anomalies necessitate specialized designs, customized energy settings, and dedicated clinical training. End-user segmentation encompasses the continuum of care environments, ranging from high-acuity hospital cardiac units to pre-hospital care networks operated by emergency medical services, extending to public and community access points that rely on user-friendly interfaces and minimal operational training. Finally, supply channel segmentation distinguishes between offline retail channels, which cater to hospital procurement teams and device distributors, and online platforms that are increasingly facilitating direct-to-consumer sales of wearable and training defibrillator products.

This comprehensive research report categorizes the Defibrillators market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Technology

- Patient Type

- End User

- Supply Channel

Highlighting Regional Variations in Demand, Regulatory Environments, and Market Dynamics Across the Americas, EMEA, and Asia-Pacific Defibrillator Markets

Regional dynamics in the defibrillator market are shaped by a combination of demographic trends, reimbursement frameworks, and regulatory landscapes. In the Americas, robust emergency response systems in North America have prioritized widespread placement of automated external defibrillators in public venues, buoyed by supportive legislative mandates and reimbursement incentives. Growth in Latin America is being driven by investments in healthcare infrastructure, rising awareness of cardiac disease prevalence, and partnerships that enable scalable training programs for lay rescuers.

Within Europe, Middle East & Africa, markets in Western Europe benefit from harmonized regulatory processes under the European Union’s Medical Device Regulation, fostering streamlined approvals and cross-border device utilization. Meanwhile, rapid urbanization in Middle Eastern economies has catalyzed demand for advanced resuscitation capabilities in both private and public healthcare facilities, and sub-Saharan Africa’s capacity building initiatives are leveraging portable AED units to extend life-saving interventions into rural and underserved regions.

Asia-Pacific demand reflects a blend of modern healthcare infrastructure expansion in countries such as Japan, Australia, and South Korea, alongside significant growth potential in India and Southeast Asia, where rising middle-class populations and chronic cardiac disease burdens are increasing clinical adoption. Local regulatory agencies are progressively aligning with international standards, and the proliferation of telehealth platforms is further enabling remote device management and maintenance for geographically dispersed healthcare networks.

This comprehensive research report examines key regions that drive the evolution of the Defibrillators market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Moves and Competitive Positioning of Leading Global Defibrillator Manufacturers Shaping Industry Leadership and Partnerships

Leading defibrillator manufacturers are pursuing diverse strategies to strengthen their market positions, from targeted acquisitions to collaborative innovation initiatives. A prominent medical technology conglomerate expanded its external defibrillator portfolio through the acquisition of a specialized wearable cardioverter developer, integrating next-generation monitoring algorithms into its global distribution network. Another major competitor formed a strategic alliance with a digital health platform provider to enable cloud-based analytics and remote performance tracking, enhancing value propositions for hospital systems and EMS networks.

Meanwhile, implantable device leaders are investing heavily in miniaturization and battery technology enhancements to extend patient device longevity and reduce procedural risks. Several players have launched research partnerships with academic centers to explore the integration of machine-learning-driven arrhythmia detection, signaling a shift toward precision medicine models. Geographic expansions including joint ventures in emerging markets and localized manufacturing collaborations reveal a concerted effort to navigate regional regulatory requirements and cost structures, thereby securing broader installed device bases and deeper customer engagement.

This comprehensive research report delivers an in-depth overview of the principal market players in the Defibrillators market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- AMI Italia S.r.l.

- Avive Solutions Inc.

- Biotronik SE & CoKG

- Boston Scientific Corporation

- CU Medical Systems, Inc.

- GE HealthCare Technologies Inc.

- Koninklijke Philips N.V.

- Mediana Co., Ltd.

- Medtonic PLC

- Metsis Medikal

- MicroPort Scientific Corporation

- Narang Medical Limited

- Nihon Kohden Corporation

- OIARSO S COOP

- Progetti Srl

- Schiller AG

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Stryker Corporation

- Thermo Fisher Scientific Inc.

- Weinmann Emergency Medical Technology GmbH + Co. KG

- ZOLL Medical Corporation by Asahi Kasei Corporation

Offering Actionable Recommendations for Industry Leaders to Enhance Resilience, Foster Innovation, and Navigate Emerging Trade and Regulatory Challenges

Industry leaders must proactively diversify supply chains to mitigate the impact of trade policy volatility, securing dual sourcing arrangements and exploring near-shore production opportunities for critical components. Investing in modular manufacturing platforms will enable rapid reconfiguration in response to regulatory changes or commodity cost fluctuations. Additionally, continued emphasis on digital connectivity-through partnerships with health IT providers-will enrich post-market data collection, support predictive maintenance programs, and generate recurring revenue streams via service contracts.

R&D Roadmaps should prioritize innovations that address unmet clinical needs, including pediatric-specific device form factors and adaptive energy algorithms for complex arrhythmias. Commercial strategies must align training and support services with device launches, ensuring high bystander confidence for automated external defibrillator usage and seamless integration within advanced life support protocols. At the policy level, industry stakeholders should engage with government agencies to advocate for targeted tariff exemptions for life-saving medical devices and harmonized reimbursement codes that reward outcome-based resuscitation metrics. By adopting these measures, market participants will enhance resilience, foster sustained innovation, and navigate emerging trade and regulatory challenges with agility.

Detailing the Rigorous Multi-Source Research Methodology Combining Primary Interviews, Secondary Data, and Advanced Analytical Techniques Underpinning This Study

This study integrates a multi-faceted research approach to deliver robust and transparent market intelligence. Primary research involved in-depth interviews with cardiologists, EMS directors, procurement leaders, and regulatory affairs experts, ensuring firsthand perspectives on device performance, procurement challenges, and policy impacts. Secondary research synthesized data from peer-reviewed clinical journals, government regulatory databases, annual reports, and financial disclosures to validate market trends and technological advancements.

Advanced analytical methodologies underpinned the evaluation framework, including SWOT analyses to identify core strengths and vulnerabilities, PESTEL assessments to contextualize regulatory and geopolitical influences, and Porter’s Five Forces to gauge competitive pressures. Data triangulation across multiple information sources bolstered the credibility of insights, while iterative validation workshops with subject-matter experts refined key conclusions. This rigorous methodological foundation ensures that the findings are grounded in empirical evidence and strategic foresight, enabling stakeholders to make well-informed decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Defibrillators market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Defibrillators Market, by Type

- Defibrillators Market, by Technology

- Defibrillators Market, by Patient Type

- Defibrillators Market, by End User

- Defibrillators Market, by Supply Channel

- Defibrillators Market, by Region

- Defibrillators Market, by Group

- Defibrillators Market, by Country

- United States Defibrillators Market

- China Defibrillators Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Summarizing Crucial Insights and Strategic Imperatives That Define the Future Trajectory of the Global Defibrillator Market Landscape

The global defibrillator market is at a pivotal juncture, driven by rapid technological innovation, evolving care delivery models, and significant policy developments that are reshaping supply chains and cost structures. Biphasic waveform adoption, wearable cardioverter solutions, and digital health integrations are collectively enhancing device functionality and clinical outcomes, while segmented patient needs and end-user requirements continue to influence product design and distribution strategies. Regional variations underscore the importance of tailored market entry approaches, as regulatory frameworks and healthcare infrastructures diverge across the Americas, Europe, Middle East & Africa, and Asia-Pacific.

Trade policy shifts, particularly the imposition of new import tariffs in 2025, have crystallized the need for adaptive sourcing strategies and localized manufacturing commitments. Leading companies are responding with targeted collaborations and technology partnerships to fortify their competitive positioning and accelerate market access. Industry stakeholders that embrace a proactive stance-combining rigorous innovation pipelines, digital connectivity, and policy engagement-will be best positioned to navigate the complexities ahead. These imperatives collectively define the future trajectory of the defibrillator market, underscoring the need for agility, collaboration, and sustained investment in life-saving technologies.

Engaging Decision-Makers with a Clear Call-To-Action to Connect with Ketan Rohom for Exclusive Access to the Full Defibrillator Market Research Report

The comprehensive insights contained in this report are designed to inform strategic decision-making and unlock growth potential across the defibrillator market spectrum. To access the full suite of data, in-depth analysis, and proprietary forecasting tools, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan will guide you through customized purchasing options, discuss licensure models, and provide a tailored briefing that aligns precisely with your organizational objectives. Engage today to secure your competitive advantage and harness exclusive market intelligence that will drive your initiatives forward.

- How big is the Defibrillators Market?

- What is the Defibrillators Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?