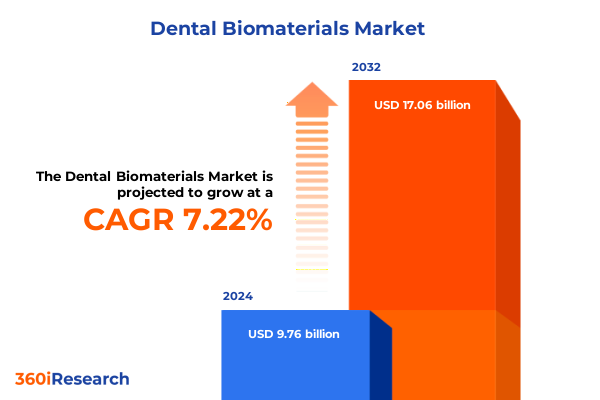

The Dental Biomaterials Market size was estimated at USD 10.43 billion in 2025 and expected to reach USD 11.17 billion in 2026, at a CAGR of 7.27% to reach USD 17.06 billion by 2032.

Introducing the Dynamic World of Dental Biomaterials: Innovations Driving Clinical Performance and Patient-Centered Oral Care Solutions

Dental biomaterials have emerged as a cornerstone of modern restorative and reconstructive dentistry, underpinning advancements in both routine procedures and complex therapies. Innovations spanning advanced ceramics, high-performance polymers, and bioactive composites have significantly enhanced the longevity, biocompatibility, and aesthetic integration of dental restorations. These developments not only improve clinical outcomes but also elevate patient satisfaction by reducing chair time, minimizing procedural invasiveness, and delivering lifelike prosthetic solutions. Recent breakthroughs in nanofilled composites and zirconia-based ceramics represent only a fraction of the multifaceted landscape reshaping intraoral rehabilitation.

Moreover, the interplay between digital dentistry platforms and next-generation materials is fueling unprecedented synergies across design, fabrication, and clinical application. Digital workflows, including intraoral scanning and computer-aided design and manufacturing, seamlessly integrate with materials such as lithium disilicate and hybrid composites, streamlining restorative processes while preserving precise anatomical detail. Coupled with growing emphasis on minimally invasive protocols and personalized treatment planning, these trends underscore the pivotal role of material science in driving the future of dental practice.

This executive summary distills key insights into emerging trends, regulatory shifts, and competitive dynamics influencing the dental biomaterials sector. Readers will discover how transformative innovations intersect with market drivers, segmentation strategies, and regional considerations to shape an evolving competitive environment. The following sections explore regulatory headwinds like the 2025 tariff revisions, delineate segmentation and regional nuances, highlight leading industry players, and conclude with actionable recommendations for stakeholders seeking to navigate this dynamic marketplace.

Exploring Transformative Shifts Reshaping Dental Biomaterials: Technological, Regulatory, and Clinical Trends Revolutionizing Oral Healthcare

The dental biomaterials sector is undergoing a profound metamorphosis driven by a confluence of technological innovations and evolving regulatory landscapes. Advanced ceramics, notably zirconia and lithium disilicate, have witnessed material enhancements in translucence, fracture toughness, and surface finish, resulting in restorations that better mimic natural dentition. Simultaneously, the integration of bioactive glass ionomers with resin-modified compositions delivers controlled ion release that promotes remineralization and reduces secondary caries risk. These scientific advancements reflect a broader trend toward multifunctional materials engineered to deliver therapeutic as well as structural performance.

Furthermore, regulatory bodies across major markets are tightening quality and safety standards, necessitating rigorous testing protocols and enhanced traceability across supply chains. Regulatory harmonization initiatives are streamlining approval pathways, yet the introduction of updated classification criteria for implantable devices underscores the importance of compliance agility. Regulatory shifts are thus prompting manufacturers to adopt robust quality management systems and engage in proactive dialogue with authorities to mitigate approval delays. Consequently, companies that invest in regulatory intelligence and adopt adaptable development frameworks are gaining a competitive edge.

Clinically, the proliferation of digital dentistry is catalyzing material-specific workflow optimization, enabling clinicians to leverage intraoral scanning, additive manufacturing, and real-time milling to maximize procedural efficiency. This shift toward fully digital treatment planning is further supported by artificial intelligence–driven software that predicts long-term material performance and guides personalized restorative strategies. Collectively, these transformative shifts signal a new era in dental biomaterials, where cross-disciplinary collaboration and adaptive innovation pave the way for enhanced patient outcomes.

Analyzing the Cumulative Impact of 2025 United States Tariffs on Dental Biomaterials: Supply Chain Disruptions and Cost Pressures

The introduction of revised tariff schedules in 2025 has exerted considerable influence on the procurement and distribution of key dental biomaterials within the United States market. Tariff escalations affecting certain metal alloys, high-performance ceramics, and specialty polymers have led to immediate cost pressures for manufacturers and distributors reliant on international suppliers. These additional duties have consequently prompted a reassessment of established import channels, compelling stakeholders to explore domestic sourcing alternatives and negotiate long-term supply contracts to hedge against potential volatility.

In response to elevated input costs, manufacturers have increasingly pursued strategic stockpiling of critical raw materials and adopted dynamic pricing frameworks to preserve margin integrity. At the same time, supply chain managers are intensifying efforts to diversify supplier networks by integrating regional partners across North America and supplementing traditional imports with nearshored components. This recalibration of supply chain architecture is shaping a more resilient and responsive procurement landscape that mitigates risks associated with geopolitical uncertainties and fluctuating trade policies.

Moreover, downstream stakeholders, including dental laboratories and clinics, are recalibrating inventory management practices to balance cost containment with uninterrupted clinical service. By leveraging collaborative agreements and pooled purchasing consortia, end users are optimizing procurement cycles while maintaining access to premium ceramics such as alumina and glass ceramics, as well as advanced composites. As the industry adapts to these tariff-induced headwinds, strategic agility and transparent supply chain governance are emerging as critical success factors for maintaining competitive positioning and ensuring uninterrupted delivery of high-quality dental biomaterials.

Unpacking Segmentation Insights to Reveal How Product, Application, End User, and Distribution Channel Dynamics Shape the Dental Biomaterials Market

A nuanced understanding of market segmentation provides valuable insight into the diverse demand drivers and competitive positioning within the dental biomaterials sector. Across product types, the market encompasses advanced ceramics, composites, glass ionomers, metals, and polymers, each with its own technological trajectory and clinical application niche. Ceramics, with subdivisions ranging from alumina and glass ceramics to lithium disilicate and zirconia, exemplify the intersection of aesthetic demand and mechanical performance, particularly in prosthetics and restorative dentistry. Composites, categorized by viscosity and particle distribution into bulk fill, hybrid, microfilled, and nanofilled formulations, are increasingly favored for minimally invasive procedures and direct restorations.

Application-based segmentation further illuminates sectoral dynamics, with restorative treatments spanning bridges, crowns, and inlays integrating seamlessly with both ceramic and composite platforms. In endodontics, gutta percha points, irrigants, and sealants illustrate material innovation aimed at enhancing canal obturation and antimicrobial efficacy. Implantology remains anchored by endosseous and subperiosteal implants, often complemented by growth factors and barrier membranes from the periodontics domain to promote osseointegration. Beyond clinics, dental laboratories-encompassing in-house and third-party prototyping hubs-and hospitals serve as critical end users, while offline channels, including dental supply distributors and specialty dealers, coexist with burgeoning online marketplaces that offer direct-to-consumer and business-to-business procurement options.

This comprehensive segmentation framework underscores how distinct material categories, clinical applications, and distribution modalities converge to shape market opportunities. By aligning portfolio strategies with specific segment requirements-whether high-performance ceramics for prosthetic workflows or resin-modified glass ionomers for restorative procedures-industry participants can tailor their innovation roadmaps to meet evolving clinical demands and capitalize on emerging distribution trends.

This comprehensive research report categorizes the Dental Biomaterials market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Application

- End User

- Distribution Channel

Delineating Regional Insights Across Americas, Europe Middle East Africa, and AsiaPacific to Uncover Growth Drivers and Market Nuances

Regional analysis illuminates the diverse factors driving demand for dental biomaterials across three key geographies. The Americas region is distinguished by its robust dental service infrastructure and high adoption of digital dentistry platforms. In North America, advanced digital workflows and premium restorative materials are widely embraced by both large dental chains and independent practices. Latin America, while characterized by variable economic conditions, is witnessing incremental uptake of cost-efficient composites and glass ionomers, driven by expanding dental insurance coverage and growing urbanization.

In the Europe Middle East Africa territory, regulatory convergence under European Medical Device Regulation (MDR) has elevated quality standards, prompting manufacturers to emphasize compliance and material traceability. Western Europe leads in the utilization of zirconia and lithium disilicate for esthetic prosthetics, while emerging markets in Eastern Europe and the Middle East are experiencing accelerated growth in implantology and orthodontic aligner applications. African markets, though currently nascent, are beginning to embrace mobile dental clinics and innovative low-cost polymer-based solutions to address public health initiatives and burgeoning access to care.

AsiaPacific represents one of the most vibrant growth arenas, fueled by rising dental awareness, expanding middle-class populations, and significant public health investments. In Southeast Asia, demand for ready-to-use restorative kits, including easy-to-handle composites and pre-sintered ceramic blocks, is intensifying. East Asia, notably Japan and South Korea, remains a hub for material innovation, particularly in the development of bioactive polymers and functionally graded ceramics. Concurrently, China’s rapidly expanding private dental chains are driving substantial volume growth across all product categories, positioning the region as a strategic frontier for global market participants seeking high-volume opportunities and competitive manufacturing partnerships.

This comprehensive research report examines key regions that drive the evolution of the Dental Biomaterials market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Key Company Insights to Illuminate Competitive Positioning, Strategic Partnerships, and Innovation Pathways in Dental Biomaterials

Within the competitive landscape, several leading players have distinguished themselves through strategic collaborations, targeted acquisitions, and dedicated innovation pipelines. Major global corporations have fortified their portfolios by integrating bioactive components into existing material platforms, often partnering with biochemical firms to pioneer ion-releasing composites that support tissue regeneration. In parallel, mid-tier enterprises are carving niche positions by focusing on specialized ceramics and tailored polymer blends, entering joint ventures with digital dentistry providers to co-develop material-specific design software and milling strategies.

Notably, collaboration with academic institutions and research consortia has emerged as a key tactic for accelerating material validation and regulatory approval. Through sponsored clinical trials and laboratory partnerships, companies are generating robust performance data for next-generation zirconia and glass ceramic formulations, thereby differentiating themselves in an increasingly evidence-driven environment. Furthermore, supply chain alliances are enabling streamlined access to critical raw inputs and reinforcing market resilience. Strategic agreements with metal alloy producers ensure consistent availability of cobalt chrome and titanium substrates, while forward contracts secure stable pricing for polyether ether ketone and polymethyl methacrylate.

In addition to material-centric collaborations, several market participants are expanding their service offerings through digital dentistry integration. By acquiring or partnering with intraoral scanner and CAD/CAM software developers, these firms are positioning themselves to deliver end-to-end restorative solutions that encompass both material and hardware components. As a result, they enhance customer loyalty and capture incremental value across the digital workflow. Such strategic initiatives underscore the importance of agility and cross-functional partnership in maintaining a leading edge within the dynamic dental biomaterials ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Dental Biomaterials market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- BEGO GmbH & Co. KG

- Bioloren S.r.l.

- Bisco, Inc.

- Brasseler USA

- CAM Bioceramics

- Carpenter Technology Corporation

- COLTENE Holding AG

- Den-Mat Holdings, LLC

- Dentsply Sirona Inc.

- DSM-Firmenich AG

- Envista Holdings Corporation

- GC CORPORATION

- Geistlich Pharma AG

- Henry Schein, Inc.

- Ivoclar Vivadent AG

- Keystone Dental Group

- KURARAY CO., LTD.

- Medtronic plc

- Mitsui Chemicals, Inc.

- Septodont Holding

- SHOFU INC.

- Straumann Group

- Victrex Manufacturing Limited

- VITA Zahnfabrik

- VOCO GmbH

- Young Innovations, Inc.

- ZimVie Inc.

Providing Actionable Recommendations for Industry Leaders to Optimize Product Development, Supply Chains, and Market Penetration Strategies in Dental Biomaterials

To thrive amidst evolving market complexities, industry leaders should prioritize the development of multifunctional materials that deliver both structural integrity and therapeutic benefits. Investing in research collaborations to incorporate antibacterial agents, remineralizing ions, and smart polymers can yield differentiated solutions that meet clinician and patient demands. Concurrently, integrating digital design parameters early in the material development process will ensure compatibility with restorative workflows, thereby reducing clinical adjustment times and enhancing overall adoption rates.

In parallel, executives must fortify supply chain resilience by diversifying procurement sources and establishing strategic reserves for critical raw materials. Implementing digital supply chain management tools will provide real-time visibility into inventory levels, enabling proactive response to tariff fluctuations or logistical disruptions. Furthermore, forging long-term alliances with regional manufacturers can mitigate geopolitical risks and unlock preferential access to emerging markets.

On the go-to-market front, companies should tailor distribution strategies to local market dynamics by balancing offline collaborations with progressive digital outreach. Leveraging educational platforms and virtual training modules will deepen brand engagement among dental professionals, while e-commerce portals facilitate direct access to consumables and premium restorative kits. Finally, aligning corporate sustainability goals with eco-conscious material innovations-such as recyclable polymers and low-carbon ceramic processing-can enhance corporate reputation and meet the growing environmental expectations of stakeholders.

Outlining a Rigorous Research Methodology That Ensures Comprehensive Data Collection, Expert Validation, and Reliable Analysis in Dental Biomaterials Market Study

The insights presented herein derive from a robust research framework designed to deliver accurate and comprehensive perspectives on the dental biomaterials domain. Primary research comprised in-depth interviews and surveys with a cross section of stakeholders, including material scientists, dental practitioners, laboratory managers, and regulatory specialists. These engagements yielded qualitative insights into clinical preferences, regulatory challenges, and technological adoption barriers, forming the foundation for nuanced analysis of emerging trends and competitive strategies.

Complementing primary data, secondary research encompassed extensive review of proprietary company filings, patent databases, scientific journals, and conference proceedings. Regulatory documentation and government publications were systematically scrutinized to map evolving tariff schedules, compliance mandates, and approval pathways across major economies. Data triangulation techniques were employed to validate findings, ensuring consistency and reliability by cross-referencing quantitative indicators such as import-export records and clinical procedure volumes.

Analytical rigor was further reinforced through iterative validation with an expert panel of dental material authorities and industry consultants. This collaborative approach enabled the refinement of segmentation frameworks and the calibration of thematic narratives to reflect real-world market dynamics. Quality assurance processes, including data audits and methodological peer reviews, were integrated throughout the research cycle to guarantee the highest standards of accuracy, objectivity, and transparency.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Dental Biomaterials market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Dental Biomaterials Market, by Product Type

- Dental Biomaterials Market, by Application

- Dental Biomaterials Market, by End User

- Dental Biomaterials Market, by Distribution Channel

- Dental Biomaterials Market, by Region

- Dental Biomaterials Market, by Group

- Dental Biomaterials Market, by Country

- United States Dental Biomaterials Market

- China Dental Biomaterials Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2544 ]

Concluding Reflections on Dental Biomaterials Evolution, Market Dynamics, and Strategic Imperatives for Driving Innovation and Competitive Advantage

In summary, the dental biomaterials sector stands at an inflection point characterized by rapid material innovations, shifting regulatory landscapes, and transforming clinical workflows. Advanced ceramics, bioactive composites, and high-performance polymers are converging with digital dentistry platforms to redefine patient care paradigms and operational efficiencies. While 2025 tariff adjustments have introduced new cost challenges, they have simultaneously catalyzed supply chain diversification and strategic procurement practices that strengthen industry resilience.

Regional and segmentation insights reveal a nuanced marketplace in which product-specific demand drivers, application focuses, and distribution modalities intersect to create distinct competitive arenas. Leading companies are leveraging partnerships and advanced manufacturing capabilities to deliver tailored solutions, while emerging entrants exploit niche specialization in areas such as antibacterial ion release and polymeric innovation. As stakeholders navigate increased regulatory complexity and evolving clinical expectations, adaptability and collaborative innovation will be key to sustaining momentum and capturing growth opportunities.

Ultimately, the ability of organizations to integrate cross-functional strategies-encompassing material R&D, digital workflow alignment, and agile supply chain management-will determine their capacity to shape the future of dental practice. By embracing a holistic, evidence-based approach, industry participants can not only meet the rigorous demands of modern dentistry but also pioneer next-generation treatments that elevate patient outcomes.

Take the Next Step in Dental Biomaterials Intelligence by Connecting With Ketan Rohom to Access the Full In Depth Market Research Report Today

For stakeholders seeking a deeper understanding of the dental biomaterials landscape, the comprehensive market research report offers exhaustive analysis of emerging trends, regulatory impacts, and competitive dynamics. This in-depth study provides granular segmentation insights, detailed regional assessments, and strategic company profiles to inform investment decisions and product development roadmaps. Readers will benefit from forward-looking recommendations grounded in rigorous primary and secondary research, ensuring actionable intelligence that can drive sustainable growth and innovation.

Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore tailored research solutions and secure access to the full suite of data, charts, and expert commentary. Whether evaluating partnerships, optimizing supply chains, or launching novel material platforms, this report equips decision-makers with the insights necessary to stay ahead of market shifts and regulatory changes. Contact Ketan to arrange a personalized consultation, discuss bespoke data requirements, and unlock the strategic advantage offered by this authoritative intelligence.

- How big is the Dental Biomaterials Market?

- What is the Dental Biomaterials Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?