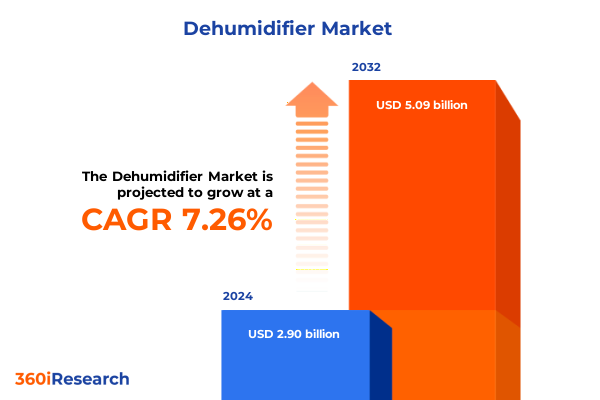

The Dehumidifier Market size was estimated at USD 3.10 billion in 2025 and expected to reach USD 3.31 billion in 2026, at a CAGR of 7.33% to reach USD 5.09 billion by 2032.

Unveiling How Dehumidifiers Shape Indoor Environment Management and Propel Market Innovation Amid Rising Global Demand for Air Quality Solutions

The modern imperative of maintaining optimal indoor humidity levels extends far beyond simple comfort. In residential spaces, excessive moisture can contribute to mold growth, structural damage, and health risks, prompting homeowners to prioritize advanced dehumidification solutions. Commercial environments such as hotels, offices, and retail spaces similarly require precise humidity control to protect assets, ensure guest satisfaction, and comply with evolving building standards. Meanwhile, industrial and pharmaceutical facilities depend on robust dehumidification systems to safeguard sensitive processes and products, underscoring the critical role dehumidifiers play across a spectrum of applications. This multifaceted demand underscores a dynamic market that is continually adapting to serve diverse end users and use cases.

As awareness of indoor air quality deepens among consumers, regulators, and facility managers, dehumidification has emerged as a key component of broader sustainability and health strategies. Consumers are increasingly influenced by concerns over allergens and respiratory issues associated with high humidity, fueling interest in devices that incorporate both dehumidification and air-purification features. At the same time, advancements in digital automation enable facility operators to integrate dehumidifiers into centralized building management systems, streamlining operations and optimizing energy consumption. Together, these factors set the stage for an in-depth exploration of the forces reshaping the global dehumidifier market and the strategic imperatives they present to industry stakeholders.

Exploring the Key Technological and Consumer Shifts Driving the Next Wave of Dehumidifier Market Transformation and Growth

The dehumidifier landscape is being fundamentally redefined by the seamless integration of smart controls and Internet of Things capabilities. Manufacturers are embedding Wi-Fi modules, app connectivity, and voice-assistant compatibility into both residential and commercial units, allowing users to remotely monitor humidity levels, schedule operations, and receive maintenance alerts. This shift toward connected devices enables data-driven performance optimization and predictive maintenance, enhancing both user experience and equipment reliability. As smart ecosystems become the norm in modern buildings, dehumidifiers are increasingly expected to align with broader home automation and facility management platforms, delivering real-time insights and remote diagnostics that were previously unattainable.

Parallel to this digital transformation, sustainability imperatives are propelling innovation in energy efficiency and refrigerant technology. Regulatory emphasis on eco-friendly refrigerants and more stringent energy standards has prompted OEMs to adopt advanced compressors, variable speed motors, and low-global-warming-potential refrigerants. ENERGY STAR qualified dehumidifiers now typically consume substantially less power than legacy models, reflecting a concerted industry push toward greener products. This convergence of environmental stewardship and cost-efficiency is creating a new benchmark for performance, with end users demanding both lower operating expenses and reduced carbon footprints from their dehumidification systems.

Health-oriented features and specialized industrial applications are also driving market diversification. In the consumer segment, units incorporating HEPA filters, UV-C sterilization, and antimicrobial coatings are gaining traction among health-conscious buyers seeking multifunctional solutions. On the industrial front, desiccant systems and high-capacity refrigerant units are being tailored to sectors such as pharmaceuticals, food storage, and data centers, where precise moisture control is mission-critical. These industry-specific requirements are fostering collaboration between dehumidifier manufacturers and engineering firms, resulting in bespoke solutions that combine robust humidity control with advanced environmental monitoring.

Analyzing the Cumulative Effects of United States Section 301 Tariffs on Dehumidifier Supply Chains, Costs, and Manufacturing Strategies in 2025

Since 2018, dehumidifiers imported into the United States from China have been subject to Section 301 tariffs, initially set at 10 percent and subsequently increased to 25 percent in 2019. These duties were imposed alongside broader trade measures targeting consumer appliances, reflecting a strategic effort to address trade imbalances with China. The sustained tariff burden has significantly influenced sourcing decisions, compelling many manufacturers to reevaluate their supply chains and consider alternative production locations in East and Southeast Asia to mitigate cost pressures and maintain competitive pricing.

In response to these tariff dynamics, industry players have accelerated efforts to diversify manufacturing footprints and streamline logistics. Production has gradually shifted to countries not subject to Section 301 measures, reducing exposure to punitive duties and optimizing lead times. At the same time, compliance and customs costs have increased operating expenditures, prompting suppliers to invest in tariff engineering strategies and engage in proactive classification reviews. Amid this evolving trade environment, companies that successfully adapt their sourcing models and implement robust duty-management practices are better positioned to navigate the cumulative impact of U.S. tariffs on cost structures and market competitiveness.

Revealing Deep Segmentation Insights Shaping the Dehumidifier Market Across Product Types, Capacities, Power Sources, and User Applications

Product innovation continues to diverge sharply between desiccant technology and refrigerant-based systems, with each product type carving out distinct applications and performance benchmarks. Desiccant dehumidifiers are favored for low-temperature environments and critical industrial settings, while refrigerant models dominate mainstream residential and commercial use due to their energy efficiency and cost-effectiveness. This bifurcation underscores the importance of tailoring solutions to temperature profiles and application requirements.

Capacity range has emerged as another pivotal differentiator. Low-capacity portable units address small-space and point-use scenarios, medium-capacity models serve larger residential areas and light commercial settings, and high-capacity systems are engineered for substantial industrial processes and warehouse facilities. These tiered capacity options enable stakeholders to match equipment capabilities precisely to humidity loads and spatial constraints, optimizing both capital and operating expenditures.

Further segmentation by power source highlights distinct value propositions in mobility and grid independence. Battery-operated dehumidifiers are carving out a niche in retrofitting and temporary applications where electrical infrastructure is limited, while electric models remain the workhorse for continuous operation in fixed installations. Portability also influences purchasing decisions: fixed systems deliver stability and higher throughput, whereas portable units provide flexibility and ease of deployment across changing operational zones.

End-user segmentation reveals diverse adoption patterns across commercial establishments, industrial facilities, and residential buildings. In the commercial segment, hotels and restaurants seek whisper-quiet, aesthetic designs that integrate seamlessly into guest environments. Offices prioritize low-profile units that support occupant comfort and productivity without disrupting office layouts. Meanwhile, retail spaces demand compact, unobtrusive solutions to maintain aesthetic integrity. Industrial users focus on heavy-duty, reliable systems that maintain stringent humidity tolerances for manufacturing processes, and residential segments gravitate toward plug-and-play devices with intuitive controls and low maintenance requirements.

Distribution channels have also evolved, with offline stores-encompassing hypermarkets, supermarkets, and specialty appliance retailers-continuing to offer hands-on shopping experiences and immediate fulfillment. At the same time, online stores, including brand-run platforms and third-party e-commerce websites, are expanding their share by offering extensive product selection, digital content, and home delivery. These dual distribution ecosystems are shaping go-to-market strategies, requiring manufacturers to optimize pricing, packaging, and promotional activities across both physical and digital retail environments.

This comprehensive research report categorizes the Dehumidifier market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Capacity Range

- Power Source

- Portability

- Mounting Type

- End User

- Distribution Channel

Unearthing Regional Nuances and Opportunities in the Dehumidifier Market Across the Americas, Europe Middle East & Africa, and Asia-Pacific

In the Americas, advanced building codes and energy efficiency programs have elevated demand for dehumidifiers that meet or exceed federal conservation criteria. Updated ENERGY STAR requirements encourage adoption of models delivering significant energy savings above baseline federal standards, reinforcing the value proposition of premium efficiency credentials. Adoption rates vary by climate zone, with humid regions driving the highest per-capita uptake as property owners and facility managers seek to balance comfort and utility costs while adhering to sustainability targets.

Across Europe, the Middle East & Africa, ecodesign directives and the Ecodesign for Sustainable Products Regulation (ESPR) are reshaping product requirements. Newly enacted limits on standby and networked power consumption extend to a wide range of appliances, encouraging manufacturers to incorporate ultra-low-power electronics in dehumidifiers. As EU Member States roll out these measures, consumers benefit from transparent information on energy performance, while producers align product roadmaps with escalating circularity and reparability requirements. These regulatory shifts are accelerating the phase-in of next-generation units that combine low standby losses with recyclable materials and digital product passports.

Asia-Pacific remains the largest and most dynamic region, driven by climatic conditions that make humidity control indispensable in both residential and commercial contexts. Rapid urbanization, rising middle-class incomes, and government initiatives promoting smart city infrastructure have catalyzed strong uptake of IoT-enabled dehumidifiers. Local manufacturers and multinational brands are competing to deliver connected solutions that support centralized monitoring across building management systems, positioning dehumidifiers as integral components of broader smart environment deployments.

This comprehensive research report examines key regions that drive the evolution of the Dehumidifier market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Dehumidifier Industry Players and Their Strategic Innovations Driving Competitive Differentiation and Market Leadership

Leading players across the dehumidifier landscape are leveraging a combination of product innovation, strategic partnerships, and geographic expansion to reinforce competitive positioning. In the residential segment, global appliance brands have introduced compact smart models featuring app-based control, while premium niche vendors are differentiating through health-focused add-ons like UV-C sterilization and multi-stage filtration. On the commercial and industrial front, specialized engineering firms are scaling up desiccant capacity and integrating building automation interface modules to meet stringent process requirements in pharmaceuticals, data centers, and food storage.

Strategic moves such as targeted acquisitions and joint ventures have further broadened technology portfolios. Partnerships between air-treatment specialists and wireless connectivity providers are yielding proprietary humidity-monitoring platforms, while alliances with software developers enable predictive maintenance analytics. Manufacturing footprint expansions in East Asia and Southeast Asia reflect deliberate efforts to hedge against tariff exposure, optimize lead times, and capture growth in emerging markets. Through these combined tactics, leading companies are actively shaping the market’s trajectory and setting benchmarks for performance, reliability, and user experience.

This comprehensive research report delivers an in-depth overview of the principal market players in the Dehumidifier market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airwatergreen AB

- Bry-Air, Inc. by Pahwa Group

- Condair Group AG

- Cotes A/S

- Daikin Industries, Ltd.

- Danby Appliances Inc.

- Dantherm Group A/S

- DehuTech AB

- Desicco Pty Ltd.

- Deutsche Beteiligungs AG

- De’Longhi Appliances S.r.l.

- Ebac Industrial Products Ltd.

- Ecor Pro Ltd

- Fisen Corporation

- Haier Group Corporation

- Honeywell International Inc.

- Koninklijke Philips N.V.

- LG Electronics Inc.

- Mitsubishi Electric Corporation

- Munters Group

- Samsung Electronics Co., Ltd.

- Sharp Corporation

- Stulz GmbH

- Trane Technologies PLC

- W.A. Hammond Drierite Co., Ltd.

- Whirlpool Corporation

- Xiaomi Corporation

Providing Actionable Recommendations for Industry Leaders to Navigate Regulatory, Technological, and Supply Chain Complexities in Dehumidifier Markets

To capitalize on evolving market dynamics, industry leaders should prioritize the development of integrated smart dehumidification solutions compatible with popular home automation and facility management systems. Investing in IoT architecture and data analytics capabilities will unlock value through remote diagnostics, energy optimization, and predictive maintenance services. By positioning dehumidifiers as connected building assets, vendors can differentiate offerings and foster recurring revenue through digital service subscriptions.

Simultaneously, proactive management of supply chain risks is essential. Companies must continue to diversify manufacturing locations, pursue tariff engineering strategies, and engage in robust customs classification reviews to minimize exposure to adverse trade measures. Aligning R&D roadmaps with regulatory trajectories-such as forthcoming ecodesign and energy labelling requirements-will also ensure that new product introductions meet or exceed compliance deadlines, reducing time-to-market delays and guarding brand reputation.

Outlining the Comprehensive Research Methodology Employed to Ensure Rigorous Analysis and Actionable Insights in the Dehumidifier Market Study

This analysis draws upon a multi-tiered research framework combining primary and secondary data sources to deliver comprehensive market insights. Primary research included in-depth interviews with senior executives from leading dehumidifier manufacturers, commercial integrators, and technology partners to validate emerging trends and assess strategic imperatives. Secondary inputs encompassed regulatory filings, industry association publications, government databases, and reputable news outlets to map policy changes and technological developments.

Quantitative data were synthesized through rigorous data triangulation, cross-referencing import/export statistics, customs tariff schedules, and energy efficiency programme documentation. Qualitative findings were refined via iterative expert workshops and peer review, ensuring that conclusions reflect both current realities and forward-looking considerations. This methodological approach guarantees that the study’s recommendations are grounded in empirical evidence and aligned with industry best practices.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Dehumidifier market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Dehumidifier Market, by Product Type

- Dehumidifier Market, by Capacity Range

- Dehumidifier Market, by Power Source

- Dehumidifier Market, by Portability

- Dehumidifier Market, by Mounting Type

- Dehumidifier Market, by End User

- Dehumidifier Market, by Distribution Channel

- Dehumidifier Market, by Region

- Dehumidifier Market, by Group

- Dehumidifier Market, by Country

- United States Dehumidifier Market

- China Dehumidifier Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1908 ]

Summarizing Critical Findings and Strategic Implications to Illuminate the Future Trajectory of the Global Dehumidifier Market Landscape

The global dehumidifier market is at an inflection point, shaped by digital transformation, regulatory evolution, and shifting supply chain dynamics. Smart, connected devices are rapidly becoming the new standard, while heightened regulatory scrutiny on energy consumption and environmental impact is driving manufacturers toward sustainable product architecture. Trade measures continue to influence sourcing strategies, underscoring the importance of diversified manufacturing footprints and proactive duty management.

Looking ahead, organizations that successfully integrate smart functionalities, adhere to emergent ecodesign mandates, and optimize global supply chains will secure competitive advantage. The convergence of health-focused features, energy-saving credentials, and seamless connectivity represents the next frontier of dehumidifier innovation. As dehumidification becomes integral to broader indoor environment solutions, companies that anticipate these trends and align strategic investments accordingly will lead market growth and redefine industry benchmarks.

Connect Directly with Ketan Rohom to Access the Complete Dehumidifier Market Research Report and Drive Strategic Decision Making

Don’t miss the opportunity to leverage comprehensive insights and strategic guidance tailored to drive your business forward. Reach out to Ketan Rohom, Associate Director of Sales & Marketing, and discover how this in-depth dehumidifier market research report can empower your decisions, enhance your competitive positioning, and accelerate growth across segments and regions.

- How big is the Dehumidifier Market?

- What is the Dehumidifier Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?