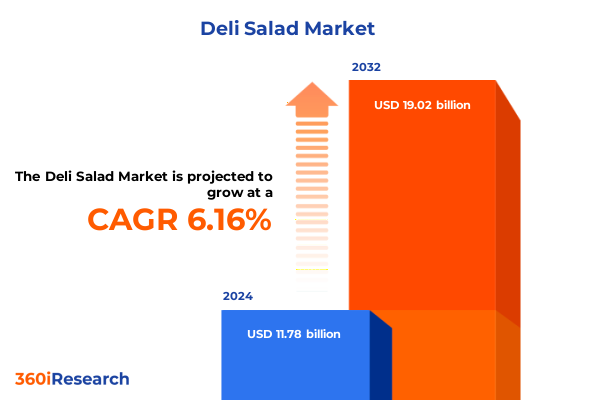

The Deli Salad Market size was estimated at USD 12.44 billion in 2025 and expected to reach USD 13.15 billion in 2026, at a CAGR of 6.25% to reach USD 19.02 billion by 2032.

Unveiling the Deli Salad Market’s Fundamentals and Emerging Dynamics to Lay the Groundwork for Strategic Decision-Making in a Rapidly Evolving Landscape

The deli salad market represents a dynamic intersection of convenience, nutrition, and consumer-driven innovation within the broader prepared foods industry. Over recent years, shifting lifestyles and heightened health awareness have converged to elevate the role of deli salads as a staple choice for a balanced meal on the go. As consumers seek options that blend taste with wellness, deli salads have evolved beyond simple side dishes to become a core component of dietary routines across diverse demographics.

With the proliferation of retail channels ranging from traditional supermarkets to e-commerce platforms, the deli salad category has expanded both in variety and availability. Traditional chicken, egg, and tuna formulations now sit alongside protein-rich shrimp preparations and an array of vegetable-centric offerings. These developments reflect a broader trend toward personalized nutrition and convenience, positioning deli salads as a focal point for manufacturers and retailers aiming to capture contemporary consumer preferences.

This executive summary lays the groundwork for understanding the fundamentals of the deli salad market. By examining the key forces driving growth, the impact of regulatory shifts, and the strategies adopted by leading players, stakeholders will gain a nuanced perspective on how to navigate this rapidly evolving landscape. Through targeted analysis, this report illuminates the foundational factors that underpin current market dynamics, setting the stage for more detailed exploration in subsequent sections.

Identifying Revolutionary Consumer Behavior, Technological Innovations, and Sustainability Trends Reshaping How Deli Salads Are Produced, Sold, and Consumed Today

The deli salad sector is undergoing unprecedented transformation driven by evolving consumer expectations and technological advancements. In recent years, an increased emphasis on clean-label ingredients and transparent sourcing has prompted producers to reformulate recipes, incorporating wholesome vegetables, lean proteins, and dressings crafted from recognizable components. This shift aligns with a broader movement toward health-oriented eating, where shoppers prioritize nutrient density and ingredient clarity over traditional indulgence alone.

Concurrently, digital innovations have redefined how deli salads reach end consumers. Mobile ordering, click-and-collect services, and subscription-based meal programs have all accelerated the category’s accessibility. These channels not only streamline the purchase journey but also enable brands to gather valuable data on consumption patterns, facilitating tailored product development and targeted marketing initiatives.

Moreover, sustainability has emerged as a key driver of industry change. Brands are increasingly adopting eco-friendly packaging materials and optimizing production processes to minimize waste. From compostable containers to reduced single-use plastics in multi-serve trays, these efforts resonate with environmentally conscious consumers and contribute to a positive brand image. Taken together, these transformative shifts underscore the industry’s commitment to meeting modern demands while fostering innovation across the supply chain.

Analyzing the Far-Reaching Consequences of the 2025 U.S. Tariff Adjustments on Supply Chains, Pricing Structures, and Competitive Dynamics in the Deli Salad Industry

The imposition of new tariff measures by the United States in early 2025 has introduced significant headwinds for deli salad manufacturers reliant on imported ingredients. Suppliers of specialty proteins such as shrimp and tuna have encountered higher input costs, prompting reevaluations of sourcing strategies and, in some cases, product reformulations to offset increased duties. As a result, procurement teams are exploring alternative origins for key ingredients or shifting toward domestically sourced proteins to preserve margin structures.

Price sensitivity among end consumers has compelled brands to absorb portions of increased costs while simultaneously enhancing value through premium ingredients or novel product attributes. This balancing act reflects an industry striving to maintain competitive pricing without sacrificing quality or brand equity. In parallel, multinationals with robust global supply chains have leveraged their scale to negotiate more favorable terms with exporters and to distribute tariff impacts across broader portfolios, thereby mitigating the immediate financial burden.

From a strategic standpoint, the tariffs have accelerated the pursuit of vertical integration and long-term supplier partnerships. By forging closer ties with growers and processors, deli salad producers aim to secure cost stability and consistent quality amid a volatile trade environment. Ultimately, these shifts highlight the industry’s adaptability and its capacity to remodel supply chain structures in response to evolving trade policies.

Deciphering Consumer Preferences and Market Niches through Comprehensive Analysis of Product, Dressing, Packaging, Consumer Demographics, and Distribution Segments

A nuanced understanding of market segmentation reveals critical avenues for innovation and growth within the deli salad category. When dissecting product types, the landscape bifurcates into meat-based and vegetable-based deli salads, each spawning distinct consumer segments and innovation pathways. The meat-focused subcategory encompasses traditional chicken salad, egg salad, shrimp salad, and tuna salad formulations, where protein quality and flavor complexity dictate purchasing decisions. Conversely, the vegetable-driven segment spans options such as bean salad, broccoli salads, coleslaw, macaroni salad, pasta salad, and potato salad, earning favor among those seeking plant-centric or side-dish alternatives.

Closer inspection of dressing types underscores the importance of taste profiles in driving repeat purchases. Creamy dressings deliver indulgent mouthfeel, ranch varieties offer familiar tang, and vinaigrettes cater to consumers prioritizing lighter, more acidic finishes. Across these dressing classifications, the capacity to introduce limited-edition flavors or health-oriented formulations-such as reduced-fat creams or fermented dairy bases-has proven especially effective at capturing adventurous palates.

Packaging formats also shape consumer engagement and purchasing frequency. Family and multi-serve packs serve as economical solutions for households and gatherings, while single-serve or portion packs capitalize on convenience and on-the-go consumption. Packaging innovations that prolong freshness, such as compartmentalized trays and resealable lids, further enhance the appeal of both formats.

Beyond physical product characteristics, demographic segmentation provides insight into target markets. Elderly consumers often prioritize ease of preparation and familiar flavors, families seek shareable formats and balanced nutrition, health-conscious individuals emphasize clean ingredients and calorie transparency, on-the-go professionals demand portable meal solutions, and vegetarian consumers drive demand for plant-based compositions. These person-centric segments inform not only product development but also messaging strategies and distribution priorities.

Finally, the channels through which deli salads are purchased reveal shifting consumer behaviors. Offline outlets-including convenience stores, specialty food shops, and supermarkets and hypermarkets-continue to dominate volume sales; however, the rapid expansion of online platforms, encompassing both dedicated brand websites and third-party e-commerce marketplaces, enables direct-to-consumer delivery and subscription services. This multi-channel retail environment necessitates an omnichannel approach, ensuring product availability and consistent brand experience across diverse purchasing pathways.

This comprehensive research report categorizes the Deli Salad market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Dressing Type

- Packaging

- Consumer

- Distribution Channel

Exploring Regional Demand Variations, Supply Infrastructure Strengths, and Consumption Patterns across the Americas, Europe Middle East Africa, and Asia-Pacific Regions

Regional dynamics exert a profound influence on the deli salad market’s trajectory, as divergent consumption habits and infrastructure capabilities shape localized demand. In the Americas, established cold chain networks support widespread distribution of fresh deli salads, with innovation concentrated on premium ingredients and novel flavor fusions to satisfy a palate that values both quality and convenience. North American consumers, in particular, have demonstrated a propensity for high-protein formulations, while Latin American markets exhibit growing interest in vegetable-based and fusion-inspired variants.

In the Europe, Middle East & Africa region, regulatory frameworks and health guidelines drive consumer expectations around ingredient transparency and nutritional labeling. European consumers often favor artisanal and organic deli salads, leading brands to highlight provenance and sustainability commitments. In contrast, markets in the Middle East and North Africa display robust demand for bold, spice-driven dressings and wraps, compelling suppliers to tailor formulations and packaging to align with local preferences and retail formats.

The Asia-Pacific region presents a tapestry of emerging growth opportunities, fueled by rapid urbanization and a burgeoning middle class. Urban consumers increasingly embrace ready-to-eat options, stimulating the proliferation of convenience-store grab-and-go displays and meal-kit integrations. Simultaneously, regional flavor profiles, such as sesame-infused vinaigrettes and pickled vegetable salads, are gaining traction as global brands adapt their offerings to resonate with local tastes. Across all three regions, the interplay of logistical infrastructure, regulatory environments, and cultural preferences underscores the necessity for region-specific strategies that balance global best practices with localized execution.

This comprehensive research report examines key regions that drive the evolution of the Deli Salad market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players to Highlight Strategic Partnerships, Innovation Pipelines, and Competitive Positioning That Define the Global Deli Salad Ecosystem

Leading players in the deli salad realm have distinguished themselves through a combination of strategic partnerships, product innovation, and supply chain optimization. Some heritage food manufacturers leverage deep relationships with growers and poultry suppliers to ensure consistent access to high-quality inputs, while specialty producers collaborate with local farmers to source heirloom vegetables and regionally inspired ingredients. These alliances not only enhance product authenticity but also serve as compelling differentiators in a crowded marketplace.

Innovation pipelines have become a critical source of competitive advantage. Companies investing in research and development facilities are introducing heat-and-eat deli salad bowls, probiotic-infused dressings, and hybrid formats that blend salad with grains or protein-rich bases. Such forward-thinking initiatives not only cater to health-focused consumers but also open up adjacent meal occasions, expanding the category’s relevance beyond traditional lunchtime consumption.

In parallel, several major players are deepening their digital footprints through direct-to-consumer platforms and subscription services. By harnessing consumer data from these channels, they refine their offerings, tailor promotional campaigns, and streamline production forecasting. These digital capabilities complement traditional wholesale relationships with retailers and foodservice operators, ensuring a balanced go-to-market approach that mitigates channel-specific risks.

Finally, operational excellence remains a cornerstone of success. Market leaders continuously invest in cold chain enhancements, automated processing lines, and quality assurance protocols to maximize efficiency and product safety. By combining robust production facilities with agile distribution networks, they maintain high service levels and quickly respond to evolving market conditions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Deli Salad market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ALDI GmbH & Co.KG

- Aramark Corporation

- Birds Eye by Conagra Brands, Inc.

- Bonduelle Group

- Bumble Bee Foods, LLC

- Del Monte Foods Inc.

- Deli Star Corporation

- Dole PLC

- Don's Foods

- Garden-Fresh Foods

- Hormel Foods Corporation

- Häns Kissle

- Lakeview Farms

- McCain Foods Limited

- Mrs. Gerry’s Kitchen, LLC

- Picadeli US Inc

- Ready Pac Foods

- Reser's Fine Foods, Inc.

- Ron’s Home Style Foods

- Sandridge Crafted Foods

- Sunkist Growers Inc, USA

- Taylor Fresh Foods, Inc.

- The Kraft Heinz Company

- Unilever PLC

- Walker's Fresh Foods

- Willow Tree Farm

Delivering Actionable Strategic Imperatives and Best Practices for Industry Leaders to Capitalize on Emerging Opportunities and Mitigate Future Market Disruptions

Industry participants aiming to capture market share and drive sustained growth should prioritize a multifaceted strategic agenda. First and foremost, accelerating product diversification by launching novel formulations-such as fortified plant-based salads or globally inspired flavor combinations-will enable brands to stand out and appeal to a broader consumer base. Equally important is the adoption of sustainable packaging innovations, including compostable trays and reduced-plastic materials, to align with evolving environmental expectations and strengthen brand loyalty among eco-conscious shoppers.

In parallel, companies should enhance digital engagement by integrating e-commerce platforms with loyalty programs and personalized marketing campaigns. Leveraging advanced analytics to interpret consumer purchasing patterns can inform targeted promotions and product development roadmaps. Furthermore, forging strategic alliances with last-mile delivery partners and meal-kit services can extend market reach and foster recurring revenue streams.

To fortify supply chain resilience, industry leaders must diversify their supplier networks and pursue vertical integration opportunities where feasible. Cultivating long-term contracts with ingredient producers can mitigate the impact of trade disruptions and tariff fluctuations, while investments in automated production technologies will support scalable growth without compromising quality or safety.

Finally, a data-driven approach to talent development and organizational agility will be vital. By fostering cross-functional teams with expertise in R&D, sustainability, and digital operations, companies can respond swiftly to emerging trends and capitalize on shifting consumer demands. Through these concerted efforts, industry leaders can not only navigate near-term challenges but also lay the foundation for enduring success.

Detailing the Rigorous Research Framework Including Data Sources, Analytical Techniques, and Validation Processes Employed to Ensure Integrity and Reliability of Findings

This comprehensive analysis employs a blend of primary and secondary research methodologies to ensure accuracy and reliability. Primary research consisted of in-depth interviews with senior executives at leading deli salad manufacturers, procurement specialists at major retail chains, and category buyers overseeing ready-to-eat offerings. These conversations provided nuanced perspectives on supply chain strategies, innovation priorities, and consumer engagement tactics.

Complementing these insights, a rigorous review of industry publications, regulatory filings, and proprietary company disclosures was conducted to validate emerging trends and competitive benchmarks. Trade association reports and regulatory databases contributed critical context regarding tariff implications and labeling requirements, while academic literature in food science informed assessments of formulation innovations and shelf-life extension techniques.

Quantitative data points were corroborated through cross-referencing multiple sources, followed by thematic analysis to identify recurring patterns and outlier developments. To further ensure validity, findings were subjected to peer review by subject-matter experts in food processing and supply chain management. This iterative process yielded a robust framework for interpreting market dynamics and translating observations into actionable intelligence.

Ethical considerations, including respondent confidentiality and unbiased data handling, were strictly maintained throughout the research cycle. Collectively, these methodological pillars underpin the credibility of the report’s conclusions and recommendations, providing stakeholders with a dependable foundation for decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Deli Salad market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Deli Salad Market, by Product Type

- Deli Salad Market, by Dressing Type

- Deli Salad Market, by Packaging

- Deli Salad Market, by Consumer

- Deli Salad Market, by Distribution Channel

- Deli Salad Market, by Region

- Deli Salad Market, by Group

- Deli Salad Market, by Country

- United States Deli Salad Market

- China Deli Salad Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Key Insights and Strategic Conclusions to Provide Clarity on Market Dynamics and Support Informed Decision-Making for Stakeholders

In synthesizing the multifaceted insights presented throughout this summary, several core themes emerge. First, consumer demand for healthy, convenient, and transparent food options has driven significant product innovation and supply chain reconfiguration within the deli salad sector. Shifts in sourcing strategies and packaging enhancements reflect the industry’s responsiveness to evolving preferences and regulatory pressures.

Second, the 2025 U.S. tariff adjustments have acted as both a challenge and catalyst for strategic realignment. While cost pressures have intensified, they have also promoted deeper supplier collaboration and the pursuit of domestic sourcing solutions. These adaptations underscore the market’s resilience and its capacity for agility under changing trade regimes.

Third, segmentation and regional analyses reveal a landscape defined by diverse consumer profiles and localized market drivers. Understanding the nuances across product types, dressing formats, packaging preferences, demographic cohorts, and distribution channels is essential for designing targeted growth strategies. Similarly, tailoring offerings to region-specific tastes and logistical realities remains a prerequisite for global success.

Finally, the compendium of best practices and research integrity guidelines outlined herein provides a strategic blueprint for stakeholders seeking to navigate complexity and seize new opportunities. By leveraging these insights, industry participants can position themselves at the forefront of an evolving market and lay the groundwork for sustainable competitive advantage.

Act Now to Secure Comprehensive Market Intelligence and Propel Growth Insights by Partnering with Ketan Rohom for Exclusive Access to Our Deli Salad Report

For tailored guidance on leveraging these insights to drive market leadership and to obtain the full breadth of our comprehensive market intelligence, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. By partnering with Ketan, you will gain exclusive access to detailed data, proprietary analysis, and actionable strategies designed to optimize your position in the deli salad market. Secure your advantage today and capitalize on the timely opportunities illuminated in this report.

- How big is the Deli Salad Market?

- What is the Deli Salad Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?