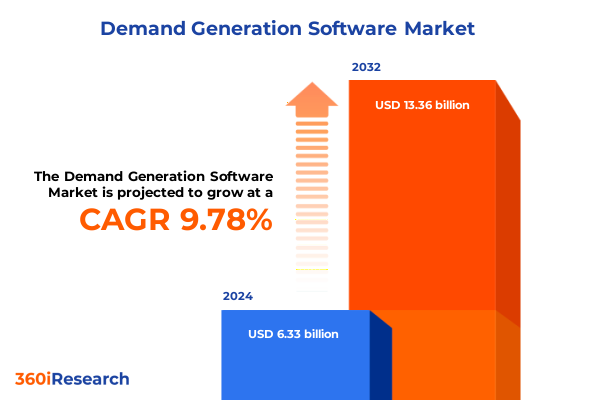

The Demand Generation Software Market size was estimated at USD 6.96 billion in 2025 and expected to reach USD 7.59 billion in 2026, at a CAGR of 9.76% to reach USD 13.36 billion by 2032.

Setting the Stage for Demand Generation Software Excellence in Modern Business Ecosystems and Emerging Digital Channels and Advanced Analytics Applications

Demand generation software has emerged as a cornerstone of modern marketing and revenue operations, serving as the engine that powers lead acquisition, nurturing workflows, and pipeline acceleration. In an era defined by fragmented buyer journeys and heightened expectations around personalization, organizations are turning to integrated platforms that can seamlessly orchestrate multichannel campaigns, capture rich behavioral data, and deliver real-time analytics. This report delivers an executive summary that distills the most critical insights and actionable takeaways to guide decision-makers in navigating a complex technology landscape and elevating their demand generation capabilities.

Through a comprehensive analysis of current market dynamics, technological innovations, and emerging best practices, this introduction sets the stage for an in-depth exploration of how businesses can harness the latest tools to cultivate deeper engagement across target audiences. It also underscores the importance of aligning marketing and sales teams around unified metrics and processes to drive measurable ROI. As we embark on this journey, readers will gain clarity on the shifts reshaping the industry, practical segmentation frameworks for tailored approaches, and the competitive imperatives that define leadership in the demand generation space.

Navigating Radical Transformations Driving Demand Generation Software Innovations through AI Automation and Customer-Centric Marketing Paradigms

The landscape of demand generation software is undergoing rapid transformation, driven principally by advancements in artificial intelligence and machine learning. These technologies enable marketers to automate content personalization at scale, predict high-value prospects with greater accuracy, and optimize campaign performance through continuous insights. Consequently, organizations that integrate AI-driven predictive models into their workflows are outpacing peers in lead quality and conversion velocity.

Simultaneously, the paradigm has shifted from disparate technology stacks to unified platforms that offer end-to-end visibility across the customer lifecycle. Tight integration of marketing automation with CRM, social listening, web analytics, and customer data platforms is now a strategic imperative. This convergence ensures that teams can deliver cohesive experiences, avoid data silos, and rapidly adapt to evolving buyer behavior. Additionally, heightened attention to data privacy regulations and consent management has catalyzed solutions that balance compliant data capture with meaningful personalization, marking a new chapter in responsible demand generation.

Evaluating the Far-Reaching Effects of 2025 United States Tariffs on Demand Generation Software Supply Chains and Vendor Strategies

In 2025, the United States implemented new tariff structures targeting hardware imports and certain enterprise software services, yielding notable ripple effects in the demand generation technology sector. Though core platform functionalities remain digital, ancillary costs such as data center equipment, server maintenance, and hardware-dependent integrations have experienced upward pressure. Vendors with on-premise deployment models have had to recalibrate pricing and pass a portion of these cost increases to end users, especially where hybrid cloud architectures rely on localized hardware components.

Furthermore, service providers that maintain offshore development centers have navigated shifting labor cost structures due to tariffs on outsourced computing services and cross-border data transfer fees. As a result, organizations are evaluating more strategically whether to adopt public cloud offerings hosted domestically or continue managing private cloud environments with higher upfront capital expenditures. Ultimately, these cumulative tariff impacts are accelerating customer migration toward subscription-based, SaaS-driven delivery models that minimize hardware dependencies and simplify cost predictability in an uncertain trade policy environment.

Uncovering Deep Segmentation Insights across Deployment Models Organization Sizes End Users and Industry Verticals Shaping Market Dynamics

A nuanced understanding of market segmentation is critical for tailoring demand generation strategies that resonate with diverse operational requirements. When considering deployment models, enterprises can opt for cloud solutions or traditional on-premise setups. Within cloud environments, decision- makers often weigh the benefits of hybrid architectures that blend on-site control with cloud scalability against private clouds that offer enhanced security or public clouds that deliver rapid provisioning and global accessibility. These choices influence integration complexity as well as the pace of innovation.

Equally significant is organizational scale. Large enterprises typically demand robust platform extensibility, extensive IT governance, and broad user access controls, whereas small and medium enterprises often prioritize rapid implementation, lower total cost of ownership, and out-of-the-box best practices. As for end-user constituencies, agencies require flexible multi-client management and branded deliverables, marketing teams need granular campaign orchestration-whether digital channels or field marketing activations-and sales teams depend on seamless handoffs between field representatives and inside sales personnel who drive qualification and closure.

Industry vertical segmentation unveils additional layers of requirement specificity. Within the financial services domain, banking, capital markets, and insurance each present unique compliance and customer journey considerations. In healthcare, hospitals emphasize patient engagement pathways while pharmaceutical organizations focus on physician and clinician outreach. Meanwhile, IT and telecom providers leverage sophisticated integration APIs, and retail companies harness real- time consumer behavior signals for hyperlocal promotions. By mapping these segmentation variables to platform capabilities, organizations can craft demand generation initiatives that align precisely with both technical constraints and business objectives.

This comprehensive research report categorizes the Demand Generation Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Deployment Model

- Organization Size

- End User

- Industry Vertical

Gaining Strategic Regional Perspectives to Harness Growth Opportunities across Americas Europe Middle East Africa and Asia Pacific Markets

Regional nuances play a pivotal role in determining both adoption rates and feature priorities within the demand generation software market. In the Americas, widespread maturity in digital marketing practices and established cloud ecosystems drive early adoption of advanced analytics, real-time personalization, and account-based marketing methodologies. Market leaders in North America are setting benchmarks for omnichannel orchestration, prompting competitors to continuously expand feature sets and refine user experience.

Across Europe, the Middle East, and Africa, regulatory compliance-particularly around data privacy-remains a defining concern. Organizations in these regions often prioritize robust consent management, granular permissioning, and multilingual support for campaigns spanning multiple jurisdictions. Simultaneously, there is growing interest in AI-driven lead prioritization and cross-border integration patterns that can accommodate diverse technology landscapes.

In Asia-Pacific, accelerating digital transformation initiatives and burgeoning e-commerce uptake are fueling demand for solutions that deliver high-speed campaign deployment, mobile optimization, and localized content delivery. Enterprises and agencies are actively seeking platforms capable of supporting multilingual communications, regional payment integrations, and seamless interfacing with popular local social networks. This heterogeneity underscores the importance of vendor ecosystems that can adapt rapidly to each market’s distinctive requirements.

This comprehensive research report examines key regions that drive the evolution of the Demand Generation Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Critical Competitive Intelligence and Innovative Strategies from Leading Demand Generation Software Providers Driving Industry Progress

Leading providers in the demand generation software sphere have pursued differentiated strategies to secure market leadership and foster customer loyalty. Established incumbents have concentrated on platform consolidation, expanding legacy marketing automation capabilities to encompass AI-driven recommendations, integrated customer data management, and advanced reporting modules. These vendors leverage extensive partner networks and global support infrastructures to serve enterprise clients with complex needs.

Conversely, innovative challengers have carved out niches by prioritizing agility, user-centric design, and specialized features such as real-time conversational engagement, predictive analytics, and native integrations with emerging social and collaboration platforms. Their success often hinges on delivering rapid time to value and maintaining transparent pricing models tailored for mid-market adoption. Meanwhile, cross-industry alliances between software vendors and system integrators are delivering end-to-end solutions that combine strategic advisory services with technical implementation expertise.

Additionally, collaborative ecosystems have arisen around open APIs and developer communities, fostering third-party extensions that enhance core platform functionality. This has empowered organizations to build custom modules for campaign optimization, data enrichment, and compliance monitoring. As a result, companies are choosing providers that offer both robust out-of-the-box capabilities and the flexibility to innovate through extensible architectures.

This comprehensive research report delivers an in-depth overview of the principal market players in the Demand Generation Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 6Sense Insights, Inc.

- ActiveCampaign, LLC

- Adobe Inc.

- Braze, Inc.

- Clearbit, Inc.

- Demandbase, Inc.

- Drift.com, Inc.

- HubSpot, Inc.

- Instapage, Inc.

- Iterable, Inc.

- Klaviyo, Inc.

- Oracle Corporation

- Outreach, Inc.

- Salesforce, Inc.

- Salesloft, Inc.

- SharpSpring, Inc.

- Terminus, Inc.

- The Rocket Science Group LLC

- Unbounce Marketing Solutions Inc.

- ZoomInfo Technologies LLC

Empowering Industry Leaders with Strategic Recommendations to Optimize Demand Generation Software Investments and Accelerate Sustainable Growth Trajectories

To maintain competitive advantage, industry leaders should prioritize the integration of AI-driven personalization engines within their demand generation workflows. By leveraging predictive scoring models and dynamic content delivery, marketing teams can engage prospects at optimal touchpoints throughout the buyer journey. Equally important is fostering cross-functional collaboration between marketing operations and sales enablement groups to ensure that lead-hand off processes are seamless and data-driven.

Moreover, organizations ought to evaluate deployment strategies through the lens of long-term total cost of ownership and resilience. Hybrid cloud architectures can balance the need for data sovereignty with the scalability of public cloud, while private cloud implementations deliver enhanced control for regulated industries. In parallel, investing in continuous training and change management will empower user adoption and minimize implementation friction.

Finally, companies should cultivate strategic partnerships with vendors that provide robust developer APIs and a thriving integration marketplace. This ensures that teams can extend platform capabilities to address emerging business requirements without resorting to costly custom development. By implementing a framework for iterative performance measurement and optimization, leaders can refine campaign effectiveness, adapt to evolving market conditions, and accelerate revenue growth in a sustainable manner.

Applying Robust Research Methodologies and Analytical Frameworks to Deliver Accurate and Actionable Demand Generation Software Market Insights

Our research methodology combines a multi-pronged approach to deliver comprehensive and reliable insights into the demand generation software landscape. We began with an extensive review of primary data sources, including in-depth interviews with marketing technology executives, IT decision-makers, and agency specialists to capture firsthand perspectives on platform selection criteria, deployment experiences, and performance outcomes.

This qualitative input was complemented by rigorous secondary research, encompassing public filings, industry white papers, technology analyst reports, and thematic publications. We systematically triangulated these data points to validate emerging trends, competitive dynamics, and regional market behaviors. Key metrics such as adoption drivers, integration patterns, and feature preferences were coded and analyzed to uncover consistent patterns across organizations of varying sizes and verticals.

Finally, our findings underwent expert validation workshops, where industry veterans and market practitioners reviewed preliminary conclusions to ensure accuracy, relevance, and actionable applicability. This layered validation process ensures that the insights presented in this report not only reflect the current state of the market but also anticipate future developments, equipping stakeholders with a robust foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Demand Generation Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Demand Generation Software Market, by Deployment Model

- Demand Generation Software Market, by Organization Size

- Demand Generation Software Market, by End User

- Demand Generation Software Market, by Industry Vertical

- Demand Generation Software Market, by Region

- Demand Generation Software Market, by Group

- Demand Generation Software Market, by Country

- United States Demand Generation Software Market

- China Demand Generation Software Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Synthesizing Core Findings to Illuminate Future Pathways for Demand Generation Software Adoption and Market Evolution Strategies

Bringing together the insights from technological advances, regulatory shifts, and competitive strategies, this executive summary elucidates the critical factors shaping demand generation software adoption in 2025 and beyond. The convergence of AI-powered automation, integrated platform ecosystems, and responsive deployment models has redefined organizational expectations around agility, scalability, and personalization.

Furthermore, the cumulative impact of United States tariffs has underscored the imperative for cost transparency and flexible delivery architectures, while segmentation and regional analyses have highlighted the diverse needs of enterprises across deployment preferences, organizational scale, end-user groups, and industry sectors. These insights collectively point toward a future in which success hinges on the ability to adapt rapidly to evolving buyer behaviors, regulatory requirements, and competitive pressures.

By synthesizing these findings, stakeholders are equipped with a clear blueprint for selecting, implementing, and optimizing demand generation software solutions that align with their strategic objectives. Whether pursuing incremental performance improvements or transformative growth initiatives, this report provides the actionable intelligence required to drive sustained impact.

Engaging with Associate Director Sales Marketing to Secure Comprehensive Demand Generation Software Market Research and Drive Strategic Success

To access the full breadth of insights outlined herein and equip your organization with a comprehensive roadmap for demand generation software excellence, we invite you to engage directly with Ketan Rohom, Associate Director Sales & Marketing. Ketan brings extensive expertise in tailoring market intelligence to your unique strategic imperatives, ensuring that you receive targeted guidance on vendor selection, deployment strategies, and optimization tactics. By partnering with him, you will gain exclusive visibility into regional performance nuances, tariff mitigation frameworks, and competitive benchmarking that are not publicly available. Reach out to schedule a personalized briefing session today and take the decisive step toward unlocking the transformative potential of demand generation software for your enterprise

- How big is the Demand Generation Software Market?

- What is the Demand Generation Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?