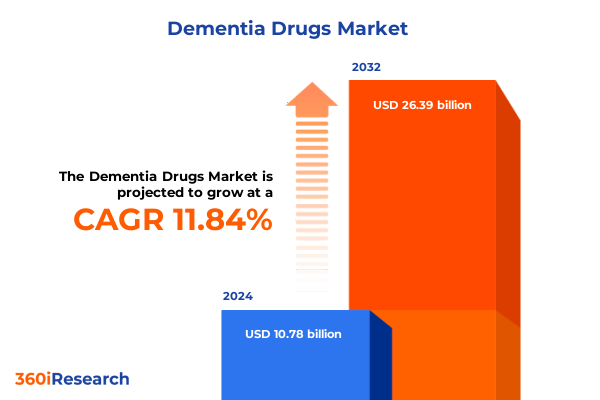

The Dementia Drugs Market size was estimated at USD 11.96 billion in 2025 and expected to reach USD 13.28 billion in 2026, at a CAGR of 11.96% to reach USD 26.39 billion by 2032.

Exploring the Current Landscape of Dementia Therapeutics Featuring Emerging Treatments and Strategic Shifts in Patient Care Paradigms

The evolving terrain of dementia therapeutics has witnessed an unprecedented surge of innovation, marked by a shift from solely symptomatic interventions to therapies that target underlying disease mechanisms. Recent approvals and advisory endorsements have elevated expectations for disease-modifying agents, catalyzing interest across stakeholder groups. At the same time, imaging and fluid biomarkers have refined diagnostic precision, enabling earlier and more accurate identification of at-risk individuals. This convergence of science and technology is shaping a new paradigm in which patient stratification, risk management, and individualized treatment regimens take center stage.

As the medical community grapples with the growing burden of cognitive decline, therapeutic strategies are also adapting to incorporate combination approaches and novel modalities. The integration of digital tools-from remote cognitive monitoring to AI-driven pattern recognition-further enhances the continuum of care. In parallel, regulatory authorities are evolving their review frameworks to balance accelerated access with rigorous safety verification, reflecting a commitment to address unmet needs in dementia management. This introduction outlines the dynamic shifts redefining the landscape and sets the stage for an in-depth exploration of market and policy drivers influencing therapeutic trajectories.

Identifying the Pivotal Shifts Reshaping Dementia Care through Biomarker Applications Innovative Therapies and Evolving Regulatory Frameworks

Recent developments have ushered in a transformative epoch in dementia care, anchored in breakthroughs in amyloid-targeting agents and antibody therapies. Landmark approvals have validated the amyloid hypothesis, reinforcing the importance of pathological targeting while acknowledging the need for comprehensive safety monitoring to mitigate risks such as amyloid-related imaging abnormalities. In parallel, tau-directed compounds are advancing through late-stage clinical trials, promising complementary options to broaden the therapeutic arsenal.

Beyond pharmacology, diagnostic innovation has been pivotal, with fluid biomarkers and advanced imaging furnishing unprecedented insight into disease progression. These tools enable clinicians to intervene earlier, tailoring treatment based on individual risk profiles and biomarker signatures. Emerging digital health platforms facilitate remote assessment and real-time data capture, transforming patient engagement and adherence strategies. This integrative approach underscores a shift from episodic care to continuous disease management, setting a new benchmark for clinical decision-making.

Assessing the Aggregate Outcomes of 2025 United States Tariff Policies on Dementia Drug Supply Chains Manufacturing and Cost Dynamics

In 2025, U.S. trade policy has increasingly leveraged tariffs as levers to catalyze domestic pharmaceutical manufacturing and safeguard national security interests. A blanket 10% tariff on all imported goods, enacted in April, encompasses active pharmaceutical ingredients and finished therapeutics, reshaping cost structures across the industry. These measures have prompted pharmaceutical companies to reassess global sourcing strategies to mitigate escalating input costs and potential supply disruptions.

More stringent measures, including tariffs of up to 245% on Chinese APIs, underscore the imperative to diversify supply chains and explore onshoring partnerships. With China supplying a significant share of APIs for generics, the hike has elevated production costs and spurred initiatives to bolster U.S.-based manufacturing capacity. Concurrently, a 25% levy on medical devices imported from Canada and Mexico has pressured healthcare systems to absorb or pass through higher expenses, amplifying the urgency for strategic resilience. While temporary exemptions have offered interim relief for certain critical healthcare goods, uncertainty looms as legal challenges and policy adjustments evolve. The cumulative effect of these tariffs is manifesting in heightened cost pressures, accelerated reshoring efforts, and a recalibration of risk management protocols within supply chain frameworks.

Deriving Actionable Insights from Multi-Dimensional Segmentation Spanning Drug Class Distribution Channel End User and Patient Demographics

Analyzing drug class segmentation reveals a landscape anchored by cholinesterase inhibitors-Donepezil, Galantamine, and Rivastigmine-that continue to serve as first-line therapies, even as novel agents gain traction. Combination therapies pairing Donepezil with Memantine are increasingly selected for moderate cases, leveraging synergistic benefits to address cognitive and functional deficits. Within the NMDA receptor antagonist category, Memantine remains a cornerstone, underscoring persistent demand for symptom-targeting interventions in later disease stages.

Examining distribution channels highlights the dominance of hospital pharmacies in early adoption of innovative treatments, supported by infusion infrastructure. Simultaneously, online and retail pharmacies are expanding access for oral and transdermal formulations, while specialty pharmacies manage high-cost biologics under controlled distribution programs. The end-user landscape illustrates that clinics and hospitals are pivotal for initiation and monitoring of complex regimens, whereas long-term care facilities and home care settings drive sustained therapy adherence and patient support, especially for older cohorts.

Evaluating treatment type segmentation underscores the growing preference for monotherapy in mild disease, complemented by combination therapy for moderate to severe stages to maximize clinical benefit. Oral administration retains its appeal due to patient convenience, yet transdermal systems are gaining traction by improving compliance and reducing systemic fluctuations. Patient age stratification indicates that individuals aged 65 to 74 represent the most active treatment segment, while the growing 85-and-above cohort presents unique dosing and safety considerations. Disease stage segmentation reaffirms mild cases as focal points for early intervention, moderate cases for combination approaches, and severe stages for palliative support. Finally, patent status segmentation differentiates branded innovators with protected exclusivity from generic competitors driving cost containment and accessibility.

This comprehensive research report categorizes the Dementia Drugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drug Class

- Treatment Type

- Route Of Administration

- Patient Age Group

- Disease Stage

- Patent Status

- Distribution Channel

- End User

Highlighting Regional Variations in Dementia Treatment Adoption and Market Drivers across Americas Europe Middle East Africa and Asia Pacific

North America has emerged as a focal point for rapid adoption of disease-modifying therapies, propelled by supportive reimbursement policies and expanded Medicare coverage for pioneering treatments. The FDA’s conversion of accelerated approvals to traditional approvals has provided regulatory clarity, enabling broader patient access through hospital systems and specialty infusion centers. At the same time, domestic investment in API manufacturing and R&D hubs has strengthened supply chain resilience, positioning the region for sustained innovation and cost management.

In Europe, recent reversals in regulatory decisions-such as the EMA’s recommendation for Kisunla following initial rejection-reflect a cautious yet adaptive stance toward novel amyloid-targeting agents. While the European Commission’s final decisions are pending, uptake is tempered by rigorous risk-minimization protocols and negotiations on pricing and reimbursement. National health technology assessments continue to evaluate long-term value, underscoring the need for real-world evidence generation to support broader market penetration.

Asia-Pacific markets are characterized by a dual focus on generic competition and emerging biotech collaborations. Pharmaceutical firms are actively licensing Chinese innovations to enrich their pipelines, while regional manufacturers expand facilities to serve both domestic and export markets. Despite cost sensitivities, countries such as Japan and South Korea are investing in advanced diagnostics and digital health platforms, fostering ecosystems that integrate precision medicine with community-based care pathways. These efforts underscore the region’s strategic alignment with global trends and its potential to influence future therapeutic development.

This comprehensive research report examines key regions that drive the evolution of the Dementia Drugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Competitive Dynamics and Strategic Positioning among Leading Biotechnology Pharmaceutical and Emerging Entrants in the Dementia Drug Arena

Biogen and Eisai’s collaboration on lecanemab has redefined commercial and clinical frameworks for amyloid-targeting antibodies. The traditional approval achieved in mid-2023 established a precedent for subsequent therapies, complemented by broader Medicare coverage that underpins market confidence. Eli Lilly’s donanemab has demonstrated robust efficacy in Phase 3 trials, achieving statistically significant slowing of cognitive and functional decline, and has earned unanimous backing from FDA advisory panels. The anticipated regulatory actions by year-end position donanemab for rapid entry should approvals align with trial outcomes.

Roche and Novartis are advancing tau-targeted programs, exploring approaches that may synergize with amyloid therapies. Partnerships between large pharma and biotech innovators-such as collaborations to develop next-generation amyloid cleaving enzymes-underscore a shift toward diversified modality portfolios. Meanwhile, smaller entrants are focusing on neuroinflammation and synaptic resilience, expanding the horizon beyond traditional amyloid and tau paradigms.

Furthermore, contract manufacturing organizations and specialized API producers have expanded capacity in response to tariff-driven reshoring incentives. Their strategic alliances with biotech firms facilitate scalable production of complex biologics, ensuring that supply chain flexibility aligns with clinical development timelines. Collectively, these competitive dynamics illustrate a market in flux, characterized by strategic collaborations, pipeline diversifications, and infrastructure enhancements geared toward accelerating the next wave of dementia therapeutics.

This comprehensive research report delivers an in-depth overview of the principal market players in the Dementia Drugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AC Immune SA

- AstraZeneca plc

- Axsome Therapeutics, Inc.

- Cassava Sciences, Inc.

- Eisai Co., Ltd.

- Eli Lilly and Company

- F. Hoffmann-La Roche Ltd.

- H. Lundbeck A/S

- Johnson & Johnson

- Merck & Co., Inc.

- Novartis AG

- Otsuka Pharmaceutical Co., Ltd.

Formulating Strategic Recommendations to Drive Innovation Optimize Supply Chains Elevate Patient Engagement and Enhance Therapeutic Outcomes

Industry leaders should prioritize early engagement with regulatory agencies to streamline pathways for accelerated review and approval, leveraging confirmatory trial data to transition drugs from conditional to traditional approvals. By proactively collaborating on post-marketing safety studies and real-world evidence generation, companies can expedite reimbursement negotiations and mitigate payer concerns. Establishing robust risk-management plans for amyloid-related imaging abnormalities and other safety endpoints will further solidify stakeholder confidence.

Supply chain optimization is critical: organizations must diversify API sourcing by forging partnerships with domestic and alternate international producers. Onshoring initiatives should be complemented by strategic inventory buffers, dual sourcing agreements, and investment in advanced manufacturing technologies to enhance agility. Additionally, companies should harness digital health platforms to improve patient adherence and streamline data collection, facilitating personalized treatment adjustments and longitudinal outcomes tracking.

Finally, fostering multidisciplinary alliances with diagnostic developers, payers, and patient advocacy groups can amplify market access strategies. Collaborative pilot programs integrating biomarker screening with early intervention protocols will reinforce value propositions, while targeted educational campaigns can demystify novel therapeutic mechanisms for clinicians and caregivers. By adopting these strategic imperatives, industry leaders can position their organizations at the vanguard of dementia care innovation.

Detailing Rigorous Research Methodology Encompassing Primary Secondary Data Sources Expert Interviews and Robust Verification Processes

This analysis integrates a rigorous research framework combining primary and secondary methodologies. Secondary research included a comprehensive review of regulatory filings, peer-reviewed publications, and press releases from government agencies and leading pharmaceutical companies. Global trade policy documentation and tariff notices were analyzed to assess economic implications for supply chains.

Primary research comprised in-depth interviews with key opinion leaders, including neurologists, pharmacologists, and reimbursement specialists, to validate emerging trends and strategic imperatives. These qualitative insights were triangulated with quantitative data drawn from public health databases, clinical trial registries, and API production reports to ensure robustness. Data verification protocols encompassed cross-checking sources, peer review by subject-matter experts, and consistency validation against independent industry analyses.

Analytical techniques such as scenario planning and sensitivity testing were employed to evaluate potential impacts of policy shifts and competitive developments. The resulting findings underwent iterative refinement to reflect evolving market dynamics, ensuring that recommendations and insights remain current, actionable, and aligned with stakeholder priorities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Dementia Drugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Dementia Drugs Market, by Drug Class

- Dementia Drugs Market, by Treatment Type

- Dementia Drugs Market, by Route Of Administration

- Dementia Drugs Market, by Patient Age Group

- Dementia Drugs Market, by Disease Stage

- Dementia Drugs Market, by Patent Status

- Dementia Drugs Market, by Distribution Channel

- Dementia Drugs Market, by End User

- Dementia Drugs Market, by Region

- Dementia Drugs Market, by Group

- Dementia Drugs Market, by Country

- United States Dementia Drugs Market

- China Dementia Drugs Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 1590 ]

Synthesizing Conclusions Emphasizing Market Transformation Collaborative Opportunities and Imperatives for Stakeholder Alignment in Dementia Care

In synthesizing the findings, it is evident that dementia therapeutics are at a pivotal juncture, characterized by the emergence of disease-modifying agents and transformative diagnostic capabilities. The strategic interplay between regulatory evolution, policy imperatives, and competitive dynamics underscores the complexity of the market. Stakeholders must reconcile the promise of novel therapies with pressing challenges in supply chain resilience and cost management to deliver sustainable patient outcomes.

Collaborative opportunities abound, from joint ventures in advanced manufacturing to integrated care models that align biomarkers with personalized treatment pathways. These alliances have the potential to accelerate innovation cycles while distributing risk and investment burdens. At the same time, payer engagement and evidence-based value demonstration remain essential to secure broad access and reimbursement, especially as high-cost biologics become more prevalent.

Ultimately, alignment across the ecosystem-spanning manufacturers, regulators, providers, and payers-is imperative to navigate the evolving landscape. By leveraging shared insights and maintaining adaptive strategies, the industry can chart a course toward more effective, accessible, and economical dementia care.

Empower Decision Making by Connecting with Ketan Rohom Associate Director Sales and Marketing to Access Comprehensive Dementia Drug Market Intelligence

Unlock the full depth of our analytical findings, insights, and strategic guidance by reaching out to Ketan Rohom Associate Director Sales and Marketing. He offers personalized consultations to align the report’s intelligence with your organization’s objectives, ensuring you harness detailed understanding of competitive positioning, segmentation nuances, and regulatory impacts to make informed choices. Secure access to the comprehensive dementia drug market intelligence and establish a direct dialogue to clarify any data points or tailor additional analyses. Embark on a journey to elevate your decision-making with this indispensable resource-connect with Ketan Rohom today to initiate your subscription and gain an immediate edge in a rapidly evolving market.

- How big is the Dementia Drugs Market?

- What is the Dementia Drugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?